FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

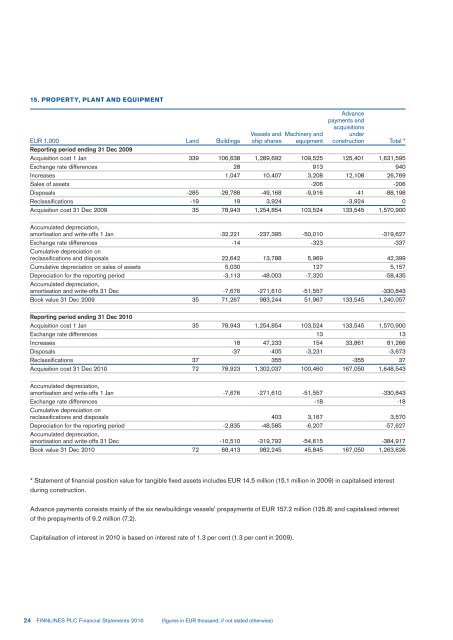

15. PROPERTY, PLANT AND EQUIPMENT<br />

EUR 1,000 Land Buildings<br />

* Statement of financial position value for tangible fixed assets includes EUR 14.5 million (15.1 million in 2009) in capitalised interest<br />

during construction.<br />

Advance payments consists mainly of the six newbuildings vessels’ prepayments of EUR 157.2 million (125.8) and capitalised interest<br />

of the prepayments of 9.2 million (7.2).<br />

Capitalisation of interest in <strong>2010</strong> is based on interest rate of 1.3 per cent (1.3 per cent in 2009).<br />

24 FINNLINES PLC Financial Statements <strong>2010</strong> (figures in EUR thousand, if not stated otherwise)<br />

Vessels and Machinery and<br />

ship shares equipment<br />

Advance<br />

payments and<br />

acquisitions<br />

under<br />

construction Total *<br />

Reporting period ending 31 Dec 2009<br />

Acquisition cost 1 Jan 339 106,638 1,289,692 109,525 125,401 1,631,595<br />

Exchange rate differences 28 913 940<br />

Increases 1,047 10,407 3,208 12,108 26,769<br />

Sales of assets -206 -206<br />

Disposals -285 -28,788 -49,168 -9,916 -41 -88,198<br />

Reclassifications -19 19 3,924 -3,924 0<br />

Acquisition cost 31 Dec 2009 35 78,943 1,254,854 103,524 133,545 1,570,900<br />

Accumulated depreciation,<br />

amortisation and write-offs 1 Jan -32,221 -237,395 -50,010 -319,627<br />

Exchange rate differences -14 -323 -337<br />

Cumulative depreciation on<br />

reclassifications and disposals 22,642 13,788 5,969 42,399<br />

Cumulative depreciation on sales of assets 5,030 127 5,157<br />

Depreciation for the reporting period -3,113 -48,003 -7,320 -58,435<br />

Accumulated depreciation,<br />

amortisation and write-offs 31 Dec -7,676 -271,610 -51,557 -330,843<br />

Book value 31 Dec 2009 35 71,267 983,244 51,967 133,545 1,240,057<br />

Reporting period ending 31 Dec <strong>2010</strong><br />

Acquisition cost 1 Jan 35 78,943 1,254,854 103,524 133,545 1,570,900<br />

Exchange rate differences 13 13<br />

Increases 18 47,233 154 33,861 81,266<br />

Disposals -37 -405 -3,231 -3,673<br />

Reclassifications 37 355 -355 37<br />

Acquisition cost 31 Dec <strong>2010</strong> 72 78,923 1,302,037 100,460 167,050 1,648,543<br />

Accumulated depreciation,<br />

amortisation and write-offs 1 Jan -7,676 -271,610 -51,557 -330,843<br />

Exchange rate differences -18 -18<br />

Cumulative depreciation on<br />

reclassifications and disposals 403 3,167 3,570<br />

Depreciation for the reporting period -2,835 -48,585 -6,207 -57,627<br />

Accumulated depreciation,<br />

amortisation and write-offs 31 Dec -10,510 -319,792 -54,615 -384,917<br />

Book value 31 Dec <strong>2010</strong> 72 68,413 982,245 45,845 167,050 1,263,626