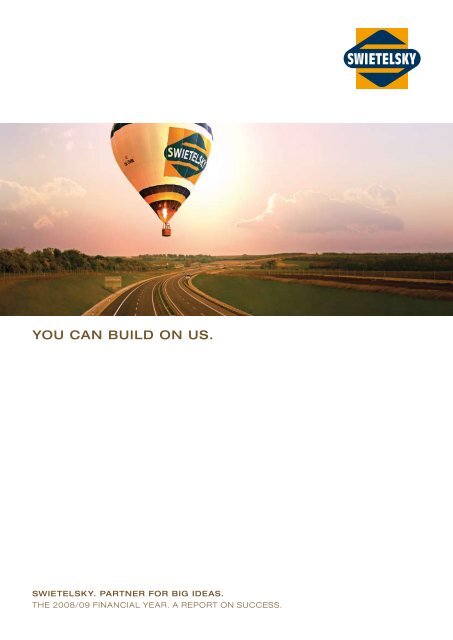

YOU CAN BUILD ON US.

YOU CAN BUILD ON US.

YOU CAN BUILD ON US.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>YOU</strong> <strong>CAN</strong> <strong>BUILD</strong> <strong>ON</strong> <strong>US</strong>.<br />

SWIETELSKY. PARTNER FOR BIG IDEAS.<br />

THE 2008/09 FINANCIAL YEAR. A REPORT <strong>ON</strong> SUCCESS.

We cannot predict<br />

the future, but We<br />

can invent it.<br />

(DanDriDge M. Cole)<br />

The financial crisis and its related effects have confronted both the<br />

entire global economy and our Group with fresh challenges. Nonetheless,<br />

we enjoyed a successful year in 2008/09.<br />

Times like these demonstrate that we have developed our business<br />

model in a far-sighted manner. Our extensive diversification in every<br />

area of the construction industry, as well as the systematic cultivation<br />

of the domestic Austrian market and our core German, Czech and<br />

Hungarian markets, permit us to anticipate stable results in the coming<br />

years. The fact that in the past we have attached great value to<br />

sufficient liquidity reserves, low net debts and a healthy equity ratio<br />

has proven to be a correct decision. We regard the coming financial<br />

year with optimism. Our order backlog amounts to more than 1 billion<br />

euros and this largely secures our business for the coming financial<br />

year. 2009/2010 is a year of challenges, but also chances, even if<br />

one merely thinks of the economic stimulus packages that have been<br />

launched in many countries.<br />

We are ready to seize these opportunities!<br />

Kurt Kladensky Walter Küssel<br />

Executive director Executive director<br />

Adolf Scheuchenpflug Karl Weidlinger<br />

Executive director Executive director<br />

Erneuerung der ÖBB Donaubrücke<br />

Tulln, Niederösterreich

Customer orientation 4<br />

innovative strength 6<br />

internationality 8<br />

Performance range 10<br />

road and bridge construction 12<br />

Civil construction 14<br />

Special civil and underground construction,<br />

environmental technology 16<br />

railway construction 18<br />

Tunnel and gallery construction 20<br />

Financial statements 2008/09 22<br />

2 . 3

Hotel Josef, Prag, Tschechien

SucceSS doeSn‘t come to you.<br />

you go to it.<br />

(Marva CollinS)<br />

customer orientation.<br />

Our customers enjoy trustworthy and perfect project realisation across every<br />

area of SWIETELSKY’s diverse range of supplies and services. Indeed, this<br />

reliability extends from major, international projects to family homes, and from<br />

underground tunnels to construction projects in the mountainous regions.<br />

The SWIETELSKY name is a synonym for full service, adherence to deadlines<br />

and cost efficiency. Over 70 years of experience in the construction industry<br />

and EN ISO 9001:2000 accreditation constitute a guarantee for strong partnerships,<br />

which above all, are focused on the success of our customers.<br />

Particularly in the construction sector, absolute thoroughness provides the<br />

foundations for friction-free teamwork. Accordingly, SWIETELSKY attaches<br />

the greatest importance to the precise planning of all working processes and<br />

complete documentation, which even after many years, leaves no questions<br />

unanswered. Our internal company auditing unit also ensures optimum quality<br />

assurance.<br />

MVC Motors, Wien<br />

4 . 5

Beschneiungsanlage Zürs, Vorarlberg

geniuS learnS from nature.<br />

talent from bookS.<br />

(JoSh BillingS)<br />

innovative strength.<br />

In times of economic difficulty, more than ever, SWIETELSKY’s maxim is to look to the future, accept<br />

challenges and develop innovative solutions, in order to create an enthusiastic response on the part of<br />

the customer.<br />

Indeed, SWIETELSKY goes even further in this regard, for when no adequate technology exists for a new<br />

project, we proceed to create it. The experience gathered during innumerable projects in Austria, Europe<br />

and the rest of the world helps us to turn new visions into reality and in this manner we continually extend<br />

the horizons of the possible.<br />

Over 7.000 highly motivated and excellently trained employees make SWIETELSKY, “a partner for big<br />

ideas”. Moreover, the SWIETELSKY name also stands for the fact, that in spite of this large workforce,<br />

flexibility is not neglected. This is because from the outset, it was and is our company strategy to promote<br />

individual responsibility and a proactive approach in coordination with the respective project manager.<br />

Therapeutisches Kletterzentrum<br />

Weinberg, Niederösterreich<br />

6 . 7

learn the paSt,<br />

Watch the preSent and<br />

create the future.<br />

(JeSSe ConraD)<br />

internationality.<br />

SWIETELSKY numbers among Austria’s largest construction companies<br />

and disposes over offices and subsidiaries in all the federal<br />

provinces. Other Group locations are situated in Germany, Hungary,<br />

the Czech Republic, Slovakia, Poland, Croatia, Italy, Romania, Serbia,<br />

Switzerland and the United Kingdom.<br />

In addition, SWIETELSKY has already completed projects in Asia and<br />

Africa. However, we are not driven by a desire simply to expand, but<br />

rather a readiness to undertake strategically intelligent further development<br />

in the interests of our clients and the company.<br />

The long-term secret of success of the company founder, Hellmuth<br />

Swietelsky, is decentralised profit centres. These “companies within<br />

the company”, which operate on their own responsibility, constitute<br />

a pioneering achievement within the construction industry. Moreover,<br />

during major projects, internationally operating SWIETELSKY experts<br />

coordinate these units.<br />

Bergisel Schanze,<br />

Innsbruck, Tirol

Brücke in Záreci, Südböhmen<br />

8 . 9

Errichtung des Spielfeldes,<br />

Stadion Borussia Mönchengladbach, Deutschland

it’S not the effort that countS,<br />

it’S the reSult you get.<br />

(anonyMouS)<br />

performance range.<br />

The SWIETELSKY portfolio incorporates construction projects of every type<br />

and size. Excellently trained employees realise projects in the following areas:<br />

• Road and bridge construction<br />

• Civil construction<br />

• Special civil and underground construction,<br />

environmental technology<br />

• Railway construction<br />

• Tunnel and gallery construction<br />

As a general contractor, SWIETELSKY completes turnkey objects in all<br />

shapes and sizes, from offices, hotels and commercial buildings, to industrial<br />

facilities and hospitals.<br />

For over 20 years, SWIETELSKY has also enjoyed an excellent reputation<br />

as a builder of modern apartments, semi-detached and detached houses.<br />

SWIETELSKY also offers a full service in this area, from site selection to the<br />

handing over of the keys.<br />

The company performance range is rounded off by PPP projects (Public<br />

Private Partnership), SWIETELSKY completing every contract to per-<br />

fection in its role as a strong domestic partner in the public sector.<br />

Tunnelbaumaschine<br />

10 . 11

Neugestaltung des Hauptplatzes As,<br />

Kreis Karlsbad<br />

Straße in Tschechien Pflasterung Friedhof Traun,<br />

Oberösterreich<br />

Neubau 4er Straße Budapest, Ungarn

the journey iS the reWard.<br />

(ChineSe ProverB)<br />

road and bridge building.<br />

SWIETELSKY provides excellent transport links. We number among the leading road builders<br />

in Central and Eastern Europe and dispose over numerous raw material depots and mixing<br />

plants at strategically favourable points. As a consequence, we are able to complete road<br />

building projects of every dimension throughout Europe in a rapid and cost-efficient manner.<br />

asphalt. concrete.<br />

SWIETELSKY operates numerous company asphalt and concrete mixing plants both in Austria<br />

and neighbouring countries. Our in-Group testing and monitoring unit guarantees that<br />

all quality criteria and environmental regulations are strictly adhered to. Something that our<br />

customers can build on!<br />

In addition, SWIETELSKY road building expertise is supplemented by more than 30 years of<br />

experience with regard to the construction, maintenance and refurbishing of bridges.<br />

