Atlantic, Europe and Mediterranean Basin (441 kb) - Investis

Atlantic, Europe and Mediterranean Basin (441 kb) - Investis

Atlantic, Europe and Mediterranean Basin (441 kb) - Investis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

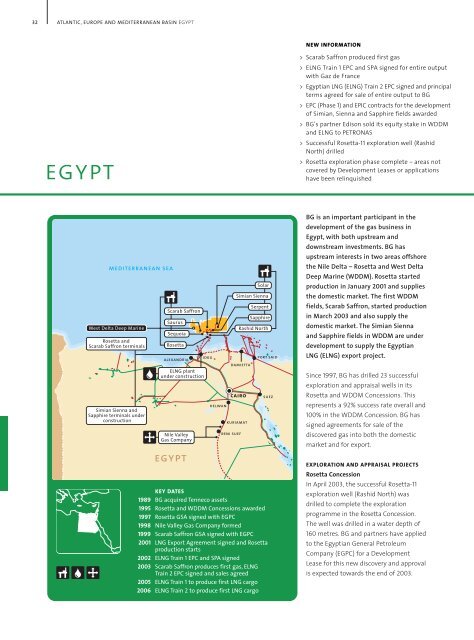

32 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN EGYPT<br />

egypt<br />

mediterranean sea<br />

West Delta Deep Marine<br />

Rosetta <strong>and</strong><br />

Scarab Saffron terminals<br />

Simian Sienna <strong>and</strong><br />

Sapphire terminals under<br />

construction<br />

Scarab Saffron<br />

Saurus<br />

Sequoia<br />

Rosetta<br />

alex<strong>and</strong>ria<br />

ELNG plant<br />

under construction<br />

Nile Valley<br />

Gas Company<br />

egypt<br />

idku<br />

helwan<br />

damietta<br />

cairo<br />

kuriamat<br />

beni suef<br />

Solar<br />

Simian Sienna<br />

Serpent<br />

Sapphire<br />

Rashid North<br />

port said<br />

KEY DATES<br />

1989 BG acquired Tenneco assets<br />

1995 Rosetta <strong>and</strong> WDDM Concessions awarded<br />

1997 Rosetta GSA signed with EGPC<br />

1998 Nile Valley Gas Company formed<br />

1999 Scarab Saffron GSA signed with EGPC<br />

2001 LNG Export Agreement signed <strong>and</strong> Rosetta<br />

production starts<br />

2002 ELNG Train 1 EPC <strong>and</strong> SPA signed<br />

2003 Scarab Saffron produces first gas, ELNG<br />

Train 2 EPC signed <strong>and</strong> sales agreed<br />

2005 ELNG Train 1 to produce first LNG cargo<br />

2006 ELNG Train 2 to produce first LNG cargo<br />

suez<br />

NEW INFORMATION<br />

> Scarab Saffron produced first gas<br />

> ELNG Train 1 EPC <strong>and</strong> SPA signed for entire output<br />

with Gaz de France<br />

> Egyptian LNG (ELNG) Train 2 EPC signed <strong>and</strong> principal<br />

terms agreed for sale of entire output to BG<br />

> EPC (Phase 1) <strong>and</strong> EPIC contracts for the development<br />

of Simian, Sienna <strong>and</strong> Sapphire fields awarded<br />

> BG’s partner Edison sold its equity stake in WDDM<br />

<strong>and</strong> ELNG to PETRONAS<br />

> Successful Rosetta-11 exploration well (Rashid<br />

North) drilled<br />

> Rosetta exploration phase complete – areas not<br />

covered by Development Leases or applications<br />

have been relinquished<br />

BG is an important participant in the<br />

development of the gas business in<br />

Egypt, with both upstream <strong>and</strong><br />

downstream investments. BG has<br />

upstream interests in two areas offshore<br />

the Nile Delta – Rosetta <strong>and</strong> West Delta<br />

Deep Marine (WDDM). Rosetta started<br />

production in January 2001 <strong>and</strong> supplies<br />

the domestic market. The first WDDM<br />

fields, Scarab Saffron, started production<br />

in March 2003 <strong>and</strong> also supply the<br />

domestic market. The Simian Sienna<br />

<strong>and</strong> Sapphire fields in WDDM are under<br />

development to supply the Egyptian<br />

LNG (ELNG) export project.<br />

Since 1997, BG has drilled 23 successful<br />

exploration <strong>and</strong> appraisal wells in its<br />

Rosetta <strong>and</strong> WDDM Concessions. This<br />

represents a 92% success rate overall <strong>and</strong><br />

100% in the WDDM Concession. BG has<br />

signed agreements for sale of the<br />

discovered gas into both the domestic<br />

market <strong>and</strong> for export.<br />

EXPLORATION AND APPRAISAL PROJECTS<br />

Rosetta Concession<br />

In April 2003, the successful Rosetta-11<br />

exploration well (Rashid North) was<br />

drilled to complete the exploration<br />

programme in the Rosetta Concession.<br />

The well was drilled in a water depth of<br />

160 metres. BG <strong>and</strong> partners have applied<br />

to the Egyptian General Petroleum<br />

Company (EGPC) for a Development<br />

Lease for this new discovery <strong>and</strong> approval<br />

is expected towards the end of 2003.

