FINANCIAL STATEMENTS 2010 - Finnlines

FINANCIAL STATEMENTS 2010 - Finnlines FINANCIAL STATEMENTS 2010 - Finnlines

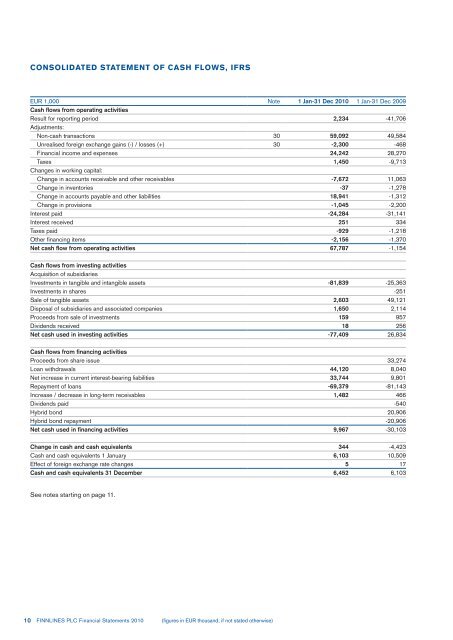

CONSOLIDATED STATEMENT OF CASH FLOWS, IFRS EUR 1,000 Note 1 Jan-31 Dec 2010 1 Jan-31 Dec 2009 Cash flows from operating activities Result for reporting period 2,234 -41,706 Adjustments: Non-cash transactions 30 59,092 49,584 Unrealised foreign exchange gains (-) / losses (+) 30 -2,300 -468 Financial income and expenses 24,242 28,270 Taxes 1,450 -9,713 Changes in working capital: Change in accounts receivable and other receivables -7,672 11,063 Change in inventories -37 -1,278 Change in accounts payable and other liabilities 18,941 -1,312 Change in provisions -1,045 -2,200 Interest paid -24,284 -31,141 Interest received 251 334 Taxes paid -929 -1,218 Other financing items -2,156 -1,370 Net cash flow from operating activities 67,787 -1,154 Cash flows from investing activities Acquisition of subsidiaries Investments in tangible and intangible assets -81,839 -25,363 Investments in shares -251 Sale of tangible assets 2,603 49,121 Disposal of subsidiaries and associated companies 1,650 2,114 Proceeds from sale of investments 159 957 Dividends received 18 256 Net cash used in investing activities -77,409 26,834 Cash flows from financing activities Proceeds from share issue 33,274 Loan withdrawals 44,120 8,040 Net increase in current interest-bearing liabilities 33,744 9,801 Repayment of loans -69,379 -81,143 Increase / decrease in long-term receivables 1,482 466 Dividends paid -540 Hybrid bond 20,906 Hybrid bond repayment -20,906 Net cash used in financing activities 9,967 -30,103 Change in cash and cash equivalents 344 -4,423 Cash and cash equivalents 1 January 6,103 10,509 Effect of foreign exchange rate changes 5 17 Cash and cash equivalents 31 December 6,452 6,103 See notes starting on page 11. 10 FINNLINES PLC Financial Statements 2010 (figures in EUR thousand, if not stated otherwise)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 1. CORPORATE INFORMATION Finnlines is one of the largest North-European liner shipping companies, providing sea transport services mainly in the Baltic and the North Sea. In addition to freight, the company's ro-pax vessels carry passengers between five countries and eight ports. The company also provides port services in Helsinki, Turku and Kotka. Finnlines has subsidiaries or sales offices in Germany, Belgium, the UK, Sweden, Denmark and Poland and a repre- sentative office in Russia. The Group's parent company, Finnlines Plc, is a Finnish pub- lic limited company, which operates under Finnish jurisdiction and legislation. The parent company is registered in Helsinki at Porkkalankatu 20, 00180 Helsinki. Copies of financial statements can be obtained from www.finnlines.com or the company's head- quarters. These financial statements were authorised for issue by the Board of Directors of Finnlines Plc on 2 March 2011. In accordance with the Finnish Companies Act, the financial state- ments are presented for approval to the Annual General Meeting. 2. ACCOUNTING PRINCIPLES BASIS OF PREPARATION OF THE FINANCIAL STATEMENTS The consolidated financial statements are prepared in accord- ance with the International Financial Reporting Standards (IFRS), using the IAS and IFRS standards and SIC and IFRIC interpreta- tions valid on 31 December 2010. The International Financial Re- porting Standards mean the standards implemented in the EU by Regulation (EC) 1606/2002, and the related interpretations. The notes to the Consolidated Financial Statements also comply with Finnish accounting and corporate legislation. The Consolidated Financial Statements are primarily prepared using the acquisition cost method. Exceptions to this principle are financial assets and liabilities recognised at fair value through profit or loss. IMPLEMENTATION OF STANDARDS New and amended standards adopted in 2010 The following new and revised IFRSs have been adopted in these consolidated financial statements. The