Fall 2009 (pdf) - Alumni - University of St. Thomas

Fall 2009 (pdf) - Alumni - University of St. Thomas Fall 2009 (pdf) - Alumni - University of St. Thomas

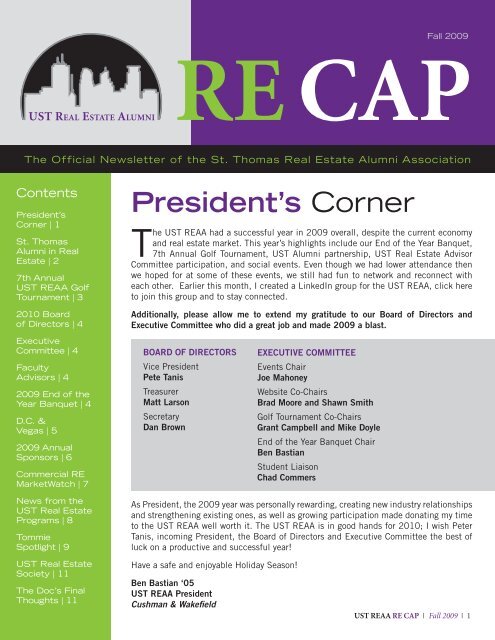

The UST REAA had a successful year in 2009 overall, despite the current economy and real estate market. This year’s highlights include our End of the Year Banquet, 7th Annual Golf Tournament, UST Alumni partnership, UST Real Estate Advisor Committee participation, and social events. Even though we had lower attendance then we hoped for at some of these events, we still had fun to network and reconnect with each other. Earlier this month, I created a LinkedIn group for the UST REAA, click here to join this group and to stay connected. Additionally, please allow me to extend my gratitude to our Board of Directors and Executive Committee who did a great job and made 2009 a blast. As President, the 2009 year was personally rewarding, creating new industry relationships and strengthening existing ones, as well as growing participation made donating my time to the UST REAA well worth it. The UST REAA is in good hands for 2010; I wish Peter Tanis, incoming President, the Board of Directors and Executive Committee the best of luck on a productive and successful year! Have a safe and enjoyable Holiday Season! Ben Bastian ‘05 UST REAA President Cushman & Wakefi eld RE CAPFall 2009 The Official Newsletter of the St. Thomas Real Estate Alumni Association Contents President’s Corner | 1 St. Thomas Alumni in Real Estate | 2 7th Annual UST REAA Golf Tournament | 3 2010 Board of Directors | 4 Executive Committee | 4 Faculty Advisors | 4 2009 End of the Year Banquet | 4 D.C. & Vegas | 5 2009 Annual Sponsors | 6 Commercial RE MarketWatch | 7 News from the UST Real Estate Programs | 8 Tommie Spotlight | 9 UST Real Estate Society | 11 The Doc’s Final Thoughts | 11 President’s Corner BOARD OF DIRECTORS Vice President Pete Tanis Treasurer Matt Larson Secretary Dan Brown EXECUTIVE COMMITTEE Events Chair Joe Mahoney Website Co-Chairs Brad Moore and Shawn Smith Golf Tournament Co-Chairs Grant Campbell and Mike Doyle End of the Year Banquet Chair Ben Bastian Student Liaison Chad Commers UST REAA RE CAP | Fall 2009 | 1

- Page 2 and 3: St. Thomas Alumni in Real Estate Th

- Page 4 and 5: 2009 End of the Year Banquet Mike S

- Page 6 and 7: As David Kelley writes in The New I

- Page 8 and 9: News from the University of St. Tho

- Page 10 and 11: THE UNIVERSITY OF ST. THOMAS and OP

- Page 12: Overall Capital Markets: Liquidity

The UST REAA had a successful year in <strong>2009</strong> overall, despite the current economy<br />

and real estate market. This year’s highlights include our End <strong>of</strong> the Year Banquet,<br />

7th Annual Golf Tournament, UST <strong>Alumni</strong> partnership, UST Real Estate Advisor<br />

Committee participation, and social events. Even though we had lower attendance then<br />

we hoped for at some <strong>of</strong> these events, we still had fun to network and reconnect with<br />

each other. Earlier this month, I created a LinkedIn group for the UST REAA, click here<br />

to join this group and to stay connected.<br />

Additionally, please allow me to extend my gratitude to our Board <strong>of</strong> Directors and<br />

Executive Committee who did a great job and made <strong>2009</strong> a blast.<br />

As President, the <strong>2009</strong> year was personally rewarding, creating new industry relationships<br />

and strengthening existing ones, as well as growing participation made donating my time<br />

to the UST REAA well worth it. The UST REAA is in good hands for 2010; I wish Peter<br />

