here - Foresight Group

here - Foresight Group

here - Foresight Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

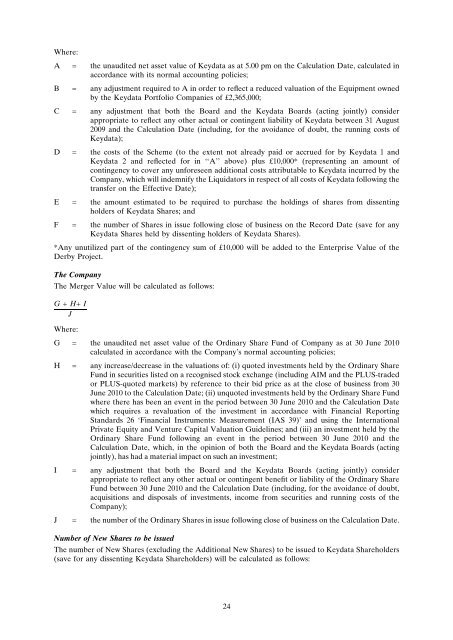

W<strong>here</strong>:<br />

A = the unaudited net asset value of Keydata as at 5.00 pm on the Calculation Date, calculated in<br />

accordance with its normal accounting policies;<br />

B = any adjustment required to A in order to reflect a reduced valuation of the Equipment owned<br />

by the Keydata Portfolio Companies of £2,365,000;<br />

C = any adjustment that both the Board and the Keydata Boards (acting jointly) consider<br />

appropriate to reflect any other actual or contingent liability of Keydata between 31 August<br />

2009 and the Calculation Date (including, for the avoidance of doubt, the running costs of<br />

Keydata);<br />

D = the costs of the Scheme (to the extent not already paid or accrued for by Keydata 1 and<br />

Keydata 2 and reflected for in ‘‘A’’ above) plus £10,000* (representing an amount of<br />

contingency to cover any unforeseen additional costs attributable to Keydata incurred by the<br />

Company, which will indemnify the Liquidators in respect of all costs of Keydata following the<br />

transfer on the Effective Date);<br />

E = the amount estimated to be required to purchase the holdings of shares from dissenting<br />

holders of Keydata Shares; and<br />

F = the number of Shares in issue following close of business on the Record Date (save for any<br />

Keydata Shares held by dissenting holders of Keydata Shares).<br />

*Any unutilized part of the contingency sum of £10,000 will be added to the Enterprise Value of the<br />

Derby Project.<br />

The Company<br />

The Merger Value will be calculated as follows:<br />

G + H+ I<br />

J<br />

W<strong>here</strong>:<br />

G = the unaudited net asset value of the Ordinary Share Fund of Company as at 30 June 2010<br />

calculated in accordance with the Company’s normal accounting policies;<br />

H = any increase/decrease in the valuations of: (i) quoted investments held by the Ordinary Share<br />

Fund in securities listed on a recognised stock exchange (including AIM and the PLUS-traded<br />

or PLUS-quoted markets) by reference to their bid price as at the close of business from 30<br />

June 2010 to the Calculation Date; (ii) unquoted investments held by the Ordinary Share Fund<br />

w<strong>here</strong> t<strong>here</strong> has been an event in the period between 30 June 2010 and the Calculation Date<br />

which requires a revaluation of the investment in accordance with Financial Reporting<br />

Standards 26 ‘Financial Instruments: Measurement (IAS 39)’ and using the International<br />

Private Equity and Venture Capital Valuation Guidelines; and (iii) an investment held by the<br />

Ordinary Share Fund following an event in the period between 30 June 2010 and the<br />

Calculation Date, which, in the opinion of both the Board and the Keydata Boards (acting<br />

jointly), has had a material impact on such an investment;<br />

I = any adjustment that both the Board and the Keydata Boards (acting jointly) consider<br />

appropriate to reflect any other actual or contingent benefit or liability of the Ordinary Share<br />

Fund between 30 June 2010 and the Calculation Date (including, for the avoidance of doubt,<br />

acquisitions and disposals of investments, income from securities and running costs of the<br />

Company);<br />

J = the number of the Ordinary Shares in issue following close of business on the Calculation Date.<br />

Number of New Shares to be issued<br />

The number of New Shares (excluding the Additional New Shares) to be issued to Keydata Shareholders<br />

(save for any dissenting Keydata Shareholders) will be calculated as follows:<br />

24