Information Memorandum - Foresight Group

Information Memorandum - Foresight Group

Information Memorandum - Foresight Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

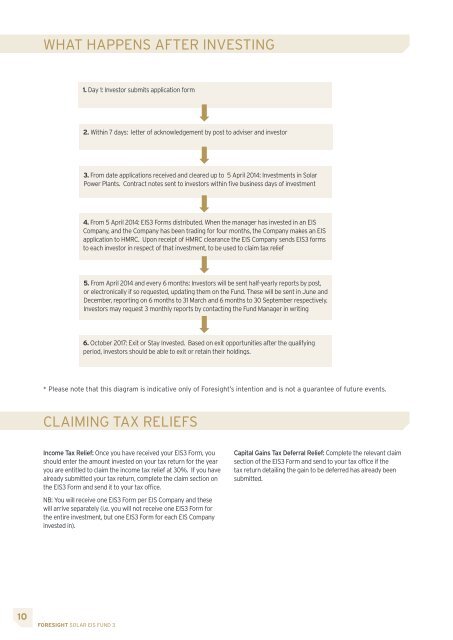

WHAT HAPPENS AFTER INVESTING<br />

CLAIMING TAX RELIEFS<br />

10 FORESIGHT SOLAR EIS FUND 3<br />

1. Day 1: Investor submits application form<br />

2. Within 7 days: letter of acknowledgement by post to adviser and investor<br />

3. From date applications received and cleared up to 5 April 2014: Investments in Solar<br />

Power Plants. Contract notes sent to investors within five business days of investment<br />

4. From 5 April 2014: EIS3 Forms distributed. When the manager has invested in an EIS<br />

Company, and the Company has been trading for four months, the Company makes an EIS<br />

application to HMRC. Upon receipt of HMRC clearance the EIS Company sends EIS3 forms<br />

to each investor in respect of that investment, to be used to claim tax relief<br />

5. From April 2014 and every 6 months: Investors will be sent half-yearly reports by post,<br />

or electronically if so requested, updating them on the Fund. These will be sent in June and<br />

December, reporting on 6 months to 31 March and 6 months to 30 September respectively.<br />

Investors may request 3 monthly reports by contacting the Fund Manager in writing<br />

6. October 2017: Exit or Stay Invested. Based on exit opportunities after the qualifying<br />

period, investors should be able to exit or retain their holdings.<br />

* Please note that this diagram is indicative only of <strong>Foresight</strong>’s intention and is not a guarantee of future events.<br />

Income Tax Relief: Once you have received your EIS3 Form, you<br />

should enter the amount invested on your tax return for the year<br />

you are entitled to claim the income tax relief at 30%. If you have<br />

already submitted your tax return, complete the claim section on<br />

the EIS3 Form and send it to your tax office.<br />

NB: You will receive one EIS3 Form per EIS Company and these<br />

will arrive separately (i.e. you will not receive one EIS3 Form for<br />

the entire investment, but one EIS3 Form for each EIS Company<br />

invested in).<br />

Capital Gains Tax Deferral Relief: Complete the relevant claim<br />

section of the EIS3 Form and send to your tax office if the<br />

tax return detailing the gain to be deferred has already been<br />

submitted.