Annual Report for the year ended 31 December 2008

Annual Report for the year ended 31 December 2008 Annual Report for the year ended 31 December 2008

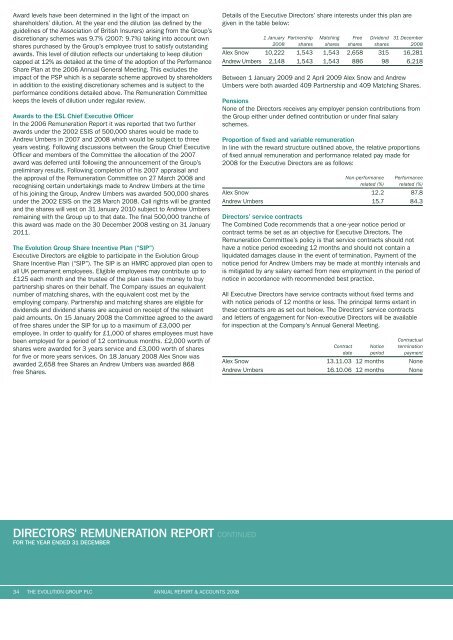

Award levels have been determined in the light of the impact on shareholders’ dilution. At the year end the dilution (as defined by the guidelines of the Association of British insurers) arising from the Group’s discretionary schemes was 9.7% (2007: 9.7%) taking into account own shares purchased by the Group’s employee trust to satisfy outstanding awards. This level of dilution reflects our undertaking to keep dilution capped at 12% as detailed at the time of the adoption of the performance share plan at the 2006 Annual General Meeting. This excludes the impact of the psp which is a separate scheme approved by shareholders in addition to the existing discretionary schemes and is subject to the performance conditions detailed above. The Remuneration Committee keeps the levels of dilution under regular review. awards to the esl chief executive officer in the 2006 Remuneration Report it was reported that two further awards under the 2002 Esis of 500,000 shares would be made to Andrew umbers in 2007 and 2008 which would be subject to three years vesting. Following discussions between the Group Chief Executive Officer and members of the Committee the allocation of the 2007 award was deferred until following the announcement of the Group’s preliminary results. Following completion of his 2007 appraisal and the approval of the Remuneration Committee on 27 March 2008 and recognising certain undertakings made to Andrew umbers at the time of his joining the Group, Andrew umbers was awarded 500,000 shares under the 2002 Esis on the 28 March 2008. Call rights will be granted and the shares will vest on 31 January 2010 subject to Andrew umbers remaining with the Group up to that date. The final 500,000 tranche of this award was made on the 30 December 2008 vesting on 31 January 2011. The evolution group share incentive plan (“sip”) Executive Directors are eligible to participate in the Evolution Group share incentive plan (“sip”). The sip is an HMRC approved plan open to all uK permanent employees. Eligible employees may contribute up to £125 each month and the trustee of the plan uses the money to buy partnership shares on their behalf. The Company issues an equivalent number of matching shares, with the equivalent cost met by the employing company. partnership and matching shares are eligible for dividends and dividend shares are acquired on receipt of the relevant paid amounts. On 15 January 2008 the Committee agreed to the award of free shares under the sip for up to a maximum of £3,000 per employee. in order to qualify for £1,000 of shares employees must have been employed for a period of 12 continuous months. £2,000 worth of shares were awarded for 3 years service and £3,000 worth of shares for five or more years services. On 18 January 2008 Alex snow was awarded 2,658 free shares an Andrew umbers was awarded 868 free shares. direcTors' remuneraTion reporT CONTiNuED for The year ended 31 december 34 THE EvOluTiON GROup plC ANNuAl REpORT & ACCOuNTs 2008 Details of the Executive Directors’ share interests under this plan are given in the table below: 1 January Partnership Matching Free Dividend 31 December 2008 shares shares shares shares 2008 Alex snow 10,222 1,543 1,543 2,658 315 16,281 Andrew umbers 2,148 1,543 1,543 886 98 6,218 Between 1 January 2009 and 2 April 2009 Alex snow and Andrew umbers were both awarded 409 partnership and 409 Matching shares. pensions None of the Directors receives any employer pension contributions from the Group either under defined contribution or under final salary schemes. proportion of fixed and variable remuneration in line with the reward structure outlined above, the relative proportions of fixed annual remuneration and performance related pay made for 2008 for the Executive Directors are as follows: Non-performance Performance related (%) related (%) Alex snow 12.2 87.8 Andrew umbers 15.7 84.3 directors’ service contracts The Combined Code recommends that a one-year notice period or contract terms be set as an objective for Executive Directors. The Remuneration Committee’s policy is that service contracts should not have a notice period exceeding 12 months and should not contain a liquidated damages clause in the event of termination. payment of the notice period for Andrew umbers may be made at monthly intervals and is mitigated by any salary earned from new employment in the period of notice in accordance with recommended best practice. All Executive Directors have service contracts without fixed terms and with notice periods of 12 months or less. The principal terms extant in these contracts are as set out below. The Directors’ service contracts and letters of engagement for Non-executive Directors will be available for inspection at the Company’s Annual General Meeting. Contract Notice Contractual termination date period payment Alex snow 13.11.03 12 months None Andrew umbers 16.10.06 12 months None

