The Economic Impact of Electricity Price Increases on ... - Eskom

The Economic Impact of Electricity Price Increases on ... - Eskom

The Economic Impact of Electricity Price Increases on ... - Eskom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

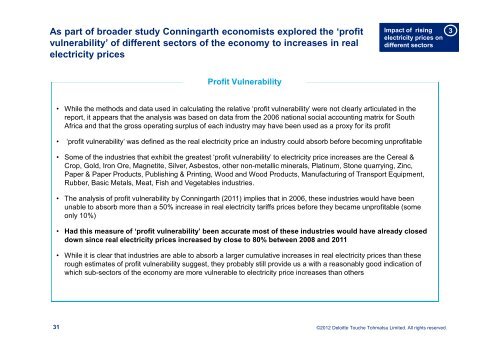

As part <str<strong>on</strong>g>of</str<strong>on</strong>g> broader study C<strong>on</strong>ningarth ec<strong>on</strong>omists explored the ‘pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it<br />

vulnerability’ <str<strong>on</strong>g>of</str<strong>on</strong>g> different sectors <str<strong>on</strong>g>of</str<strong>on</strong>g> the ec<strong>on</strong>omy to increases in real<br />

electricity prices<br />

31<br />

Pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it Vulnerability<br />

<str<strong>on</strong>g>Impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> rising<br />

electricity prices <strong>on</strong><br />

different sectors<br />

• While the methods and data used in calculating the relative ‘pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability’ were not clearly articulated in the<br />

report, it appears that the analysis was based <strong>on</strong> data from the 2006 nati<strong>on</strong>al social accounting matrix for South<br />

Africa and that the gross operating surplus <str<strong>on</strong>g>of</str<strong>on</strong>g> each industry may have been used as a proxy for its pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it<br />

• ‘pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability’ was defined as the real electricity price an industry could absorb before becoming unpr<str<strong>on</strong>g>of</str<strong>on</strong>g>itable<br />

• Some <str<strong>on</strong>g>of</str<strong>on</strong>g> the industries that exhibit the greatest ‘pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability’ to electricity price increases are the Cereal &<br />

Crop, Gold, Ir<strong>on</strong> Ore, Magnetite, Silver, Asbestos, other n<strong>on</strong>-metallic minerals, Platinum, St<strong>on</strong>e quarrying, Zinc,<br />

Paper & Paper Products, Publishing & Printing, Wood and Wood Products, Manufacturing <str<strong>on</strong>g>of</str<strong>on</strong>g> Transport Equipment,<br />

Rubber, Basic Metals, Meat, Fish and Vegetables industries.<br />

• <str<strong>on</strong>g>The</str<strong>on</strong>g> analysis <str<strong>on</strong>g>of</str<strong>on</strong>g> pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability by C<strong>on</strong>ningarth (2011) implies that in 2006, these industries would have been<br />

unable to absorb more than a 50% increase in real electricity tariffs prices before they became unpr<str<strong>on</strong>g>of</str<strong>on</strong>g>itable (some<br />

<strong>on</strong>ly 10%)<br />

• Had this measure <str<strong>on</strong>g>of</str<strong>on</strong>g> ‘pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability’ been accurate most <str<strong>on</strong>g>of</str<strong>on</strong>g> these industries would have already closed<br />

down since real electricity prices increased by close to 80% between 2008 and 2011<br />

• While it is clear that industries are able to absorb a larger cumulative increases in real electricity prices than these<br />

rough estimates <str<strong>on</strong>g>of</str<strong>on</strong>g> pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it vulnerability suggest, they probably still provide us a with a reas<strong>on</strong>ably good indicati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

which sub-sectors <str<strong>on</strong>g>of</str<strong>on</strong>g> the ec<strong>on</strong>omy are more vulnerable to electricity price increases than others<br />

©2012 Deloitte Touche Tohmatsu Limited. All rights reserved.<br />

3