Offering Circular - Deutsche Bank

Offering Circular - Deutsche Bank

Offering Circular - Deutsche Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BELGISCH ADDENDUM BIJ HET OFFERING CIRCULAR<br />

dbInvestor Solutions plc<br />

Openbaar aanbod van maximum 200.000.000 EUR Variable Secured Notes III met<br />

vervaldag in 2017<br />

Aanbiedingsprijs 102 procent van het Nominaal Bedrag<br />

ISIN: XS0203898183<br />

Onderhavig addendum bevat bijkomende informatie voor België en moet samen met het <strong>Offering</strong><br />

<strong>Circular</strong> dd. 29 oktober 2004 (het “<strong>Offering</strong> <strong>Circular</strong>”) worden gelezen. Het onderhavig addendum<br />

mag niet afzonderlijk van het <strong>Offering</strong> <strong>Circular</strong> worden verspreid. Alle in het <strong>Offering</strong> <strong>Circular</strong><br />

gedefinieerde begrippen die in onderhavig Belgisch Addendum niet anderszins worden<br />

gedefinieerd, hebben de betekenis die het <strong>Offering</strong> <strong>Circular</strong> eraan verleent, tenzij in hun context<br />

een andere definitie vereist is.<br />

Aan het <strong>Offering</strong> <strong>Circular</strong>, dat op 29 oktober 2004 is goedgekeurd door de marktautoriteit van de<br />

Beurs van Luxemburg, werd door de Commissie voor het <strong>Bank</strong>,- Financie-, en Assurantiewezen<br />

op 8 november 2004 wederzijdse erkenning verleend in de zin van artikel 23 van de wet van 22<br />

april 2003 betreffende de openbare aanbiedingen van effecten en van de artikelen 1, lid 3 en 8<br />

van het Koninklijk Besluit van 14 november 1991 over de wederzijdse erkenning binnen de<br />

Europese Gemeenschappen van het prospectus bij een openbaar aanbod en van het prospectus<br />

bij toelating tot de notering van een effectenbeurs. Onderhavig Belgisch Addendum werd op 8<br />

november 2004 goedgekeurd door de Commissie voor het <strong>Bank</strong>-, Financie-, en Assurantiewezen.<br />

De voornoemde goedkeuringen en/of erkenningen houden geenszins een beoordeling in van de<br />

opportuniteit of de kwaliteit van de verrichting noch van de toestand van de betrokken partijen.<br />

Onderhavig Belgisch Addendum werd origineel opgesteld in het Engels en werd vertaald in het<br />

Nederlands en het Frans. De gelijkvormigheid tussen de diverse taalversies werd nagegaan<br />

onder de verantwoordelijkheid van de Emittent. Alleen de originele versie heeft bewijswaarde. Bij<br />

gebeurlijke verschillen tussen de originele versie en de vertalingen zal de originele versie<br />

prevaleren.<br />

Potentiële beleggers van de Notes moeten zich ervan vergewissen dat ze de aard van de<br />

Notes volledig begrijpen evenals het risico verbonden aan een belegging in de Notes en<br />

nagaan of dit risico aangepast is aan hun persoonlijk risicoprofiel. Potentiële beleggers<br />

worden verzocht kennis te nemen van de “General Investment Considerations” in deel 2<br />

van het <strong>Offering</strong> <strong>Circular</strong>. In het bijzonder moeten ze zich ervan bewust zijn dat de Notes<br />

gedurende de looptijd kunnen dalen in waarde. De terugbetaling a pari is enkel<br />

gegarandeerd op vervaldag en in geval van voortijdige wederinkoop. In geval van twijfel<br />

wordt de potentiële beleggers aangeraden hun professionele raadgever te consulteren. De<br />

Emittent behoudt zich het recht voor de Effecten voortijdig terug te betalen op elke<br />

interestbetalingsdag vanaf de interesten die vervallen in 2007. De effecten<br />

vertegenwoordigen enkel verplichtingen in hoofde van de Emittent en geenszins in hoofde<br />

van <strong>Deutsche</strong> <strong>Bank</strong> AG noch van een van haar filialen.<br />

Gedurende de eerste twee jaar genereren de Effecten een Bruto Rentevoet van 6,00%. Voor de<br />

daaropvolgende Interestperiodes vanaf deze die begint op (met inbegrip van) 11 januari 2007 tot<br />

deze die eindigt op of voor de vervaldatum (niet inbegrepen) hangt de Bruto Rentevoet af van de<br />

rentevoet CMS op 10 jaar en de rentevoet CMS op 2 jaar. Gedurende deze Interestperiodes kan<br />

de Bruto Rentevoet niet worden gegarandeerd. In uitzonderlijke omstandigheden kan de CMS op<br />

10 jaar gelijk zijn aan of minder dan nul of kan het verschil tussen de CMS op 10 jaar en de CMS<br />

op 2 jaar gelijk zijn aan of minder dan nul. In deze hypotheses zal de Bruto Rentevoet gelijk zijn<br />

aan nul en zal geen enkele coupon worden uitbetaald.

1. BESCHRIJVING VAN DE EFFECTEN<br />

Het <strong>Offering</strong> <strong>Circular</strong> en onderhavig Belgisch Addendum hebben betrekking op maximaal<br />

200.000.000 EUR Variable Secured Notes III met vervaldag in 2017 (de “Effecten”), uitgegeven<br />

door de Emittent. De Effecten vertegenwoordigen niet-bevoorrechte contractuele verbintenissen<br />

van de Emittent en zijn onderling in elk opzicht pari passu gerangschikt.<br />

De Emittent mag de Effecten verkopen op de door hem gekozen tijdstippen en aan de door hem<br />

vastgestelde prijzen, met dien verstande dat indien de Effecten genoteerd zijn op een<br />

effectenbeurs, hun verkoop zal dienen te geschieden met inachtname van alle uit dien hoofde<br />

toepasselijke reglementeringen. De Emittent is niet verplicht om alle Effecten te verkopen. De<br />

Effecten mogen van tijd tot tijd worden aangeboden of verkocht middels één of meer<br />

verrichtingen, hetzij op de over-the-counter markt hetzij anderszins aan de geldende marktprijzen<br />

of in onderhandelde transacties, steeds naar goeddunken van de Emittent.<br />

De Emittent is vrij om van tijd tot tijd en zonder de instemming van Effectenhouders, verdere<br />

effecten uit te geven en deze met de Effecten te consolideren teneinde daarmee één enkele<br />

reeks te vormen.<br />

De Emittent heeft het recht om de Effecten zelf aan te kopen en heeft verder bepaalde rechten<br />

van vervroegde aflossing, terugbetaling of annulering van de Effecten. De Emittent heeft tevens<br />

het recht om zichzelf te laten substitueren en om over te gaan tot een vervanging van het kantoor<br />

waarlangs hij optreedt.<br />

De Effecten zijn niet geregistreerd onder de United States Securities Act van 1933, en de handel<br />

in de Effecten is niet goedgekeurd door de United States Commodity Futures Trading<br />

Commission of onder de United States Commodity Exchange Act.<br />

2. KORTE SAMENVATTING VAN DE VOORWAARDEN VAN DE EFFECTEN<br />

Emittent: dbInvestor Solutions plc, een vennootschap voor speciale doeleinden,<br />

opgericht in de Ierse Republiek (zie “Description of the Issuer” in het<br />

<strong>Offering</strong> <strong>Circular</strong>).<br />

Bezwaarde Eigendom:<br />

De Effecten houden uitsluitend verplichtingen in voor de Emittent (op een<br />

beveiligde beperkte verhaalbasis). <strong>Deutsche</strong> <strong>Bank</strong> AG heeft geen<br />

verplichtingen met betrekking tot de Effecten.<br />

De Effecten zullen als volgt worden gewaarborgd (samen de<br />

“Bezwaarde Eigendom” voor de effecten):<br />

(a) het Zakelijk Onderpand; en<br />

(b) de Hedgingovereenkomst (zie “Hedging Agreement(s)” in Product<br />

Condition 4 d). van het <strong>Offering</strong> <strong>Circular</strong>).<br />

De Bezwaarde Eigendom wordt door de Emittent bezwaard ten bate van<br />

de Vermogensbeheerder als zekerheid voor de verplichtingen van de<br />

Emittent krachtens de bepalingen van het vermogensbeheerinstrument,<br />

de Effecten en de Hedgingovereenkomst.<br />

In omstandigheden waarin de zekerheid afdwingbaar wordt, (zie “Andere<br />

Annulering” hieronder), zal de Bezwaarde Eigendom door de<br />

Vermogensbeheerder te gelde worden gemaakt en de opbrengsten<br />

daarvan zullen in de volgende volgorde worden aangewend:<br />

(a) ten eerste tot betaling van de bedragen die verschuldigd zijn aan de<br />

Vermogensbeheerder;<br />

(b) ten tweede tot betaling van de bedragen die verschuldigd zijn aan<br />

de Tegenpartij bij de Hedgingovereenkomst; en<br />

(c) ten derde tot betaling van de bedragen die verschuldigd zijn aan de<br />

Effectenhouders,<br />

2

op voorwaarde dat, wanneer de zekerheid afdwingbaar wordt ten<br />

gevolge van een fout vanwege de Tegenpartij bij de<br />

Hedgingovereenkomst, alle betalingen die verschuldigd zijn aan de<br />

Effecthouders de voorrang zullen hebben op de betalingen die<br />

verschuldigd zijn aan de Tegenpartij bij de Hedgingovereenkomst.<br />

Zakelijk Onderpand: Op de Emissiedatum zal het Zakelijk Onderpand bestaan uit In<br />