SWIETELSKY. Your partner for:<br />

• Roads<br />

• Motorways<br />

• Airports<br />

• Forestry and commercial roads<br />

• Park design<br />

• Plaza design<br />

• New bridge constructions<br />

• Bridge overhauls<br />

• Asphalt<br />

• Concrete<br />

• Gravel<br />

• Recycling<br />

12 . 13

Pankrac House Prag,<br />

Tschechien<br />

Panoramahaus Dornbirn,<br />

Vorarlberg

Bürohaus Jungmannova<br />

Plaza, Prag<br />

architecture aimS at eternity.<br />

(Sir ChriSToPher Wren)<br />

civil construction.<br />

SWIETELSKY is a reliable partner for new buildings and conversions of all types. We take up every challenge<br />

and do the job, irrespective of whether this involves the restoration of a historical building, or the<br />

construction of a spectacular skyscraper. Leading architects and design offices act as our partners and all<br />

projects are realised according to the strictest quality criteria (EN ISO 9001:2000).<br />

In the course of project construction, we build and sell turnkey objects such as owner-occupied apartments,<br />

semi-detached houses and individual SWIETELSKY massive construction houses at fixed prices<br />

and with fixed deadlines.<br />

Among other awards, SWIETELSKY is the holder of the 2008 Solid Bautech Prize in<br />

the “Ecology” category, which we won for sustainable construction and achievements in the<br />

passive house construction sector. Specifically, the prize was presented to SWIETELSKY for its project<br />

ENERGYbase in Floridsdorf, Vienna.<br />

SWIETELSKY. Your partner for:<br />

• New buildings<br />

• Building conversions<br />

• Building repairs<br />

• Renovations/Work on classified buildings<br />

• Single family homes<br />

• Residential complexes<br />

• Office complexes<br />

• Industrial buildings<br />

• Hotels<br />

Wohnanlage Kirchlergründe Jenbach, Tirol<br />

14 . 15

ARGE KOPS II, Vorarlberg<br />

U-Bahn-Baustelle U2/8,<br />

Stadlau, Wien<br />

Hochbehälter Reith bei Seefeld, Tirol

it iS not the mountain We<br />

conquer, but ourSelveS.<br />

(Sir eDMunD hillary)<br />

Special civil underground construction.<br />

Rough terrain? Difficult geological conditions? For SWIETELSKY such problems do not exist. We find the<br />

optimum approach and ideal realisation for every construction project. Our specialists demonstrate their<br />

extensive experience in both the special and underground construction areas. The range on offer extends<br />

from underground construction projects, e.g. deep foundations, construction pits and slope stabilisation,<br />

to construction in high alpine regions, e.g. cable cars and lifts, avalanche protection structures, etc.<br />

environmental technology.<br />

If in the past, the challenge was the mastery of nature by humankind, in our day and age ecological thought<br />

and action take priority. Planning and construction in harmony with nature is the maxim. SWIETELSKY<br />

makes a solid contribution to efficiency and environmental compatibility through innovative developments<br />

and the construction of sewers, landfills and sewage treatment plants.<br />

SWIETELSKY. Your partner for:<br />

• Transport structures<br />

• Open underground structures<br />

• Covered underground structures<br />

• Underground lines<br />

• Underground railway construction<br />

• Power plant construction<br />

• Industrial concrete construction<br />

• Energy concrete construction<br />

• Slurry walls<br />

• Drilling piles<br />

• Anchors<br />

• Single member piles<br />

• Slope stabilisation<br />

• Drilling<br />

• Sewer construction<br />

• Sewer repairs<br />

• Landfills<br />

• Wastewater treatment plants<br />

16 . 17

Skill and confidence are<br />

an unconquered army.<br />

(george herBerT)<br />

railway construction.<br />

For more than 70 years, railway construction has numbered among SWIETELSKY’s<br />

core activities and this has made the company one of the leaders in the European<br />

market. With over 200 special machines and excellently trained specialists we ensure<br />

that the railway construction projects entrusted to our company stay on track<br />

with regard to quality, scheduling and costs.<br />

We take care that permanent way construction machinery is attuned exactly to<br />

respective railway management needs. All special machine designs, repairs and<br />

maintenance are completed in-house at the Group’s own mechanical engineering<br />

centre in Fischamend (Lower Austria).<br />

SWIETELSKY. Your partner for:<br />

• Track construction<br />

• Track modifications<br />

• Track substructure improvement<br />

• Permanent way<br />

• Underground railway construction<br />

• Tramway construction<br />

• Special equipment<br />

SWIETELSKY is also successfully under way as a railway transport enterprise.<br />

RM 80<br />

SUZ 500<br />

Gleisbaukran

Bahnbaumaschine RU 800 S<br />

18 . 19

neceSSity iS the<br />

mother of invention.<br />

(PlaTo)<br />

gallery and tunnel construction.<br />

SWIETELSKY Tunnelbau GmbH und Co KG in Innsbruck is a leading company<br />

in the underground construction sector. Logically, the company’s primary<br />

focus is on gallery and tunnel projects in alpine regions, but it is also<br />

able to point to numerous international references.<br />

In order to avoid expensive surprises underground to the greatest possible<br />

extent, SWIETELSKY completes thorough, preparatory geological studies<br />

and site exploration.<br />

In addition to road, rail and underground railway tunnels, SWIETELSKY<br />

specialises in underground power plant construction, as evidenced by<br />

our current “Limberg 2” project in the immediate vicinity of the Kaprun<br />

reservoirs. In this case, the entire plant is to be located underground in<br />

caverns.<br />

SWIETELSKY. Your partner for:<br />

• Railway tunnels<br />

• Road tunnels<br />

• Underground railway construction<br />

• Power plant galleries<br />

• Caverns<br />

• Shafts<br />

• Maintenance

Durchschlag Lohbergtunnel, Deutschland Abdichtung Innenschale<br />

Lohbergtunnel, Deutschland<br />

Lohbergtunnel, Deutschland<br />

20 . 21

Sporthalle Telfs, Tirol

knoWledge, in truth, iS the<br />

great Sun in the firmament.<br />

(Daniel WeBSTer)<br />

SWietelSky annual report 2008/09.<br />

list of contents<br />

Consolidated profit and loss account for the 2008/09 financial year 24<br />

Consolidated balance sheet as at March 31, 2009 26<br />

Cash flow statement for the 2008/09 financial year 28<br />

Consolidated equity statement for the 2008/09 financial year 30<br />

Statement of recognized income and expenses 32<br />

notes to the consolidated financial statements for the 2008/09 financial year 33<br />

