2010 Telegraph Publ .TXT - Notepad - Lee County, Illinois

2010 Telegraph Publ .TXT - Notepad - Lee County, Illinois

2010 Telegraph Publ .TXT - Notepad - Lee County, Illinois

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

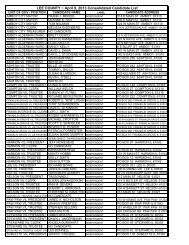

<strong>2010</strong> <strong>Telegraph</strong> <strong>Publ</strong> .<strong>TXT</strong><br />

Harmon Township<br />

Median Level of Assessment .3333<br />

Your non-farm property is to be assessed at the above listed median level of<br />

assessment for the assessment district.<br />

You may check the accuracy of your assessment by dividing your assessment by the<br />

median level of assessment.<br />

The resulting value should equal the estimated fair cash value of your property.<br />

If the resulting value is greater than the estimated fair cash value of your<br />

property, you may be over-assessed.<br />

If the resulting value is less than the fair cash value of your property, you may be<br />

under-assessed.<br />

You may appeal your assessment to the Board of Review within 30 days of the date of<br />

this publication<br />

(on or before November 12, <strong>2010</strong>).<br />

Harmon<br />

10-13-24-300-003 97,199 BOEHLE, LEON F & MAXINE K ETAL<br />

10-13-35-400-002 345 DORE, THOMAS E<br />

10-13-17-400-004 8,494 HENRY, MICHAEL R & HENRY, BECKY<br />

10-13-14-304-010 21,579 KAECKER, WILLIAM D & KAECKER, GLENDA M<br />

10-13-17-400-003 235 KOLB, PHILIP D & JENNIFER R<br />

10-13-26-100-008 29,430 LIVINGSTON, RANDY L & MARY LOU<br />

10-13-14-100-007 9,133 MELZER, MARY<br />

10-13-10-400-010 5,463 SCHMIDT, RAYMOND C & SCHMIDT, MEG ELLEN<br />

NOTICE TO TAXPAYERS<br />

Marion Township<br />

Median Level of Assessment .3333<br />

Your non-farm property is to be assessed at the above listed median level of<br />

assessment for the assessment district.<br />

You may check the accuracy of your assessment by dividing your assessment by the<br />

median level of assessment.<br />

The resulting value should equal the estimated fair cash value of your property.<br />

If the resulting value is greater than the estimated fair cash value of your<br />

property, you may be over-assessed.<br />

If the resulting value is less than the fair cash value of your property, you may be<br />

under-assessed.<br />

You may appeal your assessment to the Board of Review within 30 days of the date of<br />

this publication<br />

(on or before November 12, <strong>2010</strong>).<br />

Marion<br />

12-14-15-300-010 82,188 BUREAU SERVICE COMPANY<br />

12-14-04-100-001 151,346 CONDERMAN TRUST, RONALD G & CONDERMAN , JUDY E<br />

12-14-10-400-001 82,874 DANIEL E HEMBROUGH, TRUSTEE, DANIEL E HEMBROUGH TRUST<br />

& SARA R HEMBROUGH, TRUSTEE, SARA R HEMBROUGH TRUST<br />

12-14-13-100-005 46,033 GARLAND, TERRY L & JANE E<br />

12-14-08-300-003 71,675 JACOBS, ERNEST B & LINDA L<br />

12-14-25-200-009 40,978 QUEST, ALAN & QUEST, EILEEN<br />

12-14-05-400-005 44,695 RHODENBAUGH, DAVID & RHODENBAUGH, MICHELE<br />

12-14-23-200-009 53,605 VANDEWOESTYNE, JACK & TONI TREGO<br />

NOTICE TO TAXPAYERS<br />

Nachusa Township<br />

Median Level of Assessment .3333<br />

Your non-farm property is to be assessed at the above listed median level of<br />

assessment for the assessment district.<br />

You may check the accuracy of your assessment by dividing your assessment by the<br />

Page 36