non-executive directors Non-executive Directors do not hold service contracts but letters of engagement. The Non-executive Directors’ letters of engagement are each for an initial term of one year with two months’ notice. Non-executive Directors are subject to the process of re-appointment on a rolling basis at the time of the Annual General Meeting. Non-executive Directors receive a fee for their services to the Board. The Chairman and Executive Directors set fee levels for Non-executive Directors, excluding the Chairman. The other Non-executive Directors set the fee for the Chairman. The Non-executive Directors are not involved in the discussions to determine their own remuneration. Additionally the current policy of the Board is that Non-executive Directors should not serve more than nine years if it is determined that this would prejudice their independence. The current expected time commitment of Nonexecutive Directors other than the Chairman is 20 days per annum. The Chairman commits on average two days per week to the Company. Non-executive Directors do not participate in the Group’s annual bonus arrangements or long-term incentive arrangements. Fees cease to be payable immediately upon termination of any appointments for any reason and no compensation is payable in respect of such termination. The overall fee for Non-executive Directors is a £60,000 basic fee plus £15,000 for chairing a Committee and in respect of the senior Nonexecutive Director. The fee for Martin Gray, during the year was £125,000. The Board believe these fee levels are appropriate and reflect the experience brought by the Non-executive Directors, the time commitment they give, and the contribution they make. FIVE YEAR HISTORICAL TSR PERFORmANCE Growth in the value of a hypothetical £100 £250 £200 £150 £100 £50 £0 Dec 03 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 The Evolution Group plc FTsE small Cap FTsE 250 The above graph shows the TsR against that of the FTsE small cap index (excluding investment Trusts) and the FTsE 250. TsR is calculated assuming dividends are reinvested on receipt. in the opinion of the Directors, the FTsE small cap index (excluding investment Trusts) is the most appropriate index against which the total shareholder return of the Group should be measured as at 31 December 2008, because it was an index of similar-sized companies to the Group as at that date. The Group’s growth strategy and commitment to improving shareholder value seek to ensure that the Group becomes part of the FTsE 250 and it is this index that the Group entered during March 2009. For context only, in the period shown in the graph above, the Group was listed on the AiM market from December 1999 up until its move to the Full list of the london stock Exchange in June 2003, when it became a constituent of the FTsE small cap index. Thereafter, the Group’s shares then joined the FTsE 250 index in March 2004 and left the FTsE 250 index in June 2005 when they returned to the FTsE small cap index. The Group joined the FTsE 250 index in March 2009. environmental social and governance (esg) The Committee does not consider corporate performance on EsG issues when setting the remuneration of Executive Directors as given the profile and operations of the Group it does not believe that consideration of these matters is likely to have a material impact on such remuneration. However, the Board does consider the major risks to the Group when setting quantitative and qualitative performance objectives of the Executive Directors and performance against those objectives does have a direct bearing on the level of remuneration, including bonuses and share awards provided to those Directors. We have made very good progress WiTh The inTegraTion and developmenT of each of our businesses. 35