Tanis, incoming President, the Board <strong>of</strong> Directors and Executive Committee the best <strong>of</strong><br />

luck on a productive and successful year!<br />

Have a safe and enjoyable Holiday Season!<br />

Ben Bastian ‘05<br />

UST REAA President<br />

Cushman & Wakefi eld<br />

RE CAP<strong>Fall</strong><br />

<strong>2009</strong><br />

The Official Newsletter <strong>of</strong> the <strong>St</strong>. <strong>Thomas</strong> Real Estate <strong>Alumni</strong> Association<br />

Contents<br />

President’s<br />

Corner | 1<br />

<strong>St</strong>. <strong>Thomas</strong><br />

<strong>Alumni</strong> in Real<br />

Estate | 2<br />

7th Annual<br />

UST REAA Golf<br />

Tournament | 3<br />

2010 Board<br />

<strong>of</strong> Directors | 4<br />

Executive<br />

Committee | 4<br />

Faculty<br />

Advisors | 4<br />

<strong>2009</strong> End <strong>of</strong> the<br />

Year Banquet | 4<br />

D.C. &<br />

Vegas | 5<br />

<strong>2009</strong> Annual<br />

Sponsors | 6<br />

Commercial RE<br />

MarketWatch | 7<br />

News from the<br />

UST Real Estate<br />

Programs | 8<br />

Tommie<br />

Spotlight | 9<br />

UST Real Estate<br />

Society | 11<br />

The Doc’s Final<br />

Thoughts | 11<br />

President’s Corner<br />

BOARD OF DIRECTORS<br />

Vice President<br />

Pete Tanis<br />

Treasurer<br />

Matt Larson<br />

Secretary<br />

Dan Brown<br />

EXECUTIVE COMMITTEE<br />

Events Chair<br />

Joe Mahoney<br />

Website Co-Chairs<br />

Brad Moore and Shawn Smith<br />

Golf Tournament Co-Chairs<br />

Grant Campbell and Mike Doyle<br />

End <strong>of</strong> the Year Banquet Chair<br />

Ben Bastian<br />

<strong>St</strong>udent Liaison<br />

Chad Commers<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 1

<strong>St</strong>. <strong>Thomas</strong> <strong>Alumni</strong> in Real Estate<br />

The <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong> has produced several outstanding pr<strong>of</strong>essionals that work in the real estate<br />

industry. Below are 202 individuals on our distribution list that went to UST for undergrad, graduate, mini-<br />

MBA or law school. Take a look at the list and see who you know. We are always looking to expand our<br />

distribution list, please email any additions to Ben Bastian at benjamin.bastian@cushwake.com and make<br />

