The Economic Impact of Electricity Price Increases on ... - Eskom

The Economic Impact of Electricity Price Increases on ... - Eskom

The Economic Impact of Electricity Price Increases on ... - Eskom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

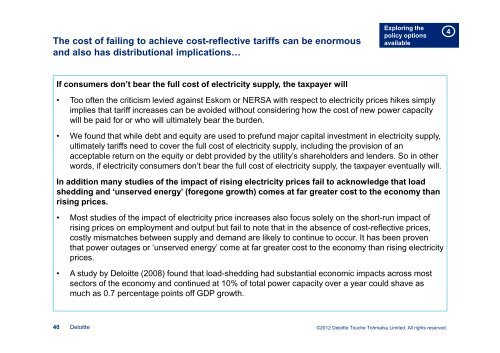

<str<strong>on</strong>g>The</str<strong>on</strong>g> cost <str<strong>on</strong>g>of</str<strong>on</strong>g> failing to achieve cost-reflective tariffs can be enormous<br />

and also has distributi<strong>on</strong>al implicati<strong>on</strong>s…<br />

If c<strong>on</strong>sumers d<strong>on</strong>’t bear the full cost <str<strong>on</strong>g>of</str<strong>on</strong>g> electricity supply, the taxpayer will<br />

• Too <str<strong>on</strong>g>of</str<strong>on</strong>g>ten the criticism levied against <strong>Eskom</strong> or NERSA with respect to electricity prices hikes simply<br />

implies that tariff increases can be avoided without c<strong>on</strong>sidering how the cost <str<strong>on</strong>g>of</str<strong>on</strong>g> new power capacity<br />

will be paid for or who will ultimately bear the burden.<br />

• We found that while debt and equity are used to prefund major capital investment in electricity supply,<br />

ultimately tariffs need to cover the full cost <str<strong>on</strong>g>of</str<strong>on</strong>g> electricity supply, including the provisi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> an<br />

acceptable return <strong>on</strong> the equity or debt provided by the utility’s shareholders and lenders. So in other<br />

words, if electricity c<strong>on</strong>sumers d<strong>on</strong>’t bear the full cost <str<strong>on</strong>g>of</str<strong>on</strong>g> electricity supply, the taxpayer eventually will.<br />

In additi<strong>on</strong> many studies <str<strong>on</strong>g>of</str<strong>on</strong>g> the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> rising electricity prices fail to acknowledge that load<br />

shedding and ‘unserved energy’ (foreg<strong>on</strong>e growth) comes at far greater cost to the ec<strong>on</strong>omy than<br />

rising prices.<br />

40<br />

• Most studies <str<strong>on</strong>g>of</str<strong>on</strong>g> the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> electricity price increases also focus solely <strong>on</strong> the short-run impact <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

rising prices <strong>on</strong> employment and output but fail to note that in the absence <str<strong>on</strong>g>of</str<strong>on</strong>g> cost-reflective prices,<br />

costly mismatches between supply and demand are likely to c<strong>on</strong>tinue to occur. It has been proven<br />

that power outages or ‘unserved energy’ come at far greater cost to the ec<strong>on</strong>omy than rising electricity<br />

prices.<br />

• A study by Deloitte (2008) found that load-shedding had substantial ec<strong>on</strong>omic impacts across most<br />

sectors <str<strong>on</strong>g>of</str<strong>on</strong>g> the ec<strong>on</strong>omy and c<strong>on</strong>tinued at 10% <str<strong>on</strong>g>of</str<strong>on</strong>g> total power capacity over a year could shave as<br />

much as 0.7 percentage points <str<strong>on</strong>g>of</str<strong>on</strong>g>f GDP growth.<br />

Deloitte<br />

Exploring the<br />

policy opti<strong>on</strong>s<br />

available<br />

©2012 Deloitte Touche Tohmatsu Limited. All rights reserved.<br />

4