- Page 1 and 2: Yesterday Today Tomorrow... ANNUAL

- Page 3 and 4: FINANCIAL ANd OPERATIONAL HIGHLIGHT

- Page 5 and 6: Balance Sheet strength and cash bal

- Page 7 and 8: evolution securities Evolution secu

- Page 9 and 10: Corporate Finance Evolution securit

- Page 11 and 12: Wdb capital The Group’s investmen

- Page 13 and 14: EARNINGS PER SHARE ON TOTAL OPERATI

- Page 15 and 16: evolution securities’ income anal

- Page 17 and 18: other activities The Group’s othe

- Page 19 and 20: Lord macLaurin of Knebworth, dL (72

- Page 21 and 22: principal risks and uncertainties T

- Page 23 and 24: share capital Details of the change

- Page 25 and 26: The Directors consider that in prep

- Page 27 and 28: The Chief Executive, Alex snow, is

- Page 29 and 30: The Committee observed that during

- Page 31 and 32: appropriate and comprehensive proce

- Page 33 and 34: The Board has delegated to the Remu

- Page 35: The concept of a bonus ceiling does

- Page 39 and 40: On 8 April 2009, Alex snow was awar

- Page 41 and 42: We have audited the Consolidated Fi

- Page 43 and 44: ASSETS 2008 2007 Note £’000 £

- Page 45 and 46: 2008 2007 £’000 £’000 (loss)/

- Page 47 and 48: shareholding of more than one half

- Page 49 and 50: ) Distribution channels and custome

- Page 51 and 52: (b) Share-based plans The Group’s

- Page 53 and 54: Risk Reporting The Group Board rece

- Page 55 and 56: Neither past Past due but not impai

- Page 57 and 58: By business segment (continued) The

- Page 59 and 60: 6. otHeR inCome Restated 2008 2007

- Page 61 and 62: 11. aUditoRs’ RemUneRation During

- Page 63 and 64: 14. inCome taX eXPense (CONTINuED)

- Page 65 and 66: 18. intanGiBle assets notes to tHe

- Page 67 and 68: 20. deFeRRed inCome taX (CONTINuED)

- Page 69 and 70: 24. tRadinG PoRtFolio assets notes

- Page 71 and 72: 31. Consolidated moVement in sHaReH

- Page 73 and 74: 33. CasH FloW FRom oPeRatinG aCtiVi

- Page 75 and 76: 38. emPloYee sHaRe sCHemes Movement

- Page 77 and 78: 38. emPloYee sHaRe sCHemes (CONTINu

- Page 79 and 80: THE EVOLuTION GROuP PLC PARENT COMP

- Page 81 and 82: ASSETS ComPanY BalanCe sHeet AS AT

- Page 83 and 84: statement oF ReCoGnised inCome and

- Page 85 and 86: 1. aCCoUntinG PoliCies (CONTINuED)

Award levels have been determined in <strong>the</strong> light of <strong>the</strong> impact on<br />

shareholders’ dilution. At <strong>the</strong> <strong>year</strong> end <strong>the</strong> dilution (as defined by <strong>the</strong><br />

guidelines of <strong>the</strong> Association of British insurers) arising from <strong>the</strong> Group’s<br />

discretionary schemes was 9.7% (2007: 9.7%) taking into account own<br />

shares purchased by <strong>the</strong> Group’s employee trust to satisfy outstanding<br />

awards. This level of dilution reflects our undertaking to keep dilution<br />

capped at 12% as detailed at <strong>the</strong> time of <strong>the</strong> adoption of <strong>the</strong> per<strong>for</strong>mance<br />

share plan at <strong>the</strong> 2006 <strong>Annual</strong> General Meeting. This excludes <strong>the</strong><br />

impact of <strong>the</strong> psp which is a separate scheme approved by shareholders<br />

in addition to <strong>the</strong> existing discretionary schemes and is subject to <strong>the</strong><br />

per<strong>for</strong>mance conditions detailed above. The Remuneration Committee<br />

keeps <strong>the</strong> levels of dilution under regular review.<br />

awards to <strong>the</strong> esl chief executive officer<br />

in <strong>the</strong> 2006 Remuneration <strong>Report</strong> it was reported that two fur<strong>the</strong>r<br />

awards under <strong>the</strong> 2002 Esis of 500,000 shares would be made to<br />

Andrew umbers in 2007 and <strong>2008</strong> which would be subject to three<br />

<strong>year</strong>s vesting. Following discussions between <strong>the</strong> Group Chief Executive<br />

Officer and members of <strong>the</strong> Committee <strong>the</strong> allocation of <strong>the</strong> 2007<br />

award was deferred until following <strong>the</strong> announcement of <strong>the</strong> Group’s<br />

preliminary results. Following completion of his 2007 appraisal and<br />

<strong>the</strong> approval of <strong>the</strong> Remuneration Committee on 27 March <strong>2008</strong> and<br />

recognising certain undertakings made to Andrew umbers at <strong>the</strong> time<br />

of his joining <strong>the</strong> Group, Andrew umbers was awarded 500,000 shares<br />

under <strong>the</strong> 2002 Esis on <strong>the</strong> 28 March <strong>2008</strong>. Call rights will be granted<br />

and <strong>the</strong> shares will vest on <strong>31</strong> January 2010 subject to Andrew umbers<br />

remaining with <strong>the</strong> Group up to that date. The final 500,000 tranche of<br />

this award was made on <strong>the</strong> 30 <strong>December</strong> <strong>2008</strong> vesting on <strong>31</strong> January<br />

