Sorted by Commenter - Ethics - State of California

Sorted by Commenter - Ethics - State of California

Sorted by Commenter - Ethics - State of California

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

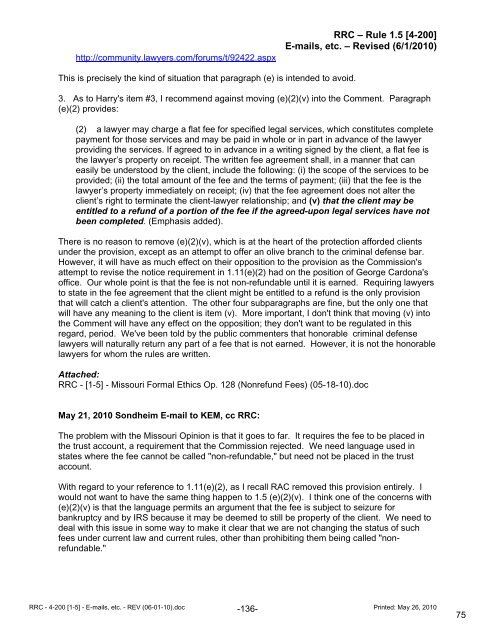

http://community.lawyers.com/forums/t/92422.aspx<br />

This is precisely the kind <strong>of</strong> situation that paragraph (e) is intended to avoid.<br />

RRC – Rule 1.5 [4-200]<br />

E-mails, etc. – Revised (6/1/2010)<br />

3. As to Harry's item #3, I recommend against moving (e)(2)(v) into the Comment. Paragraph<br />

(e)(2) provides:<br />

(2) a lawyer may charge a flat fee for specified legal services, which constitutes complete<br />

payment for those services and may be paid in whole or in part in advance <strong>of</strong> the lawyer<br />

providing the services. If agreed to in advance in a writing signed <strong>by</strong> the client, a flat fee is<br />

the lawyer’s property on receipt. The written fee agreement shall, in a manner that can<br />

easily be understood <strong>by</strong> the client, include the following: (i) the scope <strong>of</strong> the services to be<br />

provided; (ii) the total amount <strong>of</strong> the fee and the terms <strong>of</strong> payment; (iii) that the fee is the<br />

lawyer’s property immediately on receipt; (iv) that the fee agreement does not alter the<br />

client’s right to terminate the client-lawyer relationship; and (v) that the client may be<br />

entitled to a refund <strong>of</strong> a portion <strong>of</strong> the fee if the agreed-upon legal services have not<br />

been completed. (Emphasis added).<br />

There is no reason to remove (e)(2)(v), which is at the heart <strong>of</strong> the protection afforded clients<br />

under the provision, except as an attempt to <strong>of</strong>fer an olive branch to the criminal defense bar.<br />

However, it will have as much effect on their opposition to the provision as the Commission's<br />

attempt to revise the notice requirement in 1.11(e)(2) had on the position <strong>of</strong> George Cardona's<br />

<strong>of</strong>fice. Our whole point is that the fee is not non-refundable until it is earned. Requiring lawyers<br />

to state in the fee agreement that the client might be entitled to a refund is the only provision<br />

that will catch a client's attention. The other four subparagraphs are fine, but the only one that<br />

will have any meaning to the client is item (v). More important, I don't think that moving (v) into<br />

the Comment will have any effect on the opposition; they don't want to be regulated in this<br />

regard, period. We've been told <strong>by</strong> the public commenters that honorable criminal defense<br />

lawyers will naturally return any part <strong>of</strong> a fee that is not earned. However, it is not the honorable<br />

lawyers for whom the rules are written.<br />

Attached:<br />

RRC - [1-5] - Missouri Formal <strong>Ethics</strong> Op. 128 (Nonrefund Fees) (05-18-10).doc<br />

May 21, 2010 Sondheim E-mail to KEM, cc RRC:<br />

The problem with the Missouri Opinion is that it goes to far. It requires the fee to be placed in<br />

the trust account, a requirement that the Commission rejected. We need language used in<br />

states where the fee cannot be called "non-refundable," but need not be placed in the trust<br />

account.<br />

With regard to your reference to 1.11(e)(2), as I recall RAC removed this provision entirely. I<br />

would not want to have the same thing happen to 1.5 (e)(2)(v). I think one <strong>of</strong> the concerns with<br />

(e)(2)(v) is that the language permits an argument that the fee is subject to seizure for<br />

bankruptcy and <strong>by</strong> IRS because it may be deemed to still be property <strong>of</strong> the client. We need to<br />

deal with this issue in some way to make it clear that we are not changing the status <strong>of</strong> such<br />

fees under current law and current rules, other than prohibiting them being called "nonrefundable."<br />

RRC - 4-200 [1-5] - E-mails, etc. - REV (06-01-10).doc -136-<br />

Printed: May 26, 2010<br />

75

![Proposed Rule 4.1 [N/A] “Truthfulness in Statements to Others” - Ethics](https://img.yumpu.com/19037854/1/190x245/proposed-rule-41-n-a-truthfulness-in-statements-to-others-ethics.jpg?quality=85)