Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the financial statements<br />

31 December 2005 and 2004<br />

(all amounts are expressed in thousands of KM)<br />

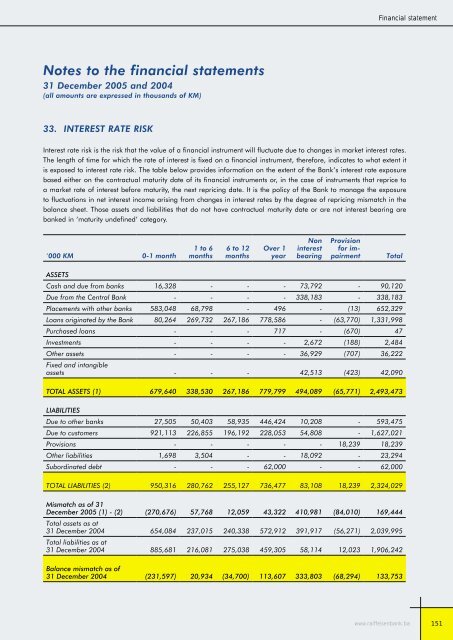

33. INTEREST RATE RISK<br />

Financial statement<br />

Interest rate risk is the risk that the value of a financial instrument will fluctuate due to changes in market interest rates.<br />

The length of time for which the rate of interest is fixed on a financial instrument, therefore, indicates to what extent it<br />

is exposed to interest rate risk. The table below provides information on the extent of the <strong>Bank</strong>’s interest rate exposure<br />

based either on the contractual maturity date of its financial instruments or, in the case of instruments that reprice to<br />

a market rate of interest before maturity, the next repricing date. It is the policy of the <strong>Bank</strong> to manage the exposure<br />

to fluctuations in net interest income arising from changes in interest rates by the degree of repricing mismatch in the<br />

balance sheet. Those assets and liabilities that do not have contractual maturity date or are not interest bearing are<br />

banked in ‘maturity undefined’ category.<br />

‘000 KM 0-1 month<br />

ASSETS<br />

1 to 6<br />

months<br />

6 to 12<br />

months<br />

Over 1<br />

year<br />

Non<br />

interest<br />

bearing<br />

Provision<br />

for impairment<br />

Total<br />

Cash and due from banks 16,328 - - - 73,792 - 90,120<br />

Due from the Central <strong>Bank</strong> - - - - 338,183 - 338,183<br />

Placements with other banks 583,048 68,798 - 496 - (13) 652,329<br />

Loans originated by the <strong>Bank</strong> 80,264 269,732 267,186 778,586 - (63,770) 1,331,998<br />

Purchased loans - - - 717 - (670) 47<br />

Investments - - - - 2,672 (188) 2,484<br />

Other assets - - - - 36,929 (707) 36,222<br />

Fixed and intangible<br />

assets - - - 42,513 (423) 42,090<br />

TOTAL ASSETS (1) 679,640 338,530 267,186 779,799 494,089 (65,771) 2,493,473<br />

LIABILITIES<br />

Due to other banks 27,505 50,403 58,935 446,424 10,208 - 593,475<br />

Due to customers 921,113 226,855 196,192 228,053 54,808 - 1,627,021<br />

Provisions - - - - - 18,239 18,239<br />

Other liabilities 1,698 3,504 - - 18,092 - 23,294<br />

Subordinated debt - - - 62,000 - - 62,000<br />

TOTAL LIABILITIES (2) 950,316 280,762 255,127 736,477 83,108 18,239 2,324,029<br />

Mismatch as of 31<br />

December 2005 (1) - (2) (270,676) 57,768 12,059 43,322 410,981 (84,010) 169,444<br />

Total assets as at<br />

31 December 2004 654,084 237,015 240,338 572,912 391,917 (56,271) 2,039,995<br />

Total liabilities as at<br />

31 December 2004 885,681 216,081 275,038 459,305 58,114 12,023 1,906,242<br />

Balance mismatch as of<br />

31 December 2004 (231,597) 20,934 (34,700) 113,607 333,803 (68,294) 133,753<br />

www.raiffeisenbank.ba<br />

151