Tug Boat Market Report - November 2012 - Marcon International, Inc.

Tug Boat Market Report - November 2012 - Marcon International, Inc.

Tug Boat Market Report - November 2012 - Marcon International, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

Vessels and Barges for Sale or Charter Worldwide<br />

<strong>November</strong> <strong>2012</strong><br />

<strong>Tug</strong> <strong>Market</strong> <strong>Report</strong><br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

P.O. Box 1170, 9 NW Front Street, Suite 201<br />

Coupeville, WA 98239 U.S.A.<br />

Telephone (360) 678 8880<br />

Fax (360) 678-8890<br />

E Mail: info@marcon.com<br />

http://www.marcon.com<br />

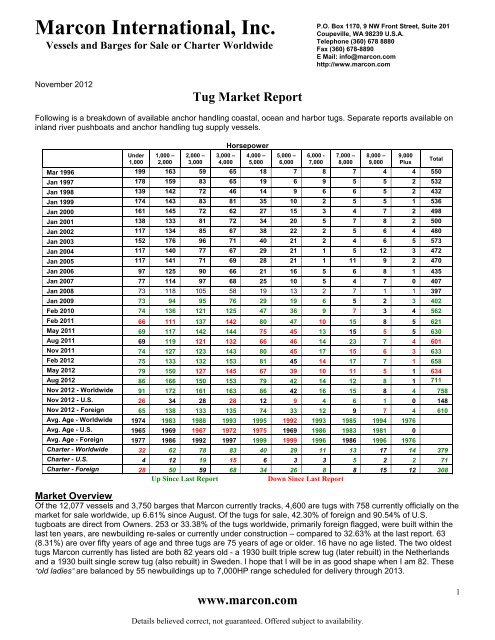

Following is a breakdown of available anchor handling coastal, ocean and harbor tugs. Separate reports available on<br />

inland river pushboats and anchor handling tug supply vessels.<br />

Under<br />

1,000<br />

1,000 –<br />

2,000<br />

2,000 –<br />

3,000<br />

3,000 –<br />

4,000<br />

Horsepower<br />

Mar 1996 199 163 59 65 18 7 8 7 4 4 550<br />

Jan 1997 178 159 83 65 19 6 9 5 5 2 532<br />

Jan 1998 139 142 72 46 14 9 6 6 5 2 432<br />

Jan 1999 174 143 83 81 35 10 2 5 5 1 536<br />

Jan 2000 161 145 72 62 27 15 3 4 7 2 498<br />

Jan 2001 138 133 81 72 34 20 5 7 8 2 500<br />

Jan 2002 117 134 85 67 38 22 2 5 6 4 480<br />

Jan 2003 152 176 96 71 40 21 2 4 6 5 573<br />

Jan 2004 117 140 77 67 29 21 1 5 12 3 472<br />

Jan 2005 117 141 71 69 28 21 1 11 9 2 470<br />

Jan 2006 97 125 90 66 21 16 5 6 8 1 435<br />

Jan 2007 77 114 97 68 25 10 5 4 7 0 407<br />

Jan 2008 73 118 105 58 19 13 2 7 1 1 397<br />

Jan 2009 73 94 95 76 29 19 6 5 2 3 402<br />

Feb 2010 74 136 121 125 47 36 9 7 3 4 562<br />

Feb 2011 66 111 137 142 80 47 10 15 8 5 621<br />

May 2011 69 117 142 144 75 45 13 15 5 5 630<br />

Aug 2011 69 119 121 132 66 46 14 23 7 4 601<br />

Nov 2011 74 127 123 143 80 45 17 15 6 3 633<br />

Feb <strong>2012</strong> 75 133 132 153 81 45 14 17 7 1 658<br />

May <strong>2012</strong> 79 150 127 145 67 39 10 11 5 1 634<br />

Aug <strong>2012</strong> 86 166 150 153 79 42 14 12 8 1 711<br />

4,000 –<br />

5,000<br />

Nov <strong>2012</strong> - Worldwide 91 172 161 163 86 42 16 15 8 4 758<br />

Nov <strong>2012</strong> - U.S. 26 34 28 28 12 9 4 6 1 0 148<br />

Nov <strong>2012</strong> - Foreign 65 138 133 135 74 33 12 9 7 4 610<br />

5,000 –<br />

6,000<br />

6,000 -<br />

7,000<br />

7,000 –<br />

8,000<br />

8,000 –<br />

9,000<br />

Avg. Age - Worldwide 1974 1983 1988 1993 1995 1992 1993 1985 1994 1976<br />

Avg. Age - U.S. 1965 1969 1967 1972 1975 1969 1986 1983 1981 0<br />

Avg. Age - Foreign 1977 1986 1992 1997 1999 1999 1996 1986 1996 1976<br />

Charter - Worldwide 32 62 78 83 40 29 11 13 17 14 379<br />

Charter - U.S. 4 12 19 15 6 3 3 5 2 2 71<br />

Charter - Foreign 28 50 59 68 34 26 8 8 15 12 308<br />

Up Since Last <strong>Report</strong> Down Since Last <strong>Report</strong><br />

<strong>Market</strong> Overview<br />

Of the 12,077 vessels and 3,750 barges that <strong>Marcon</strong> currently tracks, 4,600 are tugs with 758 currently officially on the<br />

market for sale worldwide, up 6.61% since August. Of the tugs for sale, 42.30% of foreign and 90.54% of U.S.<br />

tugboats are direct from Owners. 253 or 33.38% of the tugs worldwide, primarily foreign flagged, were built within the<br />

last ten years, are newbuilding re-sales or currently under construction – compared to 32.63% at the last report. 63<br />

(8.31%) are over fifty years of age and three tugs are 75 years of age or older. 16 have no age listed. The two oldest<br />

tugs <strong>Marcon</strong> currently has listed are both 82 years old - a 1930 built triple screw tug (later rebuilt) in the Netherlands<br />

and a 1930 built single screw tug (also rebuilt) in Sweden. I hope that I will be in as good shape when I am 82. These<br />

“old ladies” are balanced by 55 newbuildings up to 7,000HP range scheduled for delivery through 2013.<br />

9,000<br />

Plus<br />

Total<br />

1

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

The majority of tugs <strong>Marcon</strong> tracks for sale are in the U.S. with 145 tugs<br />

officially on the market (up from 144 last report), followed by Southeast Asia<br />

with 141 (vs. 135), 121 each in Europe (111) and the Far East (104), 75 in the<br />

Mediterranean (74), 47 Mid East (46), 31 Caribbean (26), 17 each in Canada<br />

(17) and where location unstated (16), 12 each in Africa (10) and Latin<br />

America (11), Southwest Asia 11 (10) and 8 in the South Pacific (7). CAT<br />

diesels still power most tugs for sale with machinery in 148 or 20% of the tugs<br />

<strong>Marcon</strong> lists. This is followed by 109 Cummins, 62 EMD, 50 Niigata, 43<br />

Yanmar, 33 Deutz, 25 each with GM and Mitsubishi, 22 Ruston and 18 MAK<br />

powered tugs. 205 tugs are powered by machinery from other manufacturers<br />

from ABC to Zibo with, as always, eight Fairbanks Morse boats out there<br />

looking for a new home. Conventional single and twin screw tugs prevail with<br />

142 (18.7%) and 461 (60.8%), respectively, for sale worldwide. These are<br />

followed by 121 azimuthing tugs (16.0%) on the market, 26 Voith Schneider<br />

tractor tugs (3.4%), six triple screw and two shallow draft quad screws (1.1%).<br />

We hit another record total of 758 tugs for sale worldwide, up 6.6% since<br />

August of this year when 711 tugs were officially for sale – and up 19.7%<br />

since <strong>November</strong> 2011. Several of the listings include multiple tugs and, as<br />

in the past, there are many vessels officially on the market which we are<br />

not familiar with, plus others not officially for sale which can be developed<br />

for sale out of competition. All of the increase was in the overseas market<br />

with 47 additional tugs coming available for sale and 15 for charter within<br />

the last three months. While there have been a few U.S. flag tugs sold, a<br />

few more came on the market leaving the number of domestic tugs for<br />

sale flat. The greatest number of foreign flag tugs for sale are in the 1,000<br />

– 1,999HP, 2,000-2,999 and 3,000-3,999HP ranges with about 133 – 138<br />

available in each grouping, and all showing an increase since August. The<br />

only horsepower range that showed a decline was 8,000 – 8,999 which dropped off one tug to seven now officially<br />

listed for sale. U.S. flag tugs fell slightly in the under 999HP (-1), 3,000-3,999HP (-3) and 5,000-5,999HP (-1) ranges,<br />

but four more domestic tugs in the 7,000–8,999HP range came on the market. We are continuing to see slightly more<br />

activity in tug sales, especially with U.S. boats going foreign and expect this to continue over the next six months.<br />

<strong>Marcon</strong> <strong>International</strong>’s year-to-date sales revenues are still down over last year, but under the circumstances I think<br />

we are doing pretty well. Fourth quarter <strong>2012</strong> could end up to be our best quarter this year. <strong>2012</strong> has booked 29 sales<br />

and eight charters so far and several additional sales are pending. To date this year we have sold or chartered 15 tugs<br />

and one AHTS with a total of 56,596BHP which is an improvement over 2010 and 2011’s figures.<br />