Aanmerking Komende Zekerheden voor een bedrag dat naar<br />

goeddunken door de Berekeningsagent zal worden bepaald zodat, op<br />

de Emissiedatum, het totaal uitstaand saldo in hoofdsom gelijk is aan of<br />

groter dan het totale Nominale Bedrag van alle Effecten, die op die<br />

datum zijn uitgegeven.<br />

Vervanging van het Zakelijk<br />

Onderpand:<br />

In Aanmerking Komende<br />

Zekerheden:<br />

ABS-activa: Elke verbintenis die ofwel<br />

Het Zakelijk Onderpand kan eveneens liquide middelen bevatten op een<br />

rekening die rente opbrengt bij de bewarende bank.<br />

Het Zakelijke Onderpand kan van tijd tot tijd en naar goeddunken van de<br />

Emittent worden vervangen door andere In Aanmerking Komende<br />

Zekerheden, op voorwaarde dat het vervangingsonderpand eveneens<br />

een AAA-rating heeft.<br />

De Emittent verbindt zich ertoe door middel van de<br />

Hedgingovereenkomst dat hij zijn recht om het Zakelijk Onderpand te<br />

vervangen enkel zal gebruiken zoals wordt aanbevolen door de<br />

Tegenpartij bij de Hedgingovereenkomst. Dergelijke vervanging zal<br />

enkel plaatsvinden na bevestiging door Standard and Poor's dat de<br />

bestaande rating niet zal worden aangetast.<br />

Zekerheden uitgegeven door soevereine of quasi-soevereine<br />

instellingen of krediet- of financiële instellingen die deel uitmaken van<br />

een lidstaat van de Europese Unie en bepaalde ABS-activa (andere dan<br />

Cash CDO’s (zie “Cash CDO” in Product Condition 4 b) 2. van het<br />

<strong>Offering</strong> <strong>Circular</strong>)) die op de datum van selectie door de<br />

Berekeningsagent door Standard and Poor's niet lager zijn gewaardeerd<br />

dan AAA en die in het geval van ABS-activa die schuldzekerheden zijn,<br />

hoger zijn gewaardeerd dan alle andere schuldzekerheden die door<br />

dezelfde emittent zijn uitgegeven met betrekking tot dezelfde groep van<br />

uitstaande vorderingen of andere activa of, naar gelang van het geval,<br />

dezelfde portefeuille van corporate of andere referentie-entiteitsnamen<br />

of activa.<br />

(a) een zekerheid is of enige andere verplichting die wordt bewezen door<br />

een certificaat (in een globale, definitieve of andere vorm) en die<br />

ofwel:<br />

(i) in hoofdzaak wordt gedekt door de kasstromen van een groep<br />

van uitstaande (huidige of toekomstige) vorderingen of andere<br />

activa (met inbegrip van maar niet beperkt tot vaste of<br />

doorlopende obligaties of leningen), of<br />

(ii) waarvan de prestaties (hetzij via een afgeleide transactie of<br />

anderszins) gekoppeld zijn aan een portefeuille van corporate of<br />

andere referentie-entiteitsnamen of referentie-activa (met<br />

inbegrip van maar niet beperkt tot ABS-activa die onder de<br />

subparagrafen (a)(i), (a)(iii) en (b) van deze definitie vallen), of<br />

(iii) wordt gedekt door de kasstromen van een groep van uitstaande<br />

(huidige of toekomstige) vorderingen of andere activa (met<br />

inbegrip van maar niet beperkt tot vaste of doorlopende<br />

obligaties of leningen) en waarvan de prestaties gedeeltelijk<br />

gekoppeld zijn aan een portefeuille van corporate of andere<br />

referentie-entiteitsnamen, in ieder geval, al dan niet samen met<br />

eventuele rechten of andere activa die zijn bestemd om de<br />

betaling of de tijdelijke uitkering te verzekeren van de<br />

opbrengsten aan de houders ervan of<br />

3

(b) een “door activa ondersteunde zekerheid”, zoals die term van tijd tot<br />

tijd wordt omschreven in de “Algemene richtlijnen betreffende<br />

formulier S-3 Verklaring van registratie”, uitgevaardigd krachtens de<br />

Amerikaanse Beurswet van 1933, als gewijzigd.<br />

Rating: Verwachte rating van AAA door Standard and Poor's op de<br />

Emissiedatum.<br />

Totaal Nominaal Bedrag: Tot maximum 200.000.000 EUR.<br />

Nominaal bedrag per Effect: 1000 EUR.<br />

Uitgifteprijs per effect: 1000 EUR.<br />

Aanbiedingsprijs per effect: 1020 EUR.<br />

Plaatsingskosten: 2%.<br />

Inschrijvingsperiode<br />

Primaire Markt:<br />

Emissiedatum: 11 januari 2005.<br />

Vervaldag: 11 januari 2017.<br />

Terugbetalingsbedrag per<br />

Effect:<br />

15 november 2004 – 5 januari 2005.<br />

1000 EUR.<br />

Bruto Rentevoet: - met betrekking tot elke Interestperiode beginnend op (en met<br />

inbegrip van) de Emissiedatum tot deze die eindigt op (maar met<br />

uitsluiting van) 11 januari 2007 : 6,00 % per jaar;<br />

CMS op 10 jaar/CMS op 2<br />

jaar:<br />

- met betrekking tot elke Interestperiode vanaf (en met inbegrip van)<br />

11 januari 2007 tot deze die eindigt op (maar met uitsluiting van) de<br />

Vervaldag : een jaarlijkse rentevoet bepaald als volgt:<br />

Minimum [110 % * CMS10yr; 6 * spread]<br />

waarbij de «spread» gelijk is aan het verschil tussen de rentevoet<br />

CMS op 10 jaar en de rentevoet CMS op 2 jaar (cfr. «Interest<br />

Definitions» in Deel 1 van het <strong>Offering</strong> <strong>Circular</strong>), met dien verstande<br />

dat, indien de aldus berekende rentevoet minder zou zijn dan 0, de<br />

Bruto Rentevoet gelijk zal zijn aan 0% op de betreffende<br />

Interestberekeningsdag.<br />

Voorbeeld:<br />

- Indien de rentevoet CMS op 10 jaar 4,50% bedraagt en de rentevoet<br />

CMS op 2 jaar 3,20%, bedraagt de “Spread” derhalve 1,30%. Deze<br />

“Spread” wordt vermenigvuldigd met 6, hetzij 7,80%;<br />

- De rentevoet CMS op 10 jaar (4,50%) vermenigvuldigd met 110%<br />

geeft 4,95%;<br />

- De toepasselijke Bruto Rentevoet zal gelijk zijn aan de laagste<br />

waarde, hetzij 4,95%.<br />

Met betrekking tot de datum waarom de interest wordt bepaald (de<br />

Interestberekeningsdag), de jaarlijkse SWAP-rentevoet voor de<br />

wisselverrichtingen uitgedrukt in euro en met een vaste duur van<br />

respectievelijk 10 jaar en 2 jaar, uitgedrukt in een percentage dat<br />

verschijnt op de dag die overeenkomt met de dag waarop de rente wordt<br />

bepaald, op het scherm Reuters ISDAFIX2 onder de hoofding<br />

«EURIBOR BASIS» en boven «11:00 AM FRANKFURT» (cfr. «CMS<br />

10yr Page» en «CMS 2yr Page» in Product Condition 2 b) van het<br />

<strong>Offering</strong> <strong>Circular</strong>). Deze informatie kan eveneens verkregen worden bij<br />

<strong>Deutsche</strong> <strong>Bank</strong> SA/NV bij Tele Invest, op het nummer 078/153.154.<br />

De CMS op respectievelijk 10 jaar et 2 jaar is een interbancaire<br />

rentevoet die, in het algemeen, dicht aanleunt bij de referentievoet van<br />

staatsobligaties in dezelfde munt op respectievelijk 10 jaar en 2 jaar.<br />

4

Interestperiode: Periode vanaf en met inbegrip van de Emissiedatum tot, maar met<br />

uitsluiting van, de eerste Interestbetalingsdatum, en elke opeenvolgende<br />

periode tussen twee Interestbetalingsdata.<br />

Interestbepalingsdag: Twee TARGET-betalingsdagen vóór de laatste dag van elke<br />

Interestperiode.<br />

TARGET: Trans -European Automated Real-time Gross Settlement Express<br />

Transfer System.<br />

Interestbetalingsdatum: 11 januari van elk jaar met ingang van 2006 tot de Vervaldag,<br />

onderhevig aan de volgende Business Day Convention. Het<br />

interestbedrag met betrekking tot elke Interestperiode zal worden<br />

bepaald op een vaste 30/360 basis (zie “Interest Definitions” in het<br />

<strong>Offering</strong> <strong>Circular</strong>).<br />

Afwikkeling: Cash Afwikkeling.<br />

Afwikkelingvaluta: Euro.<br />

Vroegtijdige Annulering<br />

door de Emittent:<br />

Andere annulering: In geval van:<br />

Bedrag in Geval van<br />

Vroegtijdige Beëindiging:<br />

Mits hij de houders daarvan minimum 10 werkdagen voordien in kennis<br />

stelt, is de Emittent ertoe gerechtigd de Effecten a pari weder in te kopen<br />

op elke Interestbetalingsdatum vanaf en met inbegrip van de<br />

Interestbetalingsdatum die valt in 2007.<br />

(a) Wanbetaling of een versnelde of aanzienlijke afschrijving met<br />

betrekking tot een van de Zakelijke Onderpanden (zoals meer in<br />

detail beschreven in de algemene voorwaarden van het <strong>Offering</strong><br />

