Second National Reconcilation Study EITI Peru - unofficial…

Second National Reconcilation Study EITI Peru - unofficial…

Second National Reconcilation Study EITI Peru - unofficial…

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consultoría para la Elaboración del Segundo Estudio Nacional de<br />

Conciliación de la Iniciativa de Transparencia para las Industrias<br />

Extractivas (ITIE) en el Perú (2008 – 2010) (continuación)<br />

1.6. The Canon’s use<br />

It can be used to finance or co-finance public investment projects that involve providing public<br />

services with universal access that generate benefits for the community, are within the<br />

competencies of the corresponding government level and are compatible with sector policies.<br />

These projects cannot involve interventions for business purposes or those that can be conducted<br />

by the private sector.<br />

2. Procedures in the process to collect Income Tax and the Gas Royalty and distribute the gas canon<br />

2.1. Collections<br />

Income Tax<br />

The companies calculate their Income Tax through the Annual Sworn Declaration. They use the<br />

annual declaration format that is provided by the collections agent SUNAT. Every month, the<br />

companies make advance payments based on their income; at the end of the fiscal period, they<br />

regularize the annual income tax through the Annual Sworn Declaration. This sworn declaration is<br />

presented to SUNAT in the months of March and April of the year after the filing year. The Income<br />

Tax on earned income for the period (amount that is the basis of the distribution process)<br />

corresponds to the amount calculated for Income Tax net credits without the right to devolution<br />

(boxes N° 504 and 516 respectively). Companies can present Substitute Declarations and<br />

Rectifying Declarations in lieu of the Annual Sworn Declaration.<br />

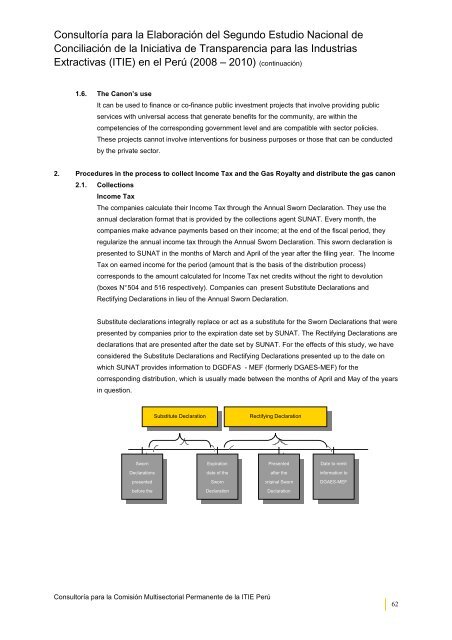

Substitute declarations integrally replace or act as a substitute for the Sworn Declarations that were<br />

presented by companies prior to the expiration date set by SUNAT. The Rectifying Declarations are<br />

declarations that are presented after the date set by SUNAT. For the effects of this study, we have<br />

considered the Substitute Declarations and Rectifying Declarations presented up to the date on<br />

which SUNAT provides information to DGDFAS - MEF (formerly DGAES-MEF) for the<br />

corresponding distribution, which is usually made between the months of April and May of the years<br />

in question.<br />

Sworn<br />

Declarations<br />

presented<br />

before the<br />

Substitute Declaration Rectifying Declaration<br />

Expiration<br />

date of the<br />

Sworn<br />

Declaration<br />

Consultoría para la Comisión Multisectorial Permanente de la ITIE Perú<br />

Presented<br />

after the<br />

original Sworn<br />

Declaration<br />

Date to remit<br />

information to<br />

DGAES-MEF<br />

62