group management report for the 2008/09 financial year 90<br />

audit certificate (report of the independent auditors) 110<br />

Ortsplatzgestaltung, Oberschlierbach,<br />

Oberösterreich<br />

22 . 23

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

Lift Kaunertal-Bergstation, Tirol<br />

Pistenbau Stubaital, Tirol<br />

ÖBB Hangsicherung<br />

Windau, Tirol

ConSoLIdaTEd ProfIT and LoSS aCCounT<br />

for THE BuSInESS YEar 2008/09<br />

Amounts in TEUR Notes 2008/09 2007/08<br />

Revenue (1) 1,246,502 1,244,413<br />

Changes in inventories 0 731<br />

Own work capitalized 8,310 6,037<br />

Other operating income (2) 35,145 12,319<br />

Raw materials, consumables and services used (3) -795,766 -806,467<br />

Employee benefits expense (4) -304,005 -273,205<br />

Other operating expenses (6) -149,104 -135,501<br />

Share of profit or loss of associates (7) 6,906 8,633<br />

Net investment income (8) 1,059 3,203<br />

Earnings before interest, taxes and depreciation (EBITDA) 49,047 60,163<br />

Depreciation and amortization expense (5) -18,745 -17,698<br />

Earnings before interest and taxes (EBIT) 30,302 42,465<br />

Interest income 3,867 2,841<br />

Interest expenses -7,956 -10,218<br />

Net interest income (9) -4,089 -7,377<br />

Other financial result (10) -15 -187<br />

Profit before tax 26,198 34,901<br />

Income tax expense (11) -3,659 -6,623<br />

Profit for the period 22,539 28,278<br />

Attributable to: Minority interest 9 0<br />

Attributable to: Hybrid Capital Owner 4,069 1,525<br />

Attributable to: Equity holders of the parent 18,461 26,753<br />

24 . 25

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

ConSoLIdaTEd BaLanCE SHEET<br />

aS of MarCH 31, 2009<br />

aSSETS<br />

March 31,<br />

March 31,<br />

Amounts in TEUR Notes 2009 2008<br />

Non-current assets:<br />

Intangible assets (12) 11,147 9,274<br />

Tangible assets (12) 124,748 114,205<br />

Investments in associated companies (13) 9,268 14,207<br />

Other financial assets (13) 21,160 17,083<br />

Trade receivables (15) 4,297 1,699<br />

Other accounts receivable and other assets (15) 1,608 1,170<br />

Deferred taxes (17) 2,683 2,622<br />

Current assets:<br />

174,911 160,260<br />

Inventories (14) 35,323 37,812<br />

Trade receivables (15) 264,226 299,245<br />

Other accounts receivable and other assets (15) 65,897 57,938<br />

Cash and cash equivalents (16) 37,883 38,006<br />

403,329 433,001<br />

578,240 593,261<br />

Betriebserweiterung<br />

Hofstätter, Pichling,<br />

Oberösterreich

SHarEHoLdEr’S EquITY and LIaBILITIES<br />

March 31, March 31,<br />

Amounts in TEUR Notes 2009 2008<br />

Shareholder's Equity:<br />

Capital stock 7,705 7,705<br />

Capital reserves 1,094 1,094<br />

Hybrid capital 69,183 69,183<br />

Revaluation reserves 8,707 9,244<br />

Retained earnings 110,949 110,050<br />

Minority interests 62 0<br />

Non-current liabilities:<br />

(18) 197,700 197,276<br />

Provisions (19) 16,293 19,130<br />

Financial liabilities (20) 65,126 65,566<br />

Trade payables (20) 9,023 9,402<br />

Other liabilities (20) 4,146 3,490<br />

Deferred taxes (17) 2,418 8,675<br />

Current liabilities:<br />

97,006 106,263<br />

Provisions (19) 20,822 25,299<br />

Financial liabilities (20) 28,710 15,183<br />

Trade payables (20) 161,835 186,696<br />

Other liabilities (20) 72,167 62,544<br />

ARGE Stadtvillen Anna, Hall in Tirol<br />

283,534 289,722<br />

578,240 593,261<br />

26 . 27

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

ConSoLIdaTEd CaSH-fLoW STaTEMEnT<br />

for THE BuSInESS YEar 2008/09<br />

Amounts in TEUR 2008/09 2007/08<br />

Profit for the period 22,539 28,278<br />

Deferred taxes -5,369 788<br />

Non-cash effective results from associates 437 -3,509<br />

Non-cash effective results from change in consolidation scope -350 0<br />

Depreciation/write-ups 20,458 17,698<br />

Changes in long-term provisions -3,044 4,105<br />

Gains/losses on disposal of non-current assets -4,872 -231<br />

Cash-flow from profits 29,799 47,129<br />

Change in items:<br />

Inventories -3,034 -1,071<br />

Receivables from trade, construction contracts and consortia 17,478 -48,703<br />

Receivables from subsidiaries and<br />

receivables from participation companies -16,642 -3,808<br />

Other assets -3,914 -4,529<br />

Liabilites from trade, construction contracts and consortia -12,873 19,101<br />

Liabilities from subsidiaries and liabilities<br />

from participation companies 3,388 -1,876<br />

Other liabilities 10,989 4,471<br />

Current provisions -2,705 2,209<br />

Cash-flow from operating activities 22,486 12,923<br />

Purchase of financial assets -30,776 -28,162<br />

Gains/losses on disposal of non-current assets 4,872 231<br />

Disposals of nun-current assets at carrying value 3,494 1,398<br />

Exchange rate differences and changes in consolidation<br />

circle minus acquired cash and cash equivalents 269 0<br />

Cash-flow from investing activities -22,141 -26,533

Amounts in TEUR 2008/09 2007/08<br />

Change in bank borrowings 8,163 -29,652<br />

Change in bond loans -1,572 59<br />

Change in liabilites from finance leases 1,954 -2,192<br />

Hybrid capital 0 69,183<br />

Change in group financing 7,505 -11,207<br />

Paid Hybrid premiums -4,069 0<br />

Distribution of company profits -9,400 -5,200<br />

Cash-flow from financing activities 2,581 20,991<br />

Cash-flow from operating activities 22,486 12,923<br />

Cash-flow from investing activities -22,141 -26,533<br />

Cash-flow from financing activities 2,581 20,991<br />

Net changes in cash and cash equivalents 2,926 7,381<br />

Cash and cash equivalents at the beginning of the business year 20,467 13,593<br />

Change in cash and cash equivalents due to exchange rate differences -2,153 -507<br />

Cash and cash equivalents at the end of the business year (22) 21,240 20,467<br />

Interest paid 7,382 7,385<br />

Interest received 2,000 1,565<br />

Taxes paid 3,063 2,524<br />

28 . 29

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

dEvELoPMEnT of THE ConSoLIdaTEd SHarEHoLdEr’S<br />

EquITY for THE BuSInESS YEar 2008/09<br />

Amounts in TEUR Capital stock Capital reserves Hybrid capital Revaluation<br />

reserves<br />

Balance at April 1, 2007 7,705 1,094 0 9,608<br />

Differences arising from currency conversion 0 0 0 -171<br />

Purchase of foreign shares 0 0 0 0<br />

Hybrid capital 0 0 69,183 0<br />

Merger of Jos. Ertl GmbH and<br />

C. Peters Baugesellschaft m.b.H. 0 0 0 0<br />

Change in revaluation reserve 0 0 0 -193<br />

Changes financial instruments IAS 39 0 0 0 0<br />

Profit for the period 0 0 0 0<br />

Distribution of company profits 0 0 0 0<br />

Balance at March 31, 2008 7,705 1,094 69,183 9,244<br />

Differences arising from currency conversion 0 0 0 -488<br />

Neutral change of Revaluation reserves 0 0 0 617<br />

Changes in hedging resverves 0 0 0 0<br />

Deferred taxes on neutral change in equity 0 0 0 -666<br />

Profit for the period 0 0 0 0<br />

Change in minority interest resulting from capital consolidation 0 0 0 0<br />

Paid Hybrid premiums 0 0 0 0<br />

Distribution of company profits 0 0 0 0<br />

Balance at March 31, 2009 7,705 1,094 69,183 8,707

Retained Currency Shareholder’s Minority Total<br />

earnings conversion<br />

differences<br />

Equity<br />

interests<br />

86,222 1,769 106,398 1,628 108,026<br />

0 570 399 0 399<br />

0 0 0 -1,628 -1,628<br />

0 0 69,183 0 69,183<br />

27 0 27 0 27<br />

0 0 -193 0 -193<br />

-90 0 -90 0 -90<br />

28,278 0 28,278 0 28,278<br />

-6,726 0 -6,726 0 -6,726<br />

107,711 2,339 197,276 0 197,276<br />

0 -7,856 -8,344 0 -8,344<br />

0 0 617 0 617<br />

-378 0 -378 0 -378<br />

72 0 -594 0 -594<br />

22,530 0 22,530 9 22,539<br />

0 0 0 53 53<br />

-4,069 0 -4,069 0 -4,069<br />

-9,400 0 -9,400 0 -9,400<br />

116,466 -5,517 197,638 62 197,700<br />

U-Bahn-Baustelle U2/8,<br />

Wien<br />

U-Bahn-Baustelle U2/8,<br />

Wien<br />

30 . 31

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

STaTEMEnT of rECognIzEd<br />

InCoME and ExPEnSES<br />

Amounts in TEUR 2008/09 2007/08<br />

Profit for the period 22,539 28,278<br />

Differences arising from currency conversion -8,344 399<br />

Changes in financial instruments IAS 39 -378 -113<br />

Change of revaluation reserve 617 -230<br />

Deffered taxes on neutral income and expenses -594 60<br />

Total of recognized income and expense for the period -8,699 116<br />

Net income recognized directly in equity 13,840 28,394<br />

Attributable to: Minority interest 9 0<br />

Attributable to: Hybrid Capital Owner 4,069 1,525<br />

Attributable to: Equity holders of the parent 9,762 26,869<br />

RU 800 S<br />

Gleis- und Weichenbau,<br />

Umfahrung Enns,<br />

Oberösterreich

grouP noTES To THE fInanCIaL STaTEMEnTS<br />

for THE 2008/09 BuSInESS YEar of<br />

SWIETELSKY BaugESELLSCHafT M.B.H., LInz<br />

Basic principles<br />

SwIETELSky Baugesellschaft m.b.H. is located at A-4020 Linz, Edlbacherstraße 10, Austria. The enterprise is the<br />

holding company of an internationally acting construction group. The group’s main business activities are classified in<br />