Actual sales price compared toBHP, as of the end of <strong>November</strong> with<br />

sales of 23,700BHP concluded to date, is US$ 344/BHP for a “generic”<br />

1979 built tug. The graph does not take into account the vessel’s<br />

condition and whether azimuthing, twin screw, single screw or tractor;<br />

but is just a simple comparison of tugs sold built 33 years ago. All eight<br />

tugs sold in this case were twin conventional tugs sold for future<br />

trading. None were sold for scrap. <strong>2012</strong>’s Price/BHP of US$ 344/BHP<br />

to date is fairly close to 2005’s US$ 339.5 for a generic tug two years<br />

older when <strong>Marcon</strong> sold 38,101BHP in tugs. It is unlikely that we will<br />

see any major improvement in second-hand tug prices, especially older<br />

units, within the near future. Condition, as always, and, more than ever, location are the key factors affecting the final<br />

sale price for second-hand tugs. It does not take much of a mobilization cost to make or break a sale in these times.<br />

I recently talked to one owner who asked my opinion on how much should he spend on a 47 year old, 3,000BHP twin<br />

screw tug, taking into consideration today’s sale & purchase market. After a short discussion of the numbers and the<br />

specific tug involved, we both quickly came to the conclusion that anything spent should be dependent only on the<br />

earning capability of the tug in his existing trade and not on any expected improvement in resale value. The tug is<br />

regularly working and very likely to remain in that trade for a number of years. The only return on additional investment<br />

that can be counted on will come from continued employment and not from any increase in resale value. A close eye<br />

though will be kept on the future of the trade and her potential life span which could be another five to ten years.<br />

www.marcon.com<br />

Mitsubishi<br />

3%<br />

Deutz<br />

5%<br />

Yanmar<br />

6%<br />

Niigata<br />

7%<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

EMD<br />

8%<br />

Cummins<br />

15%<br />

TUG ENGINE TYPES<br />

Ruston<br />

GM 3%<br />

3%<br />

MAK<br />

2%<br />

Other<br />

28%<br />

CAT<br />

20%<br />

2

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Recent <strong>Marcon</strong> <strong>Tug</strong> Sales & Charters<br />

Crowley Maritime’s 5,750BHP twin screw tug “Pathfinder” was sold on a<br />

private and confidential basis. The 136.2’ x 36.5’ x 19.2’ depth tug was<br />

originally built for Crowley in 1970 by McDermott Marine in Amelia, Louisiana.<br />

She is powered by a pair of EMD 16-645E5s developing a total of 5,750BHP<br />

with Falk 4.536 gears and 5-blade stainless props. <strong>Tug</strong> is fitted with a Markey<br />

TDSDW 36C double drum tow winch and hydraulic pins. “Pathfinder” was laid<br />

up in Puget Sound at the time of sale. <strong>Marcon</strong> acted as sole broker in the<br />

transaction and has represented both buyer and seller in multiple sales and<br />

purchases over the years.<br />

The twin screw tug “King Philip” has been sold to Latin American<br />

interests on a private basis. The 96.0’ x 34.0’ x 17.9’ tug was the third<br />

tug built by its former Owner, family-run Seaboats, <strong>Inc</strong>., at their<br />

shipyard facility in Fall River, Massachusetts in 1996 for their in-house<br />

use. “King Philip”, designed by Jonathan Laiby of Woods Hole, is<br />

powered by a pair of CAT D399 turbo-charged diesels developing a<br />

total of 2,250BHP at 1,225RPM through Reintjes 5.976 gears to fixed<br />

pitch props. Towing gear consists of a single drum Almon Johnson,<br />

GM4-71 diesel powered winch with approximately 2,000’ of 2” wire and<br />

a stern roller. The ABS loadlined tug is fitted with an upper pilot house<br />

and well suited for pushing in the notch, as well as coastal and ocean<br />

towing. Vessel was reflagged to foreign registry.<br />

2,900BHP twin screw tug sold on private and confidential basis.<br />

TradeWinds Towing of New Orleans has taken the twin screw tug “Leslie Foss”<br />

(ex-Caribe Pioneer, Leslie Foss) on bareboat charter from Foss Maritime of<br />

Seattle, Washington. The U.S. flag, 120’ x 31’ x 14.9’ tug was built in 1970 as one<br />

of four similar tugs constructed at McDermott Shipyard in Amelia, Louisiana for<br />

Foss. During her 32 years working for Foss, she has worked not only in the<br />

Pacific Northwest and Alaska, but as far afield as Talara, Peru; Attu, Adak and<br />

Shemya in the Aleutian Islands; the Caribbean; U.S. East Coast and the Great<br />

Lakes towing construction, derrick, accommodations, cement and oil barges.<br />

“Leslie Foss” is powered by a pair of EMD 12-645E2 diesel totaling 3,000BHP,<br />

turning 103” x 82” 5-blade propellers which gives her 37.5 tons of bollard pull and<br />

a free running speed of 12kn. Ship’s power is supplied by two 99kW and one<br />

75kW gensets, all powered by John Deere 6068 diesel engines. With 96,000 gallons of fuel capacity she has the long<br />

legs required for ocean towing. Towing gear consists of a<br />

Markey TDSD-32 double drum winch, stern roller and tow<br />

pins. Charterers plan to employ the tug on various<br />

coastwise and ocean towing projects in the U.S. Gulf of<br />

Mexico and have already committed her on the first tow<br />

under their operation. This is the second sale that <strong>Marcon</strong><br />

has been fortunate to work on with the Buyer. <strong>Marcon</strong> has<br />

been involved with about a dozen transactions with the<br />

seller over the years. <strong>Marcon</strong> acted as sole broker.<br />

Two late 2011 / <strong>2012</strong> built, 4,900BHP ASD escort tugs<br />

have been chartered on a private and confidential basis for coastal and harbor towing in Central America. The 65 ton<br />

bollard pull Z-peller tugs, only recently placed into service, are fitted with 30T at 10m/min line pull bow and stern<br />

winches, stern roller, tugger winch, 2T knuckle boom crane and FiFi-1 with waterspray. <strong>Marcon</strong> represented the<br />

Owners in this transaction.<br />

<strong>2012</strong> has booked 29 sales and eight charters as of the end of <strong>November</strong> including 15 tugs totalling 51,144BHP. Four<br />

ocean deck barges and three inland deck barges with aggregate deadweight capacities of 26,000 and 6,800 tons<br />

respectively have also been sold. One two year old 5,150BHP AHTS was also fixed on a six month charter. We have<br />

several additional sales pending and expected to close within the next two to three weeks.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

3

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Once Again – Yet Another Record Number of <strong>Tug</strong>s Worldwide<br />

Once again the worldwide number of tugs hit another record - even in today’s economy. While information in IHS<br />

Fairplay Sea-web only covers “sea-going” vessels over 100GRT, there are many tugs either under that tonnage or in<br />

inland service. According to Sea-web, as of <strong>November</strong> 6th, <strong>2012</strong>, there were 15,490 “sea-going” tugs over 100GRT<br />

worldwide, up from 14,805 in <strong>November</strong> 2011, and up 207 vessels from last August’s report. Total horsepower is<br />

40,727,371BHP, up 615,595BHP since August. Even taking into account flags of convenience, the largest national<br />

fleet of tugs over 100GRT sails under Indonesian flag, which has just overtaken the U.S. for first place in horsepower.<br />

The U.S. operates 1,450 “sea-going” tugs over 100GRT, or 9.36% of the world market, totaling 4,768,428BHP<br />

(11.71% global BHP). Average age of tugs worldwide is 21 years with the U.S. flag “sea-going” fleet now at 33 years<br />

(built 1979).<br />

Top 50 “Sea-Going” <strong>Tug</strong> Fleets By Units As Of <strong>November</strong> <strong>2012</strong> According to HIS Fairplay Sea-web<br />

