The Home Depot

The Home Depot

The Home Depot

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE HOME DEPOT<br />

Justin R. Quillen<br />

ACG2021 002

Executive Summary<br />

For the fiscal year ending on February 1, 2009 <strong>The</strong> <strong>Home</strong> <strong>Depot</strong> was the<br />

worlds largest retailer of home improvement supplies based on net sales.<br />

<strong>The</strong> <strong>Home</strong> <strong>Depot</strong> sales a variety of supplies such as building materials, lawn<br />

care and home improvement items.<br />

Throughout the fiscal year February 1, 2008 to February 1, 2009 there has<br />

been hard economic struggle leading the company in a new direction.<br />

Instead of focusing more on the footage growth they the company stared<br />

focusing more on maximizing productivity in their existing stores.<br />

For the good of the company they decided to close 15 and to remove 50<br />

stores from the new pipeline and exit our EXPO, THD Design Center,<br />

Yardbirds and HD.<br />

http://homedepotar.com/html/downloads/HD_Annual_Report_2008.pdf

Part A. Introduction<br />

• <strong>Home</strong> <strong>Depot</strong>s CEO is Francis S. Blake<br />

• <strong>The</strong>ir home office is 2455 PACES FERRY ROAD, N.W., ATLANTA,<br />

GEORGIA 30339<br />

• <strong>The</strong> last fiscal year ended on February 1, 2009<br />

• <strong>Home</strong> <strong>Depot</strong> supplies the public as well as contractors with home improving<br />

items, stretching from plumbing, electrical, building materials and lawn and<br />

garden, most anything to help spruce up or build your house.<br />

• <strong>The</strong> <strong>Home</strong> <strong>Depot</strong> is mainly spread throughout the United States with 1,971<br />

stores. <strong>The</strong>re are 262 store also spread out through the countries of Canada,<br />

China and Mexico.

Part A. Audit Report<br />

• <strong>The</strong> <strong>Home</strong> <strong>Depot</strong> uses a independent auditing firm named KPMG LLP .<br />

• <strong>The</strong> auditors said that <strong>Home</strong> <strong>Depot</strong> kept good records and control over their financial<br />

reporting as of February 1,2009, “based on criteria established in Internal Control –<br />

Integrated Framework issued by the Committee of Sponsoring Organizations of the<br />

Treadway Commission.”

Part A. Stock Market Information<br />

• Most recent price of stock as of March 2, 2010: $31.43<br />

• 12 Month Range $17.49-31.55<br />

• Dividend per share .91<br />

• I would say buy because<br />

in a years time the stock<br />

of <strong>Home</strong> <strong>Depot</strong> has gone<br />

from 28.75 to 31.50.<br />

http://www.dailyfinance.com/charts/the-home-depot-inc/hd/nys/classiccharts

Part B. Industry Situation and<br />

Company Plans<br />

• <strong>Home</strong> <strong>Depot</strong> supplies the homeowner and<br />

contractors with the supplies they need to renovate<br />

and construct homes. <strong>Home</strong> <strong>Depot</strong> has three main<br />

customers. <strong>The</strong> Do-It-Yourselfers, Do-It-For-Me,<br />

and the Professionals.<br />

• For the future, <strong>Home</strong> <strong>Depot</strong> has decided to go<br />

back to their core roots with a simple model, ”lots<br />

of products, expert advice and low prices.” To<br />

give great customer service to help the<br />

homeowner with household repair.<br />

http://business.highbeam.com/137336/article-1G1-190851102/back-future-home-depot-relies-its-roots-future-growth

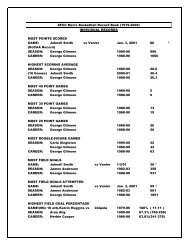

Part C. Income Statement<br />

•<strong>The</strong> income statement is a single<br />

step format.<br />

2009 2008<br />

Operating Income 4.8B 4.36B<br />

Gross Income 20.7B 22.2B<br />

Net Income 2.66B 2.26B<br />

<strong>The</strong> difference in income from 2008 to 2009 is very visible. Operating<br />

income is up .44M, Gross income is down 1.5B, and Net Income is up .4 M.

Part C. Balance Sheet<br />

Assets = Liabilities + Stockholders<br />

Equity<br />

2008 41.16B 21.48B 17.78B<br />

2009 40.88B 23.38B 19.4B<br />

•<strong>The</strong> difference from 2008 to 2009 are Assets<br />

up .28M, Liabilities down 1.9B and Stock<br />

Holders Equity down 1.7B. Liabilities changed<br />

the most at 1.9 B and Stockholders Equity at<br />

1.7B.

Part C. Statement of Cash Flows<br />

•Fund for operations is more for both 2008 and 2009. <strong>The</strong> difference<br />

for 2008 is 2.14B and for 2009 it is 1.81B.<br />

•<strong>The</strong>y opened 77 store in the 2008 to 2009 year spread out through<br />

the United States, Canada, Mexico and China.<br />

•<strong>Home</strong> <strong>Depot</strong> gets a lot of its financing from long term barrowings.<br />

•Cash flow overall has decreased by .2B. From 5.73B to 5.53B.

Part D. Accounting Policies<br />

•Cash equivalents- All investments that have a high<br />

liquidity bought within three months are equal to cash.<br />

• Revenues- It takes into account the net revenue of<br />

returns.

Part E. Financial Analysis<br />

Liquidity Ratios<br />

2009 2008<br />

Working Capital 12.7% 9.4%<br />

Current Ratio 1.3% 1.2%<br />

Receivable Turnover 49.5 47.2<br />

Avg. Days’ Sales<br />

Uncollected<br />

6.8 days 7.3 days<br />

Inventory Turnover 3.9 3.6<br />

Avg. Days’ Inventory on<br />

hand<br />

92.5 days 89.9 days

Part E. Financial Analysis<br />

Profitability Ratios<br />

• Profit margin: 2008-25.99B 2009-23.99B<br />

• Asset turnover: 2008-1.6 2009-1.7<br />

• Return on assets: 2008-9.1% 2009-5.29%<br />

• Return on equity: 2008-20.56% 2009-12.74%<br />

• From 2008 to 2009 profit margin dropped 2billion dollars. Asset<br />

turnover went up and return on assets and equity went down.

Part E. Financial Analysis<br />

Solvency Ratio<br />

• For 2008 the debt to equity ratio was .64 and in<br />

2009 it was .54 since the economy has been down<br />

<strong>Home</strong> <strong>Depot</strong> has slowed down on expanding so<br />

in turn they are not buying more properties and<br />

starting new projects so their debt to equity has<br />

gone down.

Part E. Financial Analysis<br />

Market Strength Ratios<br />

• Price/earnings per share 2008- .45 2009-<br />

.41<br />

• Dividend yield in 2008 was 2.26% and in<br />

2009 was 3%.