5 different geographic regions: Austria, Germany, Hungary, Czech Republic as well as other countries.<br />

The consolidated financial statement of SwIETELSky Baugesellschaft m.b.H., Linz, under application of Art. 245a of<br />

the Austrian Commercial Code, has been set up as of March 31, 2009 in accordance with the “International Financial<br />

Reporting Standards” (IFRS) stipulations issued by the „International Accounting Standards Board“ (IASB) and including<br />

the interpretations of the “International Financial Reporting Interpretations Committees” (IFRIC).<br />

Applied were exclusively those standards and interpretations adopted by the European Commission before the<br />

reporting deadline and published in the Official Journal of the European Union. Further reporting requirements of<br />

Art. 245a para. 1 of the Austrian Commercial Code (UGB) were fulfilled as well.<br />

In addition to the profit and loss account and the balance sheet, a cash flow statement in accordance with IAS 7, is<br />

set up as well as changes in equity and shares of other shareholders (IAS 1). Additionally, the notes include segment<br />

reporting in accordance with IFRS 8.<br />

The consolidated profit and loss account is prepared according to the total expenditure format.<br />

The consolidated financial statement is presented in TEUR which, however, may cause rounding differences.<br />

Changes to accounting and valuation<br />

As of April 1, 2008, the group has applied new as well as modified standards and interpretations as stated below:<br />

- Changes in IAS 39 and IFRS 7 - Reclassification of financial instruments<br />

- IFRIC 11 / IFRS 2 - Group and treasury share transactions<br />

- IFRIC 14 / IAS 19 - The limit on a defined benefit asset, minimum funding requirements and their interaction<br />

The first-time application of the IFRS standards mentioned had no consequences on the assets, financial and<br />

earnings situation of the SwIETELSky Baugesellschaft m.b.H. Group’s consolidated financial statements and notes.<br />

32 . 33

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

Future amendments to financial reporting standards<br />

The IASB and the IFRIC approved further standards and interpretations. However, these were not required to<br />

be applied in the 2008/09 financial year. The amendments affect the following standards and interpretations:<br />

IFRS 1 and IAS 27 Cost of an Investment in a Subsidiary,<br />

Jointly Controlled Entity or Associate January 1, 2009<br />

IFRS 2 Share-based Payment: Vesting Conditions and Cancellations January 1, 2009<br />

IFRS 3 Capital Consolidation (amended 2008) 1) July 1, 2009<br />

IFRS 8 Operating Segments January 1, 2009<br />

IAS 1 Presentation of Financial Statements January 1, 2009<br />

IAS 23 Borrowing Costs January 1, 2009<br />

IAS 27 Consolidated and Separate Financial Statements 1) July 1, 2009<br />

IAS 32 and IAS 1 Amendments on puttable financial instruments<br />

and obligations arising on liquidation January 1, 2009<br />

IAS 39 Financial Instruments: Recognition and Measurement –<br />

Exposures qualifying for hedge accounting 1) July 1, 2009<br />

IFRIC 12 Service Concession Arrangements 1) January 1, 2008<br />

IFRIC 13 Customer Loyalty Programmes July 1, 2008<br />

IFRIC 15 Agreements for the Construction of Real Estate 1) January 1, 2009<br />

IFRIC 16 Hedges of a Net Investment in a Foreign Operation 1) October 1, 2008<br />

IFRIC 17 Distributions of Non-cash Assets to Owners 1) July 1, 2009<br />

IFRIC 18 Transfers of Assets from Customers 1) July 1, 2009<br />

Amendments to various IFRS under the annual improvement process January 1, 2009<br />

1) pending EU recognition<br />

Application for<br />

financial years<br />

which begin on or after<br />

IFRS 1 and IAS 27 Cost of an Investment in a Subsidiary, Jointly Controlled<br />

Entity or Associate:<br />

IFRS 1 allows first-time adopters to use a surrogate value of either fair value according to IAS 39 or book value<br />

to measure the initial cost of investments in subsidiaries, jointly controlled entities or associates. In accordance<br />

with IAS 27, no separation is required of dividends paid out of pre-acquisition or post-acquisition reserves. If a<br />

new parent company is formed through reorganisation with no changes to the relative ownership levels, the cost<br />

of the investment in the new parent is measured at the book value of its share of the equity of the previous parent.

IFRS 3 and IAS 27:<br />

Phase II of the Business Combination project reworked the rules for capital consolidation. The most important<br />

changes are that IFRS 3 allows an accounting policy choice to measure non-controlling interest at fair value (full<br />

goodwill method), transaction costs must be recognised in profit or loss, no goodwill adjustments are possible with<br />

post-acquisition reassessment of the purchase price, and step acquisitions result in a remeasurement of the previously<br />

recognised assets and liabilities in profit or loss.<br />

IFRS 8 Operating Segments was initially applied in the financial year 2007/08 ahead of schedule.<br />

IAS 1 Presentation of Financial Statements:<br />

IAS 1 requires all non-owner changes in equity to be presented either in one statement of comprehensive income<br />

or in two separate statements. Furthermore, the statement of changes in equity may only present owner changes in<br />

equity.<br />

IAS 23 Borrowing Costs:<br />

The amendments require borrowing costs to be capitalised as part of the initial costs. The option of immediately recognising<br />

interest as an expense was removed. The new rules, which apply to acquisition, construction or production<br />

of a qualifying asset from January 1, 2009, will result in higher capitalisation of borrowing costs related to that asset.<br />

IFRIC 12 Service Concession Arrangements:<br />

IFRIC 12 regulates the accounting of rights and duties from service concession agreements. If the company has an<br />

unconditional contractual right to receive a payment, a financial asset is recognised (financial asset model). If the<br />

company merely has the right to charge users a usage fee, an intangible asset is recognised (intangible asset model).<br />

IFRIC 13 Customer Loyalty Programmes:<br />

IFRIC 13 regulates the accounting of customer loyalty programmes by companies which offer such programmes<br />

themselves or which participate in the loyalty programmes offered by other companies.<br />

IFRIC 15 Agreements for the Construction of Real Estate:<br />

IFRIC 15 puts into concrete terms the concept of construction contracts according to IAS 11 and reconciles revenue recognition<br />

according to IAS 18 with agreements for the construction of real estate. IFRIC 15 states that IAS 11 is applicable<br />

only if the buyer has the ability to specify the major structural elements of the real estate design - if not, IAS 18 applies.<br />

34 . 35

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

IFRIC 16 Hedges of a Net Investment in a Foreign Operation:<br />

IFRIC 16 provides guidelines for the accounting of a hedge of a net investment in a foreign operation.<br />

IFRIC 17 Distributions of Non-cash Assets to Owners:<br />

IFRIC 17 regulates the accounting of the distribution of non-cash assets.<br />

IFRIC 18 Transfers of Assets from Customers:<br />

IFRIC 18 deals with agreements in which a company receives from a customer an asset that the company<br />

must then use either to connect the customer to a network or to provide the customer with ongoing access<br />

to a supply of goods or services.<br />

Consolidation methods<br />

In addition to SwIETELSky Baugesellschaft m.b.H., all important domestic and foreign subsidiaries are included<br />

in the consolidated financial statement of March 31, 2009, in which SwIETELSky Baugesellschaft<br />

m.b.H. has the direct or indirect majority of votes. Immaterial subsidiaries as well as associated companies<br />

are accounted at equity or with continued initial costs.<br />

29 (previous year: 25) affiliated companies were not included, as their influence on the group assets, financial<br />

and earnings situation is immaterial. The sales volume of the subsidiaries, which are not included, is less than<br />

1.5 per cent of group sales.<br />

The companies included in the 2008/09 consolidated financial statements can be seen in the list of participations<br />

(Attachment 2 to the notes).<br />

Balance sheet date of all companies included in the group is March 31, 2009, except SwIETELSky Constructii<br />

Feroviare s.r.l., Bukarest, Romania, whose business year ends as of December 31.<br />

The consolidated group developed in the 2008/09 business year as follows:<br />

Full consolidation Equity valuation<br />

Situation on April 1, 2008 24 22<br />

First consolidation 4 0<br />

Deconsolidation 0 19<br />

Situation on March 31, 2009 28 3<br />

therefrom foreign companies 13 3

In the financial year 19 associated companies were deconsolidated due to immateriality. The deconsolidated enterprises<br />

are not included as consolidated companies in the group’s financial statements. Furthermore, the enterprises<br />

are included as investments and valued accordingly.<br />

There were no further changes in the consolidated group during the 2008/09 business year.<br />