Flag TotalBHP % # <strong>Tug</strong>s % Avg BHP Avg Age<br />

Worldwide 40,727,371 100.00 15,490 100.00<br />

2,629 1991<br />

Indonesia 5,010,750 12.30% % 3,078 19.87% %<br />

1,628 2001<br />

United States Of America 4,768,428 11.71% 1,450 9.36% 3,289 1979<br />

Unknown 1,425,736 3.50% 821 5.30% 1,737 1978<br />

Japan 2,453,698 6.02% 764 4.93% 3,212 1996<br />

Singapore 1,894,175 4.65% 668 4.31% 2,836 2006<br />

Korea, South 1,319,954 3.24% 476 3.07% 2,773 1989<br />

Malaysia 940,913 2.31% 462 2.98% 2,037 2002<br />

Panama 1,302,963 3.20% 430 2.78% 3,030 1989<br />

India 1,062,684 2.61% 398 2.57% 2,670 1995<br />

Russia 991,594 2.43% 371 2.40% 2,673 1987<br />

Italy 1,010,531 2.48% 322 2.08% 3,138 1985<br />

United Kingdom 791,493 1.94% 252 1.63% 3,141 1990<br />

Australia 860,998 2.11% 250 1.61% 3,444 1995<br />

China, People's Republic Of 758,689 1.86% 219 1.41% 3,464 1992<br />

Canada 623,350 1.53% 217 1.40% 2,873 1975<br />

Brazil 640,176 1.57% 199 1.28% 3,217 2001<br />

St Vincent & The Grenadines 651,175 1.60% 189 1.22% 3,445 2000<br />

Iran 410,145 1.01% 185 1.19% 2,217 1989<br />

Turkey 494,602 1.21% 178 1.15% 2,779 1991<br />

United Arab Emirates 517,033 1.27% 178 1.15% 2,905 1996<br />

Spain 604,577 1.48% 172 1.11% 3,515 1992<br />

Philippines 336,710 0.83% 163 1.05% 2,066 1977<br />

Mexico 522,936 1.28% 157 1.01% 3,331 1986<br />

Netherlands 553,528 1.36% 152 0.98% 3,642 1999<br />

Venezuela 422,129 1.04% 151 0.97% 2,796 1986<br />

Egypt 441,135 1.08% 148 0.96% 2,981 1988<br />

Saudi Arabia 450,984 1.11% 145 0.94% 3,110 1990<br />

Ukraine 228,411 0.56% 117 0.76% 1,952 1983<br />

Greece 205,826 0.51% 113 0.73% 1,821 1973<br />

France 378,582 0.93% 107 0.69% 3,538 1992<br />

Vietnam 198,113 0.49% 102 0.66% 1,942 1996<br />

Thailand 256,432 0.63% 100 0.65% 2,564 1984<br />

Chinese Taipei 241,172 0.59% 93 0.60% 2,593 1987<br />

Germany 321,618 0.79% 85 0.55% 3,784 1989<br />

Norway 238,320 0.59% 84 0.54% 2,837 1979<br />

Nigeria 163,760 0.40% 78 0.50% 2,099 1986<br />

Bahrain 224,662 0.55% 75 0.48% 2,995 1991<br />

Cyprus 260,424 0.64% 73 0.47% 3,567 2001<br />

Chile 250,693 0.62% 69 0.45% 3,633 1999<br />

Honduras 124,181 0.30% 65 0.42% 1,910 1968<br />

Algeria 237,818 0.58% 64 0.41% 3,716 1990<br />

Colombia 183,908 0.45% 60 0.39% 3,065 1997<br />

Argentina 163,380 0.40% 59 0.38% 2,769 1980<br />

Malta 288,552 0.71% 56 0.36% 5,153 2002<br />

Portugal 126,242 0.31% 56 0.36% 2,254 1979<br />

Finland 146,880 0.36% 55 0.36% 2,671 1970<br />

Libya 138,975 0.34% 53 0.34% 2,622 1990<br />

Belgium 213,401 0.52% 51 0.33% 4,184 1999<br />

Sweden 134,985 0.33% 51 0.33% 2,647 1965<br />

Kuwait 203,692 0.50% 50 0.32% 4,074 1996<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

4

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

I keep expecting to see total global fleet numbers starting to decline<br />

instead of hitting a record every new market report. Maybe I need a little<br />

more patience. At the time of our <strong>November</strong> 2010 report, the average<br />

horsepower for the world’s 14,430 “sea-going” tugs was 2,633BHP with an<br />

average year built of 1990. Today’s average of 15,490 tugs is 2,629BHP<br />

with a year built of 1991. The U.S. fleet in <strong>November</strong> 2010 included 1,514<br />

“sea-going” tugs with an average of 3,194BHP and year built of 1978.<br />

Today’s U.S. fleet did decline 4.2% to 1,450 tugs, average horsepower<br />

increased to 3,289BHP – mostly ATBs and ASDs; and average year built<br />

is 1979 vs. 1978, but that still makes the U.S. fleet one more year older.<br />

<strong>Marcon</strong> is trying to do our part – five of eighteen tugs we sold during 2011<br />

and <strong>2012</strong> were U.S. tugs averaging 36 years old that went overseas.<br />

Breakdown of U.S. “Sea-Going” Fleet<br />

Following is a breakdown of the U.S. sea-going tug fleet as of <strong>November</strong> <strong>2012</strong>,<br />

according to IHS Fairplay Sea-web, compared with last quarter. As of August<br />

<strong>2012</strong>, the U.S. domestic tug fleet consisted of 1,469 “sea-going” tugs totaling<br />

4,847,030HP. The U.S. flag fleet decreased by 19 tugs to 1,450 while total<br />

horsepower fell by 78,602BHP to 4,768,428HP- reflecting recent sales of a<br />

number of 5,750-7,200HP 1970s built tugs overseas to West Africa plus to<br />

domestic operators for foreign service. High horsepower and large tugs are<br />

easy to track, but Sea-web has data on only 52 U.S. tugs under 999BHP. As<br />

most of the “under thousand horsepower” tugs in the U.S. are below 100 gross<br />

register tons, they are generally not included in the Registry. Not counting<br />

pushboats, there are eight to nine hundred additional small tugs in U.S.<br />

coastal waters. As of Spring <strong>2012</strong>, there were 7,159 “towboats” (both tugs &<br />

inland river pushboats) in the U.S. Approx. half were under 100GRT. Inland river pushboats do not meet IHSF criteria<br />

and therefore are also not included in Sea-Web.<br />

U.S. Sea-Going <strong>Tug</strong> Fleet Over 100GRT ByBHP According to Lloyd’s Register as of <strong>November</strong> <strong>2012</strong><br />

UnknownBHP<br />

Under<br />

999<br />

1000-<br />

1999<br />

2000-<br />

2999<br />

3000-<br />

3999<br />

4000-<br />

4999<br />

5000-<br />

5999<br />

6000-<br />

6999<br />

7000-<br />

7999<br />

8000-<br />

8999<br />

9000 Plus Total<br />

Total # 124 52 271 221 269 244 97 69 52 10 41 1,450<br />

AvgBHP 789 1,504 2,356 3,416 4,358 5,446 6,412 7,153 8,066 11,223<br />

Avg LOA 89 80 87 97 106 106 115 113 137 133 141<br />

Avg Beam 28 23 26 29 32 34 36 38 39 41 47<br />

Avg Depth 12 9 11 13 15 15 17 18 20 20 24<br />

Avg Year Built 1974 1952 1966 1975 1980 1992 1990 1999 1983 1996 2004<br />

Previous U.S. Sea-Going <strong>Tug</strong> Fleet Over 100GRT According to Lloyd’s Register as of August <strong>2012</strong><br />

UnknownBHP<br />

Under<br />

999<br />

1000-<br />

1999<br />

2000-<br />

2999<br />

3000-<br />

3999<br />

4000-<br />

4999<br />

5000-<br />

5999<br />

6000-<br />

6999<br />

7000-<br />

7999<br />

8000-<br />

8999<br />

9000 Plus Total<br />

Total # 131 54 274 223 272 243 97 65 54 10 46 1,469<br />

AvgBHP 788 1,501 2,360 3,412 4,358 5,446 6,401 7,160 8,066 11,643<br />

Avg LOA 91 81 87 97 106 106 116 113 138 137 140<br />

Avg Beam 28 23 26 29 32 34 36 38 39 42 48<br />

Avg Depth 12 9 11 13 15 15 17 18 20 20 24<br />

Avg Year Built 1974 1951 1965 1975 1979 1991 1989 1999 1983 1996 2003<br />

Of the 1,450 U.S. flag tugs in Lloyd’s as of <strong>November</strong>, 205 have unknown engines. 466<br />

or 37% where type is known are powered by EMDs, 381 (31%) by CATs, 126 (10%) by<br />

General Motors / Detroit Diesels and Cummins and Alco are tied with 4% market share<br />

each. Of 1,450 U.S. flag tugs, 394 (27%) and 773 (53%) are conventional single screw<br />

and twin screw, respectively. The remaining 20% of U.S. flag tugs are 223 azimuthing, 37<br />

triple screw and 23 Voith-Schneider tractor tugs. Two years ago, 33% of U.S. tugs were<br />

powered by EMDs, 30% by CATs, 17% by General Motors / Detroit Diesels and 4% still<br />

by Fairbank Morse. 30% and 52% of U.S. tugs were conventional single and twin screw<br />

respectively with the remaining 18% consisting of 196 azimuthing, 38 triple screw and 23<br />

tractor tugs. There are 65 fewer single screw and 27 more ASD tugs in the fleet today<br />

than two years ago.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

5

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

New Construction, Shipyard and Conversion News<br />

According to “Fairplay Newbuildings”, as of 6 th <strong>November</strong> <strong>2012</strong>,<br />

there were 6,628 ships over 299GRT on the World Orderbook,<br />

down 139 or about 2.06% from 6,767 ships in August, and<br />

showing a further decline from 7,956 newbuildings one year ago.<br />

This is the lowest number of ships on the World Orderbook since<br />

<strong>Marcon</strong> started tracking newbuildings over five years ago. Many<br />

