New Representatives all Score Tags LOA 0-3 - Avon the beauty of ...

New Representatives all Score Tags LOA 0-3 - Avon the beauty of ...

New Representatives all Score Tags LOA 0-3 - Avon the beauty of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

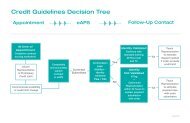

<strong>New</strong> <strong>Representatives</strong> <strong>all</strong> <strong>Score</strong> <strong>Tags</strong> <strong>LOA</strong> 0-3 & 4-6<br />

Credit Guidelines<br />

<strong>New</strong> <strong>Representatives</strong> should be made aware <strong>of</strong> <strong>the</strong>ir Credit Limit and<br />

deposit requirements at time <strong>of</strong> appointment and again at Training Contact<br />

2, to minimize <strong>the</strong> occurrence <strong>of</strong> over limit hold orders. If <strong>the</strong><br />

Representative will be sending in an order that puts her account balance<br />

over her Credit Limit, she should be informed <strong>of</strong> <strong>the</strong> required deposit<br />

amount and encouraged to send in that deposit with <strong>the</strong> order. This will<br />

avoid her order being held because it is over her credit limit. .<br />

All fields <strong>of</strong> <strong>the</strong> Representative Contract must be completed and accurately<br />

filled out to insure <strong>the</strong> Representative is tagged properly. <strong>Avon</strong> cannot<br />

change or rescore a new Representative if she is tagged incorrectly as a<br />

result <strong>of</strong> a Contract error.<br />

FAQ’s<br />

(Frequently Asked Questions)<br />

1. What are <strong>the</strong> new credit guidelines starting in C21 <strong>LOA</strong> 0-3? <strong>New</strong> credit limits have<br />

been established for M, G & E score tags <strong>LOA</strong> 0-3. M - $200, G - $300 & E - $400. U &<br />

L scoretags will remain at $100 credit limit. If a new Representative has an order which<br />

is over <strong>the</strong>ir credit limit, <strong>the</strong>y will be required to send in a deposit for <strong>the</strong> amount over<br />

<strong>the</strong>ir credit limit when <strong>the</strong>y submit <strong>the</strong>ir order. If a deposit is not sent in with <strong>the</strong> new<br />

<strong>Representatives</strong> order and <strong>the</strong> order is over <strong>the</strong> credit limit her order will go on a “C” list<br />

hold.<br />

2. What are <strong>the</strong> credit guidelines for new <strong>Representatives</strong> starting in C21 <strong>LOA</strong> 4-6? In<br />

<strong>the</strong> new <strong>Representatives</strong> 4 th to 6 th Campaign <strong>the</strong> U & L score tags will remain at $100<br />

credit limit, M - $300, G- $400 & E- $500. <strong>New</strong> <strong>Representatives</strong> in <strong>LOA</strong> 4-6 who send<br />

in orders that are over <strong>the</strong>ir credit limit, <strong>the</strong>ir order will go on “A” list hold. See <strong>the</strong><br />

revised Contract Scoring worksheet for details <strong>of</strong> <strong>the</strong> credit limits for <strong>all</strong> score tags.<br />

3. How will a new Representative know what <strong>the</strong>ir credit limit is? A new Representative<br />

will know <strong>the</strong>ir credit limit in two ways. 1) At time <strong>of</strong> Appointment <strong>the</strong> Appointment<br />

maker will complete <strong>the</strong> Credit Scoring Worksheet and let <strong>the</strong> new Representative know<br />

what her credit limit is. 2) When a new Representative logs on to youravon.com she will<br />

see a new Landing page geared for new <strong>Representatives</strong> only. The new Representative<br />

will see her initial credit limit displayed in <strong>the</strong> box to <strong>the</strong> right on <strong>the</strong> home page along<br />

with contact information <strong>of</strong> <strong>the</strong> new <strong>Representatives</strong> Upline and District Manager.<br />

4. Does a new Representative need to send in a deposit with add on orders that are<br />

over credit limit? Yes, <strong>all</strong> new <strong>Representatives</strong> are required to send in a deposit with<br />

every order that puts <strong>the</strong> Representative’s account balance over <strong>the</strong>ir credit limit<br />

regardless if it is a regular campaign order or an add-on order. Example: C-9 has no

previous balance. If <strong>the</strong> Representative sends in a regular C-9 order <strong>of</strong> $400 (net sales),<br />

and her credit limit is $100, <strong>the</strong> Representative would be required to send in $300 deposit<br />

with <strong>the</strong> C-9 order, leaving a balance <strong>of</strong> $100. If an add-on order is placed in C9 for $150<br />

(net sales), <strong>the</strong> balance would be $250 (add-on order <strong>of</strong> $150 plus prior balance <strong>of</strong> $100).<br />

