Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

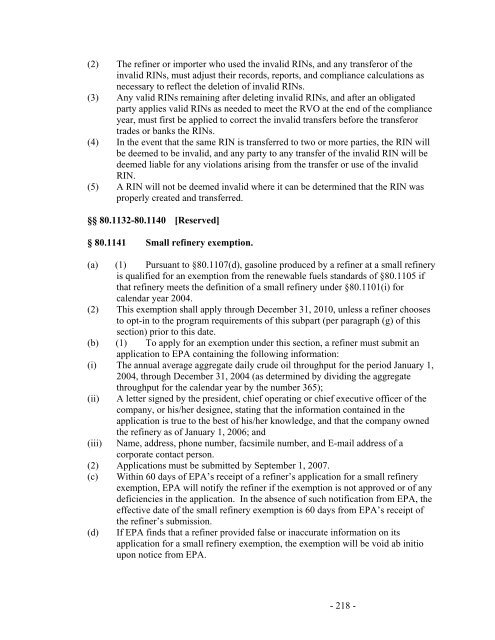

(2) The refiner or importer who used the invalid RINs, <strong>and</strong> any transferor <strong>of</strong> the<br />

invalid RINs, must adjust their records, reports, <strong>and</strong> compliance calculations as<br />

necessary to reflect the deletion <strong>of</strong> invalid RINs.<br />

(3) Any valid RINs remaining after deleting invalid RINs, <strong>and</strong> after an obligated<br />

party applies valid RINs as needed to meet the RVO at the end <strong>of</strong> the compliance<br />

year, must first be applied to correct the invalid transfers before the transferor<br />

trades or banks the RINs.<br />

(4) In the event that the same RIN is transferred to two or more parties, the RIN will<br />

be deemed to be invalid, <strong>and</strong> any party to any transfer <strong>of</strong> the invalid RIN will be<br />

deemed liable for any violations arising from the transfer or use <strong>of</strong> the invalid<br />

RIN.<br />

(5) A RIN will not be deemed invalid where it can be determined that the RIN was<br />

properly created <strong>and</strong> transferred.<br />

§§ 80.1132-80.1140 [Reserved]<br />

§ 80.1141 Small refinery exemption.<br />

(a) (1) Pursuant to §80.1107(d), gasoline produced by a refiner at a small refinery<br />

is qualified for an exemption from the renewable fuels st<strong>and</strong>ards <strong>of</strong> §80.1105 if<br />

that refinery meets the definition <strong>of</strong> a small refinery under §80.1101(i) for<br />

calendar year 2004.<br />

(2) This exemption shall apply through December 31, 2010, unless a refiner chooses<br />

to opt-in to the program requirements <strong>of</strong> this subpart (per paragraph (g) <strong>of</strong> this<br />

section) prior to this date.<br />

(b) (1) To apply for an exemption under this section, a refiner must submit an<br />

application to EPA containing the following information:<br />

(i) The annual average aggregate daily crude oil throughput for the period January 1,<br />

2004, through December 31, 2004 (as determined by dividing the aggregate<br />

throughput for the calendar year by the number 365);<br />

(ii) A letter signed by the president, chief operating or chief executive <strong>of</strong>ficer <strong>of</strong> the<br />

company, or his/her designee, stating that the information contained in the<br />

application is true to the best <strong>of</strong> his/her knowledge, <strong>and</strong> that the company owned<br />

the refinery as <strong>of</strong> January 1, 2006; <strong>and</strong><br />

(iii) Name, address, phone number, facsimile number, <strong>and</strong> E-mail address <strong>of</strong> a<br />

corporate contact person.<br />

(2) Applications must be submitted by September 1, 2007.<br />

(c) Within 60 days <strong>of</strong> EPA’s receipt <strong>of</strong> a refiner’s application for a small refinery<br />

exemption, EPA will notify the refiner if the exemption is not approved or <strong>of</strong> any<br />

deficiencies in the application. In the absence <strong>of</strong> such notification from EPA, the<br />

effective date <strong>of</strong> the small refinery exemption is 60 days from EPA’s receipt <strong>of</strong><br />

the refiner’s submission.<br />

(d) If EPA finds that a refiner provided false or inaccurate information on its<br />

application for a small refinery exemption, the exemption will be void ab initio<br />

upon notice from EPA.<br />

- 218 -