50<br />

20<br />

40<br />

50<br />

40<br />

40<br />

Partners (%) Rosetta Concession<br />

BG (operator)<br />

40 Shell<br />

20 Edison International<br />

50<br />

Partners (%) WDDM Concession<br />

BG (operator)<br />

50 PETRONAS<br />

West Delta Deep Marine Concession<br />

(WDDM)<br />

Since the Concession was awarded in 1995,<br />

BG has drilled 16 successful exploration<br />

<strong>and</strong> appraisal wells in WDDM – a 100%<br />

success rate. BG has also conducted an<br />

extensive seismic acquisition programme<br />

– a total of 4 910 sq km of 3D seismic,<br />

together with 4 900 sq km of 2D seismic<br />

has been shot. In August 2002, 1 225 sq km<br />

of the 3D seismic was acquired <strong>and</strong><br />

evaluation of this data will form the<br />

basis of future exploration activity<br />

in the Concession.<br />

This exploration programme has resulted<br />

in the discovery of nine gas fields – Scarab,<br />

Saffron, Simian, Sienna, Sapphire, Serpent,<br />

Saurus, Sequoia <strong>and</strong> Solar. The Sapphire<br />

field also contains significant quantities<br />

of condensate. The Sapphire-1 well, drilled<br />

in July 2000, flowed at 35 mmscfd of gas<br />

<strong>and</strong> 1 100 bbls of condensate per day. In<br />

December 2000, the Sapphire-2 appraisal<br />

well confirmed the presence of<br />

significant volumes of condensate in the<br />

Sapphire accumulation. In 2001, a further<br />

successful appraisal well, Sapphire-3<br />

was drilled, confirming the largest gas<br />

column recorded to date in Egypt.<br />

A new discovery in 2002, the Solar field,<br />

<strong>and</strong> two further successful appraisal<br />

wells underlined the prolific nature of the<br />

WDDM Concession. The Solar-1 well was<br />

completed in January 2002 after being<br />

drilled in 1 046 metres of water. The<br />

Sapphire-4 well, drilled in a water depth<br />

of 488 metres, confirmed the north-east<br />

extension of the Sapphire field. In April<br />

2002, the Sienna-2 well, drilled in a water<br />

depth of 991 metres, confirmed the<br />

extent of the Sienna field. This well<br />

marked the completion of the latest<br />

appraisal programme <strong>and</strong> confirmed<br />

sufficient reserves to underpin the<br />

marketing of ELNG Train 2. With the<br />

exception of Solar, all WDDM discoveries<br />

to date have been captured in<br />

Development Leases.<br />

In April 2003, BG’s partner in WDDM,<br />

Edison International, announced the sale<br />

of its 50% interest in the Concession to<br />

the Malaysian oil <strong>and</strong> gas company<br />

PETRONAS. The sale completed in June<br />

2003 <strong>and</strong> was effective from 1 January<br />

2003. BG remains the Concession operator.<br />

UPSTREAM DEVELOPMENT PROJECTS<br />

Rosetta<br />

BG <strong>and</strong> its partners, Shell <strong>and</strong> Edison<br />

International, signed a 25 year Gas Sales<br />

Agreement (GSA) in October 1997 with<br />

EGPC, to supply gas from the Rosetta<br />

Concession into the domestic market.<br />

EGPC received first gas from Rosetta on<br />

31 January 2001, just 45 months from first<br />

discovery in April 1997. The initial stage<br />

of the Rosetta development consists of<br />

six wells tied back to a ‘not normally<br />

manned’ platform with a 66 km gas <strong>and</strong><br />

condensate pipeline to the onshore<br />

terminal, for delivery into the national<br />

grid system near Idku, east of Alex<strong>and</strong>ria.<br />

A joint venture company, Rashid Petroleum<br />

Company, conducts operations on behalf<br />

of the Rosetta partners <strong>and</strong> EGPC.<br />

Since the Rosetta Concession award in<br />

1995, BG has undertaken gross capital<br />

20<br />

25<br />

10<br />

50<br />

50<br />

20<br />

25<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN EGYPT 33<br />

20<br />

Partners (%) Rashid Petroleum Company<br />

BG<br />

50 EGPC<br />

20 Shell<br />

10 Edison International<br />

25<br />

Partners (%) Burullus Gas Company<br />

BG<br />

50 EGPC<br />

25 PETRONAS<br />

expenditure of $314 million to realise the<br />

first phase of development. During 2002,<br />

Rosetta produced a total of 99.1 bcf of<br />

gas (21.6 bcf net BG). Rosetta has shown<br />

that it is capable of producing up to<br />

335 mmscfd, well above its Daily Contract<br />

Quantity (DCQ) of 275 mmscfd. It has<br />

continued to prove a flexible <strong>and</strong> reliable<br />

source of gas to the Egyptian domestic<br />

market <strong>and</strong> has been able to realise<br />

opportunities to produce above the DCQ<br />

during periods of high dem<strong>and</strong>. This<br />

helped Rosetta achieve an average rate<br />

above the 75% of the Annual Contract<br />

Quantity (ACQ) minimum contractual<br />

take level in 2002.<br />

Phase 2 of the Rosetta development<br />

will consist of an unmanned minimum<br />

facilities wellhead platform tied back to<br />

the existing Rosetta platform. The project<br />

FEED work started in March 2003 <strong>and</strong><br />

first gas from the project is scheduled<br />

for the fourth quarter of 2005.<br />

Scarab Saffron<br />

Delivery of first gas from the Scarab<br />

Saffron development occurred on<br />

29 March 2003. Scarab Saffron supplies<br />

gas to the domestic market under a<br />

GSA signed in August 1999 with EGPC.<br />

Under an amendment to the GSA signed<br />

in December 2002, the initial DCQ will<br />

be 440 mmscfd upon completion of the<br />

90 day run in period. On 1 January 2004,<br />

the DCQ will rise to 586 mmscfd for one<br />

year <strong>and</strong> then will rise again at the start<br />

of 2005 to 626 mmscfd. On 1 January<br />

2006, the DCQ will decrease to 533 mmscfd<br />

unless three months have already

34 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN EGYPT<br />

12<br />

12<br />

12<br />

12<br />

38<br />

5<br />

35.5<br />

35.5<br />

38<br />

egypt continued<br />

elapsed since the first shipment from<br />

ELNG, as the DCQ will then rise an<br />

additional 100 mmscfd to 633 mmscfd<br />

for seven years.<br />

The Scarab Saffron fields are larger <strong>and</strong><br />

in deeper water (in excess of 700 metres)<br />

than any other gas fields so far developed<br />

in Egypt <strong>and</strong> are the first to be developed<br />

using sub-sea completion technology.<br />

The Scarab Saffron development consists<br />

of eight sub-sea wells tied into a pipeline<br />

end manifold that is in turn tied back to<br />

an onshore terminal by two gas pipelines<br />