Additions to consolidation scope<br />

In the 2008/09 business year, the following subsidiaries were initially included to the group’s financial statements:<br />

Company Name Direct Share First Consolidation<br />

Full Consolidation:<br />

RTS Rail Transport Service GmbH 90 % April 1, 2008 1)<br />

RTS Rail Transport Service Germany GmbH 100 % April 1, 2008 1)<br />

Bahnbau Petri Hoch- und Tiefbau Gesellschaft m.b.H. 100 % April 1, 2008 1)<br />

SwIETELSky Magyarország kft. 100 % May 31, 2008 2)<br />

The acquisitions have the following effects on the group’s consolidated statements:<br />

Amounts in TEUR Acquired Fair Value- Book Value<br />

Value Amendment<br />

Non-current assets 3,965 0 3,965<br />

Current assets 6,024 0 6,024<br />

Non-current liabilities -364 0 -364<br />

Current liabilities -8,797 0 -8,797<br />

Net assets 828 0 828<br />

Increase in minority interest in equity -53<br />

Effect on consolidated profit and loss -350<br />

Goodwill 2,036<br />

Purchase price 2,461<br />

Less non-cash-effective purchase price component -2,461<br />

Acquired cash and cash equivalents 269<br />

Net cash inflow from the acquisition 269<br />

1) Due to the entity’s increased business volume, the enterprise<br />

was initially included to the group’s financial statements. The<br />

acquisition was performed before April 1, 2008.<br />

2) The enterprise was spun-off of the consolidated company<br />

SwIETELSy Épitö kft., Budapest, Hungary.<br />

36 . 37

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

Consolidation methods<br />

In the 2008/09 financial year, negative goodwill in the amount of TEUR 350 occurred. This amount is reported<br />

under other operating income.<br />

Since the date of initial consolidation, the revenues of the first-time consolidated companies’ accumulated to<br />

the consolidated group’s revenue amount to TEUR 15,326. The accumulated profits for the period amount<br />

to TEUR 14.<br />

Acquisitions after the reporting period<br />

Acquisitions after the reporting period are stated in section (27) ‘Significant events after the balance sheet date’.<br />

Consolidation methods<br />

The financial statements of domestic and foreign companies included in the consolidated financial statements<br />

are set up in accordance with uniform accounting and valuation principles. The annual financial statements of<br />

domestic and foreign group companies are adapted accordingly; insignificant deviations remain unchanged.<br />

For acquisitions from April 1, 2003 capital consolidation is made in accordance with the stipulations in IFRS 3. All<br />

assets and debts of the subsidiaries are recorded at the accompanying values. The proportional equity thereby<br />

determined is offset by the participation book value. Differences on the assets side, which are allotted to special,<br />

identifiable intangible assets, which were acquired within the framework of the business combination, are recognised<br />

separately from the goodwill. If a useful life can be allocated to these assets, the planned amortisation<br />

is made over the projected useful life. Intangible assets with an indefinite useful life are tested annually for their<br />

intrinsic value and amortised if necessary on the basis of an impairment test.<br />

Any remaining differences on the assets side are capitalized as goodwill and amortised on the basis of an impairment<br />

test in accordance with IAS 36. There is no planned depreciation of goodwill resulting from acquisitions<br />

after April 1, 2003.<br />

Internal reporting figures formed the basis for the impairment test. within the framework of the application of the<br />

DCF-method market interest rates after tax were applied.<br />

The same principles of capital consolidation are applied to participations included under the Equity-Method as<br />

in the case of fully-consolidated companies, whereby the respective last available financial statement serves<br />

as the basis for the equity consolidation. Adjustments to the IFRS valuation requirements have been drawn up<br />

according to materiality.

within the framework of debt consolidation, receivables from trade, loans as well as other receivables are rounded up<br />

with the corresponding liabilities and provisions among the subsidiaries included in the financial statements.<br />

Expenditure and income from internal-group trade have been eliminated. Interim results incurred from internal-group<br />

trade transactions in the fixed- and current assets have been cancelled, as far as they are not of minor importance.<br />

Minority interests in equity and in the result of the companies, which are controlled by the parent company, are shown<br />

separately in the consolidated financial statements.<br />

The necessary tax deferrals are made for consolidation procedures affecting the profit and loss account.<br />

Currency translation<br />

The group currency is the Euro. The financial statements for the foreign companies are converted into Euro according<br />

to the concept of functional currency. As the companies run their business independently regarding financial, economic<br />

and organizational matters in all companies this is the respective local currency.<br />

All balance sheet items are converted at the mean foreign exchange price at the balance sheet date. Expenditure- and<br />

income items are converted at the average annual price.<br />

In the business year exchange rate differences of TEUR -7,856 (previous year: TEUR 570) are recognized in the equity<br />

with no effect on the operating result in the course of the capital consolidation.<br />

Currency translation differences between the cut off date within the balance sheet and the average price within the<br />

profit and loss account are allocated to equity.<br />

It was not necessary to perform revaluations according to IAS 29 (Financial Reporting in Hyperinflationary Economies).<br />

38 . 39

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

aCCounTIng and vaLuaTIon PrInCIPLES<br />

Intangible assets and tangible assets<br />

Acquired intangible assets and tangible assets are recognized at their historical or production price, less<br />

planned and unplanned depreciation. Both the direct and the appropriate parts of overhead costs for the<br />

selfconstructed plants are included in the production costs.<br />

Planned depreciation of depreciable fixed assets is made according to the straight line method in accordance<br />

with the foreseeable useful life, whereby in the case of utilization over a six month period of an asset acquired<br />

in the business year the depreciation is recognized at the full annual amount, in the case of shorter utilization<br />

period at half the annual amount. Should there be indications of impairment in the case of assets and should<br />

the market value of the future cash surpluses be under the market values, then impairment is made according<br />

to IAS 36 to the lower accompanying value.<br />

The following useful lives were assumed in the determination of the rate of depreciation:<br />

Intangible assets:<br />

Useful life<br />

in years<br />

Software and licenses 3-4<br />

Tangible assets:<br />

Buildings 10-50<br />

Machinery and technical equipment 3-17<br />

Other plant, furniture and fixtures 3-10<br />

Leasing contracts on assets, on which all the chances and risks essentially lay with the company, are treated<br />

as finance leases. Fixed assets underlying these leasing agreements are capitalized at the present value of<br />

the minimum payments at the beginning of leasing relations and depreciated over the foreseeable useful life<br />

or over shorter contract terms. These are offset by the liabilities arising from future leasing payments, whereby<br />

the former are recognized at the present value of the outstanding obligations at the balance sheet date.<br />

In addition there are leasing agreements for tangible assets, which are regarded as operating leases. Leasing<br />

payments resulting from these contracts are recognized as expenditure.

Revaluation<br />

Real estates as well as flats and stock spaces are revaluated. Differing amounts less deferred taxes, which result<br />

from revaluation, will be charged against equity. The accumulated amount of revaluations added up to TEUR 8,707<br />

(previous year: TEUR 9,244) on the balance sheet date. Deferred taxes resulting from revaluation amounted to TEUR<br />

2,683 (previous year: TEUR 2,817) on the balance sheet date.<br />

Tangible assets (real estates and buildings) were revalued according to an independent expertise from:<br />

weismann+Pitschmann of February 23, 2007 for Austria<br />

Dipl.-Ing. (FH) wilfried Mirbeth of April 1, 2007 for Germany<br />

HUNGVENT Pénzügyi és<br />

Befektetési Tanácsadó kft of February 25, 2009 for Hungary<br />

For the determination of the current market price the reference value method has been used.<br />

Financial assets<br />

In accordance with IAS 28 shares in associated companies are valued at equity - in far as they are not shares of minor<br />

significance. Basically the same valuation methods are applied here as for fully consolidated companies.<br />

Subsidiaries and participations which are neither consolidated nor presented at equity, are classified as available for<br />

sale at their historical cost since their fair values could not be identified reliably.<br />

Interest-bearing loans are, as long as no value deductions are necessary, reported at their nominal value. Significant<br />

interest-free or low interest-bearing loans are discounted to their present value.<br />

At initial recognition securities classified as available for sale are valued according at cost and later recognized at fair<br />

value. Basically fair value changes are recognized directly in equity and only recognized in the consolidated income<br />

statement upon disposal of the security. The permanent impairment of securities classified as available for sale is<br />

recorded in the consolidated income statement.<br />

40 . 41

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

Inventories<br />

Inventories are valued at historical cost or production cost or at the lower market value of a lower accompanying<br />

value.<br />

Production costs include all direct costs as well as appropriate parts of overheads arising during production.<br />