<strong>Circular</strong>) ; en/of<br />

(b) Beëindiging van de Hedgingovereenkomst op een andere manier<br />

dan in omstandigheden waarin de Tegenpartij bij de<br />

Hedgingovereenkomst verkiest de Hedgingovereenkomst vroegtijdig<br />

te beëindigen in overeenstemming met paragraaf (e) van de<br />

„Hedgingovereenkomst“<br />

zal de Hedgingovereenkomst een einde nemen (in voornoemd geval<br />

(a)), zal de zekerheid afdwingbaar worden, zullen er geen verdere<br />

betalingen van interesten of in hoofdsom meer plaatshebben verbonden<br />

aan de Effecten en zullen de houders van de Effecten met betrekking<br />

tot elk Effect het Bedrag in Geval van Vroegtijdige Beëindiging<br />

ontvangen.<br />

Een bedrag dat gelijk is aan een pro rata deel van:<br />

(a) de opbrengsten van de uitwinning van de zekerheid gevestigd door<br />

het vermogensbeheerinstrument over het Zakelijk Onderpand, minus<br />

(b) alle sommen die met betrekking tot het Zakelijk Onderpand zijn veilig<br />

gesteld en met voorrang op de aanspraken van de houders van de<br />

Effecten, met inbegrip van elk bedrag betaalbaar aan de<br />

Vermogensbeheerder en elke betaling aan de Tegenpartij van de<br />

Hedgingovereenkomst verschuldigd wegens beëindiging van de<br />

Hedgingovereenkomst.<br />

De houders van de Effecten dienen er echter nota van te nemen dat het<br />

totaal van alle sommen die met betrekking tot de Bezwaarde Eigendom<br />

zijn veilig gesteld met voorrang op de aanspraken van de Effecthouders<br />

een aanzienlijk gedeelte kan vormen van de opbrengsten van de<br />

realisatie van het Zakelijke Onderpand.<br />

Indien de Effecten vroegtijdig worden beëindigd tengevolge van een in<br />

gebreke blijven van de Tegenpartij bij de Hedgingovereenkomst, zullen<br />

de houders van de Effecten het Zakelijk Onderpand ontvangen. Voor<br />

meer informatie wordt verwezen naar “Early Termination Amount“ in<br />

Deel 1 van het <strong>Offering</strong> <strong>Circular</strong> (pagina's 25 – 26 van het <strong>Offering</strong><br />

<strong>Circular</strong>).<br />

5

Tegenpartij bij de<br />

Hedgingovereenkomst:<br />

<strong>Deutsche</strong> <strong>Bank</strong> AG Londen<br />

Berekeningsagent: <strong>Deutsche</strong> <strong>Bank</strong> AG Londen.<br />

Arranger: <strong>Deutsche</strong> <strong>Bank</strong> AG Londen.<br />

In geval de kortetermijnrating van de Tegenpartij bij de<br />

Hedgingovereenkomst zou verlaagd worden tot onder A-1+ en indien<br />

zo’n verlaging een negatieve impact zou hebben op de bestaande rating<br />

van de Effecten, zal de Tegenpartij bij de Hedgingovereenkomst alle<br />

redelijke inspanningen gebruiken om:<br />

- de rechten en plichten onder de Hedgingovereenkomst over te<br />

dragen naar een andere entiteit die een rating heeft van A-1+ of<br />

meer; of<br />

- een garantie van een andere entiteit - met rating van A-1+ of meer -<br />

te bekomen voor de plichten onder de Hedgingovereenkomst;<br />

Zie “Downgrade of the Hedging Counterparty” in Deel 1 van het <strong>Offering</strong><br />

<strong>Circular</strong> voor meer informatie (pagina 24 – 25 van het <strong>Offering</strong> <strong>Circular</strong>).<br />

Vermogensbeheerder: <strong>Deutsche</strong> Trustee Company Limited.<br />

Handelsdagen: Londen, Brussel, Frankfurt & TARGET.<br />

Notering: Een aanvraag tot notering van de effecten op de Beurs van Luxemburg<br />

werd ingediend.<br />

Vereffening: Euroclear and Clearstream.<br />

ISIN Code: XS0203898183.<br />

Common Code: 020389818.<br />

6

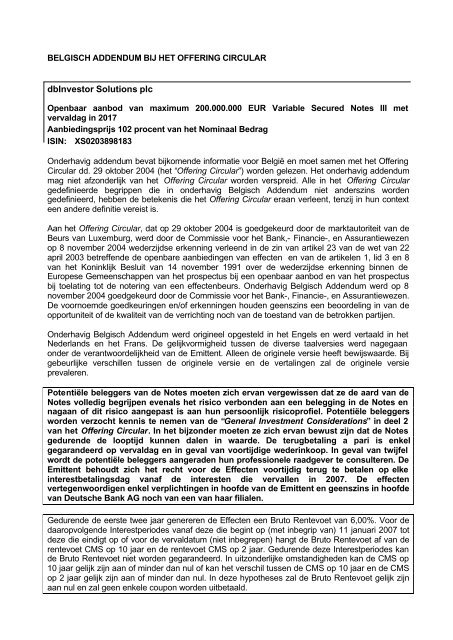

Historische Gegevens<br />

Historische gegevens betreffende de swap-rentevoet op 10 jaar en de swap-rentevoet op 2 jaar<br />

(bron: Bloomberg).<br />

Onderstaande grafiek toont de evolutie van de swap-rentevoet op 10 jaar en de swap-rentevoet<br />

op 2 jaar. De rentevoeten zijn uitgedrukt in percentage op de verticale as en de data zijn<br />

aangeduid op de horizontale as.<br />

6.50<br />

6.00<br />

5.50<br />

5.00<br />

4.50<br />

4.00<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

Jan-99<br />

Jul-99<br />

10 year swap rate vs 2 year swap rate<br />

Jan-00<br />

Jul-00<br />

Jan-01<br />

Jul-01<br />

7<br />

Jan-02<br />

Jul-02<br />

Jan-03<br />

Jul-03<br />

Jan-04<br />

2 year swap rate 10 year swap rate<br />

Onderstaande grafiek toont de evolutie van het verschil tussen de swap-rentevoet op 10 jaar en<br />

de swap-rentevoet op 2 jaar (de “Spread”).<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

-<br />

Jan-99<br />

Jul-99<br />

Jan-00<br />

10 year swap rate - 2 year swap rate<br />

Jul-00<br />

Jan-01<br />

Jul-01<br />

De recente historische prestaties van de rentevoet zijn geen indicatie voor toekomstige<br />

prestaties.<br />

Jan-02<br />

Jul-02<br />

Jan-03<br />

Jul-03<br />

Jul-04<br />

Jan-04<br />

Jul-04

Jaar Minimum<br />

Spread<br />

Maximum<br />

Spread<br />

Gemiddelde<br />

Spread<br />

8<br />

Minimum<br />

CMS 10<br />

jaar<br />

Maximum<br />

CMS 10<br />

1999 0,94 1,83 1,38 4,02 5,85 4,91<br />

2000 0,33 1,47 0,74 5,47 6,02 5,82<br />

2001 0,62 1,49 1,00 4,59 5,56 5,24<br />

2002 0,89 1,51 1,17 4,38 5,49 5,03<br />

2003 1,41 1,77 1,59 3,60 4,59 4,23<br />

2004 (tot 12 1,34<br />

november)<br />

1,80 1,59 3,91 4,54 4,24<br />

jaar<br />

Gemiddelde<br />

CMS 10 jaar<br />

De berekeningen zijn uitgevoerd met gebruik van voor het publiek toegankelijke bronnen (zoals<br />

Bloomberg). Noch de Uitgever, noch de Tegenpartij bij de Hedgingovereenkomst hebben op een<br />

onafhankelijke manier de informatie geverifieerd die van deze bronnen werd bekomen.<br />

Voor de respectievelijke Interestperiodes vanaf deze die begint op (met inbegrip van) 11 januari<br />

2007 tot deze die eindigt op of voor de vervaldatum (niet inbegrepen) zal de Bruto Rentevoet<br />

afhangen van de CMS-rentevoet op 10 jaar en van de CMS-rentevoet op 2 jaar. De Bruto<br />

Rentevoet voor deze Interestperiodes kan niet worden gegarandeerd. In uitzonderlijke<br />

omstandigheden kan de CMS op 10 jaar gelijk zijn aan of lager dan nul of kan het verschil tussen<br />

de CMS op 10 jaar en de CMS op 2 jaar gelijk zijn aan of lager dan nul. In deze hypotheses zal<br />

de Bruto Rentevoet gelijk zijn aan nul en zal geen enkele coupon worden uitbetaald.<br />

Aan de potentiële beleggers wordt aangeraden in geval van twijfel hun professionele adviseur te<br />

raadplegen.<br />

Dit hoofdstuk is een beknopt overzicht van de Productvoorwaarden die in Hoofdstuk I van het<br />

<strong>Offering</strong> <strong>Circular</strong> worden uiteengezet. Het is niet bedoeld als een volledige beschrijving van de<br />

Effecten, en moet in tegendeel samen worden gelezen met, en is onderworpen aan alle overige<br />

hoofdstukken van onderhavig document en het <strong>Offering</strong> <strong>Circular</strong>.