application of these new and revised IFRSs have not had any material impact on the amounts reported for the current and prior years but may affect the accounting for future transactions and events. • Revised IFRS 3 Business Combinations (issued in 2008) and consequential amendments to IAS 27, Consolidated and separate financial statements, IAS 28, Investments in associates, and IAS 31, Interests in joint ventures, are effective prospectively to business combinations for which the acquisition date is on or after the beginning of the first an- nual reporting period beginning on or after 1 July 2009. The revised standard continues to apply the acquisition method to business combinations but with some significant changes compared with IFRS 3. For example, all payments to purchase a business are recorded at fair value at the acquisition date, with contingent payments classified as debt subsequently re- measured through the statement of comprehensive income. (figures in EUR thousand, if not stated otherwise) There is a choice on an acquisition-by-acquisition basis to measure the non-controlling interest in the acquiree either at fair value or at the non-controlling interest's proportionate share of the acquiree’s net assets. Further, under the revised standard all acquisition-related costs will be expensed. • Amended IAS 27 Consolidated and Separate Financial Statements (issued in 2008). The standard requires the ef- fects of all transactions with non-controlling interests to be recorded in equity if there is no change in control and these transactions will no longer result in goodwill or gains and loss- es. The standard also specifies the accounting when control is lost. Any remaining interest in the entity is re-measured to fair value, and a gain or loss is recognised in profit or loss. • Amendment to IAS 39 Financial Instruments – Recognition and Measurement – Eligible Hedged Items. The amend- ment provides clarification on identifying inflation as a hedged risk and on hedging with options. • IFRIC 17 Distribution of Non-cash Assets to Owners. The interpretation provides guidance on the appropriate account- ing treatment when an entity distributes assets other than cash as dividends to its shareholders. • IFRIC 18 Transfers of Assets from Customers. The interpre- tation addresses the accounting by recipients for transfers of property, plant and equipment from customers. This interpre- tation clarifies the requirements of IFRSs for agreements in which an entity receives from a customer an item of property, plant and equipment, or cash to acquire such item, that the entity must then use either to connect the customer to a net- work or to provide the customer with ongoing access to sup- ply of goods or services (such as supply of electricity, gas or water). • Amendments to IFRS 2, Share-based payment – Group Cash-settled Share-based Payment Transactions. The amendments clarify the scope of IFRS 2. • Improvements to IFRS (April 2009). In the annual im- provement process IASB deals with non-urgent but neces- sary amendments to IFRS, which are collected and issued annually. Implementation of new and revised standards and interpreta- tions in future accounting periods IASB has published the following new or revised standards and interpretations which the Group has not yet adopted. The Group will adopt each standard and interpretation as from the effective date, or if the effective date is other than the first day of the re- porting period, from the beginning of the next reporting period af- ter the effective date. The application of these new IFRSs are not estimated to have a material impact on the amounts reported for the future periods except for the application of IFRS 9 for which the management has not yet estimated the possible impact. • Amendment to IAS 32 Financial Instruments: Presentation – Classification of Rights Issues (effective for reporting pe- riods beginning on or after 1 February 2010). The amendment FINNLINES PLC Financial Statements 2010 11