The new Representative would be required to send in a deposit <strong>of</strong> $150 with <strong>the</strong> C-9 addon<br />

order, leaving a balance <strong>of</strong> $100.<br />

5. When a new Representative c<strong>all</strong>s a Customer Care Specialist, will <strong>the</strong> specialist be<br />

able to tell <strong>the</strong> new Representative how much <strong>the</strong>y are required to send in for a<br />

deposit? No, <strong>the</strong> Customer Care Specialists are aware <strong>of</strong> <strong>the</strong> Credit guidelines however<br />

<strong>the</strong>y do not have <strong>the</strong> deposit details to share with new <strong>Representatives</strong>. Customer Care<br />

Specialists can give <strong>the</strong> Representative her account balance, and let her know she has an<br />

order on hold and she will need to pay everything over her credit limit amount.<br />

Communicating <strong>the</strong> Hold order policy in advance at <strong>the</strong> time <strong>of</strong> appointment is <strong>the</strong> sole<br />

responsibility <strong>of</strong> <strong>the</strong> Appointment maker. Customer Care Specialists will direct <strong>the</strong> new<br />

Representative to contact her District Manager. A new Representative should be told <strong>of</strong><br />

her credit limit at time <strong>of</strong> appointment and again at Training Contact 2. It is <strong>the</strong><br />

Appointment maker’s responsibility to notify <strong>the</strong> new Representative <strong>of</strong> her credit limit.<br />

Please refer to <strong>the</strong> training documents, “Contract Scoring Worksheet,” “Contract Scoring<br />

Worksheet Instructions,” and “For Appointment Makers Only,” to ensure that <strong>the</strong> new<br />

Representative is receiving <strong>the</strong> correct credit guidelines for her specific score tag. At<br />

Training Contact 2, before <strong>the</strong> <strong>Representatives</strong> first order submission, <strong>the</strong> Appointment<br />

maker may assist in estimating how much <strong>of</strong> a deposit is required for <strong>the</strong> new<br />

Representative to send in with her first order. Refer to <strong>the</strong> worksheet on page 2 <strong>of</strong> <strong>the</strong><br />

training document, “For Appointment Makers Only.”<br />

6. When an order goes on a “C” list hold for over credit limit, will <strong>the</strong> order<br />

automatic<strong>all</strong>y be released when <strong>the</strong> deposit is posted to <strong>the</strong> Representative’s<br />

Account? No, <strong>the</strong> order will not automatic<strong>all</strong>y be released when <strong>the</strong> deposit is posted to<br />

<strong>the</strong> new Representative’s account. However to support DSM’s with Hold Orders, Credit<br />

will run a report six times daily to show any over limit “C” list hold orders where<br />

payment has posted. The Credit Agents will review <strong>the</strong>se reports and if <strong>the</strong> entire overlimit<br />

amount posts to <strong>the</strong> account, <strong>the</strong>y will release <strong>the</strong> order. DSM/Admin’s should<br />

review <strong>the</strong>ir “C” Hold Order and <strong>all</strong>ow 4 hours from <strong>the</strong> time <strong>the</strong> payment posts for <strong>the</strong><br />

order to be released. Credit Agents will contact DSM/ DSM Administrative Helper by<br />

voicemail and e-mail where insufficient payment has posted. DSM/DSM Administrative<br />

Helper will need to contact new <strong>Representatives</strong> to expedite payment. As with any hold<br />

order, if not released after10 business days <strong>the</strong> order will cancel.<br />

Note: To avoid <strong>the</strong> Representative’s order going to “C” list hold, please inform <strong>the</strong> new<br />

Representative <strong>of</strong> <strong>the</strong> importance <strong>of</strong> including <strong>the</strong> required deposit in her regular and addon<br />

orders. This will save precious time and effort on everyone’s part.<br />

7. With <strong>the</strong> new over limit “C” hold order policy will this have any affect on <strong>the</strong> way I<br />

review o<strong>the</strong>r Hold orders today? No, DSM/DSM Administrative Helper will still need<br />

to review and resolve issues around o<strong>the</strong>r Hold orders on a daily basis.

8. How does a new Representative pay a deposit if <strong>the</strong> balance amount is “0”? A new<br />

Representative can pay <strong>the</strong> deposit with her credit card or QuikPay, through Fast Talk,<br />

yourAVON.com or mail a money order to her specific Branch location. All new<br />

<strong>Representatives</strong> who score a "U" tag must pay by credit card, cashiers check or money order for<br />

<strong>the</strong> first six Campaigns. After six Campaigns <strong>the</strong> account may qualify for review by <strong>the</strong> District<br />

Manager to be removed from NPC (No Personal Check) status, which will enable payment by<br />

check or QuikPay.<br />

DSM’s Only<br />

9. If I do not know your password for <strong>the</strong> Automated Hold Order Release System, who<br />

do I c<strong>all</strong>? C<strong>all</strong> <strong>the</strong> Regional Support Center (RSC) at 1-866-389-2866 to obtain or<br />

change your password.