Distribution costs as well as costs for general administration are not included in production costs. The interest<br />

on borrowing in connection to the production is not capitalized.<br />

Accounts receivable and other assets<br />

Receivables from trade and other receivables are valued at their nominal value less valuation adjustments for<br />

realizable individual risks. Financial receivables are classified under the category “Loans and Receivables” and<br />

valued at their historical costs. Graduated valuation adjustments are formed according to risk groups in order<br />

to take general loan risks on customer receivables into consideration.<br />

Non-interest bearing and low-interest bearing receivables are discounted. Foreign currency receivables are<br />

valued on the balance sheet date at the valid exchange rate or in the case of hedging at the hedged rate.<br />

In the case of receivables from construction contracts the results are realized according to the Percentage of<br />

Completion Method (IAS 11). The output actually attained by the balance sheet date serves as a benchmark<br />

for the degree of completion. Threatening losses from the further construction process are accounted for by<br />

means of appropriate depreciations.<br />

when the performance to be valued, which was provided within the framework of a construction contract, exceeds<br />

the payments received for it, then this is shown on the assets side under receivables from construction<br />

contracts. In the reverse case this is reported on the liabilities side under liabilities from trade.<br />

The results, in the case of construction contracts, which are carried out in consortia, are realized according<br />

to the Percentage of Completion Method in accordance with the degree of completion on the balance sheet<br />

date. Threatening losses arising from further construction work are accounted for by means of appropriate<br />

depreciations. Receivables from or liabilities to consortia include the proportional contract result as well as<br />

capital contributions, in- and out payments and charges resulting from services.<br />

The valuation of other assets is made at historical cost less extraordinary depreciation.

Cash and cash equivalents<br />

Cash and cash equivalents cover all liquid and likewise assets which have a maturity less than three months at the<br />

acquisition date. Cash and cash equivalents are valued at cost.<br />

Deferred taxes<br />

The determination of tax deferral is made according to the Balance Sheet Liability Method for all temporary differences<br />

between the carrying value of the balance sheet items in the IFRS consolidated financial statement and their existing<br />

tax values in the case of individual companies. Furthermore, the tax advantage which can probably be realized from<br />

existing losses carried forward is included in this process. Differing amounts from non-tax deductible goodwill are<br />

exceptions to this extensive tax deferral.<br />

Deferred tax assets are only recognized if it is probable that the included tax advantage is realizable. The calculation<br />

of the tax deferral is based on the usual income tax rate in the respective country at the point of the predicted reversal<br />

in their value difference.<br />

Provisions<br />

Provisions for severance pay are created as a result of statutory regulations. The provision for severance payments is<br />

determined by using the actuarial expertise. Here the future claim over the length of employment of the employees is<br />

collected while taking any future pay rises into consideration. The present value of the partly earned partial-claims on<br />

the deadline day is recognized as the provision.<br />

The change in value of the determined provision amount as a result of changes in the calculation parameter<br />

(= actuarial profit or loss) is immediately recognized as a whole in the profit and loss account.<br />

Pension provisions are calculated according to the Projected Unit Credit Method. In this method the discounted<br />

pension claim acquired up to balance sheet date is determined.<br />

The effect in value of the change to these assumptions is recognized as an actuarial profit and loss and is in total<br />

immediately recognized in the profit and loss account. Service costs are recognized in the personnel expenses, the<br />

proportion of the interest in the allocation of provisions in the financial result.<br />

The calculation of the severance pay- and pension provisions is based on an interest rate of 5.5 % (previous year:<br />

5.5 %) and an expected development of income and pensions of 3.55 % (previous year: 3.5 %). Life expectancy for<br />

severance pay and pension provisions are calculated according to AVÖ 2008-P “Angestellte”.<br />

42 . 43

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

The other provisions take into consideration all realizable risks and uncertain obligations. They are recognized<br />

at the respective amount, which is necessary at the balance sheet date according to commercial judgment, in<br />

order to cover future payment obligations, realizable risks and uncertain obligations within the group. Hereby<br />

the respective amount is recognized, which arises as the most probable on careful examination of the facts.<br />

Long-term provisions are, in as far as they are not immaterial, accounted at their discounted discharge amount<br />

on the balance sheet date. The discharge amount also includes cost increases to be considered on the<br />

balance sheet date. Provisions, which arise from the obligation to recultivate gravel sites, are allocated according<br />

to the rate of utilization.<br />

Liabilities<br />

Liabilities are basically recognized at the repayment amount. Foreign currency liabilities are valued at the middle<br />

foreign currency rate at the balance sheet date. Interest free liabilities especially those from financial leasing<br />

liabilities, if material, are accounted at the present value of the repayment obligation. Financial liabilities are<br />

classified under the category “Financial Liabilities at Amortized Cost” and measured at their historical costs.<br />

Contingent liabilities<br />

Contingent liabilities are possible or existing obligations, with which an outflow of resources is not probable.<br />

They are not recognized in the balance sheet. The reported obligation volumes of contingent liabilities correspond<br />

to the extent of liability on the balance sheet date.<br />

Derivative financial instruments<br />

Derivative financial instruments are basically used to reduce the risk of change of interest rate and change of<br />

foreign exchange rate.<br />

All derivative financial instruments are accounted at fair value in accordance with IAS 39 and reported under<br />

“Other Receivables or Other Liabilities”.<br />

Derivative financial instruments are measured on the basis of inter-bank conditions and, if necessary, the loan<br />

margin or stock exchange price applicable for SwIETELSky, under application of the buying and selling rate<br />

on the balance sheet date. where quoted market prices are not used, the fair value is calculated by means of<br />

financial mathematic methods.

SwIETELSky Baugesellschaft m.b.H. Group applies the requirements of the hedging relationships according to<br />

IAS 39 (Hedge Accounting) in order to hedge fair values and future cash flows. Gains and losses from derivative financial<br />

instruments designated as qualified hedging instruments within the framework of a fair value hedge, or for which<br />

no qualified hedge relationship in accordance with IAS 39 could be established and which therefore do not qualify for<br />

hedge accounting, are recognized with an effect on income in the consolidated income statement. Profits and losses<br />

from derivative financial instruments, for which a cash flow hedge relationship could be created, are recognised in<br />

the cash flow hedge reserve not affecting net income until the time of realization. Changes in profits and losses due<br />

to ineffectiveness of the derivative financial instruments are recognized with an effect on income in the consolidated<br />

income statement. The effectiveness of the hedging relationships (fair value hedges and cash flow hedges) is controlled<br />

by effectiveness tests prospectively and retrospectively on each balance sheet date. There was no material<br />

ineffectiveness related to the hedging transactions up to the balance sheet date.<br />

Derivatives, which are not included in a hedging relationship according to IAS 39, are categorized under “At Fair Value<br />

through Profit or Loss (Trading)” and valued at fair value with an effect on income.<br />

Revenue recognition<br />

Revenue from construction contracts are recognised progressively in accordance with the level of the completion<br />

(percentage of completion method). Service rendered till the balance sheet date serves as a benchmark for the stage<br />

of completion.<br />

Sales from the disposal of own projects, from trade, from goods and services to joint ventures, from other goods<br />

and services and from the sale of construction materials are recognised with the transfer of the control and risks and<br />

rewards involved and with the rendering of the service.<br />

Bacher Lechbrücke, Tirol<br />

ÖBB Brücke in Neumarkt-Kallham, Oberösterreich<br />

44 . 45

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

Estimations and assumptions<br />

Estimations and assumptions, which refer to the amount and recognition of the assets and liabilities<br />

accounted, the income and expenditure as well as the statement of contingent liabilities, are necessary for the<br />

preparation of the consolidated financial statement according to IFRS and essentially concern the assessment<br />

of building projects until completion, in particular the amount of the realization of profits, the accounting and<br />

evaluation of provisions and the impairment test of goodwill and other assets. In the case of future-oriented<br />

assumptions and estimations on the balance sheet date the turnover at the time of the preparation of the<br />

consolidated financial statement as well as the realistically expected development of the global and branchrelated<br />

environment are taken into account with regard to the expected future business development. In the<br />

case of developments in the underlying conditions which deviate from the assumptions and which are beyond<br />

the control of the management board the amount, which actually results can deviate from the estimated<br />

values. In the case if such a development occurs the assumptions and, if necessary, the carrying values of<br />

the affected assets and liabilities are adjusted to the latest information. As the consolidated financial statement<br />

is being prepared, there are no signs which indicate the necessity to significantly change the underlying<br />

assumptions and estimations.<br />

Steinschlagschutzbarrieren<br />

Weizklamm, Steiermark<br />

Hangsicherung Windau, Tirol

noTES on THE ITEMS of THE<br />

ConSoLIdaTEd ProfIT and LoSS aCCounT<br />

(1) Revenue<br />

Revenue of TEUR 1,246,502 (previous year: TEUR 1,244,413) are attributed in particular to revenue from construction<br />

contracts, sales revenue of own projects, trade to consortia, other services as well as proportionally acquired profits<br />

from consortia.<br />

Revenue from construction contracts, which contain the periodical part of profits according to the level of completion<br />

of the respective contract (Percentage of Completion Method) amount to TEUR 556,341 (previous year: TEUR 706,199).<br />

