FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

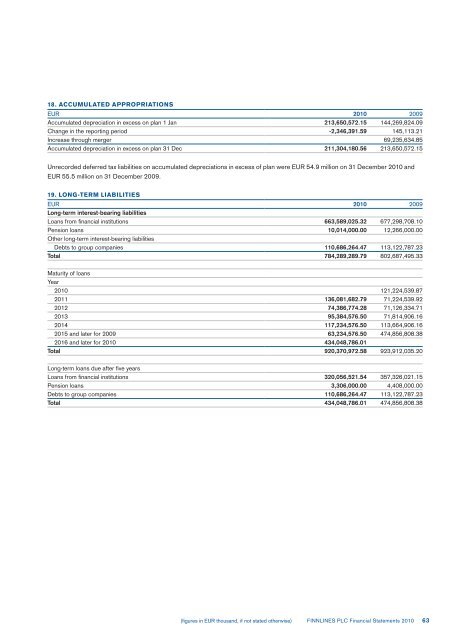

18. ACCUMULATED APPROPRIATIONS<br />

EUR <strong>2010</strong> 2009<br />

Accumulated depreciation in excess on plan 1 Jan 213,650,572.15 144,269,824.09<br />

Change in the reporting period -2,346,391.59 145,113.21<br />

Increase through merger 69,235,634.85<br />

Accumulated depreciation in excess on plan 31 Dec 211,304,180.56 213,650,572.15<br />

Unrecorded deferred tax liabilities on accumulated depreciations in excess of plan were EUR 54.9 million on 31 December <strong>2010</strong> and<br />

EUR 55.5 million on 31 December 2009.<br />

19. LONG-TERM LIABILITIES<br />

EUR <strong>2010</strong> 2009<br />

Long-term interest-bearing liabilities<br />

Loans from financial institutions 663,589,025.32 677,298,708.10<br />

Pension loans 10,014,000.00 12,266,000.00<br />

Other long-term interest-bearing liabilities<br />

Debts to group companies 110,686,264.47 113,122,787.23<br />

Total 784,289,289.79 802,687,495.33<br />

Maturity of loans<br />

Year<br />

<strong>2010</strong> 121,224,539.87<br />

2011 136,081,682.79 71,224,539.92<br />

2012 74,386,774.28 71,126,334.71<br />

2013 95,384,576.50 71,814,906.16<br />

2014 117,234,576.50 113,664,906.16<br />

2015 and later for 2009 63,234,576.50 474,856,808.38<br />

2016 and later for <strong>2010</strong> 434,048,786.01<br />

Total 920,370,972.58 923,912,035.20<br />

Long-term loans due after five years<br />

Loans from financial institutions 320,056,521.54 357,326,021.15<br />

Pension loans 3,306,000.00 4,408,000.00<br />

Debts to group companies 110,686,264.47 113,122,787.23<br />

Total 434,048,786.01 474,856,808.38<br />

(figures in EUR thousand, if not stated otherwise)<br />

FINNLINES PLC Financial Statements <strong>2010</strong><br />

63