– 36-inch <strong>and</strong> 24-inch export pipelines.<br />

This additional pipeline capacity has<br />

been installed to allow subsequent field<br />

developments to tie into the Scarab<br />

Saffron facilities. Field operations are<br />

controlled from the onshore terminal via<br />

electrical <strong>and</strong> hydraulic umbilical lines.<br />

Burullus Gas Company, a joint venture<br />

company consisting of BG, EGPC <strong>and</strong><br />

PETRONAS, is undertaking exploration<br />

<strong>and</strong> field development operations on<br />

behalf of the WDDM Concession holders.<br />

Export Development Projects<br />

In April 2001, a fully termed agreement<br />

was signed with EGPC, setting the<br />

commercial foundation for the<br />

development of a LNG export project.<br />

The agreement includes amendments<br />

to the existing WDDM Concession<br />

Agreement <strong>and</strong> the GSA. The Egyptian<br />

People’s Assembly ratified the amended<br />

Concession Agreement in March 2002.<br />

Shareholders (%) ELNG Holding,<br />

Operating <strong>and</strong> Train 1 Companies<br />

35.5 BG<br />

35.5 PETRONAS<br />

12 EGPC<br />

12 Egyptian Natural Gas Holding Company (EGAS)<br />

5 Gaz de France<br />

38<br />

Shareholders (%) in ELNG Train 2 Company<br />

BG<br />

38 PETRONAS<br />

12 EGPC<br />

12 EGAS<br />

BG <strong>and</strong> its partner are therefore the first,<br />

<strong>and</strong> currently only, upstream players in<br />

Egypt with a definitive export agreement<br />

allowing the export of gas from a<br />

development within a concession area.<br />

The amendments to the WDDM<br />

Concession Agreement also introduced<br />

a floor <strong>and</strong> ceiling price to domestic gas<br />

sales. At Brent oil prices below $10/bbl,<br />

the floor price payable for domestic gas<br />

is $1.50/mmbtu <strong>and</strong> a ceiling price of<br />

$2.65/mmbtu applies when Brent is<br />

above $20/bbl. This pricing arrangement<br />

was adopted simultaneously for the<br />

Rosetta Development Leases <strong>and</strong> has<br />

been adhered to since production on<br />

Rosetta commenced.<br />

As part of the Scarab Saffron<br />

development, sufficiently large offshore<br />

pipelines have been installed to support<br />

a two-train LNG development, in addition<br />

to supplies to the domestic market from<br />

the Scarab Saffron fields.<br />

Simian Sienna <strong>and</strong> Sapphire<br />

The Simian Sienna fields are being<br />

developed to supply gas to Train 1 of the<br />

ELNG export project whilst the Sapphire<br />

field will supply Train 2. Development of<br />

the Simian Sienna <strong>and</strong> Sapphire fields<br />

will be integrated with the Scarab<br />

Saffron fields to maximise synergies<br />

<strong>and</strong> reduce development costs through<br />

st<strong>and</strong>ardisation of equipment <strong>and</strong><br />

optimising facilities capacity. Like the<br />

Scarab Saffron project, they will use<br />

sub-sea completion technology but due<br />

to the increased step-out from the shore,<br />

the project will utilise a shallow water<br />

controls platform to reduce controls system<br />

risks <strong>and</strong> maintain plant availability. EPIC<br />

20<br />

5<br />

37.5<br />

37.5<br />

Shareholders (%) NVGC<br />

37.5 BG<br />

37.5 Edison International<br />

20 Orascom<br />

5 Middle East Gas Association<br />

<strong>and</strong> EPC contracts have been awarded<br />

to develop the offshore <strong>and</strong> onshore<br />

facilities for the three fields.<br />

DOWNSTREAM PROJECTS<br />

Egyptian LNG (ELNG)<br />

The ELNG Train 1 <strong>and</strong> Train 2 plants <strong>and</strong><br />

common facilities are under construction<br />

in their own Tax Free Zone near Idku.<br />

The zone is adjacent to the Rosetta <strong>and</strong><br />

Scarab Saffron facilities where gas from<br />

BG’s fields enters the Egyptian national<br />

gas transmission system. The $1.35 billion<br />

first train is designed to produce 3.6 mtpa<br />

of LNG <strong>and</strong> the second train is expected<br />

to double the plant’s capacity. The<br />

two-train development is expected to<br />

cost approximately $1.9 billion. Both trains<br />

will be built using the Phillips liquefaction<br />

technology <strong>and</strong> they will share storage<br />

<strong>and</strong> marine facilities. The site can<br />

accommodate up to six LNG trains <strong>and</strong><br />

a multiple company structure has been<br />

selected by the sponsors to give<br />

maximum flexibility for future expansions.<br />

It is designed to allow other gas producers<br />

in Egypt to invest in future LNG export<br />

gas trains, without having to replicate<br />

supporting infrastructure. Additionally,<br />

it is intended to make future expansions<br />

of the ELNG project easier to finance.<br />

The ELNG Holding Company will own<br />

both the ELNG site <strong>and</strong> common facilities,<br />

such as storage tanks <strong>and</strong> jetty. An<br />

operating company will undertake<br />

operations of all trains, although separate<br />

companies will own the individual trains.<br />

The ELNG Train 1 Company will borrow<br />

the required funds <strong>and</strong> build <strong>and</strong> own

Train 1. The ELNG Train 2 Company is in<br />

the process of being formed <strong>and</strong> will do<br />

the same in relation to Train 2.<br />

Following a Heads of Terms agreement<br />

signed in January 2002, a LNG Sale <strong>and</strong><br />

Purchase Agreement was signed in<br />

October 2002 for the sale of the entire<br />

output of the 3.6 mtpa first train to Gaz<br />

de France. Train 1 is scheduled to start<br />

production in the second half of 2005.<br />

In parallel to the commercial framework,<br />

construction of Train 1 <strong>and</strong> the common<br />

facilities started with an early works<br />

programme in May 2002 <strong>and</strong> the full<br />

EPC contract with Bechtel was signed in<br />

September 2002. BG <strong>and</strong> its partners also<br />

made progress securing project finance<br />

of $1.15 billion for the construction of<br />

Train 1 <strong>and</strong> common facilities with the<br />

announcement in January 2003 of the<br />

appointment of 12 international <strong>and</strong><br />

three Egyptian banks as International<br />

<strong>and</strong> Egyptian M<strong>and</strong>ated Lead Arrangers<br />

respectively.<br />

At the same time as purchasing Edison’s<br />

stake in the WDDM Concession, PETRONAS<br />

also purchased its stake in the ELNG<br />

project in June 2003.<br />

