Annual Report 2010-2011 - Gammon India

Annual Report 2010-2011 - Gammon India

Annual Report 2010-2011 - Gammon India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13. In respect of the road projects undertaken by the Company, in furtherance to the recommendation of the Dispute Resolution Board (DRB), the<br />

Company has been awarded claims by the Arbitration Tribunal for an aggregate amount of ` 94.54 Crores which has been recognized as revenue<br />

& included in Sundry Debtors. The Company contends that such awards have reached finality for the determination of the amounts of such<br />

claims and are reasonably confident of recovery of such claims although the client has moved the court to set aside the awards.<br />

Considering the fact that the Company has received favorable awards from the DRB and the arbitration tribunal, the Management is reasonably<br />

certain that the claims will get favorable verdict from the courts.<br />

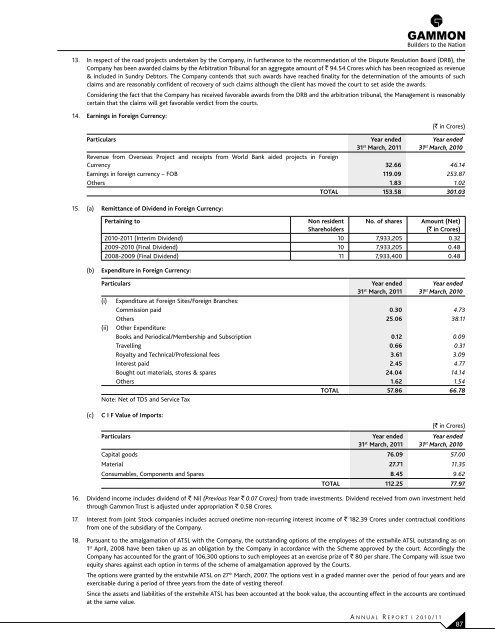

14. Earnings in Foreign Currency:<br />

Particulars Year ended<br />

31 st March, <strong>2011</strong><br />

A NNUAL R EPORT I <strong>2010</strong>/11<br />

(` in Crores)<br />

Year ended<br />

31 st March, <strong>2010</strong><br />

Revenue from Overseas Project and receipts from World Bank aided projects in Foreign<br />

Currency 32.66 46.14<br />

Earnings in foreign currency – FOB 119.09 253.87<br />

Others 1.83 1.02<br />

TOTAL 153.58 301.03<br />

15. (a) Remittance of Dividend in Foreign Currency:<br />

Pertaining to Non resident No. of shares Amount (Net)<br />

Shareholders<br />

(` in Crores)<br />

<strong>2010</strong>-<strong>2011</strong> (Interim Dividend) 10 7,933,205 0.32<br />

2009-<strong>2010</strong> (Final Dividend) 10 7,933,205 0.48<br />

2008-2009 (Final Dividend) 11 7,933,400 0.48<br />

(b) Expenditure in Foreign Currency:<br />

Particulars Year ended<br />

31 st March, <strong>2011</strong><br />

Year ended<br />

31 st March, <strong>2010</strong><br />

(i) Expenditure at Foreign Sites/Foreign Branches:<br />

Commission paid 0.30 4.73<br />

Others 25.06 38.11<br />

(ii) Other Expenditure:<br />

Books and Periodical/Membership and Subscription 0.12 0.09<br />

Travelling 0.66 0.31<br />

Royalty and Technical/Professional fees 3.61 3.09<br />

Interest paid 2.45 4.77<br />

Bought out materials, stores & spares 24.04 14.14<br />

Others 1.62 1.54<br />

TOTAL 57.86 66.78<br />

Note: Net of TDS and Service Tax<br />

(c) C I F Value of Imports:<br />

Particulars Year ended<br />

(` in Crores)<br />

31st Year ended<br />

March, <strong>2011</strong> 31st March, <strong>2010</strong><br />

Capital goods 76.09 57.00<br />

Material 27.71 11.35<br />

Consumables, Components and Spares 8.45 9.62<br />

TOTAL 112.25 77.97<br />

16. Dividend income includes dividend of ` Nil (Previous Year ` 0.07 Crores) from trade investments. Dividend received from own investment held<br />

through <strong>Gammon</strong> Trust is adjusted under appropriation ` 0.58 Crores.<br />

17. Interest from Joint Stock companies includes accrued onetime non-recurring interest income of ` 182.39 Crores under contractual conditions<br />

from one of the subsidiary of the Company.<br />

18. Pursuant to the amalgamation of ATSL with the Company, the outstanding options of the employees of the erstwhile ATSL outstanding as on<br />

1st April, 2008 have been taken up as an obligation by the Company in accordance with the Scheme approved by the court. Accordingly the<br />

Company has accounted for the grant of 106,300 options to such employees at an exercise prize of ` 80 per share. The Company will issue two<br />

equity shares against each option in terms of the scheme of amalgamation approved by the Courts.<br />

The options were granted by the erstwhile ATSL on 27th March, 2007. The options vest in a graded manner over the period of four years and are<br />

exercisable during a period of three years from the date of vesting thereof.<br />

Since the assets and liabilities of the erstwhile ATSL has been accounted at the book value, the accounting effect in the accounts are continued<br />

at the same value.<br />

87