Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Entropy Coherent and Entropy Convex Measures of Risk - Eurandom Entropy Coherent and Entropy Convex Measures of Risk - Eurandom

Variational Preferences ◮ A rich paradigm for decision-making under ambiguity is the theory of variational preferences (Maccheroni, Marinacci and Rustichini, 2006). ◮ An economic agent evaluates the payoff of a choice alternative (financial position) X according to U(X) = inf Q∈Q {EQ [u(X)] + α(Q)}, where u : R → R is an increasing function, Q is a set of probability measures and α is an ambiguity index defined on Q. Entropy Coherent and Entropy Convex Measures of Risk Advances in Financial Mathematics, Eurandom, Eindhoven 4/40

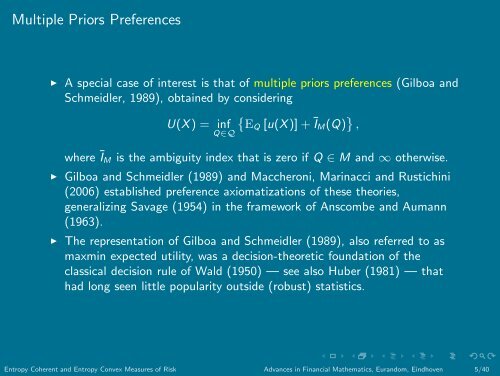

Multiple Priors Preferences ◮ A special case of interest is that of multiple priors preferences (Gilboa and Schmeidler, 1989), obtained by considering U(X) = inf Q∈Q¨EQ [u(X)] + ĪM(Q)©, where ĪM is the ambiguity index that is zero if Q ∈ M and ∞ otherwise. ◮ Gilboa and Schmeidler (1989) and Maccheroni, Marinacci and Rustichini (2006) established preference axiomatizations of these theories, generalizing Savage (1954) in the framework of Anscombe and Aumann (1963). ◮ The representation of Gilboa and Schmeidler (1989), also referred to as maxmin expected utility, was a decision-theoretic foundation of the classical decision rule of Wald (1950) — see also Huber (1981) — that had long seen little popularity outside (robust) statistics. Entropy Coherent and Entropy Convex Measures of Risk Advances in Financial Mathematics, Eurandom, Eindhoven 5/40

- Page 1 and 2: Entropy Coherent and Entropy Convex

- Page 3: Convex Measures of Risk ◮ Convex

- Page 7 and 8: Homothetic Preferences ◮ Recently

- Page 9 and 10: Variational and Homothetic Preferen

- Page 11 and 12: Question Rephrased [1] ◮ In other

- Page 13 and 14: Results [1] The contribution of thi

- Page 15 and 16: Results [3] ◮ These connections s

- Page 17 and 18: 2. Entropic Measures of Risk [1] We

- Page 19 and 20: Two Interpretations 1. Kullback-Lei

- Page 21 and 22: Entropy Coherence and Entropy Conve

- Page 23 and 24: Again Two Interpretations [2] The e

- Page 25 and 26: A Basic Duality Result Define and T

- Page 27 and 28: 3. Characterization Results [1] Rec

- Page 29 and 30: Remark 1 ◮ The case that ρ is en

- Page 31 and 32: Characterization Results [3] Recall

- Page 33 and 34: 4. Duality Results [1] Recall that

- Page 35 and 36: 5. Distribution Invariant Represent

- Page 37 and 38: 6.1 Risk Sharing ◮ Suppose that t

- Page 39 and 40: Portfolio Optimization and Indiffer

Multiple Priors Preferences<br />

◮ A special case <strong>of</strong> interest is that <strong>of</strong> multiple priors preferences (Gilboa <strong>and</strong><br />

Schmeidler, 1989), obtained by considering<br />

U(X) = inf<br />

Q∈Q¨EQ [u(X)] + ĪM(Q)©,<br />

where ĪM is the ambiguity index that is zero if Q ∈ M <strong>and</strong> ∞ otherwise.<br />

◮ Gilboa <strong>and</strong> Schmeidler (1989) <strong>and</strong> Maccheroni, Marinacci <strong>and</strong> Rustichini<br />

(2006) established preference axiomatizations <strong>of</strong> these theories,<br />

generalizing Savage (1954) in the framework <strong>of</strong> Anscombe <strong>and</strong> Aumann<br />

(1963).<br />

◮ The representation <strong>of</strong> Gilboa <strong>and</strong> Schmeidler (1989), also referred to as<br />

maxmin expected utility, was a decision-theoretic foundation <strong>of</strong> the<br />

classical decision rule <strong>of</strong> Wald (1950) — see also Huber (1981) — that<br />

had long seen little popularity outside (robust) statistics.<br />

<strong>Entropy</strong> <strong>Coherent</strong> <strong>and</strong> <strong>Entropy</strong> <strong>Convex</strong> <strong>Measures</strong> <strong>of</strong> <strong>Risk</strong> Advances in Financial Mathematics, Eur<strong>and</strong>om, Eindhoven 5/40