Construction of Train 2 started in<br />

May 2003. Early works commenced in<br />

December 2002. In June 2003, BG <strong>and</strong> its<br />

partners agreed principal terms for the<br />

sale of the whole of Train 2 output to BG<br />

Gas Marketing, a subsidiary of BG Group.<br />

At the same time, the ELNG partners<br />

signed the full EPC contract for Train 2 with<br />

Bechtel. Train 2 is expected to start LNG<br />

production in mid 2006. For approximately<br />

the first year of production, the entire<br />

output is intended to supply the Lake<br />

Charles LNG import terminal in Louisiana,<br />

USA. After that time, Train 2 volumes<br />

can be switched to supply the proposed<br />

LNG import terminal at Brindisi, Italy,<br />

which is being developed by BG <strong>and</strong><br />

Enel (see page 39).<br />

Nile Valley Gas Company (NVGC)<br />

In 1998, BG <strong>and</strong> its partners signed a<br />

25 year franchise agreement with EGPC<br />

for the exclusive right to develop the<br />

gas market in Upper Egypt. Formed in<br />

September 1998 with BG as the lead<br />

participant, the Nile Valley Gas Company<br />

(NVGC) is undertaking development of<br />

the gas market <strong>and</strong> infrastructure in<br />

Upper Egypt, focusing around Beni Suef.<br />

Phase 1, costing $38 million, has extended<br />

the gas transmission network from south<br />

of Kuriamat to Beni Suef, with first gas<br />

deliveries achieved in March 1999. During<br />

Phase 1, NVGC contracted with over<br />

17 000 domestic customers <strong>and</strong> a number<br />

of major industrial users.<br />

Further information on the Nile Valley<br />

Gas Company can be found on its<br />

website, www.nilevalleygasco.com<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN EGYPT 35<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Scarab Saffron DCQ<br />

(mmscfd)<br />

Until<br />

end 03<br />

1 Jan<br />

04<br />

1 Jan<br />

05<br />

1 Jan*<br />

06<br />

* DCQ of 533 mmscfd unless 3 months have elapsed since first<br />

ELNG shipment – will then be 633 mmscfd for 7 years<br />

NOTES

36 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN ISRAEL AND AREAS OF PALESTINIAN AUTHORITY<br />

israel <strong>and</strong><br />

areas of palestinian<br />

authority<br />

Matan (309 – Block Gal B)<br />

Michal (308 – Block Gal A)<br />

mediterranean sea<br />

Offshore Gaza<br />

Gaza Marine<br />

egypt<br />

Or<br />

Med Yavne<br />

lebanon<br />

israel<br />

gaza<br />

KEY DATES<br />

1999 BG acquired the Gal preliminary permits,<br />

Med licences <strong>and</strong> offshore Gaza licence<br />

Or gas discovery<br />

2000 3D seismic shot over the offshore Gaza <strong>and</strong><br />

Med licences<br />

Gaza Marine gas discovery<br />

2001 3D seismic shot over the Gal licences<br />

2002 Additional 2D seismic shot over the offshore<br />

Gaza licence<br />

NEW INFORMATION<br />

> Following the withdrawal of various partners<br />

from the Gal Licences, BG <strong>and</strong> the other<br />

continuing parties are actively seeking a<br />

new partner<br />

> Offshore Gaza exploration well deferred<br />

until 2004 pending the successful<br />

commercialisation of the Gaza Marine field<br />

BG has been active in the region since<br />

1999 <strong>and</strong> current activities are focused<br />

upon the successful commercialisation<br />

of its offshore gas discoveries, led by the<br />

largest reservoir Gaza Marine. Gas sales<br />

negotiations with major power <strong>and</strong><br />

industrial users in Israel are being<br />

pursued, whilst on the downstream side<br />

BG is lending its expertise to assist in<br />

the establishment of gas infrastructure<br />

across Israel <strong>and</strong> the Areas of<br />

Palestinian Authority.<br />

ISRAEL<br />

Med Yavne Lease<br />

BG rationalised its interests in the Med<br />

licences in 2002, following the earlier<br />

acquisition, processing <strong>and</strong> interpretation<br />

of seismic data. BG retains operatorship<br />

of the Med Yavne lease, which was<br />

reduced to an area of 52.3 sq km around<br />

the Or gas discovery made in 1999.<br />

Gal Licences<br />

BG is operator of two offshore<br />

exploration blocks, Matan <strong>and</strong> Michal.<br />

Early in 2003, IPE <strong>and</strong> Granit-Sonol<br />

withdrew from the licences <strong>and</strong> other<br />

partners reduced their interest.<br />

Consequently, the continuing parties<br />

are actively seeking a new partner to<br />

participate in the licences, including the<br />

planned deep water 1 600m exploration<br />

well on the Matan licence.

13.2<br />

39.8<br />

1.8<br />

8.0<br />

5<br />

42.0<br />

6<br />

35.0<br />

25<br />

19.2<br />

AREAS OF THE PALESTINIAN AUTHORITY<br />

Offshore Gaza<br />

5<br />

35.0<br />

Partners (%) Med Yavne<br />

BG (operator)<br />

42.0 Isramco Group<br />

13.2 Middle East Energy<br />

8.0 Delek Drilling Limited<br />

1.8 Dor Gas<br />

25.0<br />

Partners (%) Matan <strong>and</strong> Michal<br />

BG (operator)<br />

5.0 Isramco Group<br />

19.2 Middle East Energy<br />

6.0 STX (2000)<br />

5.0 Dor Gas<br />

39.8 Unallocated<br />

Following acquisition of over 1 000 sq km<br />

of 3D seismic data, BG drilled two<br />

successful wells in the second half of<br />

2000 (Gaza Marine-1 <strong>and</strong> Gaza Marine-2).<br />

The first of these tested 37 mmscfd of<br />

gas on a 48/64" choke with the flow rate<br />

constrained by testing equipment. The<br />

second well was not tested but confirmed<br />

a major gas discovery in the Gaza Marine<br />

field. In 2001, a major technical review<br />

recommended development via sub-sea<br />

wells <strong>and</strong> a pipeline to an onshore<br />

processing terminal, incorporating similar<br />

technologies to BG’s Scarab Saffron<br />

development offshore Egypt.<br />

During November <strong>and</strong> December 2002,<br />

BG acquired an additional 925 km of 2D<br />

seismic data in order to better evaluate<br />

the area between the existing discoveries<br />

<strong>and</strong> the shore. The offshore Gaza<br />

exploration well that was planned for<br />

2003 has now been deferred until 2004,<br />

pending the successful commercialisation<br />

of the Gaza Marine field. BG currently<br />

holds 90% equity in the licence, which<br />

will be reduced to 60% after<br />

Consolidated Contractors Company<br />

<strong>and</strong> the Palestine Investment Fund<br />

exercise their options.<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN ISRAEL AND AREAS OF PALESTINIAN AUTHORITY 37<br />

