FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

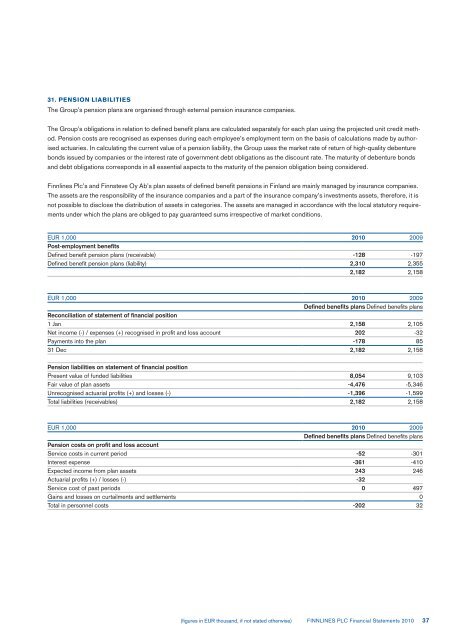

31. PENSION LIABILITIES<br />

The Group’s pension plans are organised through external pension insurance companies.<br />

The Group’s obligations in relation to defined benefit plans are calculated separately for each plan using the projected unit credit meth-<br />

od. Pension costs are recognised as expenses during each employee’s employment term on the basis of calculations made by author-<br />

ised actuaries. In calculating the current value of a pension liability, the Group uses the market rate of return of high-quality debenture<br />

bonds issued by companies or the interest rate of government debt obligations as the discount rate. The maturity of debenture bonds<br />

and debt obligations corresponds in all essential aspects to the maturity of the pension obligation being considered.<br />

<strong>Finnlines</strong> Plc’s and Finnsteve Oy Ab’s plan assets of defined benefit pensions in Finland are mainly managed by insurance companies.<br />

The assets are the responsibility of the insurance companies and a part of the insurance company’s investments assets, therefore, it is<br />

not possible to disclose the distribution of assets in categories. The assets are managed in accordance with the local statutory require-<br />

ments under which the plans are obliged to pay guaranteed sums irrespective of market conditions.<br />

EUR 1,000 <strong>2010</strong> 2009<br />

Post-employment benefits<br />

Defined benefit pension plans (receivable) -128 -197<br />

Defined benefit pension plans (liability) 2,310 2,355<br />

2,182 2,158<br />

EUR 1,000 <strong>2010</strong> 2009<br />

Defined benefits plans Defined benefits plans<br />

Reconciliation of statement of financial position<br />

1 Jan 2,158 2,105<br />

Net income (-) / expenses (+) recognised in profit and loss account 202 -32<br />

Payments into the plan -178 85<br />

31 Dec 2,182 2,158<br />

Pension liabilities on statement of financial position<br />

Present value of funded liabilities 8,054 9,103<br />

Fair value of plan assets -4,476 -5,346<br />

Unrecognised actuarial profits (+) and losses (-) -1,396 -1,599<br />

Total liabilities (receivables) 2,182 2,158<br />

EUR 1,000 <strong>2010</strong> 2009<br />

Defined benefits plans Defined benefits plans<br />

Pension costs on profit and loss account<br />

Service costs in current period -52 -301<br />

Interest expense -361 -410<br />

Expected income from plan assets 243 246<br />

Actuarial profits (+) / losses (-) -32<br />

Service cost of past periods 0 497<br />

Gains and losses on curtailments and settlements 0<br />

Total in personnel costs -202 32<br />

(figures in EUR thousand, if not stated otherwise)<br />

FINNLINES PLC Financial Statements <strong>2010</strong><br />

37