NED Eligibility and Coding Power Point

NED Eligibility and Coding Power Point

NED Eligibility and Coding Power Point

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>NED</strong><br />

<strong>Eligibility</strong><br />

<strong>and</strong><br />

<strong>Coding</strong><br />

2012

Instructions<br />

Click a Topic on the following page to be<br />

transported to that section of the training<br />

Click the icon on each additional<br />

page to return to the Topics page

What is <strong>NED</strong>?<br />

<strong>NED</strong> Requirements<br />

<strong>NED</strong> Reporting<br />

Placing a Case in SRS/<strong>NED</strong><br />

Placing an Ongoing SRS Case in SRS/<strong>NED</strong><br />

Troubleshooting<br />

If a Client Reports Earnings…<br />

If You Get an 852…<br />

Covered Topics

What is a <strong>NED</strong> Case?<br />

A <strong>NED</strong> case is an SRS SNAP case in which<br />

all adult members are defined as:<br />

Elderly or Disabled<br />

<strong>and</strong><br />

Have no countable earned income

Who is Elderly?<br />

For SNAP elderly means a person<br />

age 60 or older<br />

See OAR 461-001-0015

Who is Disabled?<br />

An adult is considered disabled for SNAP<br />

if they are receiving:<br />

SSI or SSD or aid to the blind under<br />

SSA title XVI<br />

Disability related medical assistance<br />

under SSA title XIX (Presumptive)<br />

Other disability criteria specific to<br />

SNAP See OAR 461-001-0015

<strong>NED</strong> or Not?<br />

Anna is 63 years old <strong>and</strong> loves her job in the<br />

Garden Center at Fred Meyer. She works<br />

part time <strong>and</strong> also receives a small amount<br />

of SSB from her husb<strong>and</strong> who passed away<br />

many years ago.

Not!<br />

Sorry. Anna meets the SNAP definition of<br />

elderly, but <strong>NED</strong> clients cannot have earned<br />

income.

<strong>NED</strong> or Not?<br />

Phyllis is 72 <strong>and</strong> has been retired for many<br />

years. She is living happily on her pension<br />

<strong>and</strong> SSB. Her gr<strong>and</strong>children, age 16 <strong>and</strong><br />

17, recently came to live with her, which is<br />

why she is now applying for SNAP. Can<br />

Phyllis receive SNAP as a <strong>NED</strong>?

Absolutely!<br />

The gr<strong>and</strong>children are not considered adults<br />

for SNAP. <strong>NED</strong> cases can have children on<br />

them as long as they have no countable<br />

earned income.

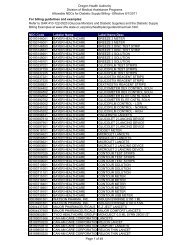

<strong>NED</strong> Requirements<br />

<strong>NED</strong> cases are identified on FSMIS using:<br />

This coding is required on all cases that<br />

qualify for SRS <strong>NED</strong>

<strong>NED</strong> Requirements<br />

<strong>NED</strong> cases must be in SRS for 12 months<br />

CRS<br />

No CRS 12 Months

<strong>NED</strong> Requirements<br />

<strong>NED</strong> cases do not receive an 852<br />

(Interim Change Report)<br />

The Expr Cert: will always match the Rpt Exp:

<strong>NED</strong> Reporting<br />

<strong>NED</strong> clients are in SRS <strong>and</strong> are only<br />

required to report one thing:<br />

When countable income exceeds 130% FPL

Myrna<br />

Myrna is receiving SNAP in SRS as a <strong>NED</strong><br />

client with SSB income at 85% FPL. She<br />

has started working at a part-time job, which<br />

increases her income to 150% FPL.<br />

Is Myrna required to report this?

Myrna Answer<br />

Yes, Myrna is required to report this as she<br />

is now over 130% FPL.<br />

Bonus Question:<br />

Is Myrna still eligible as a <strong>NED</strong> client?

Bonus Answer<br />

Nope. Myrna now has countable earned<br />

income that must be coded on the case. She<br />

can no longer be coded as a <strong>NED</strong> client.<br />

<strong>NED</strong><br />

Click Here for what to do…

Eustice<br />

Eustice is certified as SRS <strong>NED</strong> for 12<br />

months on SNAP at 150% FPL. In month 3<br />

of his certification period he goes to work<br />

part time, bringing his income to 200% FPL.<br />

Is Eustice required to report this?