10<br />

90<br />

90<br />

Partners (%) Offshore Gaza<br />

BG (operator)<br />

10 Consolidated Contractors Company<br />

NOTES

38 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN ITALY<br />

italy<br />

turin<br />

rivalta<br />

mediterranean sea<br />

tunisia<br />

milan<br />

italy<br />

rome<br />

tyrrhenian sea<br />

P<strong>and</strong>a<br />

sulmona<br />

cassino<br />

naples<br />

slovenia<br />

adriatic sea<br />

termoli<br />

croatia<br />

hungary<br />

bosnia &<br />

herzegovina<br />

Proposed LNG terminal<br />

melfi<br />

brindisi<br />

ionian sea<br />

KEY DATES<br />

1992 BG commenced activities in Italy<br />

1998 SERENE power stations began operation<br />

2003 All major construction <strong>and</strong> operational<br />

authorisations granted for Brindisi LNG Terminal<br />

2004 First BG-operated well planned for the Po Valley<br />

Brindisi LNG plant construction to begin<br />

2007 First LNG imports to Brindisi to begin<br />

NEW INFORMATION<br />

> BG granted authorisation to build a LNG<br />

terminal at Brindisi<br />

> BG signed for exclusive use of the Brindisi Port<br />

area where the terminal will be built<br />

> In May 2003, BG sold a 50% stake in the Brindisi<br />

LNG development project to Enel<br />

> Part of Brindisi supply intended to come from<br />

Egyptian LNG Train 2<br />

Active in Italy since 1992, BG is further<br />

developing its gas chain capability. Italy<br />

is a net importer of gas, a commodity<br />

upon which it is becoming increasingly<br />

dependent as the government focuses<br />

on environmentally friendly energy<br />

sources. BG is positioning itself within<br />

the Italian market to help satisfy the<br />

rise in dem<strong>and</strong>.<br />

Current BG activity in Italy includes: E&P,<br />

where BG holds 12 exploration permits;<br />

Power, through a partnership that<br />

operates five power plants; <strong>and</strong> LNG,<br />

where BG is developing a LNG import<br />

terminal on the south-eastern coast.<br />

Exploration <strong>and</strong> Production<br />

BG has refocused its Italian exploration<br />

<strong>and</strong> production on high potential oil <strong>and</strong><br />

gas exploration acreage in the Sicily<br />

Channel <strong>and</strong> the Po Valley. The portfolio<br />

consists of 12 exploration permits, six of<br />

which are operated by BG.<br />

In April 2002, BG announced a gas<br />

discovery in the Sicily Channel drilled on<br />

the P<strong>and</strong>a exploration prospect where<br />

BG has a 37.5% interest. An appraisal<br />

programme comprising the P<strong>and</strong>a West-1<br />

well, drilled in early 2003, <strong>and</strong> a 3D<br />

seismic survey, to be acquired in early<br />

2004, is intended to prove the<br />

commerciality of the discovery.<br />

A three year onshore exploration<br />

programme is underway in the Po Valley<br />

with a 2003 seismic acquisition<br />

programme. The first well is scheduled<br />

to be drilled on the high pressure/high<br />

temperature Cascina Favorita-1 prospect,

32<br />

1.6<br />

3.2<br />

5<br />

63<br />

3.2<br />

Shareholders (%) SERENE S.p.A<br />

63 Edison<br />

32 BG<br />

5 NHS (subsidiary of Banca San Paolo – IMI)<br />

located around 40 km to the south-west<br />

of Milan. The first operated well is<br />

planned for 2004, subject to the granting<br />

of environmental approvals.<br />

Power Generation<br />

BG is a partner in SERENE S.p.A, a joint<br />

venture company that owns <strong>and</strong><br />

operates approximately 400 MW of<br />

co-generation at five locations adjacent<br />

to Fiat Auto factories. The 100 MW power<br />

stations are located at Melfi, Termoli <strong>and</strong><br />

Cassino with the 50 MW stations at both<br />

Sulmona <strong>and</strong> Rivalta. The plants have<br />

been in operation for six years <strong>and</strong> are<br />

located to allow steam supply to Fiat<br />

Auto plants.<br />

SERENE supplies nearly 3 000 GWh per<br />

year of electricity to the grid operator,<br />

GRTN, <strong>and</strong> 320 000 tons of steam to Fiat.<br />

BG is co-developer of the project <strong>and</strong> has<br />

a 32% interest in the company. Fuel gas is<br />

supplied to the plants by Eni <strong>and</strong> Edison.<br />

The total investment in SERENE<br />

is £260 million, of which financing<br />

arrangements for approximately<br />

£210 million were concluded in July 1998.<br />

2007 – Expected Capacity Rights in Brindisi<br />

LNG Terminal – bcma<br />

3.2 BG<br />

3.2 Enel<br />

1.6 Regulated third party access<br />

LNG<br />

BG is developing an 8 bcmpa (6 mtpa)<br />

LNG terminal at the outer harbour of the<br />

port of Brindisi, on the south-east coast<br />

of Italy.<br />

In January 2003, BG was granted an<br />

authorisation decree by the Ministry of<br />

Productive Activities, in agreement with<br />

the Ministry of Environment <strong>and</strong> the<br />

Puglia region, to build the Brindisi<br />

terminal. In February 2003, BG signed<br />

an Agreement in Lieu of Concession with<br />

the Brindisi Port Authority, which gives<br />

BG the exclusive right to use the port<br />

area in which the terminal will be built.<br />

In May 2003, BG signed a Share Sale <strong>and</strong><br />

Purchase Agreement with Enel for them<br />

to buy 50% of the Brindisi LNG project, <strong>and</strong><br />

a Project Development <strong>and</strong> Shareholders<br />

Agreement for the joint development.<br />

The FEED contract was awarded in June<br />

2003, <strong>and</strong> construction is expected to<br />

commence in early 2004, with first imports<br />

into the Italian market expected to start<br />

in 2007. Financial advisors for project<br />

financing were appointed in July 2003.<br />

BG <strong>and</strong> Enel equally share the 80%<br />

reserved capacity in the terminal, whilst<br />

the remaining 20% will be subject to<br />

regulated third-party access. The<br />

terminal is strategically located to receive<br />

LNG from the <strong>Mediterranean</strong> <strong>Basin</strong> <strong>and</strong><br />

the Gulf States.<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN ITALY 39<br />