3. FISCAAL REGIME<br />

Hetgeen volgt is bedoeld als een algemene richtlijn en is slechts een samenvatting van het begrip<br />

dat de Emittent heeft van het huidig Belgisch fiscale recht en van de huidige fiscale praktijk, zoals<br />

toegepast op de fiscale behandeling van de Effecten. Het dient beklemtoond te worden dat deze<br />

tekst niet impliciet mag uitgebreid worden tot aangelegenheden die hierin niet specifiek zijn<br />

behandeld. Deze tekst houdt geen rekening met of bespreekt geen fiscale regimes van andere<br />

landen dan België. Bovendien kan deze tekst gewijzigd worden door veranderingen in het<br />

Belgische recht met inbegrip van veranderingen die een retroactief effect zouden kunnen hebben.<br />

Investeerders dienen advies in te winnen bij hun eigen belastingsadviseurs betreffende het<br />

Belgisch fiscaal stelsel van de inkomsten ontvangen i.v.m. de Effecten.<br />

De belangrijkste fiscale kenmerken van de Effecten van toepassing op Belgische inwoners<br />

(natuurlijke personen, rechtspersonen onderworpen aan rechtspersonenbelasting en<br />

vennootschappen) die Effecten aanhouden, zijn de volgende :<br />

I. Natuurlijke personen – Belgische rijksinwoners<br />

Interesten op de Effecten betaald of toegekend door een in België gevestigde tussenpersoon zijn<br />

in beginsel onderworpen aan een Belgische roerende voorheffing van 15%. De inhouding van de<br />

roerende voorheffing is bevrijdend in hoofde van de particuliere beleggers. Dit betekent dat de<br />

belastingplichtigen er niet zullen toe gehouden zijn in hun belastingaangifte melding te maken van<br />

inkomsten uit effecten van Belgische of buitenlandse schuldvorderingen die ze hebben<br />

verkregen, voor zover op deze inkomsten roerende voorheffing werd geheven (artikel 313<br />

W.I.B./92).<br />

Indien de interesten evenwel werden geïnd buiten België dan is de belastingplichtige natuurlijke<br />

persoon ertoe gehouden ze aan te geven in zijn belastingaangifte in de personenbelasting. Dit<br />

laatste is eveneens van toepassing op het gedeelte van de reeds verlopen interest in het geval<br />

van de verkoop van de Effecten tussen twee vervaldagen. De belasting is berekend op basis van<br />

het afzonderlijke tarief van 15 %, te verhogen met de gemeentelijke opcentiemen.<br />

Natuurlijke personen (Belgische inwoners) die de Effecten houden als een private investering<br />

worden in principe niet belast op meerwaarden gerealiseerd naar aanleiding van de vervreemding<br />

van de Effecten, met uitzondering van het gedeelte van de meerwaarde dat overeenstemt met de<br />

reeds “verlopen interest”, dat dient behandeld te worden als interest (cfr. supra). Minderwaarden<br />

zijn niet aftrekbaar. In het geval de Effecten het voorwerp uitmaken van een vervroegde inkoop<br />

door de Emittent, zal de eventuele meerwaarde voor fiscale doeleinden gelijkgesteld worden met<br />

interest, en dienovereenkomstig worden belast.<br />

II. Rechtspersonen onderworpen aan rechtspersonenbelasting in België<br />

Voor belastingplichtigen onderworpen aan de rechtspersonenbelasting is de roerende voorheffing<br />

van 15% die ingehouden werd op interesten, de definitieve belasting. Dit betekent dat de<br />

roerende voorheffing die wordt ingehouden op de interesten die ze in België innen, in hun hoofde<br />

de enige belasting is met betrekking tot deze inkomsten.<br />

Indien de interesten evenwel werden geïnd buiten België, is de belastingplichtige zelf gehouden<br />

tot betaling van de roerende voorheffing en zullen de interesten in de jaarlijkse belastingsaangifte<br />

dienen opgenomen te worden. Voormelde is eveneens van toepassing op het gedeelte van de<br />

reeds verlopen interest in het geval van de verkoop van de Effecten tussen twee vervaldagen.<br />

9

Meerwaarden gerealiseerd naar aanleiding van de vervreemding van de Effecten zijn niet<br />

belastbaar, met uitzondering van het gedeelte van de meerwaarde dat overeenstemt met de<br />

reeds “verlopen interest”, dat dient behandeld te worden als interest (cfr. supra). Minderwaarden<br />

zijn niet aftrekbaar. In het geval de Effecten het voorwerp uitmaken van een vervroegde inkoop<br />

door de Emittent, zal de eventuele meerwaarde voor fiscale doeleinden geassimileerd worden<br />

met interest, en dienovereenkomstig worden belast.<br />

III. Vennootschappen<br />

In hoofde van de belastingplichtigen die onderworpen zijn aan de vennootschapsbelasting maken<br />

de interesten en de meerwaarden deel uit van hun belastbare basis. Minderwaarden op Effecten<br />

zijn in principe aftrekbaar. Vennootschappen kunnen, onder bepaalde voorwaarden, genieten van<br />

een vrijstelling van de roerende voorheffing op interesten uit buitenlandse Effecten.<br />

IV. Beurstaks<br />

Sinds het arrest van het Hof van Justitie van de Europese Gemeenschappen van 15 juli 2004<br />

moeten de beleggers geen taks op beursverrichtingen (“TOB”), in voege sinds 10 februari 1914,<br />

meer betalen op de uitgifte van “nieuwe effecten”. Voor meer inlichtingen dienaangaande kunnen<br />

de beleggers de website van de Federale Overheidsdienst Financiën raadplegen op het adres<br />

www.minfin.fgov.be.<br />

Een beurstaks aan een tarief van 0,07% (gelimiteerd tot 250 Euro per partij en per transactie), is<br />

verschuldigd wanneer de Effecten in België worden verkocht of aangekocht in het geval dat een<br />

professionele tussenpersoon in de transactie tussenkomt. Voormelde belasting is zowel<br />

verschuldigd door de koper als de verkoper.<br />

Bepaalde investeerders, waaronder investeerders die geen Belgisch inwoner zijn en bepaalde<br />

institutionele investeerders die voor eigen rekening handelen, zijn vrijgesteld van de<br />

bovenvermelde belasting.<br />

4. INSCHRIJVINGSPERIODE<br />

In België kunnen de aanvragen tot inschrijving op de Effecten worden verricht in de kantoren van<br />

de Belgische Financiële & Betalingsagent (zoals verder aangeduid) van 15 november 2004 tot en<br />

met 5 januari 2005.<br />

De Emittent behoudt zich echter het recht voor om de inschrijvingsperiode vervroegd af te sluiten.<br />

5. VORM VAN DE EFFECTEN<br />

De Effecten worden vertegenwoordigd door een bij de Clearing Agent(en) neergelegd Globaal<br />

Effect. Er zullen geen definitieve Effecten worden uitgegeven.<br />

De Effecten zijn niet materieel leverbaar. De beleggers kunnen informatie inwinnen bij hun bank<br />

om het toepasselijk tarief te kennen voor het onder dossier plaatsen van effecten.<br />

10

6. KENNISGEVINGEN<br />

De kennisgevingen met betrekking tot de Effecten zullen worden gepubliceerd in De Tijd en<br />

l’Echo.<br />

7. VERREKENING EN AFWIKKELING<br />

Het Globale Effect zal worden gedeponeerd bij een bewaarnemer en is voor verrekening<br />

aanvaard door Euroclear <strong>Bank</strong> en Clearstream <strong>Bank</strong>ing onder de navolgende security and<br />

clearing code :<br />

ISIN: XS0203898183<br />

Common Code: 020389818<br />

8. DOCUMENTEN TER BESCHIKKING<br />

Het <strong>Offering</strong> <strong>Circular</strong> en het onderhavige Belgisch Addendum zullen verkrijgbaar zijn in de<br />

kantoren van de Belgische Financiële & Betalingsagent (zoals verder aangeduid) en op de<br />

internetsite www.dbbelgium.be. Het meest recente jaarverslag van de Emittent zal er teveneens<br />

beschikbaar zijn gedurende de volledige looptijd van de Effecten.<br />

9. FINANCIËLE & BETALINGSAGENT<br />

De Emittent heeft <strong>Deutsche</strong> <strong>Bank</strong> NV, Marnixlaan 13 – 15, 1000 Brussel (tel : +32 2 551 65 11<br />

/fax : +32 2 551 66 66), aangeduid om in België op te treden als zijn Financiële & Betalingsagent.<br />

10. NOTERING EN SECUNDAIRE MARKT<br />

Notering van de effecten op de Beurs van Luxemburg werd aangevraagd.<br />

<strong>Deutsche</strong> <strong>Bank</strong> AG zal gedurende de ganse looptijd een secundaire markt garanderen voor de<br />