Eustice Answer<br />

Nope. DHS is already aware that Eustice’s<br />

income is over 130% FPL. He has met the<br />

reporting requirements <strong>and</strong> does not have to<br />

report anything until his next certification.

Placing a Case in SRS/<strong>NED</strong><br />

at CRT or REC<br />

1. Remove any EML, SEC, SEN, TNG or<br />

HCW income segments, even if the<br />

amount is 0.00<br />

Note: Any of these income types will<br />

prevent you from coding the case as <strong>NED</strong>

Placing a case in SRS <strong>NED</strong><br />

2. Enter a Trans: CRT SRS or REC SRS<br />

<strong>and</strong> the D-Eff:

Placing a case in SRS <strong>NED</strong><br />

3. Change the N in M<strong>and</strong> Rpt: S. Do not<br />

touch the Form: or Rept: fields

Placing a case in SRS <strong>NED</strong><br />

4. Enter the Rpt Exp date, which must equal<br />

the certification end date. The certification<br />

period must be 12 months.

Placing a case in SRS <strong>NED</strong><br />

5. Enter the HH Types: <strong>NED</strong>

Placing a case in SRS <strong>NED</strong><br />

6. Make any other changes needed <strong>and</strong><br />

press F9

A Completed <strong>NED</strong> Case

Placing an Ongoing SRS Case in <strong>NED</strong><br />

Examples of this include:<br />

Cases transferred from SSP that are not<br />

yet in <strong>NED</strong><br />

People who have been approved by<br />

PMDDT<br />

This is almost the same process as a new<br />

case, but with a few added steps at the<br />

beginning.

Placing an Ongoing SRS Case in <strong>NED</strong><br />

1. Remove any EML, SEC, SEN, TNG or HCW<br />

income segments, even if the amount is 0.00<br />

2. Remove the case from SRS by using a Trans:<br />

SRS <strong>and</strong> changing the S in M<strong>and</strong> Rpt: N

Placing an Ongoing SRS Case in <strong>NED</strong><br />

3. Place the case in SRS <strong>NED</strong> using the<br />

steps on slides 20-23.<br />

4. Use Trans: SRS ADJ.<br />

Note: Do not use REC unless you are<br />

recertifying the case.

Troubleshooting<br />

If the <strong>NED</strong> just won’t work…<br />

Remove all earned income coding<br />

Are all adults elderly or disabled?<br />

Code the HH Type: <strong>NED</strong><br />

Add a HH Type: AD if the client is not elderly<br />

or receiving SSD, but is still disabled<br />

Make sure your Expr Crt: <strong>and</strong> Rpt Exp: match

If a Client Reports Earnings<br />

Remove the case from SRS <strong>NED</strong> <strong>and</strong><br />

place it in regular SRS<br />

This is possible in months 1, 2, 3, <strong>and</strong> 6, 7,<br />

8 of a certification<br />

If any other month, or if you have any<br />

problems, contact the Service Desk

If You Get an 852…<br />

1. Verify the client really should be <strong>NED</strong><br />

If not <strong>NED</strong> eligible, process normally<br />

If <strong>NED</strong> eligible, continue below<br />

2. If there are no changes or benefits will<br />

increase:<br />

Process the 852 normally<br />

Narrate, Narrate, Narrate

If You Get an 852…<br />

3. If benefits will be reduced:<br />

Is the reported info “Verified Upon<br />

Receipt?” (See SNAP F-8)<br />

If Yes, take the appropriate action<br />

(Information received that is considered<br />

“Verified Upon Receipt” must be acted on)<br />

Narrate your action

If You Get an 852…<br />

4. If the info is Not “Verified Upon Receipt”<br />

Do not pend<br />

Do not verify information through screens<br />

Process the 852 with no changes<br />

Narrate why no action was taken<br />

Do not use an REC action

SNAP Analysts<br />

Dawn Myers 503-945-7018<br />

S<strong>and</strong>y Ambrose 503-945-6092<br />

Rosanne Richard 503-945-5826<br />

Eliza Devlin 503-947-5105<br />

Sarah Lambert 503-945-6220<br />

Heidi Wormwood 503-945-5737<br />

Kate Scott 503-947-5177<br />

snap.policy@state.or.us