shipbuilders are idle as orders, especially for larger vessels,<br />

continue their steep decline as supply outstrips demand. Some<br />

overseas shipyards have not seen a single order this year and<br />

2013 does not look very good for big ship orders. Many yards will<br />

not survive. In contrast, of the total number on today’s orderbook,<br />

547, or 8.25% are tugs or “towing / pushing” vessels, up five from 542 in August. This is, of course, down from a peak<br />

of 643 in August 2011, but still healthy. 712 of today’s newbuildings, up<br />

13 from our last report, are OSVs and 259, up 32, are “Offshore –<br />

Other”. Of 547 tugs listed by Fairplay under construction, Malaysia<br />

leads the order book with 150 tugs being built, down 5 from August.<br />

They are followed by China PR at 91 (up 3) tugs, Indonesia 36,<br />

Romania 29, Vietnam 28, 27 Turkey, Spain 23, Egypt 21, 15 Japan,<br />

USA 14, 13 each in India, Poland and Singapore, 12 Russia, Brazil 9, 8<br />

each Iran and Qatar, the Netherlands and Peru 5 each, 4 South Korea,<br />

3 each Cuba, UAE and Ukraine, Chile, Serbia Thailand and Venezuela<br />

2 each and 1 each in Azerbaijan, Belgium, Canada, Colombia, Libya<br />

and South Africa. Of 547<br />

tugs being built, abt. 55.6%<br />

are to be delivered in <strong>2012</strong>, 38.4% in 2013 and 6.0% during 2014.These<br />

figures though do not cover all tugs, towboats and pushers actually under<br />

construction. Many ordered by government agencies or navies such as tugs<br />

built by Pella or other Russian yards for the Russian Navy, or domestic<br />

internal trade vs. export in China never show up on the World Orderbook. I<br />

would not be surprised to see one hundred and fifty or more tugs added to<br />

the orderbook each year If they were included – and this would still exclude<br />

the inland river towboats or pushboats operating on the Mississippi River<br />

system in the United States and other internal waterways across the world.<br />

U.S. shipyards are seeing more activity than many overseas yards and doing much better than after the 1980s’<br />

downturn when commercial construction plummeted to almost zero by 1986. As of 20 th <strong>November</strong>, MarineLog and Tim<br />

Colton U.S. Shipbuilding Contracts tallied 343 vessels and barges on order, excluding inland barges and recreational<br />

vessels. Approx. 60% vessels and barges are being built for commercial operators. There are also others that we<br />

know of that do not show up on the list. One of our friends in the U.S. Gulf, whose facility adjoins a local shipyard,<br />

commented that this time last year one of his workers could lie down and take a nap in the middle of the road leading<br />

up to the yard. Now with the increased traffic and employees going and coming, the yard had to install a stop light and<br />

build a new parking lot. We also are discussing more newbuilding options with various yards in the U.S. and abroad.<br />

CAT power still leads in popularity for propulsion in new sea-going tugs with<br />

main engines in 146 tugs. This is followed by Yanmar in 93 boats, Cummins<br />

in 58, Niigata diesels in 38, 28 Wartsila, 24 Mitsubishi, 20 General Electric,<br />

MTU 10, 9 Chinese Standard Type, 5 Daewoo, 4 each ABC and Daihatsu, 2<br />

each Deutz, MAN/MAN-B&W and MWM and 1 each with Baudouin, Iveco<br />

Aifo, John Deere, MaK, Volvo Penta and Weifang. Engines were not listed for<br />

96 tugs. Only 56 tugs below 1,000BHP are shown under construction<br />

because, as discussed earlier, many tugs of lower horsepower are under<br />

299GRT.<br />

Summary of Horsepower – Fairplay Worldwide <strong>Tug</strong> Orderbook Over 299GRT<br />

Under 1,000 – 2,000- 3,000- 4,000- 5,000- 6,000- 7,000- 8,000- 9,000- Over Unk. Total<br />

1,000HP 1,999HP 2,999HP 3,999HP 4,999HP 5,999HP 6,999HP 7,999HP 8,999HP 9,999HP 10,000HP<br />

<strong>Tug</strong>s 56 105 75 126 13 22 2 0 5 0 5 138 547<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

6

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

On 12 th September, Bollinger Marine Fabricators of Amelia, Louisiana<br />

delivered the “Ocean Wave”, the first of four “Ocean” class tugs, to Crowley<br />

Maritime Corporation. “We are extremely proud of our Ocean Class team and<br />

the delivery of the first in class tug, ‘Ocean Wave’”, said Chris Bollinger,<br />

executive VP of Bollinger Shipyards. “Our partner, Crowley and Jensen, as well<br />

as our numerous vendors, have worked hard to develop and deliver a premier<br />

vessel into the <strong>International</strong> marine market and we look forward to future<br />

deliveries of sister ‘Ocean Wind’ and DP2 vessels ‘Ocean Sky’ and ‘Ocean<br />

Sun’.” “Ocean Wave” is the first of the Ocean class tugs and is first of two<br />

10,880BHP tugs that feature DP1 capabilities. The twin screw tug is fitted with<br />

controllable pitch propellers in nozzles with independent high lift rudders. The<br />

hull is outfitted for long range ocean towing, dynamic positioning, firefighting,<br />

rescue and salvage towing, as well anchor handling. She is designed and outfitted with all tanks containing oil and oil<br />

traces inboard of the side shell to create a double hull and designed for zero discharge of any machinery cooling<br />

water, gray or black water, further safeguarding the environment. “Taking delivery of this first ocean-class tug is a<br />

significant milestone for Crowley and our customers who will benefit from its use on their projects,” said Tom Crowley,<br />

company chairman, president and CEO. “These Jensen Maritime-designed towing vessels – three of which are under<br />

construction at Bollinger – are a new generation of powerful, high-tech and environmentally friendly workhorses for<br />

Crowley that will further solidify our standing as an industry leader in ocean towing, salvage and offshore marine<br />

support for the upstream energy industry.” Propulsion for “Ocean Wave” is provided by two Caterpillar C-280-12 Tier II<br />

diesel engines, designed to operate on Ultra Low Sulfur Diesel fuel and each is rated at 5,440BHP at 1,000RPM,<br />

driving 153.5” CP props through Reintjes LAF 5666 reduction gears. Bow thruster is a Berg 850HP unit. Electric power<br />

is provided by two 1,475KVA shaft, one 340kW CAT C-18 Tier II auxiliary harbor, and one 125kW CAT C-6.6 Tier II<br />

emergency generators. Towing and deck equipment features an Intercon – DW275 hydraulic winch with upper drum<br />

capacity for 3,000’ of 2.5” wire and lower drum with 4,200’ of 2.75” wire, Triplex tow pins, Triplex shark jaws and an<br />

open stern roller. <strong>Tug</strong> complies with all applicable rules and regulations for unrestricted ocean towing, <strong>International</strong><br />

Load Line, SOLAS and ABS DP1, Green Passport classification.<br />

Shortly after her delivery from the yard, “Ocean Wave” performed her<br />

inaugural job in Cuba working with Crowley’s subsidiary Titan Salvage<br />

by removing a grounded 1993 built, Liberian-flagged containership from<br />

the northern coast. The project’s success hinged on a coordinated and<br />

timely response from Antilliana De Salvemento, the Cuban salvage<br />

company which subcontracted Titan Salvage, Crowley’s Pompano,<br />

Florida-based emergency response, marine salvage and wreck<br />

removal company, and Houston-based T&T Marine Salvage, to assist<br />

with removal of the stricken 12,582dwt containership “Hansa Berlin”<br />

(ex-P&O Nedlloyd Orinoco). The 1,016TEU containership was en route<br />

from Santiago de Cuba to Havana, Cuba, when the 149.5m x 22.6m x 11.1m depth ship came ashore 20 miles west of<br />

Havana after losing power during Tropical Storm Isaac on 26 th August. Following the grounding, Titan’s salvage<br />

master was on scene in less than 24 hours, Crowley’s government services team worked with U.S. and Cuban<br />

authorities to complete all necessary Customs documentation in advance, and the solutions team readied “Ocean<br />

Wave” for the 48-hour transit from Orange, Texas, to the site. The stricken vessel, towed by “Ocean Wave”, was<br />

successfully removed from the coastline and delivered to port in Havana, Cuba, in early October. “This successful<br />

project is testament to the power of Crowley’s total<br />

capabilities,” said the company’s Todd Busch, senior VP<br />

and general manager, technical services. “We leveraged<br />

many of our unique company assets – such as the ‘Ocean<br />

Wave’ – our collective experience, and our long-standing<br />

relationships with the Cuban authorities and Antilliana De<br />

Salvemento to complete a challenging job quickly in a<br />

location where many others would be unable to work. Not<br />

only were we able to work as a team, but we performed the<br />

job quickly and without harm to the environment or any<br />

people. It was an excellent example of what Crowley can<br />

do in emergency response situations, in some of the most challenging locations in the world.” All 19 of “Hansa Berlin’s”<br />

crew were safely taken off the vessel by helicopter and although abt. 174,000 gallons fuel oil and 27,500g diesel were<br />

on board at the time of grounding, German owners Hansa Treuhand GmbH & Co. KG reported that bunkers were<br />

removed and no pollution occurred.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

