Plastic crates - Delhi

Plastic crates - Delhi

Plastic crates - Delhi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M/s Subhash Sales Corporation<br />

Library Road, Azad Market,<br />

<strong>Delhi</strong>-110006<br />

IN THE COURT OF COMMISSIONER<br />

DEPARTMENT OF TRADE AND TAXES<br />

GOVERNMENT OF N.C.T. OF DELHI<br />

VYAPAR BHAWAN, NEW DELHI<br />

ORDER<br />

No: 273/CDVAT/2010/37<br />

Dated: 20.09.2010<br />

Present for the Applicant : S/Sh. S K Anand, Vasdev Lalwani Advocates<br />

Present for the Department : Shri T.C. Sharma, DR.<br />

The above named applicant has filed an application on 23-06-2010 under<br />

Section 84 of DVAT Act, 2004 (hereinafter referred to as the “said Act”) and the<br />

question put up before this Court for determination under the aforesaid provision of<br />

law is as under:-<br />

“Whether the sale of plastic <strong>crates</strong> used for transporting/conveyance is<br />

covered by entry no. 168 of Part-A of notification dated 11-05-2005 i.e. the<br />

list of industrial inputs under the DVAT Act and taxable @ 5% or is taxable<br />

at any other rate?”<br />

2. The application for determination has been made in the prescribed format<br />

DVAT-42 and the requisite fees of Rs.500/- paid through Demand Draft No.<br />

337348 dated 14-06-2010.<br />

3. DR for the revenue stated that this Court vide an exparte decision has<br />

already determined the question which is the subject matter of the present application<br />

vide order No. 92/CDVAT/2005 dated 17.5.2006 where in it has been held that “the<br />

articles for packing of plastics namely boxes, cases, <strong>crates</strong>, containers, carboys,<br />

bottles and the jerry cans are found to be taxable as general unclassified goods<br />

attracting tax @ 12.5% u/s 4(1)(e) of the DVAT Act, 2004”.<br />

4. Sh. Anand and Sh. Lalwani, Advocates who appeared on behalf of the dealer<br />

reiterated the grounds of application argued that the said determination order was<br />

erroneous and cited the clarification issued by the department vide circular No. 5 of<br />

2006-07; F.6(34)/Policy-I/VAT/2006/278-86 dated 21.6.2006 which reads as under:-<br />

“some entries in the schedule of VAT rates appended to the <strong>Delhi</strong> Value<br />

Added Tax Act, 2004 contain HSN codes against the items mentioned therein. It is<br />

general understanding that these HSN codes are interpreted in different sections at<br />

times.<br />

In order to clear any doubt regarding the interpretation of entries containing<br />

HSN codes, it is intended to clarify that where a four, six or eight digit code is

mentioned in the schedule, it would cover all items falling under the code unless<br />

there is any specific exclusion prescribed for the same in the said act.<br />

It is repeated for the sake of clarity beyond doubt that this clarification is not<br />

meant for such entries in the <strong>Delhi</strong> Value Added Tax Act, 2004 where the description<br />

does not match fully with the description given for that HSN entry in the Central<br />

Excise Tariff Act, 1985”.<br />

5. Sh. Lalwani stated that Entry No. 84 of the Third Schedule to the DVAT<br />

Act, 2004 containing Industrial Inputs, note 3 appended below entry No. 41A of the<br />

Third Schedule of the <strong>Delhi</strong> Value Added Tax Act, 2004 were inserted w.e.f.<br />

14.3.2006 and which read as follows:-<br />

Note – (3) subject to Note – (2), for the purpose of any entry contained in<br />

this notification, where the description against any heading or, as the case may be,<br />

sub-heading, matches fully with the corresponding description in the Central Excise<br />

Tariff, then all commodities covered for the purpose of the said tariff under the<br />

heading or sub-heading will be covered by the scope of this notification.<br />

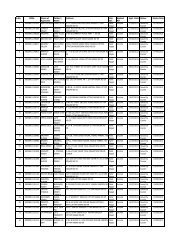

6 (i) Under the Central Excise & Customs Tariff:-<br />

As per HSN code No. 3923:-<br />

Articles for the conveyance or packing of goods, of plastics; stoppers, lids,<br />

caps and other closers of plastic.<br />

(ii) Entry No. 84(168) of schedule III of the DVAT Act, 2004:-<br />

Code No. 39.23:- Articals for the conveyance or packing of goods of<br />

plastics, stoppers, lids, caps and other closures, of plastics but not including:-<br />

(a) Insulated wares<br />

(b) bags of the type which are used for packing of goods at the time of sale for<br />

the convenience of the customer including carry bags.<br />

From the reading of entry No. 84(168) of the Third Schedule of the DVAT<br />

Act, 2004 it is evident that description used under the said entry is similar to that<br />

under code No. 3923 of the Central Excise & Customs Tariff.<br />

Therefore, note No. 3 below entry No. 41(a) of the Third Schedule of the<br />

<strong>Delhi</strong> Value Added Tax Act, 2004, which is also applicable to entry No. 84 of the<br />

said act, squarely applies to the instant case. Hence it is submitted that sub-heading<br />

code No. 3923 10 includes “<strong>crates</strong>’ is covered in entry No. 84(168) of the Third<br />

Schedule of the DVAT Act, 2004.<br />

7. DR stated that the item <strong>Plastic</strong> Crates used as article for the conveyance or<br />

packing of good can be covered under the entry No. 84(168) and shall attract VAT @ 5%.<br />

8. I have heard both the parties, gone through the earlier determination order<br />

No. 92/CDVAT/2005 dated 17.5.2006 of this Court, the circular No. 5 of 2006-07;<br />

F.6(34)/Policy-I/VAT/2006/278-86 dated 21.6.2006, entry No. 84(168) of the DVAT<br />

Act, 2004, HSN code No. 3923 under the Central Excise & Customs Tariff and on<br />

suo-moto review, I am of the considered view that the item <strong>Plastic</strong> Crates used as<br />

article for the conveyance or packing of good can be covered under the entry No.<br />

84(168) and shall attract VAT @5%. However, this determination shall be applicable

from the date mentioned herein above and will not affect old transactions prior to this<br />

date and the authorities under the DVAT Act, 2004 will not refund any amount if so<br />

collected from the applicant.<br />

Held accordingly.<br />

Copy for information and necessary action to:<br />

1. The Applicant<br />

2. The Addl. Commissioner (Law & Judicial)<br />

3. The Value Added Tax Officer (Policy Branch)<br />

4. Deptt. of Trade & Taxes Bar Association<br />

5. Guard File.<br />

(Jalaj Shrivastava)<br />

Commissioner (T&T)<br />

(Jalaj Shrivastava)<br />

Commissioner (T&T)