NOTES

40 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN SPAIN<br />

spain<br />

madrid<br />

spain<br />

Aguila<br />

Cormorán<br />

valencia<br />

france<br />

barcelona<br />

Ibis<br />

Halcón<br />

Flamenco Garceta<br />

Gorrión<br />

mediterranean sea<br />

balearic<br />

isl<strong>and</strong>s<br />

algeria<br />

KEY DATES<br />

2002 Seven exploration licences granted to BG<br />

Acquired 2 500 sq km of 3D seismic data<br />

2004 Drilling programme to begin<br />

algiers<br />

NEW INFORMATION<br />

> Technical evaluation of the 2 500 sq km of<br />

3D seismic data acquired in July 2002 is near<br />

completion<br />

> Preparation has begun for BG’s first exploration<br />

well in Spain which is expected to be spudded<br />

mid-2004<br />

BG is developing its interests in Spain,<br />

with an emphasis on building gas chain<br />

opportunities. Presently, BG is focused<br />

on evaluating its offshore exploration<br />

licences. Spain is a net importer of gas,<br />

is an EU member, <strong>and</strong> has a growing<br />

developed economy. These factors make<br />

investment in the country attractive<br />

to BG.<br />

Upstream Licences<br />

BG operates seven exploration licences<br />

offshore Spain, covering an area of<br />

6 500 sq km. The acreage is located in<br />

the Gulf of Valencia, 90 km north-east<br />

of Valencia <strong>and</strong> 100 km south-west<br />

of Barcelona.<br />

BG acquired 2 500 sq km of 3D seismic<br />

data in July 2002. The technical<br />

evaluation of this data is near completion.<br />

The drilling programme is expected to<br />

start in the middle of 2004. Any gas or<br />

oil discoveries will be developed for the<br />

Spanish domestic market. BG Group holds<br />

100% equity in all seven new licences.

trinidad <strong>and</strong> tobago<br />

Poinsettia<br />

Chaconia<br />

Hibiscus<br />

gulf of<br />

paria<br />

<strong>Atlantic</strong> LNG<br />

venezuela<br />

port of<br />

spain<br />

point<br />

lisas<br />

point<br />

fortin<br />

NCMA<br />

caribbean sea<br />

trinidad<br />

picton<br />

arima<br />

phoenix park<br />

galeota<br />

point<br />

KEY DATES<br />

1989 BG began operations in Trinidad <strong>and</strong> Tobago<br />

1996 BG <strong>and</strong> partner commenced production of the<br />

Dolphin gas field<br />

1999 US$1 billion ALNG Train 1 plant constructed<br />

at Point Fortin<br />

2001 Hibiscus platform installed<br />

2002 ALNG Train 2 started operation<br />

2003 ALNG Train 3 started operation<br />

Government approval for construction<br />

of ALNG Train 4<br />

2006 ALNG Train 4 to begin operation<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN TRINIDAD AND TOBAGO 41<br />

tobago<br />

Block E<br />

atlantic ocean<br />

Block 3(a)<br />

Angostura<br />

ECMA<br />

Starfish<br />

Block 5(a)<br />

Dolphin<br />

Block 6(b) Dolphin Deep<br />

Block 6(d)<br />

NEW INFORMATION<br />

> ALNG Train 3 started LNG production in April 2003<br />

> Government approved construction of ALNG Train 4<br />

> Ixora prospect drilled <strong>and</strong> successfully completed<br />

as part of the NCMA Development in July 2003<br />

> BG <strong>and</strong> partners signed the Joint Operating<br />

Agreement (JOA) for Block 3(a)<br />

> BG <strong>and</strong> partners expect to spud the first<br />

exploration well in Block 3(a) in 2003<br />

> BGTT retained ISO 14001 environmental certification<br />

BG Trinidad <strong>and</strong> Tobago, operating since<br />

1989, continues to reinforce its position as<br />

a major gas player in Trinidad <strong>and</strong> Tobago.<br />

BG currently supplies gas into the<br />

domestic market from the Dolphin field<br />

in the East Coast Marine Area (ECMA),<br />

<strong>and</strong> into <strong>Atlantic</strong> LNG for subsequent<br />

export to North America <strong>and</strong> <strong>Europe</strong>,<br />

from the North Coast Marine Area<br />

(NCMA) fields. BG has consistently<br />

proven the integrity of its upstream<br />

production facilities, regularly producing<br />

in excess of 800 mmscfd.<br />

BG continues to invest further in LNG<br />

expansion <strong>and</strong> seeks to create <strong>and</strong><br />

develop upstream opportunities to<br />

supply its capacity in <strong>Atlantic</strong> LNG.<br />

EAST COAST MARINE AREA<br />

Dolphin Platform<br />

The BG-operated Dolphin gas field, in a<br />

50/50 partnership with ChevronTexaco,<br />

commenced production in March 1996.<br />

The eight leg gas production platform<br />

is located 52 miles off the east coast of<br />

Trinidad in Block 6(b).<br />

The Dolphin field is contracted to supply<br />

up to 275 mmscfd of gas to the National<br />

Gas Company of Trinidad <strong>and</strong> Tobago<br />

under a 20 year supply contract.<br />

Development Activity in the ECMA<br />

In 2002, BG <strong>and</strong> partner ChevronTexaco<br />

received approval from the Government<br />

of Trinidad <strong>and</strong> Tobago for development<br />

of the Dolphin Deep field in Block 5(a)<br />

<strong>and</strong> the Starfish field which straddles<br />

Block 5(a) <strong>and</strong> Block E. Reserves from

42 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN TRINIDAD AND TOBAGO<br />