7

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Damen Shipyards launched its first ever hybrid tug - the ASD <strong>Tug</strong> 2810 Hybrid - and is<br />

proud to announce that Iskes Towage & Salvage will be the customer. The signing<br />

ceremony took place on 23 rd October, at Offshore Energy in Amsterdam. Damen is<br />

believed to be the only yard worldwide building hybrid tugs for stock at this time. The<br />

second hybrid vessel will be available from stock end-2013. Depending on the operating<br />

profile of a tug, the ASD 2810 Hybrid, which has a combination of diesel-direct and dieselelectric<br />

propulsion, facilitates average fuel savings of between 10% and 30% and cuts<br />

local emissions by 20 to 60%. The vessel has a bollard pull of 60 tons.<br />

Originally established in 1928 to tow inland barges with coal through the locks to a local steel plant, Iskes, based in<br />

Ijmuiden near Amsterdam, has been operating a conventional Damen ASD <strong>Tug</strong> 2810 since <strong>November</strong> 2011. Iskes<br />

owner and Managing Director Jim Iskes says: “We already had a very good experience with our existing Damen ASD<br />

<strong>Tug</strong> 2810, which is ideally suited to Amsterdam. We are very happy with its performance and so are the crew; it was a<br />

logical move to choose Damen for the Hybrid version. Damen welcomed our input and recognizes that we know what<br />

we are talking about. Many of the things we require are not standard but Damen has worked with us to incorporate<br />

them.” Erik van Schaik, Design & Proposal Engineer, Damen <strong>Tug</strong>s says: “In the past many green solutions were<br />

simply too expensive for the tugboat market. We were very mindful that this<br />

vessel had to cut fuel and emissions, but at the same time it had to be<br />

positioned at an attractive price for the market. We wanted to make being<br />

green commercially attractive too.” And indeed, he adds, fuel costs are not<br />

getting any cheaper, so Iskes is making considerable fuel savings as well. “The<br />

investment in the Hybrid version is higher but not excessively so. The Hybrid<br />

represents an extra investment of approximately 10% more than the regular<br />

ASD <strong>Tug</strong> 2810”, stresses Mr. Van Schaik. Iskes had been working on its own<br />

green solution together with Offshore Ship Designers, looking into the potential<br />

of a hydrogen hybrid tug. Earlier this year, the three-year E3-project was<br />

completed whereby Damen and its partners had monitored a conventional ASD<br />

<strong>Tug</strong> 2810 operating in the port of Rotterdam. The partners wanted to gather<br />

data on a typical harbor tug profile and see what was possible in terms of<br />

emissions and fuel cuts. During the monitoring campaign the E3 team found that the average load profile showed that<br />

tugs are running inefficiently for most of the time. For up to 80% of the day they can be free sailing, station keeping,<br />

running idle essentially, and in turn, this makes them less environmentally friendly and leads to higher operational<br />

costs. The diesel electric propulsion system in the ASD <strong>Tug</strong> 2810 Hybrid delivers enough power to prevent the main<br />

engines of the diesel direct propulsion system from running idle frequently or at low loads. During the E3 project<br />

Damen’s Research Department made a computer simulation model to analyze various propulsion trains. Damen can<br />

use this simulation model to calculate the exact savings that are possible from the Hybrid in each individual case,<br />

based on the tug’s operating profile and running hours. Based on the findings and after looking at various battery,<br />

LNG, hydrogen and compressed natural gas solutions, the Hybrid emerged. NOx, HC, CO, SOx, CO2 and particles all<br />

decrease substantially, as does fuel consumption.<br />

As an option, Damen is also offering a battery pack whereby it is possible<br />

to shut down all the engines during station keeping, maneuvering and free<br />

sailing at low speeds, making the vessel even more environmentally<br />

friendly. Battery packs of 100kWh each are likely to be provided, which<br />

allow the vessel to sail up to 5 knots. The Iskes Hybrid will be<br />

incorporating batteries. Mr. Iskes stressed that the company was very<br />

keen to have a combination of the diesel electric and batteries. “A<br />

100kWh battery allows the vessel to be alongside the quay for eight hours<br />

and sail for an hour. And this represents a 10 to 15% fuel saving.<br />

Batteries make it much more comfortable for the crew because when they<br />

are asleep, energy is coming from the batteries so there is no noise or<br />

emissions.” Solar panels are added to the deckhouse on the Damen<br />

standard version and these are used to charge the 24V battery packs for starting the engines and emergency power<br />

for navigation lighting and radio equipment. Other green initiatives on the vessel include LED lighting, and a special<br />

paint coating, making the vessel more environmentally friendly and clean for at least five years.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

8

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Customization of the Iskes ASD <strong>Tug</strong> 2810 Hybrid for anchor handling includes<br />

double drum winches fore and aft, wooden decks and an open stern with towing pins<br />

and chain stopper forks. Damen wanted to use tried and tested technology for the<br />

ASD <strong>Tug</strong> 2810 Hybrid. One additional clutch has been added to the vessel and a<br />

230kW water-cooled electric propulsion engine between each main engine and the<br />

rudder propeller. A fire-fighting/generator set is installed to feed the electric<br />

propulsion engines or to drive the 1,200m3/hr FiFi pump. The generator/fire-fighting<br />

set engine is fitted with an exhaust gas after-treatment system consisting of a<br />

Selective Catalytic Reduction (SCR) system, a Diesel Oxidation Catalyst (DOC) and<br />

a half open, Diesel Particulate Filter (DPF). The fire-fighting/generator set engine<br />

can deliver 695kW at 1,800RPM and is fully compliant with the IMO Tier 3<br />

regulations being introduced in 2016. Iskes says that the operator expects to be<br />

utilizing the IMO Tier 3 compliant engine 90% of the time. Each main engine has a maximum power of 1,840kW at<br />

1,600RPM and is IMO Tier 2 compliant. The captain can choose one of the following operating modes from the<br />

wheelhouse and then the Hybrid Control Unit manages everything automatically. Stand-by mode (only in combination<br />

with optional battery pack): All diesel engines will shut down and the battery pack feeds the normal electric system and<br />

electric propulsion engines that drive the rudder props. When the battery pack becomes empty the system will switch<br />

to free sailing mode automatically and the battery pack will be charged. The stand-by mode can be used for station<br />

keeping, maneuvering and free sailing at speeds of up to 5 knots. Free sailing mode: The generator/fire-fighting set<br />

starts and feeds the electric propulsion engines that drive the rudder props. The main engines are not running and the<br />

auxiliary generator set feeds the normal electric system. The free sailing mode can be used for station keeping,<br />

maneuvering and free sailing at speeds of up to 8 knots. Towing mode: Main engines start and drive the rudder<br />

props. The generator/fire- fighting set is not running and the auxiliary generator set is feeds the normal electric system.<br />

The towing mode has to be used during push/pull operations and free sailing of up to 13 knots. Fire-fighting mode:<br />

The fire-fighting mode has to be used during fire-fighting operations. Main engines start and drive the rudder props.<br />

Generator/fire- fighting set starts and drives the fire-fighting pump. The auxiliary generator set is feeds the normal<br />

electric system.<br />

Damen Shipyards Group also has signed a contract with Svitzer<br />

Middle East for delivery of two Damen Stan <strong>Tug</strong>s 1606. Svitzer<br />

is in need for both tugs due to a recent charter contract with<br />

Danish stevedoring giant APM Terminals for tugboat services in<br />

the new Khalifa Bin Salman Port in Bahrain. The STu 1606 is a<br />

standard designed 16.76m long tug with a bollard pull of 16 tons.<br />

Damen will deliver the tugs on short notice “from stock” from the<br />

yard in Changde, China. The contract was signed by Mr. Lars<br />

Seistrup, Chief Operating Officer of Svitzer Middle East, and Mr. Bram Langeveld, Sales Manager Middle East of<br />

Damen Shipyards Group…… Damen is supplying Acta Marine with four Shoalbuster anchor handling tugs. Three of<br />

the anchor handling tugs will be supplied from Damen Marine Services’<br />

charter fleet, while Damen Shipyards Hardinxveld will be supplying the<br />

fourth, a new Shoalbuster, in March 2013. “Shoalbusters are excellent<br />

multi-purpose vessels that we will be able to use all over the world in<br />

dredging and marine contracting projects, as well as for oil and gas<br />

projects and offshore wind projects”, says Govert-Jan van Oord,<br />

managing director of Acta Marine. The 26.0m x 9.1m x 3.6m depth “DMS<br />

Eagle” and “DMS Globe”, built in 2006 and 2004 respectively, are<br />

Shoalbuster 2609s that will be deployed in the Persian Gulf as they were<br />

before. The 30.08m x 9.10m x 4.40m depth “DMS Dunnock”, built in 2007, and the new ships are larger, 3,300HP units<br />

powered by CAT 3512Bs and have bollard pulls of 45-50 tons. These latter two vessels are the sister ships of the<br />

