Sorted by Commenter - Ethics - State of California

Sorted by Commenter - Ethics - State of California

Sorted by Commenter - Ethics - State of California

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

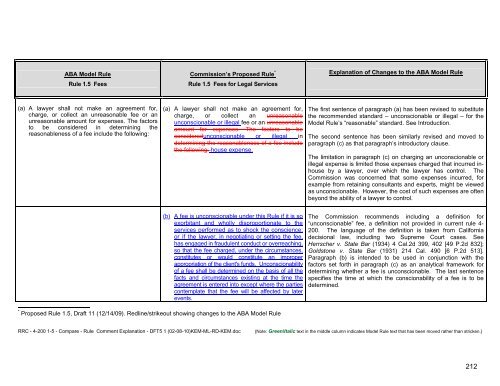

ABA Model Rule<br />

Rule 1.5 Fees<br />

(a) A lawyer shall not make an agreement for,<br />

charge, or collect an unreasonable fee or an<br />

unreasonable amount for expenses. The factors<br />

to be considered in determining the<br />

reasonableness <strong>of</strong> a fee include the following:<br />

Commission’s Proposed Rule *<br />

Rule 1.5 Fees for Legal Services<br />

(a) A lawyer shall not make an agreement for,<br />

charge, or collect an unreasonable<br />

unconscionable or illegal fee or an unreasonable<br />

amount for expenses. The factors to be<br />

consideredunconscionable or illegal in<br />

determining the reasonableness <strong>of</strong> a fee include<br />

the following:-house expense.<br />

(b) A fee is unconscionable under this Rule if it is so<br />

exorbitant and wholly disproportionate to the<br />

services performed as to shock the conscience;<br />

or if the lawyer, in negotiating or setting the fee,<br />

has engaged in fraudulent conduct or overreaching,<br />

so that the fee charged, under the circumstances,<br />

constitutes or would constitute an improper<br />

appropriation <strong>of</strong> the client's funds. Unconscionability<br />

<strong>of</strong> a fee shall be determined on the basis <strong>of</strong> all the<br />

facts and circumstances existing at the time the<br />

agreement is entered into except where the parties<br />

contemplate that the fee will be affected <strong>by</strong> later<br />

events.<br />

* Proposed Rule 1.5, Draft 11 (12/14/09). Redline/strikeout showing changes to the ABA Model Rule<br />

Explanation <strong>of</strong> Changes to the ABA Model Rule<br />

The first sentence <strong>of</strong> paragraph (a) has been revised to substitute<br />

the recommended standard – unconscionable or illegal – for the<br />

Model Rule’s “reasonable” standard. See Introduction.<br />

The second sentence has been similarly revised and moved to<br />

paragraph (c) as that paragraph’s introductory clause.<br />

The limitation in paragraph (c) on charging an unconscionable or<br />

illegal expense is limited those expenses charged that incurred inhouse<br />

<strong>by</strong> a lawyer, over which the lawyer has control. The<br />

Commission was concerned that some expenses incurred, for<br />

example from retaining consultants and experts, might be viewed<br />

as unconscionable. However, the cost <strong>of</strong> such expenses are <strong>of</strong>ten<br />

beyond the ability <strong>of</strong> a lawyer to control.<br />

The Commission recommends including a definition for<br />

“unconscionable” fee, a definition not provided in current rule 4-<br />

200. The language <strong>of</strong> the definition is taken from <strong>California</strong><br />

decisional law, including two Supreme Court cases. See<br />

Herrscher v. <strong>State</strong> Bar (1934) 4 Cal.2d 399, 402 [49 P.2d 832];<br />

Goldstone v. <strong>State</strong> Bar (1931) 214 Cal. 490 [6 P.2d 513].<br />

Paragraph (b) is intended to be used in conjunction with the<br />

factors set forth in paragraph (c) as an analytical framework for<br />

determining whether a fee is unconscionable. The last sentence<br />

specifies the time at which the conscionability <strong>of</strong> a fee is to be<br />

determined.<br />

RRC - 4-200 1-5 - Compare - Rule Comment Explanation - DFT5 1 (02-08-10)KEM-ML-RD-KEM.doc {Note: Green/Italic text in the middle column indicates Model Rule text that has been moved rather than stricken.}<br />

212

![Proposed Rule 4.1 [N/A] “Truthfulness in Statements to Others” - Ethics](https://img.yumpu.com/19037854/1/190x245/proposed-rule-41-n-a-truthfulness-in-statements-to-others-ethics.jpg?quality=85)