Revenue only reflects an incomplete picture of the output achieved in the business year. Therefore the total output of<br />

the group is additionally presented. The output numbers shown include the proportional output of consortia and not<br />

consolidated or at-equity participations.<br />

Amounts in TEUR 2008/09 2007/08<br />

Austria 707,961 690,297<br />

Hungary 192,681 214,595<br />

Czech Republic 170,442 133,783<br />

Germany 153,305 174,398<br />

Others 133,614 119,888<br />

Beschneiung Serfaus, Tirol<br />

1,358,003 1,332,961<br />

46 . 47

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

(2) Other operating income<br />

Amounts in TEUR 2008/09 2007/08<br />

Income from disposal and appreciation of fixed<br />

assets excluding financial assets 5,520 1,437<br />

Others 29,625 10,882<br />

The other remaining operating income mainly includes revenues from insurance compensation and exchange<br />

rate differences.<br />

(3) Raw materials, consumables and services used<br />

35,145 12,319<br />

Cost for services are mainly attributed to services of subcontractors and professional craftsmen as well as<br />

planning services, machine rentals and third-party repairs:<br />

Amounts in TEUR 2008/09 2007/08<br />

Cost of materials 340,800 413,388<br />

Cost of services 454,966 393,079<br />

795,766 806,467

(4) Employee benefits expense<br />

Amounts in TEUR 2008/09 2007/08<br />

wages 139,854 130,789<br />

Salaries 103,057 89,165<br />

Expenses for severance payments<br />

and contributions to pension funds 5,736 2,446<br />

Expenses for pensions 326 411<br />

Social security payments and<br />

expenses for support 50,953 46,862<br />

Other social expenses 4,079 3,532<br />

Included in the expenses for severance pay and in the expenses for pensions are expenses for service costs and<br />

actuarial profits. The proportion of interest included in the expenses for severance payments as well as for pensions<br />

is recognized under the financial result.<br />

The expenses for defined contribution plans amount to TEUR 362 (previous year: TEUR 265).<br />

The average number of employees has developed as follows:<br />

(5) Depreciation and amortization expense<br />

304,005 273,205<br />

2008/09 2007/08<br />

Salaried employees 2,281 2,192<br />

Labourers 4,753 4,859<br />

7,034 7,051<br />

The planned and extraordinary depreciation of intangible assets and tangible assets are represented in the consolidated<br />

development of fixed assets.<br />

In the business year, extraordinary depreciation of tangible assets amounting to TEUR 514 (previous year: TEUR 240)<br />

was carried out. Extraordinary amortization of goodwill amounts to TEUR 0 (previous year: TEUR 400).<br />

48 . 49

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

(6) Other operating expenses<br />

Other operating expenses of TEUR 149,104 (previous year: TEUR 135,501) mainly include maintenance<br />

costs, rental- and lease costs, travel- and advertising costs. Other taxes amount to TEUR 1,216 (previous<br />

year: TEUR 2,237).<br />

Expenses for research and development incurred in various technical special proposals, in connection with<br />

concrete competitive projects and the introduction of building processes and products onto the market was<br />

therefore recognized in total in the profit and loss account.<br />

(7) Share of profit or loss of associates<br />

Amounts in TEUR 2008/09 2007/08<br />

Income from investments in associates 7,808 8,850<br />

Expenses arising from investments in associates -902 -217<br />

(8) Net investment income<br />

Amounts in TEUR 2008/09 2007/08<br />

Income from participations 2,961 3,233<br />

Expenses arising from participations -1,902 -30<br />

In the 2008/09 business year extraordinary depreciation of participations amounting to TEUR 1,713<br />

(previous year: TEUR 0) was recorded.<br />

(9) Net interest income<br />

6,906 8,633<br />

1,059 3,203<br />

Included in interest expenses are interest components from the allocation of severance payment- and pension<br />

provisions amounting to TEUR 655 (previous year: TEUR 569).<br />

Amounts in TEUR 2008/09 2007/08<br />

Interest income 3,867 2,841<br />

Interest expenses -7,956 -10,218<br />

Net interest income -4,089 -7,377

(10) Other financial result<br />

Amounts in TEUR 2008/09 2007/08<br />

Other financial income 247 35<br />

Other financial expenses -262 -222<br />

(11) Income tax expense<br />

-15 -187<br />

Taxes paid in the individual companies, as well as the taxes owed on taxable income and deferred taxes are<br />

recognized as income tax:<br />

Amounts in TEUR 2008/09 2007/08<br />

Tax expense 9,028 5,835<br />

Deferred tax -5,369 788<br />

The differences between the Austrian corporate income tax of 25 % and the recognized overall group tax rate<br />

originate from:<br />

Amounts in TEUR 2008/09 2007/08<br />

Profit before tax 26,198 34,901<br />

Theoretical tax expenditure 25 % 6,550 8,725<br />

Differences from foreign tax rates -543 -278<br />

Tax effects from:<br />

3,659 6,623<br />

Non-tax deductible expenditure and tax-free earnings 854 913<br />

Change of tax rate -985 -559<br />

Tax-free income from associates -3,114 -2,436<br />

Change of valuation adjustment on deferred tax assets 12 2<br />

Other 885 256<br />

Recognized income tax expense 3,659 6,623<br />

50 . 51

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

noTES on ITEMS of THE<br />

ConSoLIdaTEd BaLanCE SHEET<br />

(12) Intangible and tangible assets<br />

The composition and changes in the intangible assets, goodwill and tangible assets are represented in the<br />

table “Consolidated development of fixed assets” (Attachment 1 to the notes).<br />

Goodwill<br />

At the balance sheet date goodwill is composed of as follows:<br />

Amounts in TEUR 31.3.2009 31.3.2008<br />

CELL-BAHNBAU Danubia kft./Mavepcell kft. 4,458 4,528<br />

Bahnbau Petri Hoch- und Tiefbau Gesellschaft m.b.H. 2,036 0<br />

SwIETELSky stavební s.r.o. 1,158 1,158<br />

Georg Feßl GmbH 896 896<br />

A.S.T. Baugesellschaft m.b.H. 580 580<br />

SwIETELSky Épitö kft. 430 430<br />

C. Peters Baugesellschaft m.b.H. 252 252<br />

Ing. Rudolf Seibt Gleisbau GmbH 208 208<br />

Jos. Ertl GmbH 181 181<br />

10,199 8,233<br />

Goodwill is subject to an annual impairment test. By this test, the recoverable amount of a cash-generating<br />

unit is compared with its corresponding book value.<br />

The recoverable amount is the market value or its value in use which is the discounted value of future cash<br />

flows. The identification takes place on current budgeting of internal reporting, which is based on experience<br />

from the past as well as on expectations of future market developments. The discount rate for future cash<br />

flows amounts to the rate of cost of capital which varies according to segment and country. The cost of<br />

capital rates had a range between 8.0 % and 14.0 %.<br />

In the context of the annual impairment test, the comparison of book values with the recoverable amounts of<br />

the cash-generating units resulted in no impairment requirement (previous year: TEUR 400).