2010 built, 32.27m x 9.10m “Coastal Vanguard”, which Acta Marine<br />

purchased from Damen at the end of 2010. The “DMS Dunnock” will be<br />

transferred in Singapore in January 2013, putting the ship in an<br />

excellent location to take on charter assignments in Southeast Asia and<br />

Australia. The new Shoalbuster is currently under construction in the<br />

Netherlands and will be delivered in March 2013. All Shoalbusters are<br />

built by Damen Shipyards Hardinxveld.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

9

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

On 5 th September, Damen Shipyards Group and Smit Lamnalco signed a contract<br />

for two newly designed ASD <strong>Tug</strong>s 3212 and a Stan <strong>Tug</strong> 2208. The signing<br />

ceremony took place at the Damen stand at the SMM exhibition in Hamburg<br />

(Germany). The Stan <strong>Tug</strong> 2208 were scheduled to be delivered mid-September<br />

from the stock of Damen Shipyards Cape Town. The two ASD 3212s were<br />

scheduled to be delivered in the first week of October and the early <strong>November</strong> by<br />

Damen Shipyards Galati. Smit Lamnalco plans to use the vessels for contracts in<br />

Iraq and Sierra Leone. In October <strong>2012</strong>, the powerful 32.7m x 12.8m x 5.4m depth<br />

Damen ASD 3212 tug named “SL Tiger” was delivered to Smit Lamnalco after<br />

successful completion of sea trials in Romania. The handing over took place at the building yard Damen Shipyards<br />

Galati and following the maiden voyage of this new Smit Lamnalco fleet<br />

addition, the tug will commence SMB terminal operations in Iraq. “SL Tiger” is<br />

powered by a pair of CAT 3516C HDs developing a total of 5,050bkW<br />

(6,772BHP) at 1,800RPM with Rolls Royce US255CP 2,800RPM props. Towing<br />

gear consists of a 200 ton hydraulic two speed double drum anchor / renderingrecovery<br />

winch, 5T electric capstan and a Mampaey 100T SWL tow hook. “SL<br />

Tiger” is fitted with two main engine driven 1,200m3/h fire pumps and two<br />

1,200m3/h water or 300m3/h foam monitors. <strong>Tug</strong> is classed LR +100A1 Escort<br />

<strong>Tug</strong> +LMC UMS EP, FiFi 1. Accommodations are provided for 10 persons in six<br />

cabins.<br />

Damen Shipyards Group and Wilson Sons (Brazil) signed a contract for ten Damen<br />

ASD <strong>Tug</strong>s 2411 and two ASD <strong>Tug</strong>s of the new 3212-type, destined for the booming<br />

Brazilian market. Vessels will be built at the Wilson Sons Estaleiros in Guarujá, São<br />

Paulo, Brazil and will go into service for Wilson Sons subsidiary Saveiros<br />

Camuyrano Serviços Maritimos. Wilson Sons has one of the biggest tug fleets in<br />

Latin America, serving all Brazilian waters both in harbors, inshore and at sea. Its<br />

fleet consists of approx. 75 tugs of which at least 50 tugs are azimuthing stern drives,<br />

most of which are Damen designs. The two companies have achieved a high level of<br />

cooperation: Wilson Sons builds locally, using drawing, engineering and materials packages provided by Damen and<br />

achieving the same high standards which have made Damen a market leader in harbor tugs. Of the ten 24.47m x<br />

11.33m, ASD 2411s in this contract, five will have a 55 ton bollard pull and five will have 70 ton pull. Wilson Sons is no<br />

stranger to this vessel, as they already have 19 in their fleet, used mainly in harbor ops<br />

and in restricted, inshore conditions. The new 2411s, however, comply with latest IMO<br />

and MLC 2006 crew accommodation and comfort regulations. The two 32.70m x 12.82m,<br />

Damen ASD 3212s will be a new departure. This brand new tug type was introduced at<br />

the <strong>International</strong> <strong>Tug</strong> & Salvage Convention in Barcelona in June <strong>2012</strong>. It is specially<br />

designed for working in challenging conditions and to have a wider range than regular<br />

tugs: ideal for salvage in exposed locations and for operations related to Brazil’s offshore<br />

oil industry. The ASD 3212 has a powerful 80 ton bollard pull and a host of new features,<br />

such as extra-thick “double sausage” fendering for improved energy absorption and a<br />

high bow to keep the foredeck dry. Damen has co-operated with the Dutch MARIN<br />

institute and Delft University of Technology to further improve hull form, bilge keels and<br />

skeg shape, resulting in a vessel that can work in 3m wave height. Maneuverability and<br />

crew comfort have also been addressed and the ASD 3212 complies with all major<br />

Class Societies’ requirements and latest international environmental regulations. Damen<br />

will send the first construction packages for these tugs to Brazil in January 2013. Wilson<br />

Sons expect to have built all twelve by the end of 2015. With total investment of $150<br />

million approved by the Merchant Marine Fund in <strong>November</strong> last year, Wilson Sons<br />

Rebocadores / Saveiros Camuyrano Servicos is building the azimuthing tugs<br />

for local port and maritime support. In <strong>2012</strong>, Wilson Sons Rebocadores started<br />

operating the two 24.6m x 11.7m x 4.6m depth Damen ASD 2411 tugboats –<br />

“Pictor” (Hull No. 120) in January, and “Hamal” (Hull No. 121) in May. Two<br />

additional new tugs are scheduled to be delivered before the end of this year.<br />

“Telescopium” is expected to be launched in October and “Delphinus” (Hull No.<br />

122) in December.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

10

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

In September, the two ASD 2810 tugs “Virgen Del Valle” and “Arcangel San Miguel”<br />

sailed from Vietnam to Panama, to be a delivered to MMG Shipping Group / Meyer’s<br />

Group S.A. Both were built at the Damen Song Cam Shipyard in Haiphong. The 28.7 x<br />

10.4m tugs have twin 1,864bkW CAT 3516C TA HD/Cs developing a total of 5,000BHP<br />

to Rolls Royce US 205 azimuthing drives. Deck gear consists of a 150 ton brake<br />

hydraulic two speed winch with split drum forward, Heila 2.2T hydraulic crane and two<br />

speed 150 ton brake tow winch aft. The Panamanian-flagged “Virgen Del Valle” and<br />

“Arcangel San Miguel” are classed LR +100A1 <strong>Tug</strong>, FiFi 1 (2,400m3/h), +LMC UMS.<br />

Accommodations are provided for six persons in four cabins……Kotug <strong>International</strong> is<br />

putting two new Damen ATD 2412 azimuthing tractor drive tugs into operation in the<br />

German port of Hamburg. These tugs were ordered by Elisabeth Ltd. of Malta and being<br />

chartered by the Kotug Group. Recently Kotug started towage activities in the new German<br />

deep sea port Wilhelmshaven. Due to growth in German ports and increased size of<br />

vessels, Kotug needed additional tugs on short notice. Damen’s short delivery time and<br />

quality were key factors in choosing the compact Azimuth Tractor Drive tugs “ZP Bulldog”<br />

and “ZP Boxer”. Damen arranged transport from Vietnam, where they were built at the Song<br />

Thu Co. shipyard in Da Nang, to Rotterdam, where they handed over the tugs in<br />

<strong>November</strong> in a turnkey operation. After arrival, the tugs were painted in Kotug’s<br />

red colors, equipped and prepared to commence towage activities in Hamburg,<br />

around 12 th <strong>November</strong>. The Germanischer Lloyds class tugs have a length of<br />

24.85m, width of 12.63m, depth of 4.60m and max draft of 6.45m. A pair of<br />

2,100bkW CAT 3516TA HDs with Rolls Royce US 255 forward mounted<br />

azimuthing drives develop a total of 5,600BHP and bollard pull of 70 tons.<br />

Towing gear consists of a single split drum tow winch aft with a capacity of two<br />

200m Ultralines.……On Friday 28 th September, the solemn ceremony of raising<br />

the flag of the Russian Federation and sanctification of the “Kuzbass” (Yard No. 511586), a Damen ASD <strong>Tug</strong> 2810,<br />

took place in Vostochny, near Vladivostok. This is the first Damen vessel for Vostochny Port JSC, the largest<br />

stevedoring company in the Russian Far East, specializing mainly on coal handling using conveyer equipment. The<br />

tug will start operations in early <strong>November</strong> <strong>2012</strong>, when the stevedore will have all necessary approvals and licenses.<br />

<strong>Tug</strong> was built at Damen's Chinese shipyard in Changde and arrived in the<br />

port of Vostochny, Primorsky Territory on 4 th September. Vostochny Port is<br />

considering purchase of additional Damen vessels of this type. The 28.67m<br />

x 9.80m x 4.60m depth tug is powered by a pair of 1,825bkW CAT 3516HD<br />

diesels developing 5,600HP and a bollard pull of 56 tons. “Kuzbass” is<br />

classed under the Russian Maritime Register…… Kuwait Oil Company<br />

(KOC) signed a contract for 14 Damen ASD <strong>Tug</strong>s. An extensive process of<br />

yard prequalification and tender evaluation finally resulted in an award to<br />