- Page 1 and 2: FINANCIAL STATEMENTS 2010

- Page 3 and 4: BOARD OF DIRECTORS’ REPORT THE CO

- Page 5 and 6: elated to this. Other significant r

- Page 7 and 8: CONSOLIDATED STATEMENT OF COMPREHEN

- Page 9: CONSOLIDATED STATEMENT OF CHANGES I

- Page 13 and 14: ated companies are consolidated usi

- Page 15 and 16: egory includes assets held for trad

- Page 17 and 18: In defined benefit plans, the emplo

- Page 19 and 20: Segment assets, liabilities and inv

- Page 21 and 22: 8. PERSONNEL EXPENSES EUR 1,000 201

- Page 23 and 24: 13. EARNINGS PER SHARE UNDILUTED Un

- Page 25 and 26: Assets leased through finance lease

- Page 27 and 28: Main factors used in calculating va

- Page 29 and 30: 21. DEFERRED TAX ASSETS AND LIABILI

- Page 31 and 32: EUR 1,000 2010 2009 Significant ite

- Page 33 and 34: 26. PROVISIONS EUR 1,000 2010 2009

- Page 35 and 36: Finance lease liabilities Finance l

- Page 37 and 38: 31. PENSION LIABILITIES The Group

- Page 39 and 40: Hedge Accounting The Group has orde

- Page 41 and 42: The Group had an interest rate swap

- Page 43 and 44: COMMODITY RISK The Group is exposed

- Page 45 and 46: with the Helsinki Court of Appeal a

- Page 47 and 48: In April 2009, Finnlines Plc's subs

- Page 49 and 50: Shares outstanding 31 December 2005

- Page 51 and 52: CALCULATION OF KEY RATIOS, IFRS Ear

- Page 53 and 54: PROFIT AND LOSS ACCOUNT, PARENT COM

- Page 55 and 56: CASH FLOW STATEMENT, PARENT COMPANY

- Page 57 and 58: NOTES TO THE FINANCIAL STATEMENTS,

- Page 59 and 60: 8. EXTRAORDINARY ITEMS EUR 2010 200

CONSOLIDATED STATEMENT OF CASH FLOWS, IFRS<br />

EUR 1,000 Note 1 Jan-31 Dec <strong>2010</strong> 1 Jan-31 Dec 2009<br />

Cash flows from operating activities<br />

Result for reporting period 2,234 -41,706<br />

Adjustments:<br />

Non-cash transactions 30 59,092 49,584<br />

Unrealised foreign exchange gains (-) / losses (+) 30 -2,300 -468<br />

Financial income and expenses 24,242 28,270<br />

Taxes 1,450 -9,713<br />

Changes in working capital:<br />

Change in accounts receivable and other receivables -7,672 11,063<br />

Change in inventories -37 -1,278<br />

Change in accounts payable and other liabilities 18,941 -1,312<br />

Change in provisions -1,045 -2,200<br />

Interest paid -24,284 -31,141<br />

Interest received 251 334<br />

Taxes paid -929 -1,218<br />

Other financing items -2,156 -1,370<br />

Net cash flow from operating activities 67,787 -1,154<br />

Cash flows from investing activities<br />

Acquisition of subsidiaries<br />

Investments in tangible and intangible assets -81,839 -25,363<br />

Investments in shares -251<br />

Sale of tangible assets 2,603 49,121<br />

Disposal of subsidiaries and associated companies 1,650 2,114<br />

Proceeds from sale of investments 159 957<br />

Dividends received 18 256<br />

Net cash used in investing activities -77,409 26,834<br />

Cash flows from financing activities<br />

Proceeds from share issue 33,274<br />

Loan withdrawals 44,120 8,040<br />

Net increase in current interest-bearing liabilities 33,744 9,801<br />

Repayment of loans -69,379 -81,143<br />

Increase / decrease in long-term receivables 1,482 466<br />

Dividends paid -540<br />

Hybrid bond 20,906<br />

Hybrid bond repayment -20,906<br />

Net cash used in financing activities 9,967 -30,103<br />

Change in cash and cash equivalents 344 -4,423<br />

Cash and cash equivalents 1 January 6,103 10,509<br />

Effect of foreign exchange rate changes 5 17<br />

Cash and cash equivalents 31 December 6,452 6,103<br />

See notes starting on page 11.<br />

10 FINNLINES PLC Financial Statements <strong>2010</strong> (figures in EUR thousand, if not stated otherwise)