Effecten in normale marktomstandigheden, en verwacht een prijsvork van ongeveer 1% in<br />

normale marktomstandigheden.<br />

11. TOEPASSELIJK RECHT<br />

De Effecten zijn onderworpen aan en worden beheerst door Engels recht.<br />

Geschillen ivm deze emissie kunnen door Belgische investeerders voor Belgische rechtbanken<br />

gebracht worden.<br />

11

OFFERING CIRCULAR<br />

dbInvestor Solutions plc<br />

(Incorporated with limited liability in Ireland)<br />

Programme<br />

for the<br />

issuance of Secured Securities<br />

Series 5<br />

Public Offer in Luxembourg of up to Euro 200,000,000 Variable Secured Notes III<br />

Offer Price:<br />

Euro 1,020<br />

Arranger<br />

<strong>Deutsche</strong> <strong>Bank</strong> AG London<br />

A copy of this <strong>Offering</strong> <strong>Circular</strong> and a copy of the consent of KPMG to the inclusion of their report<br />

in this <strong>Offering</strong> <strong>Circular</strong> (the "KPMG Consent") has been delivered to the Registrar of Companies<br />

in Ireland pursuant to section 47 of the Irish Companies Act 1963. Particulars of the KPMG<br />

Consent are set out in "Description of the Issuer" in Part 2 of this <strong>Offering</strong> <strong>Circular</strong>.<br />

The Preliminary <strong>Offering</strong> <strong>Circular</strong> is dated 20 January 2004 and provides information with respect<br />

to various types of financial instruments which are capable of issue under the Programme. This<br />

<strong>Offering</strong> <strong>Circular</strong> constitutes, in relation to the Securities only, a completed version of the<br />

Preliminary <strong>Offering</strong> <strong>Circular</strong> and is dated 29 October 2004.<br />

Prospective purchasers of the Securities should ensure that they understand fully the nature of<br />

the Securities, as well as the extent of their exposure to risks associated with an investment in the<br />

Securities and should consider the suitability of an investment in the Securities in the light of their<br />

own particular financial, fiscal and other circumstances. Prospective purchasers of the Securities<br />

should refer to "General Investment Considerations" in Part 2 of this <strong>Offering</strong> <strong>Circular</strong>.

Subject matter of this <strong>Offering</strong> <strong>Circular</strong><br />

The subject matter of this document (this "<strong>Offering</strong> <strong>Circular</strong>") is the issue of the Securities by the<br />

Issuer under the Programme (each capitalised term having the meaning given to it below).<br />

The Programme<br />

Under its Programme for the issuance of Secured Securities (the "Programme"), dbInvestor<br />

Solutions plc (the "Issuer") may from time to time issue secured notes and secured certificates<br />

which may relate to shares and/or indices and/or debt securities and/or commodities and/or<br />

currencies and/or other assets.<br />

The terms of the Programme are set out in Part 2 of this <strong>Offering</strong> <strong>Circular</strong>.<br />

The Securities<br />

Under the Programme the Issuer has decided to issue up to Euro 200,000,000 Series 5 Variable<br />

Secured Notes III (the "Securities") on the terms set out in this <strong>Offering</strong> <strong>Circular</strong>.<br />

The terms and conditions of the Securities (the "Conditions") are comprised of the General<br />

Conditions set out in Part 2 of this <strong>Offering</strong> <strong>Circular</strong>, as completed, modified and amended by the<br />

Product Conditions set out in Part 1 of this <strong>Offering</strong> <strong>Circular</strong>.<br />

<strong>Deutsche</strong> <strong>Bank</strong> AG London of Winchester House, 1 Great Winchester Street, London EC2N 2DB<br />

(the "Arranger") is the arranger for the Securities.<br />

Listing<br />

Application has been made to list the Securities on the Luxembourg Stock Exchange. The<br />

Luxembourg Stock Exchange takes no responsibility for the contents of this document, makes no<br />

representations as to its accuracy or completeness and expressly disclaims any liability<br />

whatsoever for any loss arising from or in reliance upon any part of this document.<br />

The Issuer has requested certificates of mutual recognition in compliance with EC Public Directive<br />

number 2001/34/EEC, as amended, for the Securities, because it intends, in addition to a public<br />

offer in Luxembourg, to publicly offer the Securities in Belgium on that basis. For the purposes of<br />

compliance with the national laws and regulations concerning the offering and/or listing of the<br />

Securities outside Luxembourg this document may have attached to it one or more addenda<br />

containing country specific information relating to the Securities (each, a “Country Addendum”).<br />

Sale of the Securities<br />

The Securities will be offered for subscription by the Issuer during the subscription period at the<br />

Offer Price. On the Issue Date, the Securities which have been subscribed for by the public will be<br />

issued to the investors by using the Arranger as an intermediary. Such Securities will be<br />

purchased by the Arranger at the Issue Price and immediately sold on at the Offer Price to the<br />

investors who have subscribed for them at such price during the subscription period. Neither the<br />

Issuer nor the Arranger shall be obliged to sell all or any of the Securities.<br />

Currency References<br />

In this <strong>Offering</strong> <strong>Circular</strong>, unless otherwise specified or the context otherwise requires, references<br />

to "dollars", "U.S. dollars", "USD" and "U.S.$" are to United States dollars and references to<br />

"Euro", "EUR" or "€" are to the lawful currency of the member states of the European Union that<br />

adopt the single currency in accordance with the Treaty establishing the European Community as<br />

amended from time to time.<br />

Selling Restrictions<br />

The Securities have not been, and will not be, registered under the United States Securities Act of<br />

1933, as amended. Any offer or sale of the Securities must be made in a transaction exempt<br />

from the registration requirements of such Act pursuant to Regulation S thereunder. The<br />

Securities may not be offered, sold or otherwise transferred in the United States or to persons<br />

who are either U.S. persons as defined in Regulation S of such Act or persons who do not come<br />

2

within the definition of a non-United States person under Rule 4.7 of the United States<br />

Commodity Exchange Act, as amended. For a description of further restrictions on the offer, sale<br />

and transfer of the Securities, please refer to "Important" on page 3 and to "Sales Restrictions" in<br />

Part 2 of this document.<br />

3

IMPORTANT<br />

Subject as set out herein, the Issuer accepts responsibility for the information contained in this<br />

<strong>Offering</strong> <strong>Circular</strong>. To the best of the knowledge and belief of the Issuer (which has taken all<br />

reasonable care to ensure that such is the case) the information contained in this <strong>Offering</strong><br />

<strong>Circular</strong> is in accordance with the facts and does not omit anything likely to affect the import of<br />

such information.<br />

Neither the delivery of this <strong>Offering</strong> <strong>Circular</strong> nor any sale made in connection herewith shall at any<br />

time imply that the information contained herein is correct at any time subsequent to the date of<br />

this <strong>Offering</strong> <strong>Circular</strong> or that any further information supplied in connection with the Securities is<br />

correct as of any time subsequent to the date indicated in the document containing the same.<br />

No person has been authorised to give any information or to make representations other than<br />

those contained in this <strong>Offering</strong> <strong>Circular</strong> in connection with the issue or sale of the Securities and,<br />

if given or made, such information or representations must not be relied upon as having been<br />

authorised by the Issuer or the Arranger.<br />

None of this <strong>Offering</strong> <strong>Circular</strong> and any further information supplied in connection with the<br />

Securities is intended to provide the basis of any credit or other evaluation and should not be<br />

considered as a recommendation by the Issuer and/or the Arranger and/or the Trustee that any<br />

recipient of this <strong>Offering</strong> <strong>Circular</strong> or any further information supplied in connection with the<br />

Securities should purchase any Securities. Each investor contemplating purchasing Securities<br />

should make its own independent investigation of the risks involved in an investment in the<br />

Securities. Neither this <strong>Offering</strong> <strong>Circular</strong> nor any other information supplied in connection with the<br />

Securities constitutes an offer by or on behalf of the Issuer and/or the Arranger or any other<br />

person to purchase any Securities.<br />

Neither the Arranger nor the Trustee has separately verified the information contained herein and<br />

accordingly neither the Arranger nor the Trustee makes any representation, recommendation or<br />

warranty, express or implied, regarding the accuracy, adequacy, reasonableness or<br />

completeness of the information contained herein or in any further information, notice or other<br />

document which may at any time be supplied in connection with the Securities or their distribution<br />

and none of them accepts any responsibility or liability therefor. Neither the Arranger nor the<br />

Trustee undertakes to review the financial condition or affairs of the Issuer during the life of the<br />

arrangements contemplated by this <strong>Offering</strong> <strong>Circular</strong> nor to advise any investor or potential<br />

investor in any Securities of any information coming to the attention of either the Arranger or the<br />