Damen this summer. The series consist of two types, with nine tugs of Damen’s recently launched 3212 model and<br />

five units of the well-known 2810 design, providing 80 tons and respectively 50 tons of bollard pull. While being based<br />

on existing Damen designs, these tugs have been extensively tailored to meet KOC’s exacting requirements on layout,<br />

systems and performances. As part of KOC’s long term strategy of increasing the country’s export capacity,<br />

substantial investments are being made to expand the marine facilities in coming years. The new tugs will be assisting<br />

tankers at near-shore loading terminals and new single point moorings further offshore, for which they will also be<br />

equipped with a powerful fire-fighting system. Cooperation between KOC and Damen goes back to late 1980s, when<br />

Damen delivered steel crew/pilot tenders and the 39.65 x 11.63 x 5.90m, 5,684HP, fire-fighting / terminal tug “Sabahi”<br />

to KOC. In the early nineties, after liberation from the Iraqi invasion, Damen delivered to KOC a complete new fleet of<br />

tugs, crew tenders, work boats and mooring boats. Damen supported KOC throughout all these years with provision of<br />

technical services, spare parts, and maintenance / renovation assistance. Damen’s naval architects and designers<br />

have already started working on development of this unique series of state-of-the-art tugs. Damen Shipyards Galati in<br />

Romania will build all 14 units, with deliveries scheduled from 2014 onwards. Wärtsilä propulsion will be installed in<br />

the nine 80 ton bollard pull and five 50 ton bollard pull tugs. Delivery of the<br />

Wärtsilä equipment is scheduled for 2014 and 2015. Of the 28 engines ordered<br />

to power these vessels, the nine 80 ton bollard pull tugs will be powered by<br />

Wärtsilä 26s and the five 50 ton bollard pull tugs by Wärtsilä 20 engines. In<br />

addition to the engines and propulsion systems, contract includes Wärtsilä’s<br />

Condition Based Maintenance (CBM) systems for each of the 14 vessels.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

11

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

PM Coast Maritime Pte. Ltd. completed sea trials of “PMS 1386”, the first of two 32.0m x<br />

12.8m Robert Allan Ltd. design “RAstar 3200” tugs to be built by their own shipyard in<br />

Singapore. The “RAstar” class of tugs is intended for operations in exposed areas such as<br />

many new LNG terminals where a high standard of sea-keeping is required. With Fi-Fi 1,<br />

oil recovery and escort notations, this particular vessel is able to fulfill a wide variety of<br />

duties in adverse conditions. The “PMS 1386” is classed by ABS with the notation +A1,<br />

Circle E, +AMS, Towing Vessel, Unrestricted Navigation, +ABCU, Escort Vessel, Fire-<br />

Fighting Class 1, Oil Recovery Capability Class 2. Tank capacities include 189m3 fuel oil,<br />

30m3 fresh water and 12.7m each of foam and oil dispersant. On trials, the vessel met or<br />

exceeded all performance expectations developing a bollard pull ahead of 65 tons and<br />

free running speed ahead of 13.1kn. In common with the majority of Robert Allan Ltd.<br />

designed tugs, a great deal of attention was paid throughout the design process to<br />

mitigate the propagation of noise and vibration. This includes the essential resilient<br />

mounting of the main engines, isolation of all exhaust system components, and the<br />

extensive use of visco-elastic floating floor systems throughout. The shipyard executed all<br />

these requirements exceptionally well, and the reward was an extremely<br />

quiet ship throughout. The vessel has been outfitted to the highest<br />

standards for a crew of up to ten people, although the normal operating<br />

crew is six. The wheelhouse is designed for maximum all-round visibility<br />

with forward and aft control stations providing maximum visibility to both<br />

fore and aft deck working areas. The deckhouse has Master and Chief<br />

Engineer single cabins with en-suite washrooms, a galley, a mess/lounge<br />

and able locker space. The lower deck accommodation contains two cabins<br />

each for up to four crew, a common lavatory and laundry area and galley<br />

stores. “PMS 1386’s” forward deck machinery comprises a forward escort<br />

rated hawser winch, manufactured by Ibersica, capable of recovery speeds<br />

up to 40 m/min, pull up to 81 tons and with a brake capacity of 200 tons complete with integrated anchor windlasses<br />

and a warping head. The aft deck is equipped with an Ibersica towing winch capable of recovery speeds up to 67<br />

m/min, pull up to 54 tons and with a brake capacity of 175 tons complete with warping head as well as tow pins with a<br />

roller and hold down block a capstan and a Palfinger 18500M knuckle-boom folding crane with 18.4 ton/meter<br />

capacity. A six person capacity 4.4m long rescue boat with davit is located aft of the wheelhouse but without unduly<br />

impacting visibility of the aft working deck from the wheelhouse. Ship-handling fenders at the bow are comprised of<br />

two rows of 800 x 400mm cylindrical fenders. Courses of 300 x 300mm hollow “D” fender provides protection at the<br />

main and foc’sle deck sheer lines, and 400mm “W” block type fendering is<br />

used at the stern. Main propulsion for each tug comprises a pair of Niigata<br />

6L28HX diesel engines; each rated for 1,838kW at 750RPM, and driving a<br />

Niigata ZP-41 fixed pitch drive unit. Dual modulation Niigata HLP80Y slipping<br />

clutches in each shaft line enable variation of prop speed independent of<br />

engine RPM for use of the Fi-Fi pumps and deck machinery hydraulics driven<br />

off the front end of each engine. The electrical plant comprises two identical<br />

Volvo Penta D7A diesel gensets, each with power output of 139ekW.<br />

The 24.4m x 9.15m x 4.04m depth “Ulupinar” series of compact ASD tugs has proven to be a<br />

very successful part of Sanmar’s portfolio, with 14 vessels in service (including three brokered<br />

by <strong>Marcon</strong>); the first one delivered in 2007. After five years, the Sanmar board decided that<br />

some updates were needed and Robert Allan Ltd. was contracted to provide an updated<br />

design that would keep this compact tug at the forefront of the modern tug world. Minor cosmetic<br />

changes brought the look to a more modern standard, and improved outfit materials and method<br />

have increased crew comfort and livability, but the real changes were “under the hood”.<br />

Upgrades to the drive and propulsion system will ensure that this model has a long future ahead<br />

of it! The first vessel has been completed and has entered service with the Sanmar fleet. The<br />

vessel is classed by RINA for towing and firefighting operations. On trials, “Ulupinar XV” met or exceeded all<br />

performance expectations, delivering a bollard pull of 50 tons ahead, 48 tons astern and a free running speed of 13kn.<br />

The upgraded main propulsion package comprises a pair of Caterpillar 3512C high speed marine diesel engines, each<br />

rated 1,500kW at 1,800RPM, driving Rolls Royce US 205 units, with 2.2m fixed pitch props.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

12

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Sanmar Denizcilik Ltd. in Turkey has announced two new series of ASD tugs<br />

which meet requirements of the under 24m rule. These new models, all Robert<br />

Allan Ltd. designs, build on the phenomenal success of the builder’s 45 to 50 ton<br />

bollard pull “Ulupinar” series, mentioned above, of which 15 have now been<br />

constructed. The “2400 SX” model (at right), an exclusive Sanmar design, is closest<br />

to the “Ulupinar” but with a 2m increase in<br />

beam over the same length. This ensures<br />

greater performance as well as stability from<br />

more powerful Caterpillar engines coupled<br />

to larger Rolls-Royce Z-drives. The new<br />

versions will give 60 or 70 tons bollard pull<br />

depending on the propulsion system size<br />

selected by the customer. The second series, the “2400 PO” model is a<br />

shallower draft broad beamed ASD intended for in-harbor operations<br />

configured primarily as a day boat although accommodation can be included if<br />

required. It utilizes the same propulsion options as the “Marmara” Series to give<br />

either 60 or 70 tons bollard pull.<br />

The eight vessel of Sanmar’s 28.20m x 12.50m Terminal class ASD tugboats<br />

will be joining the fleet of Pakistan’s number two port, Port Muhammad Bin<br />

Qasim, located 35km east of Karachi. Commonly known as PQA and named<br />

after General Muhammad Bin Qasim, it is the country’s deepest port and<br />

currently caters for more than 40 per cent of the nation’s seaborne trade<br />

requirements. Sanmar will additionally be supplying a 20m long, 20 knot pilot<br />

boat, also to be built at the company’s yard near Istanbul. Sanmar was<br />

declared the winning bidder for the construction and supply of both vessels<br />

following an international open tender competition. Delivery is expected to take<br />

place in March/April 2013. The tug is from the Canadian design team of Robert<br />

Allan Ltd. and is of the highly successful “RAstar 2800” Class and is<br />

very similar to “Seaspan Raven”, the first of four tugs delivered last<br />

year by Sanmar to the Port of Vancouver destined to reshape<br />

harbor towage and tanker escort operations in the environs of the<br />

largest port in Western North<br />

America. The RAstar escort/offshore<br />

terminal tug designation is reserved<br />

by the world’s leading tug designer<br />

for a unique class of very highperformance<br />

ASD tugs,<br />

incorporating a sponsoned hull form, which has been proven in both model and fullscale<br />

testing to provide significantly enhanced escort towing and sea-keeping<br />

performance. The escort forces are enhanced by the effects of the sponson as well<br />

as the foil-shaped escort skegs fitted. Roll motions and accelerations are less than<br />

half those of comparable sized “standard” tug hulls. These tugs are intended for<br />

escort operations in weather and sea-exposed locations where a high standard of<br />

sea-keeping is required. Port Qasim is accessible through a 45km long channel for<br />

vessels up to 11m draft and providing safe navigation for cargo vessels of up to<br />