30<br />

50<br />

10<br />

30<br />

50<br />

30<br />

50<br />

Shareholders (%) Dolphin – ECMA<br />

BG (operator)<br />

50 ChevronTexaco<br />

30<br />

Partners (%) Block 3(a)<br />

BG<br />

30 BHP (operator)<br />

30 Talisman<br />

10 Total<br />

trinidad <strong>and</strong> tobago continued<br />

these discoveries are to be produced<br />

through the upgraded Dolphin facilities<br />

via sub-sea completions <strong>and</strong> pipelines<br />

to supply gas to <strong>Atlantic</strong> LNG at Point<br />

Fortin. These completions will be the first<br />

sub-sea development in Trinidad <strong>and</strong><br />

Tobago waters to date. The Dolphin Deep<br />

Development project is scheduled to<br />

be completed in July 2005 to supply<br />

80 mmscfd to <strong>Atlantic</strong> LNG Train 3.<br />

Exploration/Appraisal Activity<br />

In April 2002, BG <strong>and</strong> partners signed<br />

a PSC with the Government of Trinidad<br />

<strong>and</strong> Tobago for Block 3(a). The 614 sq km<br />

block is located 40 km off the east coast<br />

of Trinidad in water depths of 30-90<br />

metres. The block is adjacent to Block 2(c)<br />

where BHP <strong>and</strong> partners have recently<br />

made significant gas <strong>and</strong> oil discoveries.<br />

Under the Block 3(a) PSC terms, BG <strong>and</strong><br />

partners have agreed to acquire 300 sq<br />

km of 3D seismic data <strong>and</strong> embark on a<br />

six well exploratory drilling programme.<br />

One year later, in April 2003, BG <strong>and</strong><br />

partners signed the Joint Operating<br />

Agreement (JOA) for Block 3(a). The<br />

completion of the negotiation of the<br />

JOA marked an important milestone<br />

for the partnership.<br />

NORTH COAST MARINE AREA<br />

Hibiscus Platform<br />

The BG-operated NCMA, located 40 km<br />

off the north coast of Trinidad, includes<br />

three gas fields – Hibiscus, Poinsettia<br />

<strong>and</strong> Chaconia.<br />

17.31<br />

In April 2000, a Unitisation Agreement<br />

was signed, <strong>and</strong> in December 2000 the<br />

Government of Trinidad <strong>and</strong> Tobago<br />

approved the development of the three<br />

fields. These fields are being developed<br />

in up to four phases to supply gas to the<br />

<strong>Atlantic</strong> LNG Trains 2 <strong>and</strong> 3 expansion.<br />

The Hibiscus platform was successfully<br />

installed in September 2001, in a water<br />

depth of 150 metres. The 107 km, 24 inch<br />

pipeline from the NCMA development to<br />

the <strong>Atlantic</strong> LNG plant has a capacity of<br />

500 mmscfd <strong>and</strong> is the longest pipeline<br />

in Trinidad <strong>and</strong> Tobago to date.<br />

Drilling operations began in late 2001,<br />

with Phases 1 <strong>and</strong> 2 to be completed on<br />

the Hibiscus <strong>and</strong> Chaconia fields by the<br />

third quarter of 2003. Phase 3 involves<br />

the drilling programme for the Poinsettia<br />

field, with production scheduled to begin<br />

around 2007. A possible Phase 4 would<br />

involve the installation of compressors.<br />

In August 2002, BG <strong>and</strong> its partners<br />

announced first gas production from the<br />

NCMA Hibiscus field into the newly<br />

commissioned Train 2 at <strong>Atlantic</strong> LNG.<br />

NCMA is contracted to supply 240 mmscfd<br />

of gas to Train 2 for up to 20 years, in<br />

addition to 125 mmscfd to Train 3 for the<br />

first two years, reducing thereafter to<br />

45 mmscfd. Production into Train 3<br />

started in April 2003.<br />

10<br />

20<br />

17.31<br />

19.50<br />

10<br />

34<br />

45.88<br />

26<br />

45.88<br />

Partners (%) Hibiscus – NCMA<br />

BG (operator)<br />

19.50 Petrotrin<br />

17.31 ENI<br />

17.31 PetroCanada<br />

26<br />

Shareholders (%) ALNG Train 1<br />

BG<br />

34 BP<br />

20 Repsol<br />

10 Tractebel<br />

10 NGC<br />

ATLANTIC LNG<br />

The <strong>Atlantic</strong> LNG Company of Trinidad<br />

<strong>and</strong> Tobago, in which BG is a shareholder,<br />

constructed a US$1 billion LNG plant in<br />

Point Fortin, south-west Trinidad, which<br />

came into operation in April 1999.<br />

<strong>Atlantic</strong> Train 1 produces 3.1 million<br />

tonnes of LNG per year, which is sold to<br />

markets in the north-east United States,<br />

Puerto Rico <strong>and</strong> Spain.<br />

Government approval for the two-train<br />

expansion project was received in February<br />

2000 <strong>and</strong> construction began later the<br />

same year. Train 2 commenced<br />

operations in August 2002 <strong>and</strong> Train 3<br />

in April 2003. The gross cost of the<br />

two-train expansion is US$1.1 billion.<br />

The majority of LNG produced from<br />

NCMA gas supplied to Trains 2 <strong>and</strong> 3, by<br />

BG <strong>and</strong> its partners, is contracted to be<br />

sold to El Paso Merchant Energy under<br />

a long-term contract for import into the<br />

Elba Isl<strong>and</strong> LNG receiving terminal in<br />

Georgia, USA. During 2002, <strong>and</strong> up to<br />

30 September 2003, the majority of the<br />

LNG produced from NCMA gas supplied<br />

to Trains 2 <strong>and</strong> 3 will be sold into the US<br />

market via the Lake Charles importation<br />

terminal in Louisiana, USA. BG controls<br />

approximately 81% of the capacity rights<br />

of Lake Charles (see page 46 for further<br />

details).

25<br />

42.5<br />

32.5<br />

Future LNG Expansion<br />

32.5<br />

Shareholders (%) ALNG Trains 2 & 3<br />

BG<br />

42.5 BP<br />

25 Repsol<br />

In June 2003, the Trinidad <strong>and</strong> Tobago<br />

Government announced the approval<br />

of a fourth <strong>Atlantic</strong> LNG Train at Point<br />

Fortin. Train 4, at an estimated cost of<br />

US$1.2 billion, is expected to be the<br />

largest LNG train ever constructed. BG’s<br />

shareholding in Train 4 will be no less<br />

than 26%. The train will require about<br />

800 mmscfd <strong>and</strong> produce 5.2 mtpa of<br />

LNG. Together with its sister trains,<br />

overall LNG production from <strong>Atlantic</strong> LNG<br />

should increase to over 15 mtpa. A FEED<br />

study for the construction of a fourth<br />

train was completed in February 2002.<br />

It is anticipated that Train 4 is intended<br />

to commence operations in the first<br />

quarter of 2006. LNG produced from<br />

the BG liquefaction capacity in Train 4<br />

is intended to be sold under a long-term<br />

contract to BG LNG Services, LLC <strong>and</strong><br />

delivered to Lake Charles.<br />

Further information on <strong>Atlantic</strong> LNG<br />

can be found on its website,<br />

www.atlanticlng.com<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN TRINIDAD AND TOBAGO 43<br />