Trustee.<br />

The distribution of this <strong>Offering</strong> <strong>Circular</strong> and the offering or sale of the Securities in certain<br />

jurisdictions may be restricted by law. Neither the Issuer, the Arranger, nor the Trustee<br />

represents that this document may be lawfully distributed, or that any Securities may be lawfully<br />

offered, in compliance with any applicable registration or other requirements in any jurisdiction, or<br />

pursuant to an exemption available thereunder, or assumes any responsibility for facilitating any<br />

distribution or offering. Accordingly, no Securities may be offered or sold, directly or indirectly,<br />

and none of this <strong>Offering</strong> <strong>Circular</strong>, any advertisement relating to any Securities and any other<br />

offering material may be distributed or published in any jurisdiction, except under circumstances<br />

that will result in compliance with any applicable laws and regulations. Persons into whose<br />

possession this <strong>Offering</strong> <strong>Circular</strong> comes are required by the Issuer and the Arranger to inform<br />

themselves about and to observe any such restrictions. For a description of certain restrictions on<br />

the sale and transfer of the Securities, please refer to "Sales Restrictions" in Part 2 of this <strong>Offering</strong><br />

<strong>Circular</strong>.<br />

This document contains forward-looking statements. Forward-looking statements are statements<br />

that are not historical facts, including statements about the Issuer’s beliefs and expectations. Any<br />

statement in this document that states the Issuer’s intentions, beliefs, expectations or predictions<br />

4

(and the assumptions underlying them) is a forward-looking statement. These statements are<br />

based on plans, estimates, and projections as they are currently available to the management of<br />

the Issuer. Forward-looking statements involve inherent risks and uncertainties. A number of<br />

important factors could therefore cause actual results of the Issuer or of the Securities to differ<br />

materially from those contained in any forward-looking statement.<br />

5

INVESTMENT CONSIDERATIONS<br />

Prospective purchasers of the Securities should ensure that they understand fully the<br />

nature of the Securities, as well as the extent of their exposure to risks associated with an<br />

investment in the Securities and should consider the suitability of an investment in the<br />

Securities in light of their own particular financial, fiscal and other circumstances.<br />

Prospective purchasers of the Securities should refer to the investment considerations<br />

below and "General Investment Considerations" in Part 2 of this <strong>Offering</strong> <strong>Circular</strong>. In<br />

particular, prospective investors should be aware that the Securities may decline in value<br />

and should be prepared to sustain a total loss of their investment in the Securities.<br />

The Issuer has the option to redeem the Securities early on any Interest Payment Date<br />

from and including that falling in 2007. If such option is exercised, Securityholders will<br />

bear reinvestment risk.<br />

The Securities are not guaranteed by the Arranger or any of its affiliates and neither the<br />

Arranger nor any of its affiliates has or will have any obligations in respect of the<br />

Securities. The Securities will represent secured, limited recourse obligations of the Issuer<br />

which will rank pari passu in all respects with each other. The Securities are secured by<br />

the Collateral and the Hedging Agreement, which are charged by the Issuer as security for<br />

(in the following order of priority) the Issuer's obligations to (a) the Trustee (under the<br />

Trust Instrument), (b) the Hedging Counterparty (under the Hedging Agreement) and finally<br />

(c) the Securityholders (under the Securities). As more particularly described in this<br />

<strong>Offering</strong> <strong>Circular</strong>, certain events with respect to the structural arrangements relating to the<br />

issue of the Securities (for example a payment default, acceleration or principal writedown<br />

with respect to any of the Collateral or a termination of the Hedging Agreement) will cause<br />

the Securities to be cancelled early, in which case the Securityholders will be entitled to an<br />

amount equal to the proceeds of realising the Collateral minus all sums secured on the<br />

Collateral in priority to the claims of the Securityholders. Such priority claims may<br />

represent a considerable portion of the proceeds of realisation of the Collateral and in<br />

such circumstances Securityholders will have no further claim against the assets of the<br />

Issuer or any other person. See General Condition 6.8 (Shortfall after application of<br />

proceeds) and Product Condition 6 (Early Termination Amount).<br />

6

SUMMARY<br />

This section is a brief overview of the Product Conditions set out in Part 1 of this <strong>Offering</strong> <strong>Circular</strong><br />

and the General Conditions set out in Part 2 of this <strong>Offering</strong> <strong>Circular</strong> and should be read in<br />

conjunction with, and is subject to, the Product Conditions and the General Conditions, which<br />

together constitute the Conditions.<br />

Type of Securities: Notes.<br />

Form of Securities: Bearer.<br />

Status of Securities: The Securities will represent secured, limited<br />

recourse obligations of the Issuer, which are<br />

secured in the manner described in General<br />

Condition 6.2.1 and recourse in respect of<br />

which is limited in the manner described in<br />

General Condition 6.8.<br />

Issue Price: Euro 1000 (100%) per Security.<br />

Offer Price: Euro 1020 (102%) per Security.<br />

Issue Date: 11 January 2005.<br />

Nominal Amount per Security: Euro 1000.<br />

Aggregate Nominal Amount of Securities: Up to Euro 200,000,000.<br />

Interest Rate: (a) With respect to each Interest Period from<br />

that commencing on (and including) the<br />

Issue Date to the Interest Period ending<br />

on (but excluding) 11 January 2007, 6.00<br />

per cent. per annum; and<br />

(b) With respect to each Interest Period from<br />

that commencing on (and including) 11<br />

January 2007 to the Interest Period<br />

ending on (but excluding) the Maturity<br />

Date, a rate per annum (expressed as a<br />

percentage) determined in accordance<br />

with the following formula:<br />

Min [110% * CMS10y ; 6 * (CMS10y – CMS2y)]<br />

subject to the Minimum Interest Rate of<br />

0.00%.<br />

Interest Determination Dates: Two TARGET Settlement Days prior to the<br />

last day of the related Interest Period.<br />

Interest Periods: The period commencing on (and including)<br />

the Issue Date to (but excluding) the first<br />

Interest Payment Date and each successive<br />

period commencing on (and including) an<br />

7

8<br />

Interest Payment Date to (but excluding) the<br />

next following Interest Payment Date.<br />

Interest Payment Date(s): Interest is payable annually in arrear<br />

commencing 11 January 2006 and ending on<br />

the Maturity Date, subject in each case to<br />

adjustment in accordance with the Following<br />

Business Day Convention with no adjustment<br />

of interest payable.<br />

Maturity Date: 11 January 2017.<br />

Redemption Amount per Security: Euro 1000 (100%).<br />

Early cancellation rights: The Issuer has the right, by giving not less<br />

than 10 Business Days' prior notice to the<br />

Securityholders, to redeem the Securities, at<br />

par on each Interest Payment Date from and<br />

including that falling in 2007.<br />

Early Termination Amount: If the Securities are redeemed early pursuant<br />

to General Condition 5.1 (Mandatory<br />

Cancellation) or General Condition 5.2<br />

(Cancellation for other reasons), each<br />

Securityholder will receive either a cash<br />

amount and/or delivery of Collateral. See<br />

Product Condition 6 (Early Termination<br />

Amount).<br />

Collateral: On the Issue Date the Collateral will<br />

comprise Eligible Securities in an amount<br />

determined by the Calculation Agent in its<br />

discretion such that the aggregate<br />

outstanding principal amount of the Collateral<br />

on the Issue Date is equal to or greater than<br />

the aggregate Nominal Amount of all the<br />

Securities issued on such date (the “Initial<br />

Collateral”). Subsequent to the Issue Date<br />

the Initial Collateral may from time to time be<br />

replaced by the Issuer by Eligible Securities<br />

(debt securities issued by sovereign or quasisovereign<br />

entities or credit or financial<br />

institutions in any member state of the<br />

European Union and certain ABS assets<br />

(excluding cash CDOs) as more particularly<br />

described in Product Condition 4(b) below) in<br />

accordance with General Condition 6.5. If the<br />

short-term debt rating assigned to the<br />

Hedging Counterparty by S&P is<br />

downgraded below A-1+, from and including<br />

the 30th day following the date on which<br />

such downgrade is effective, Eligible<br />

Securities must be denominated in Euro and<br />

available in denominations of Euro 1,000.<br />

The Issuer will agree in the Hedging<br />

Agreement that it will exercise its rights

9<br />

under General Condition 6.5.1, to replace the<br />

Collateral with other Eligible Securities, only<br />

as instructed by the Hedging Counterparty<br />

from time to time.<br />

In the event of a replacement of the<br />

Collateral, the Issuer will prepare and file<br />

with the Luxembourg Stock Exchange a<br />

supplement to this <strong>Offering</strong> <strong>Circular</strong>.<br />

The Collateral (including the Initial Collateral)<br />

may also comprise cash placed on deposit in<br />

an interest-bearing account with the<br />

Custodian.<br />

Calculation Agent: <strong>Deutsche</strong> <strong>Bank</strong> AG London.<br />

Listing: Application has been made to list the<br />

Securities on the Luxembourg Stock<br />

Exchange.<br />

Listing Agent: <strong>Deutsche</strong> <strong>Bank</strong> AG London.<br />

ISIN: XS0203898183.<br />

Common Code: 020389818.<br />

Use of Proceeds: The net proceeds from the issuance of the<br />

Securities will be used to enter into the<br />

Hedging Agreement and thereby to acquire<br />

the Collateral comprised in the Charged<br />

Property in respect of the Securities.

