here - Foresight Group

here - Foresight Group

here - Foresight Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

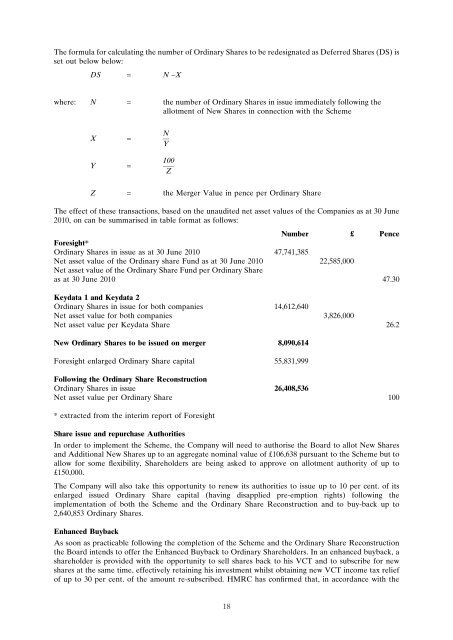

The formula for calculating the number of Ordinary Shares to be redesignated as Deferred Shares (DS) is<br />

set out below below:<br />

DS = N –X<br />

w<strong>here</strong>: N = the number of Ordinary Shares in issue immediately following the<br />

allotment of New Shares in connection with the Scheme<br />

X =<br />

Y =<br />

N<br />

Y<br />

100<br />

Z<br />

Z = the Merger Value in pence per Ordinary Share<br />

The effect of these transactions, based on the unaudited net asset values of the Companies as at 30 June<br />

2010, on can be summarised in table format as follows:<br />

Number £ Pence<br />

<strong>Foresight</strong>*<br />

Ordinary Shares in issue as at 30 June 2010 47,741,385<br />

Net asset value of the Ordinary share Fund as at 30 June 2010<br />

Net asset value of the Ordinary Share Fund per Ordinary Share<br />

22,585,000<br />

as at 30 June 2010 47.30<br />

Keydata 1 and Keydata 2<br />

Ordinary Shares in issue for both companies 14,612,640<br />

Net asset value for both companies 3,826,000<br />

Net asset value per Keydata Share 26.2<br />

New Ordinary Shares to be issued on merger 8,090,614<br />

<strong>Foresight</strong> enlarged Ordinary Share capital 55,831,999<br />

Following the Ordinary Share Reconstruction<br />

Ordinary Shares in issue 26,408,536<br />

Net asset value per Ordinary Share 100<br />

* extracted from the interim report of <strong>Foresight</strong><br />

Share issue and repurchase Authorities<br />

In order to implement the Scheme, the Company will need to authorise the Board to allot New Shares<br />

and Additional New Shares up to an aggregate nominal value of £106,638 pursuant to the Scheme but to<br />

allow for some flexibility, Shareholders are being asked to approve on allotment authority of up to<br />

£150,000.<br />

The Company will also take this opportunity to renew its authorities to issue up to 10 per cent. of its<br />

enlarged issued Ordinary Share capital (having disapplied pre-emption rights) following the<br />

implementation of both the Scheme and the Ordinary Share Reconstruction and to buy-back up to<br />

2,640,853 Ordinary Shares.<br />

Enhanced Buyback<br />

As soon as practicable following the completion of the Scheme and the Ordinary Share Reconstruction<br />

the Board intends to offer the Enhanced Buyback to Ordinary Shareholders. In an enhanced buyback, a<br />

shareholder is provided with the opportunity to sell shares back to his VCT and to subscribe for new<br />

shares at the same time, effectively retaining his investment whilst obtaining new VCT income tax relief<br />

of up to 30 per cent. of the amount re-subscribed. HMRC has confirmed that, in accordance with the<br />

18<br />

10.4.1(2)(d)<br />

13.8.1(1)(3)<br />

13.7.1(e)<br />

13.7.1(1)(a)