NOTES

44 ATLANTIC, EUROPE AND MEDITERRANEAN BASIN TUNISIA<br />

tunisia<br />

bizerte<br />

tunis<br />

tunisia<br />

Proposed power station<br />

Hannibal<br />

barca<br />

la skhira<br />

gabes<br />

sousse<br />

sfax<br />

Amilcar<br />

Ulysse A<br />

mediterranean sea<br />

Miskar<br />

Ulysse C<br />

Hasdrubal<br />

Ulysse B<br />

KEY DATES<br />

1989 BG acquired Tenneco assets<br />

1996 Miskar field began production<br />

2003 MoA signed for Barca Power station<br />

2006 Full commercial operation of Barca Power station<br />

LPG plant to be commissioned at Hannibal site<br />

NEW INFORMATION<br />

> In May 2003 BG signed a MoA in relation<br />

to the development of the $250m proposed<br />

Barca Power plant<br />

> Miskar field reserves have significantly increased<br />

following re-appraisal<br />

> Decision on Ulysse permit expected in<br />

September 2003<br />

BG is the largest producer of gas in<br />

Tunisia, satisfying around 60% of<br />

domestic gas dem<strong>and</strong> in 2002 from<br />

the Miskar field. In addition, BG holds<br />

two exploration permits in the Gulf<br />

of Gabes with a combined surface area<br />

of 3 188 sq km.<br />

BG intends to undertake further<br />

exploration activity in Tunisia <strong>and</strong> to<br />

seek further investment opportunities<br />

utilising its gas chain expertise, such as<br />

developing a gas-to-power project.<br />

Miskar Gas Field<br />

Production from the offshore Gulf of<br />

Gabes Miskar production concession, which<br />

is 100% BG owned <strong>and</strong> BG-operated,<br />

commenced in June 1996. Gas from the<br />

field is processed at the BG Hannibal<br />

plant, located 21 km south of Sfax, <strong>and</strong><br />

sold into the Tunisian system.<br />

BG has a Miskar gas sales contract with<br />

the Tunisian State electricity <strong>and</strong> gas<br />

company, Société Tunisienne de<br />

l’Electricité et du Gaz.<br />

The agreement gives BG the right to supply<br />

over 230 mmscfd on a long-term basis.<br />

On 11 April 2003, the Miskar/Hannibal<br />

system delivered a new daily record of<br />

40 015 boe <strong>and</strong> the current daily average<br />

is 38 200 boe.

BG drilled three infill wells on the Miskar<br />

field in the second half of 2002 <strong>and</strong> has<br />

signed manufacturing <strong>and</strong> installation<br />

contracts for gas compression equipment<br />

on the Miskar platform. The equipment is<br />

scheduled to be operational in 2004. BG<br />

intends to use these projects to increase<br />

gas supply from the field to 250 mmscfd<br />

by the end of 2006. These projects<br />

support development plans agreed with<br />

the Government of Tunisia, which<br />

include BG investing around $450 million<br />

between 2000 <strong>and</strong> 2009.<br />

Net average daily production in 2002<br />

(after deduction of royalties)<br />

Gas (mmscfd) 167<br />

Condensate (bpd) 4 453<br />

Miskar – estimated original gross field reserves<br />

Gas (tcf) 1.5<br />

Condensate (mmbbls) 25.9<br />

Amilcar Permit (including Hasdrubal<br />

discovery)<br />

BG is operator <strong>and</strong> joint permit holder<br />

with Enterprise Tunisienne D’Activités<br />

Pétroliéres (ETAP), the Tunisian state-owned<br />

petroleum company, of the Amilcar<br />

exploration permit, offshore Sfax in the<br />

Gulf of Gabes. BG funds 100% of the<br />

exploration costs, which can be recovered<br />

to the extent that ETAP exercises its<br />

right to participate in any subsequent<br />

production concession. ETAP’s<br />

participation right is limited to a 50%<br />

interest in the production concession<br />

concerned.<br />

BG drilled its first appraisal well,<br />

Hasdrubal-3, in June 1997, which flowed<br />

at 21 mmscfd. A further appraisal well,<br />

Hasdrubal-4, drilled in June 1998, flowed<br />

4.6 mmscfd <strong>and</strong> 1 800 bopd from a single<br />

drill stem test.<br />

During 2002, BG drilled a further<br />

appraisal well, Hasdrubal-SW1, which<br />

tested light oil <strong>and</strong> confirmed the<br />

extension of the Hasdrubal field to the<br />

south-west.<br />

BG is currently working on the<br />

development options for this gas <strong>and</strong><br />

condensate discovery.<br />

Hasdrubal discovery<br />

– estimated original gross field reserves<br />

Gas (bcf) 250<br />

Condensate (mmbbls) 20<br />

Ulysse Permit<br />

The Ulysse exploration permit was<br />

awarded to BG, the operator, <strong>and</strong> ETAP in<br />

March 1997 <strong>and</strong> subsequently extended<br />

to March 2003. 3D seismic surveys were<br />

acquired in 1997 <strong>and</strong> 2001. At Amilcar,<br />

BG funds 100% of the exploration costs,<br />

which can be recovered to the extent<br />

that ETAP exercises its right to participate<br />

(up to 50%) in any subsequent<br />

production concession. The permit has<br />

been extended until a decision has been<br />

reached regarding its renewal, which<br />

would include an extension of 900 sq km<br />

together with a programme of seismic<br />

<strong>and</strong> drilling. A decision is anticipated in<br />

September 2003.<br />

ATLANTIC, EUROPE AND MEDITERRANEAN BASIN TUNISIA 45<br />

DOWNSTREAM<br />

Barca Power<br />

In May 2003, BG signed a MoA with the<br />

Government of Tunisia in relation to<br />

the development of the $250 million<br />

proposed Barca Power project in Tunisia.<br />

The 500 MW CCGT plant will be built<br />

adjacent to BG’s Hannibal processing<br />

site. The plant will use up to 120 mmscfd<br />

of unprocessed gas reserves from BG’s<br />

offshore interests, allowing BG to increase<br />

its annual gas sales. Construction of the<br />

power plant is scheduled to begin in the<br />

third quarter of 2004, with full commercial<br />

operation expected in late 2006.<br />

The MoA for Barca Power also includes<br />

BG’s intention to install a Liquefied<br />

Petroleum Gas (LPG) plant at the<br />

Hannibal site to supply the Tunisian<br />

market. LPG would be bottled <strong>and</strong><br />

distributed by a local Tunisian company.<br />

BG is also progressing the construction<br />

of a 67 km pipeline from Hannibal<br />

to La Skhira, to transport condensate<br />

produced in Miskar <strong>and</strong> eventually<br />

from Hasdrubal.