PART 1: Product Description<br />

10

PART 1 TABLE OF CONTENTS<br />

PRODUCT CONDITIONS OF THE SECURITIES..................................................................12<br />

ANNEX 1 TO THE PRODUCT CONDITIONS ........................................................................27<br />

ADDITIONAL INFORMATION................................................................................................30<br />

11

PRODUCT CONDITIONS OF THE SECURITIES<br />

The Securities shall, upon issue, have the following "Product Conditions" which shall complete,<br />

modify and amend the General Conditions (the "General Conditions") set forth in Part 2 of this<br />

<strong>Offering</strong> <strong>Circular</strong>. The Product Conditions and the General Conditions together constitute the<br />

"Conditions" of the Securities, and will be attached to the relevant Global Security. On or about<br />

the Issue Date the Issuer will publish a supplement (the “Supplement”) confirming the amount of<br />

Securities to be issued and the Initial Collateral. The Supplement should be read in conjunction<br />

with the Product Conditions.<br />

Words and expressions defined or used in the Trust Instrument, the Agency Agreement or the<br />

General Conditions shall have the same meanings where used in the Product Conditions unless<br />

the context otherwise requires or unless otherwise stated.<br />

In the event of any inconsistency between the Product Conditions and the General Conditions,<br />

the Product Conditions shall prevail.<br />

1. INTRODUCTION<br />

(a) Issuer: dbInvestor Solutions plc.<br />

(b) Type of Securities: Notes.<br />

(c) Series No.: 5.<br />

(d) Listing: Application has been made to list the Securities on the<br />

Luxembourg Stock Exchange.<br />

(e) Security Codes: ISIN: XS0203898183.<br />

Common Code: 020389818.<br />

(f) Relevant Rating Agency(ies): The Securities are expected to be rated AAA by Standard &<br />

Poor’s Ratings Services, a division of The McGraw-Hill<br />

Companies, Inc. (“S&P”).<br />

2. DEFINITIONS<br />

(a) General Definitions<br />

No assurance can be given that such rating will be obtained<br />

or, if obtained, that such rating will be maintained. A<br />

security rating is not a recommendation to buy, sell or hold<br />

securities and may be subject to suspension, change or<br />

withdrawal at any time by the assigning rating agency.<br />

"Business Day" means a day (other than a Saturday or Sunday) on which commercial<br />

banks and foreign exchange markets settle payments and are open for general business<br />

(including dealings in foreign exchange and foreign currency deposits) in London,<br />

Frankfurt am Main and Brussels and a day on which each Clearing Agent is open for<br />

business and, for the purpose of making payments in Euro, if applicable, a TARGET<br />

Settlement Day.<br />

"Calculation Agent" means <strong>Deutsche</strong> <strong>Bank</strong> AG London.<br />

"Clearing Agent(s)" means Euroclear and Clearstream.<br />

12

"Clearstream" means Clearstream <strong>Bank</strong>ing S.A..<br />

“Collateral” shall have the meaning given in General Condition 1.1 and is as specified in<br />

Product Condition 4(b).<br />

“Disruption Cash Settlement Price” means, in respect of each Security, the fair market<br />

value of such Security on such day as shall be selected by the Issuer taking into account,<br />

without limitation, such factors as it deems relevant including, without limitation, the value<br />

of any Physical Settlement Units delivered in respect of such Security.<br />

“Eligible Securities” shall have the meaning given in General Condition 1.1 and is as<br />

specified in Product Condition 4(b).<br />

"Euroclear" means Euroclear <strong>Bank</strong> S.A./N.V..<br />

“Initial Collateral” means Eligible Securities, in an amount determined by the Calculation<br />

Agent in its discretion, such that the aggregate outstanding principal amount of the<br />

Collateral on the Issue Date is equal to or greater than the aggregate Nominal Amount of<br />

all the Securities issued on such date.<br />

"Issue Price" means, per Security, Euro 1000 (100%).<br />

"Issue Date" means 11 January 2005.<br />

“Minimum Rating Criteria” means Eligible Securities either:<br />

(i) having an Equivalent Rating on the date of selection by the Calculation Agent and<br />

which are not, in the reasonable opinion of the Calculation Agent, subject to<br />

withholding tax as of the date they are selected; or<br />

(ii) in respect of which the Issuer shall have received written confirmation from S&P<br />

that its current rating of the Securities will not be adversely affected by the<br />

Replacement,<br />

as provided for by General Condition 6.5.1(2)(y), as modified by the Product Conditions.<br />

"Nominal Amount" means Euro 1000 per Security.<br />

"Principal Agent" means <strong>Deutsche</strong> <strong>Bank</strong> AG London.<br />

“Settlement Disruption Event” means, in the opinion of the Calculation Agent, an event<br />

beyond the control of the Issuer as a result of which the Issuer cannot make delivery of a<br />

Physical Settlement Unit in accordance with such market method as it selects at the<br />

relevant time for delivery of the relevant Physical Settlement Unit.<br />

“Supplement” shall have the meaning given in the preamble to these Product Conditions.<br />

"TARGET" means the Trans-European Automated Real-time Gross Settlement Express<br />

Transfer System.<br />

(b) Interest Definitions<br />

"Day Count Fraction" means, in respect of the calculation of an amount of interest on any<br />

Security for any period of time (whether or not constituting an Interest Period, the<br />

"Calculation Period"):<br />

"30/360" being the number of days in the Calculation Period divided by 360 (the<br />

number of days to be calculated on the basis of a year of 360 days with 12 30-day<br />

13

months, unless: (i) the last day of the Calculation Period is the 31st day of a month<br />

but the first day of the Calculation Period is a day other than the 30th or 31st day of<br />

a month, in which case the month that includes that last day shall not be considered<br />

to be shortened to a 30-day month, or (ii) the last day of the Calculation Period is the<br />

last day of the month of February, in which case the month of February shall not be<br />

considered to be lengthened to a 30-day month).<br />

"Euro-zone" means the region comprising the member states of the European Union that<br />

adopt the Euro as their lawful currency in accordance with the Treaty establishing the<br />

European Community, as amended from time to time.<br />

"Interest Determination Date" means, with respect to an Interest Period, the day which is<br />

two TARGET Settlement Days prior to the last day of such Interest Period.<br />

"Interest Payment Date" means 11 January in each year commencing on and including<br />

11 January 2006 and ending on and including the Maturity Date, subject in each case to<br />

adjustment in accordance with the Following Business Day Convention with no adjustment<br />

of interest payable.<br />

"Interest Period" means the period commencing on (and including) the Issue Date to (but<br />

excluding) the first Interest Payment Date and each successive period commencing on<br />

(and including) an Interest Payment Date to (but excluding) the next following Interest<br />

Payment Date.<br />

"Interest Rate" means a rate as determined below:<br />

(a) With respect to each Interest Period from that commencing on (and including) the<br />

Issue Date to the Interest Period ending on (but excluding) 11 January 2007, 6.00<br />

per cent. per annum; and<br />

(b) With respect to each Interest Period from that commencing on (and including) 11<br />

January 2007 to the Interest Period ending on (but excluding) the Maturity Date, a<br />

rate per annum (expressed as a percentage) determined as follows:<br />

the lesser of:<br />

1. CMS 10yr multiplied by 110%, and<br />

2. six times CMS10yr – CMS2yr,<br />

which is read in formula as:<br />

Min [110% * CMS10yr ; 6 * (CMS10yr – CMS2yr)]<br />

subject to the Minimum Interest Rate and the provisions of “Interest Rates and Rounding”<br />

in Product Condition 3 (Interest and Redemption).<br />

"CMS 2yr" means, with respect to an Interest Determination Date, the annual swap rate<br />

for euro swap transactions with a maturity of 2 years, expressed as a percentage, which<br />

appears on the CMS 2yr Page under the heading "EURIBOR BASIS" and above the<br />

caption "11:00 AM FRANKFURT" as of the Relevant Time, on the relevant Interest<br />

Determination Date or if such rate does not appear on the Page, a percentage determined<br />

on the basis of the mid-market annual swap rate quotations provided by five leading swap<br />

dealers in the interbank market (the "Reference <strong>Bank</strong>s") as selected by the Calculation<br />

Agent in its sole determination at approximately the Relevant Time, on the Interest<br />

Determination Date, all as determined by the Calculation Agent. For this purpose, the midmarket<br />

annual swap rate means the arithmetic mean of the bid and offered rates for the<br />

annual fixed leg, calculated on a 30/360 (as defined in the 2000 ISDA Definitions) day<br />

count basis, of a fixed-for-floating euro interest rate swap transaction with a 2-year<br />

maturity commencing on such Interest Determination Date and in an amount that is<br />

14

epresentative for a single transaction in the relevant market at the relevant time, with an<br />

acknowledged dealer of good credit in the swap market where the floating leg, calculated<br />

on an Actual/360 (as defined in the 2000 ISDA Definitions) day count basis, is equivalent<br />

to the rate for deposits in euro for a period of six months which appears on Telerate Page<br />

248 (or such other page as may replace that page on that service, or such other service<br />

as may be nominated as the information vendor, for the purposes of displaying rates or<br />

prices comparable to Telerate Page 248) as of the Relevant Time, on such Interest<br />

Determination Date. The Calculation Agent will request the principal office of each of the<br />