75,000dwt. PQA in its quest for capacity enhancement has launched a multi-faceted<br />

strategy which also includes augmentation of its fleet of tugs and pilot boats. During<br />

the second week of September, authorities from Port Qasim visited Sanmar shipyard<br />

in Turkey for the keel-laying ceremony of the American Bureau of Shipping classed<br />

tug which will be named “Kadiro” and be powered by a pair of Caterpillar 2,000kW<br />

type 3516C diesels driving Rolls-Royce model US 255FP Z-drives. The twin screw<br />

pilot boat, which will be named “Lahoot”, will also have twin Caterpillar engines, each<br />

of 873BHP, and will have Bureau Veritas classification.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

13

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Ostensjo Rederi AS’ newbuild tug “Lomax” (ex-Terminal VII, Sanmar 04) will be<br />

delivered from Sanmar Denizcilik in Turkey within the next couple of months. The<br />

Robert Allan Ltd. RAStar 2800 design tug, which will have a bollard pull of about<br />

80 tons, will be delivered late December <strong>2012</strong>/early January 2013. The 28.2m x<br />

12.6m x 5.3m depth / 3.75m draft (hull) / 5.3m draft (skeg) tug is powered by twin<br />

2,350kW CAT diesels and will be classed ABS +A1, +AMS, ABCU, Towing Vessel,<br />

Escort Service, Fire Fighting vessel class 1, Unlimited Navigation. The RAstar<br />

Escort / Offshore Terminal <strong>Tug</strong> designation is designed with a sponsoned hull form,<br />

which has been proven in both model and full-scale testing to provide significantly<br />

enhanced escort towing and sea-keeping performance. The escort forces are<br />

enhanced by the effects of the sponson as well as the foil-shaped escort skegs<br />

fitted. Roll motions and accelerations are less than half those of comparable sized “standard” tug hulls. These tugs will<br />

typically be high-powered, and are intended for escort operations in weather and sea-exposed areas such as many<br />

new LNG terminals where a high standard of sea-keeping is required.<br />

On 7th, <strong>November</strong>, the delivery ceremony of Martens Marine’s 58.7m AHTS<br />

Vessel “Logindo Stature” (YX-3157) was held at Guangdong Yuexin Ocean<br />

Engineering Co., Ltd. “Logindo Stature” is built to ABS +A1 Offshore<br />

Support Vessel, AH, Towing Vessel, Fire Fighting Vessel Class 1, AMS, and<br />

DPS-1. She is a Khiam Chiam Marine (KCM) design vessel, which measures<br />

58.7m in length, with a molded breadth of 14.6m, and a molded depth of 5.5.<br />

The maximum draught is 4.75m. The vessel can carry 42 men, 475m3of fuel<br />

oil, 230m3of fresh water, 187m3of dry bulk and 250m3 of mud. Besides, “YX-<br />

3157” achieves a bollard pull of 67.2T and a speed of 13.51 knots. Power is<br />

provided by twin Caterpillar 3516C main engines, each rated 1,920kw at<br />

1,600RPM, driving ZF controllable pitch propellers. The electrical power is<br />

supplied by two 350KW CAT diesel-driven generators with a C4.4 CAT<br />

emergency generator. Maneuverability is enhanced by a twin 8T Kawasaki<br />

bow thruster. “YX-3157” is the first of the 58.7m AHTS vessels built by Yuexin<br />

for Martens Marine and one of most important projects for Yuexin this year.<br />

Under the support and coordination of the classification society, Yuexin has<br />

adhered to the standard procedures and quality control laying a good<br />

foundation of construction of the remainder of the rest three 58.7m AHTSs –<br />

Hulls “Yuexin 3158”, “3159” and “3160”. The successful delivery of the<br />

Indonesian flagged AHTS is attributed to the concerted effort made by the<br />

project team of Yuexin.<br />

VT Halter Marine, <strong>Inc</strong>. of Pascagoula, Mississippi, a subsidiary of VT Systems, <strong>Inc</strong>. delivered the 112’ ATB offshore<br />

pusher tug, “Evening Star” to Bouchard Transportation Co., <strong>Inc</strong>. This tug is similar to others built for Bouchard in<br />

previous years by Halter Marine. Measuring 112’ by 35’ by 17’, the 4,000BHP tug is classed by ABS A1 Towing<br />

Vessel, Dual Mode, +AMS Unrestricted Service and is equipped with an<br />

Intercon coupler system. “Evening Star” is powered by a pair of 1,500bkW<br />

EMD 710-GCT2 diesels with Reintjes 4.429:1 gears and manganese bronze<br />

fixed pitch props. Electrical power is provided by three 99kW AC generators.<br />

Construction of the vessel began in June 2011 at VT Halter Marine’s Moss<br />

Point Marine facility in Escatawpa, Mississippi. Upon delivery, the “Evening<br />

Star” will enter into Bouchard’s fleet service in New York, New York. Morton<br />

S. Bouchard III commented: “Bouchard Transportation Co, <strong>Inc</strong>. is pleased to<br />

have taken delivery of another well-built VT Halter Marine tug boat.<br />

Bouchard enjoys a thirty year old relationship with Halter, who has<br />

continuously built vessels that meet and exceed Bouchard standards. The<br />

‘Evening Star’ will be pinned to the newly built ‘B.No.250’ and operate on the East Coast. Bouchard looks forward to<br />

future successful building programs with VT Halter Marine in the near future.”<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

14

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>November</strong> <strong>2012</strong><br />

Silverburn Shipping Ltd. turned to Ijmuiden-based OSD-Holland to<br />

produce a design for a very robust and simple to maintain AHTS which can<br />

carry out platform supply duties in shallow water and ice, but also retain the<br />

flexibility to trade worldwide. The Caspian Sea and Russian rivers are a<br />

demanding environment in which Silverburn Shipping has extensive<br />

experience. Since the building of the “Tarpan” and “Tur” in 2009 and 2010<br />

Silverburn has been developing plans for a new class of very shallow draft<br />

AHTS vessels working down to 2.5 meters operating draft. The first vessel,<br />

the “Arctic” built after this OSD design was launched in Turkey at the Sefine<br />

Co. <strong>Inc</strong>. shipyard in Altinova on 26 th<br />

July <strong>2012</strong> as Hull No. 18. Drawing on 15<br />

years operation and centuries of<br />

combined staff experience in rivers, shallow water and ice conditions as well as<br />

working closely with their Naval Architects Silverburn believes they have delivered<br />

a remarkably cost effective unit for shallow draft work in Ice environments whilst<br />

giving the optimum load capacity so, as the saying goes “getting more bang for<br />

your bucks”. To ensure the best Ice capability Silverburn had a 10th scale model<br />

fully tank tested in Ice conditions at Akers state-of-the-art facility in Helsinki<br />

allowed us to refine the hull form, propeller, rudder and Bow thruster<br />

arrangements. “Arctic” is presently classed BV Hull Mach <strong>Tug</strong> FiFi 1, Aut-UMS Ice<br />

1A Unrestricted Navigation. While for this vessel the ice class is presently 1A, the<br />

hull test performances are such that an increase to 1A Super or full icebreaker<br />

specifications would not materially change the form or layout. The 49.6m x 15.8m<br />

x 2.5m draft vessel has sufficient tank space for around 900m3 of liquids of which<br />

575m3 is fuel and the balance fresh water and sewage. “Arctic” is also<br />

equipped with large capacity water makers, accommodation for 20 persons<br />

on board consisting of 8 crew and 12 passengers, 165 ton/meter crane,<br />

double drum waterfall winch, deck space for two joints of drill pipe on deck<br />

and a number of other features to enhance capability offshore. “Arctic” is<br />

powered by a pair of Cummins QSK-60 totaling 4,400BHP at 2,300RPM<br />

with Berg controllable pitch props in kort nozzles. The tug develops a<br />

bollard pull of 50 tons. Towing gear consists of a double drum waterfall<br />

winch with a wire capacity of 500m and 750m 44mm wire, 10 ton tugger<br />

winch, hydraulic tow pings, 300T SWL Karm fork and 100T stern roller.<br />

Following a batch of two vessels ordered by an India based client, “GPC Baru”, built under Cheoy Lee yard number<br />

4982, is the first in the latest series of three “RAmparts 3200CL” tugs, this time for GPC <strong>Tug</strong>s S.A.S., a member of the<br />

Sociedad Portuaria Regional de Cartagena (SPRC) Group in Columbia. The vessel will operate in the port of<br />

Cartagena, Columbia’s second largest port. The vessels are built to Lloyd’s class, with the notation LR +100A1 <strong>Tug</strong>,<br />

+LMC, +UMS, *IWS Unrestricted Service. The “RAmparts 3200CL” has<br />