2011.<br />

The evolution group share incentive plan (“sip”)<br />

Executive Directors are eligible to participate in <strong>the</strong> Evolution Group<br />

share incentive plan (“sip”). The sip is an HMRC approved plan open to<br />

all uK permanent employees. Eligible employees may contribute up to<br />

£125 each month and <strong>the</strong> trustee of <strong>the</strong> plan uses <strong>the</strong> money to buy<br />

partnership shares on <strong>the</strong>ir behalf. The Company issues an equivalent<br />

number of matching shares, with <strong>the</strong> equivalent cost met by <strong>the</strong><br />

employing company. partnership and matching shares are eligible <strong>for</strong><br />

dividends and dividend shares are acquired on receipt of <strong>the</strong> relevant<br />

paid amounts. On 15 January <strong>2008</strong> <strong>the</strong> Committee agreed to <strong>the</strong> award<br />

of free shares under <strong>the</strong> sip <strong>for</strong> up to a maximum of £3,000 per<br />

employee. in order to qualify <strong>for</strong> £1,000 of shares employees must have<br />

been employed <strong>for</strong> a period of 12 continuous months. £2,000 worth of<br />

shares were awarded <strong>for</strong> 3 <strong>year</strong>s service and £3,000 worth of shares<br />

<strong>for</strong> five or more <strong>year</strong>s services. On 18 January <strong>2008</strong> Alex snow was<br />

awarded 2,658 free shares an Andrew umbers was awarded 868<br />

free shares.<br />

direcTors' remuneraTion reporT CONTiNuED<br />

<strong>for</strong> The <strong>year</strong> <strong>ended</strong> <strong>31</strong> december<br />

34 THE EvOluTiON GROup plC ANNuAl REpORT & ACCOuNTs <strong>2008</strong><br />

Details of <strong>the</strong> Executive Directors’ share interests under this plan are<br />

given in <strong>the</strong> table below:<br />

1 January Partnership Matching Free Dividend <strong>31</strong> <strong>December</strong><br />

<strong>2008</strong> shares shares shares shares <strong>2008</strong><br />

Alex snow 10,222 1,543 1,543 2,658 <strong>31</strong>5 16,281<br />

Andrew umbers 2,148 1,543 1,543 886 98 6,218<br />

Between 1 January 2009 and 2 April 2009 Alex snow and Andrew<br />

umbers were both awarded 409 partnership and 409 Matching shares.<br />

pensions<br />

None of <strong>the</strong> Directors receives any employer pension contributions from<br />

<strong>the</strong> Group ei<strong>the</strong>r under defined contribution or under final salary<br />

schemes.<br />

proportion of fixed and variable remuneration<br />

in line with <strong>the</strong> reward structure outlined above, <strong>the</strong> relative proportions<br />

of fixed annual remuneration and per<strong>for</strong>mance related pay made <strong>for</strong><br />

<strong>2008</strong> <strong>for</strong> <strong>the</strong> Executive Directors are as follows:<br />

Non-per<strong>for</strong>mance Per<strong>for</strong>mance<br />

related (%) related (%)<br />

Alex snow 12.2 87.8<br />

Andrew umbers 15.7 84.3<br />

directors’ service contracts<br />

The Combined Code recommends that a one-<strong>year</strong> notice period or<br />

contract terms be set as an objective <strong>for</strong> Executive Directors. The<br />

Remuneration Committee’s policy is that service contracts should not<br />

have a notice period exceeding 12 months and should not contain a<br />

liquidated damages clause in <strong>the</strong> event of termination. payment of <strong>the</strong><br />

notice period <strong>for</strong> Andrew umbers may be made at monthly intervals and<br />

is mitigated by any salary earned from new employment in <strong>the</strong> period of<br />

notice in accordance with recomm<strong>ended</strong> best practice.<br />

All Executive Directors have service contracts without fixed terms and<br />

with notice periods of 12 months or less. The principal terms extant in<br />

<strong>the</strong>se contracts are as set out below. The Directors’ service contracts<br />

and letters of engagement <strong>for</strong> Non-executive Directors will be available<br />

<strong>for</strong> inspection at <strong>the</strong> Company’s <strong>Annual</strong> General Meeting.<br />

Contract Notice<br />

Contractual<br />

termination<br />

date period payment<br />

Alex snow 13.11.03 12 months None<br />

Andrew umbers 16.10.06 12 months None