Tangible assets<br />

The book values of valued asset groups of real estates, real estate and equivalent rights and buildings, including<br />

buildings on third party property, that would have resulted from valuation according to the benchmark method of IAS<br />

16, would amount to TEUR 64,557 (previous year: TEUR 55,546).<br />

On the balance sheet date the following book values are included in the tangible assets due to existing finance leasing<br />

contracts:<br />

Real estate leasing<br />

Amounts in TEUR 31.3.2009 31.3.2008<br />

Historical costs 5,474 5,474<br />

Depreciation (accumulated) -1,408 -1,189<br />

Book value 4,066 4,285<br />

Machinery leasing<br />

Amounts in TEUR 31.3.2009 31.3.2008<br />

Historical costs 7,868 8,022<br />

Depreciation (accumulated) -4,011 -3,136<br />

Book value 3,857 4,886<br />

Offset against these are liabilities from the present value of leasing obligations amounting to TEUR 6,167 (previous<br />

year: TEUR 7,837).<br />

The terms of the finance leases for real estate are between 10 and 25 years, while those for the machine leases are<br />

between 4 and 11 years.<br />

52 . 53

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

In subsequent business years the following liabilities without outstanding payments (TEUR 2,380; previous<br />

year: TEUR 2,440) will arise from leasing:<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

Term up to one year 1,058 1,563<br />

Term between one to five years 994 1,812<br />

Term over five years 2,870 3,111<br />

In addition to finance leases, there are also operating leases for the utilization of technical plants, machines,<br />

other plant, furniture and fixtures. The expenses from these contracts are recognized in the income statement.<br />

The payments made for the 2008/09 business year amount to<br />

TEUR 22,814 (previous year: TEUR 27,404).<br />

Payment obligations arising from operating lease agreements in subsequent business years are represented<br />

as follows:<br />

Restrictions on property, plant and equipment<br />

On the reporting date, liabilities to banks amounting to TEUR 599 (previous year: TEUR 0) have been pledged<br />

as collaterals.<br />

Referring to Cash and cash equivalents, no financial instruments were pledged as collaterals for liabilities.<br />

4,922 6,486<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

Term up to one year 23,191 23,250<br />

Term between one to five years 54,689 64,939<br />

Term over five years 23,410 24,689<br />

101,290 112,878<br />

On the balance sheet date there are no significant liabilities concerning the acquisition of tangible assets,<br />

which have not been considered in the consolidated financial statements.

(13) Financial assets<br />

Detailed information on the group participations (shares of more than 20 %) can be found in the list of participations<br />

(Attachment 2 to the notes).<br />

The development of the financial assets is as follows:<br />

Amounts in TEUR Balance Currency<br />

Change of<br />

consoli- Additions Disposals Transfers Impair- Balance<br />

on April 1,<br />

2008<br />

Translation dation<br />

scope<br />

ments on March 31,<br />

2009<br />

Shares in affiliated companies 9,216 -721 -2,462 2,728 232 1,098 1.713 7,914<br />

Shares in associated companies 14,207 0 0 465 902 -4,502 0 9,268<br />

Other participations 7,428 -178 0 2,602 396 3,404 0 12,860<br />

Other loans 417 -23 0 0 25 0 0 369<br />

Advance payments made 22 -3 0 9 11 0 0 17<br />

31,290 -925 -2,462 5,804 1,566 0 1,713 30,428<br />

The following table shows financial information of the associated companies (100 %):<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

Total Assets 59,338 101,817<br />

Total Liabilities 32,741 70,204<br />

Sales 76,922 180,514<br />

Profit 13,387 19,374<br />

19 associated companies were disposed from the scope of consolidation during the business year.<br />

Therefore, comparability to the prior year is limited.<br />

54 . 55

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

(14) Inventories<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

Undeveloped land 15,281 18,921<br />

Raw materials and supplies 19,716 17,351<br />

Payments made 326 1,540<br />

(15) Accounts receivable and other assets<br />

Amounts in TEUR Total shortterm longterm Total shortterm longterm<br />

Receivables from<br />

35,323 37,812<br />

March 31, 2009 March 31, 2008<br />

construction contracts 514,751 514,751 0 641,593 641,593 0<br />

Advances received -410,457 -410,457 0 -492,862 -492,862 0<br />

104,294 104,294 0 148,731 148,731 0<br />

Trade receivables 105,842 101,545 4,297 101,247 99,548 1,699<br />

Receivables from consortia 58,387 58,387 0 50,966 50,966 0<br />

Trade receivables 268,523 264,226 4,297 300,944 299,245 1,699

Amounts in TEUR Total shortterm longterm Total shortterm longterm<br />

Receivables<br />

from affiliated companies 15,170 15,170 0 16,599 16,599 0<br />

Receivables from participation<br />

companies 28,086 28,086 0 18,408 18,408 0<br />

Other accounts receivable,<br />

accruals and deferrals 24,249 22,641 1,608 24,101 22,931 1,170<br />

Other accounts receivable<br />

and other assets 67,505 65,897 1,608 59,108 57,938 1,170<br />

Accounts receivable from construction contracts are represented as follows:<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

All contracts in progress at balance sheet date:<br />

March 31, 2009 March 31, 2008<br />

Costs incurred to balance sheet date 547,103 677,484<br />

Profits arising to balance sheet date 30,884 49,633<br />

Accumulated losses -21,646 -20,918<br />

Less receivables recognized under liabilities -41,590 -64,606<br />

514,751 641,593<br />

Receivables from construction contracts amounting to TEUR 41,590 (previous year: TEUR 64,606) are recognized<br />

in liabilities as advances received exceed the receivables.<br />

As usual in the industry the customer has the contractual right to retain part of the total amount of the invoice. These<br />

retentions are, however, redeemed as a rule by security (bank- or group guarantees).<br />

56 . 57

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

In the business year, impairments of trade receivables developed as follows:<br />

Amounts in TEUR 2008/09 2007/08<br />

Impairment as of April 1 18,148 14,831<br />

Allocation, Utilization, Reversal 11,510 3,317<br />

Impairment as of March 31 29,658 18,148<br />

(16) Cash and cash equivalents<br />

Cash and cash equivalents include cash on hand, cash at banks and securities as follows:<br />

March 31, March 31,<br />

Amounts in TEUR 2009 2008<br />

Securities 16,643 17,538<br />

Cash on hand, cash at banks 21,240 20,468<br />

Gailbrücke Watsching, Kärnten<br />

37,883 38,006<br />

ÖBB Unterführung Lessern,<br />

Oberösterreich

(17) Deferred taxes<br />

Based on the currently valid tax regulations it can be assumed that the majority of the differing amounts between<br />

the tax related participation value and the proportional equity of the subsidiaries included in the consolidated financial<br />

statement, which arises in the profits received, remains tax-free. Therefore there was no accrual and deferral<br />

of taxes.<br />

Deferred taxes on losses carried forward were capitalized, as these can probably be offset with future taxable<br />

profits. No deferred tax assets were made for differences in book value on the assets side and tax losses carried<br />

forward of TEUR 0 (previous year: TEUR 458), as their effectiveness as final tax relief is not sufficiently assured.<br />

Temporary differences between the amounts stated in the IFRS consolidated financial statements and the respec-<br />

tive tax amounts affect the tax accruals and deferrals recognized in the balance sheet as follows:<br />

Amounts in TEUR Assets Liabilities Assets Liabilities<br />

Tangible assets 130 5,905 149 7,864<br />

Financial assets 57 33 0 521<br />

Inventories 2 0 547 0<br />

Receivables 4,825 10,319 1,361 6,985<br />

5,014 16,257 2,057 15,370<br />

Provisions 3,691 216 6,019 1,017<br />

Liabilities 2,378 95 2,639 381<br />

Tax losses carried forward 5,750 0 0 0<br />

Deferred tax assets 16,833 16,568 10,715 16,768<br />

Netting out of deferred tax assets<br />

March 31, 2009 March 31, 2008<br />

and liabilities to the same tax authorities -14,150 -14,150 -8,093 -8,093<br />

Deferred taxes netted out 2,683 2,418 2,622 8,675<br />

58 . 59

SWIETELSKY Baugesellschaft m.b.H., Linz<br />

(18) Shareholder’s Equity<br />

The fully-paid-in capital stock amounts to EUR 7,705,000.00 and is held by following shareholders:<br />

TRIAS Holding GmbH, Linz 6,799,469.88<br />

Thumersbacher Geräteverleih Gesellschaft m.b.H., Zell am See 616,400.00<br />

HPB-Holding GmbH, wien 289,130.12<br />

In the business year 2008/09, the company has made no transactions with TRIAS Holding GmbH. At the<br />

balance sheet date there were liabilities to TRIAS Holding GmbH, Linz, amounting to TEUR 664 (previous year:<br />

receivables TEUR 1,378).<br />

The retained earnings include currency translation differences and the statutory and mandatory retained earnings,<br />

the profit for the period as well as the result carried forward from previous periods of SwIETELSky<br />

Baugesellschaft m.b.H. and their consolidated subsidiaries, in as far as these enterprises were not eliminated<br />

in the capital consolidation.<br />

Changes in value of derivative financial instruments from cash flow hedges are represented in the cash flow<br />

hedge reserve. The cash flow hedge reserve as of March 31, 2009 amounts to TEUR -369 (as of March 31,<br />