Reference <strong>Bank</strong>s to provide a quotation of its rate. If at least three quotations are<br />

provided, CMS 2yr will be the arithmetic mean of the quotations, eliminating the highest<br />

quotation (or in the event of equality, one of the highest) and the lowest quotation (or in<br />

the event of equality, one of the lowest). In the event that the Calculation Agent is unable<br />

to obtain three or more such quotations, the Calculation Agent will determine CMS 2yr in<br />

its sole and absolute discretion.<br />

"CMS 2yr Page" means Reuters screen page ISDAFIX2 or such other page as may<br />

replace it on that information service or on such other information service, in each case as<br />

may be nominated by the person or organisation providing or sponsoring the information<br />

appearing there for the purpose of displaying rates or prices comparable to the CMS 2yr<br />

rate.<br />

"CMS 10yr" means, with respect to an Interest Determination Date, the annual swap rate<br />

for euro swap transactions with a maturity of 10 years, expressed as a percentage, which<br />

appears on the CMS 10yr Page under the heading "EURIBOR BASIS" and above the<br />

caption "11:00 AM FRANKFURT" as of the Relevant Time, on the relevant Interest<br />

Determination Date or if such rate does not appear on the Page, a percentage determined<br />

on the basis of the mid-market annual swap rate quotations provided by the Reference<br />

<strong>Bank</strong>s, as selected by the Calculation Agent in its sole determination at approximately the<br />

Relevant Time, on the Interest Determination Date, all as determined by the Calculation<br />

Agent. For this purpose, the mid-market annual swap rate means the arithmetic mean of<br />

the bid and offered rates for the annual fixed leg, calculated on a 30/360 (as defined in the<br />

2000 ISDA Definitions) day count basis, of a fixed-for-floating euro interest rate swap<br />

transaction with a 10-year maturity commencing on such Interest Determination Date and<br />

in an amount that is representative for a single transaction in the relevant market at the<br />

relevant time, with an acknowledged dealer of good credit in the swap market where the<br />

floating leg, calculated on an Actual/360 (as defined in the 2000 ISDA Definitions) day<br />

count basis, is equivalent to the rate for deposits in euro for a period of six months which<br />

appears on Telerate Page 248 (or such other page as may replace that page on that<br />

service, or such other service as may be nominated as the information vendor, for the<br />

purposes of displaying rates or prices comparable to Telerate Page 248) as of the<br />

Relevant Time, on such Interest Determination Date. The Calculation Agent will request<br />

the principal office of each of the Reference <strong>Bank</strong>s to provide a quotation of its rate. If at<br />

least three quotations are provided, the CMS 10yr will be the arithmetic mean of the<br />

quotations, eliminating the highest quotation (or in the event of equality, one of the<br />

highest) and the lowest quotation (or in the event of equality, one of the lowest). In the<br />

event that the Calculation Agent is unable to obtain three or more such quotations, the<br />

Calculation Agent will determine CMS 10yr in its sole and absolute discretion.<br />

"CMS 10yr Page" means Reuters screen page ISDAFIX2 or such other page as may<br />

replace it on that information service or on such other information service, in each case as<br />

may be nominated by the person or organisation providing or sponsoring the information<br />

appearing there for the purpose of displaying rates or prices comparable to the CMS 10yr<br />

rate.<br />

"Maximum Interest Rate": Not Applicable.<br />

15

"Minimum Interest Rate": Not Applicable with respect to the Interest Period from that<br />

commencing on (and including) the Issue Date to the Interest<br />

Period ending on (but excluding) 11 January 2007.<br />

Applicable with respect to each Interest Period commencing<br />

on or after (and including) 11 January 2007 and ending on or<br />

before (but excluding) the Maturity Date: 0.00%.<br />

"Relevant Time" means, with respect to any Interest Determination Date, 11.00 a.m. CET.<br />

"TARGET Settlement Day" means, any day on which TARGET is open.<br />

References herein and/or in the General Conditions to (i) "principal" shall be deemed to<br />

include all Redemption Amounts and all other amounts in the nature of principal payable<br />

pursuant to provisions of the Securities and (ii) "interest" shall be deemed to include all<br />

Interest Amounts and all other amounts in the nature of interest payable pursuant to the<br />

provisions of the Securities.<br />

(c) Settlement Definitions<br />

"Early Termination Amount" means, for the purposes of General Condition 5.1<br />

(Mandatory Cancellation), General Condition 5.2 (Cancellation for other reasons) and<br />

General Condition 5.3 (Cancellation at the option of the Issuer), the amount specified for<br />

each such purpose in Product Condition 6.<br />

"Maturity Date" means 11 January 2017 or, if such day is not a Business Day, the next<br />

following Business Day.<br />

"Physical Settlement Amount" means, per Security, a number of Physical Settlement<br />

Units (where "Physical Settlement Unit" means an amount of the Collateral in its then<br />

lowest available denomination) equal to a Security's pro rata share of the Collateral;<br />

provided that such amount will be rounded down to the aggregate number of Physical<br />

Settlement Units representing the nearest whole number. Securities belonging to the<br />

same Securityholder shall be aggregated for purposes of determining the aggregate<br />

Physical Settlement Amounts in respect of such Securities, provided that the aggregate<br />

Physical Settlement Amounts in respect of the same Securityholder will be rounded down<br />

to the nearest whole Physical Settlement Unit. No fractions of a Physical Settlement Unit<br />

will be delivered. In the case of a rounding down to a whole number in accordance with<br />

the foregoing, an amount (the "Adjustment Amount") in Euro will be paid, which shall be<br />

equal to the relevant proportion of the proceeds of liquidation of Collateral not delivered to<br />

Securityholders representing all such fractions of Physical Settlement Units. Any<br />

Adjustment Amount shall be paid in accordance with Product Condition 3 (Interest and<br />

Redemption) and General Condition 4 (Payments, Deliveries, Securityholder Expenses<br />

and Taxation).<br />

"Redemption Amount" means, with respect to each Security, the Nominal Amount.<br />

"Settlement Currency" means Euro.<br />

3. INTEREST AND REDEMPTION<br />

(a) Interest<br />

The Securities are interest bearing Floating Rate Securities.<br />

The amount of interest payable on each Security on each Interest Payment Date in<br />

respect of the Interest Period ending on such date will be the Interest Amount.<br />

16

(b) Interest Rate and Accrual<br />

Each Security bears interest on its Nominal Amount from the Issue Date at the rate per<br />

annum (expressed as a percentage) equal to the Interest Rate, such interest being<br />

payable in arrear on each Interest Payment Date.<br />

Interest will cease to accrue on each Security on the due date for redemption or for<br />

cancellation, as the case may be, unless upon due presentation thereof, payment of<br />

principal is improperly withheld or refused, in which event interest will continue to accrue<br />

(both before and after judgement) at the Interest Rate in the manner provided in this<br />

Product Condition 3 (Interest and Redemption) to the date on which payment in full of the<br />

amount outstanding is made or (if earlier) the date on which notice is duly given to the<br />

Securityholders in accordance with General Condition 15 (Notices) that, upon further<br />

presentation of the Global Security being made in accordance with the Conditions, such<br />

payment will be made, provided that payment is in fact made upon such presentation.<br />

The Interest Rate for each Interest Period will be determined by the Calculation Agent at<br />

or about the Relevant Time on the Interest Determination Date in respect of such Interest<br />

Period subject to the addition or subtraction of any Margin or to any other adjustment<br />

provided for in paragraph (c) (Interest Rates and Rounding) below.<br />

(c) Interest Rates and Rounding<br />

Any Interest Rate shall be subject to any Maximum Interest Rate and/or Minimum Interest<br />

Rate specified as being applicable in Product Condition 2(b) (Interest Definitions), and<br />

further shall be subject to the following provision.<br />

For the purposes of any calculations required pursuant to the provisions hereof (unless<br />

otherwise specified), (x) all percentages resulting from such calculations will be rounded, if<br />

necessary, to the nearest one hundred-thousandth of a percentage point (with halves<br />

being rounded up) (y) all figures will be rounded to seven significant figures (with halves<br />

being rounded up) and (z) all currency amounts which fall due and payable will be<br />

rounded to the nearest unit of such currency (with halves being rounded up) save in the<br />

case of yen, which shall be rounded down to the nearest yen. For these purposes, "unit"<br />

means, with respect to any currency other than Euro, the lowest amount of such currency<br />

which is available as legal tender in the country of such currency and, with respect to<br />

Euro, means 0.01 Euro.<br />

(d) Interest Calculations<br />

The amount of interest payable in respect of any Security for any period (each an<br />

"Interest Amount") shall be calculated by multiplying the product of the Interest Rate and<br />

the Nominal Amount of such Security on the first day of such period by the Day Count<br />

Fraction, unless an Interest Amount (or a formula for its calculation) is specified in Product<br />

Condition 2(b) (Interest Definitions) above in respect of such period, in which case the<br />

amount of interest payable in respect of such Nominal Amount for such period will equal<br />

such Interest Amount (or be calculated in accordance with such formula).<br />

As soon as practicable after the Relevant Time on each Interest Determination Date or<br />

such other time on such date as the Calculation Agent may be required to obtain any<br />

quotation or make any determination or calculation, the Calculation Agent will determine<br />

the Interest Rate and calculate the Interest Amounts in respect of the Nominal Amount of<br />

each Security for the relevant Interest Period, obtain such quotation or make such<br />

determination or calculation, as the case may be, and cause the Interest Rate and the<br />

Interest Amounts for each Interest Period and the relevant Interest Payment Date to be<br />

notified to the Issuer, the Trustee, the Principal Agent, each of the Paying Agents, the<br />

17