sure to join the UST REAA group on LinkedIn. Click here to view the group.<br />

Jesse Amundson ....2008<br />

Scott Anderson ......2003<br />

Markus Anderson ...2006<br />

Nick Anderson .......2007<br />

Ben Applebaum .....2004<br />

Peter Austin ..........1982<br />

Aaron Barnard .......1992<br />

Dave Barr ............. 1995<br />

Ben Bastian ..........2005<br />

Luigi Bernardi .......1985<br />

Dominic<br />

Berntson .............. 1997<br />

Mike Bisanz ......... 2010<br />

Alex Broderick ...... 2008<br />

Angela Brown ........2004<br />

Dan Brown ............2006<br />

Will Buckley ..........2006<br />

Tom Burton ...........1986<br />

Kristin Bush ......... <strong>2009</strong><br />

Grant Campbell .... 2006<br />

Chuck Caturia .......1973<br />

Andy Chana.......... 2001<br />

John Chirhart ....... 1994<br />

Jim Clifford ...........1977<br />

Keith Collins .........1989<br />

Eric Colmark .........2008<br />

Chuck<br />

Commerford ..........2001<br />

Chad Commers ......<strong>2009</strong><br />

Bill Cosgriff ...........2008<br />

Chris Courneya ..... 2006<br />

Courtney Cove .......2003<br />

Adam Cozine .........2006<br />

Bill Crawford .........1975<br />

David Daly ............2006<br />

Katie Demko ........ 2008<br />

Joe Dixon ..............2010<br />

Andy Donahue .......2005<br />

Mike Doyle ............2007<br />

Gerald Driessen .....1985<br />

Vishal Dutt ....................<br />

Mike Dwyer ...........1977<br />

2 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

<strong>St</strong>ephen Eggert ..... 1982<br />

Jon Engel ..............2007<br />

Garrett Farmer ...... 2000<br />

Jon Farnsworth ......2008<br />

Ben Fazendin ........2004<br />

John Flaherty ........1974<br />

Mike Galvin Jr. ......2007<br />

Jim Gearen ...........1983<br />

Joe Gearen ............1992<br />

Shannon Gherty .....2008<br />

Michael Gifford .... <strong>2009</strong><br />

David Glass ...........<strong>2009</strong><br />

Dan Gleason ..........1988<br />

Ben Glover ............2003<br />

Lucas Goring .........2002<br />

Chris Grabek .........2000<br />

Natalie Gregoire ....2006<br />

Kelsey Gregory.......2008<br />

Max Grinberg.........2010<br />

Tom Hildman ....... 2005<br />

Tom Hamilton....... 2000<br />

Alyssa Hamilton.....<strong>2009</strong><br />

Tim Hassett ...........1976<br />

Tim Haugen ......... 2003<br />

Brandon Hedges<br />

Chad Heer............ 1995<br />

Jen Helm ..............2002<br />

Erik Heltne ...........2008<br />

Jake Hendricks ......2008<br />

Greg Hennes ........ 1985<br />

Bill Herber ............1975<br />

Chris Hickok .........1987<br />

Andrea Hilgren ......2001<br />

Mike Honsa ...........2000<br />

Emily Howell .........2007<br />

Tina Hoye ..............1980<br />

Chris Huntley ........1999<br />

Tom Immen ...........1986<br />

Frank Jermusek .....1998<br />

Katie Jetland .........2007<br />

Rory Johnson.........2001<br />

Cory Judge ............2003<br />

Mike Julius ...........1975<br />

Jon Just ................2004<br />

Matt Karl ..............1987<br />

Katie Kieffer .........2005<br />

Rob Kimball ..........1983<br />

Terry Kingston .......1973<br />

Tim Kleiman..........<strong>2009</strong><br />

Jessi Klein ............2006<br />

Paul Knapp ...........1981<br />

Michael Krediet .....2001<br />

Brian Kruesi ..........2002<br />

Rick Kunkel ..........1980<br />

Dustin LaFavre ......2005<br />

Becky Landon .......2002<br />

Frank Lang ............<strong>2009</strong><br />

Tony Lang .............2007<br />

Matt Larson...........2006<br />

Danielle L<strong>of</strong>fl er ......2006<br />

<strong>St</strong>eve Lysen ...........1991<br />

Joe Mahoney .........2006<br />

Kelsey Malecha .....2007<br />

SaraBeth Mantia ....2004<br />

Tim Mardell ...........1971<br />

Mike Marinovich ....1993<br />

Luke Maupin .........2006<br />

Ryan Maurer ........ 1999<br />

Rob McCready .......1990<br />

Mike McEllistrem ...1979<br />

Kelcey McKean .....2007<br />

Moraghan<br />

McKenna ..............2007<br />

Amy Melchior ........1983<br />

<strong>St</strong>eve Miller.......... 2006<br />

Jeff Minea.............1983<br />

Tommy Moe ........ 1998<br />

<strong>St</strong>eph Molloy .........2001<br />

Brad Moore ...........2003<br />

Shawn Moore ........2004<br />

Peter Mork ............1994<br />

Dan Mossey...........2006<br />

Matt Mullins ........ 2005<br />

Tim Murnane .........1981<br />

Tom Musil .............1980<br />

Marc Nanne ......... 1986<br />

Adam Nathe ......... 1993<br />

Tony Navarro .........1969<br />

Nate Nelson ..........2006<br />

Dennis Nesser .......1965<br />

<strong>St</strong>eve Nilsson ....... 1995<br />

Brett Olson .......... 2005<br />

Dave Olson ........... 2006<br />

Chris Olson .......... 2008<br />

Jill Olson ..............<strong>2009</strong><br />

William Ostlund .....1994<br />

Kate Ostlund .........2003<br />

Joe Owen ..............2005<br />

Alexandra Paige<br />

Trapper .................<strong>2009</strong><br />

Chelsea<br />

Parenteau .............2007<br />

Ron Peltier ........... 1973<br />

Tim Peters ............1988<br />

Brad Pfaff ............ 1987<br />

Matt Pike ..............2007<br />

Rick Plessner ........1973<br />

Russ Popp ............2003<br />

Rome Poppler .......2003<br />

Michael Ramme ....2003<br />

Matt Rauenhorst ....2002<br />

Nick Reynolds .......1998<br />

Andy Richards .......2002<br />

Jon Riley...............1994<br />

Derek Rizzo ...........2003<br />

Colin Ryan ............2005<br />

John Ryden ...........1983<br />

Tim Rye ................2003<br />

Mike Salmen ........ 1987<br />

Rick Sand .............2006<br />

Dick Schadegg ......1974<br />

Tom Schrump ....... 2001<br />

Skye Schwing ....... 2008<br />

Jon Segner ........... 1997<br />

Paul Sevenich .......1984<br />

Matt Shapiro .........2005<br />

Tom Shaver ...........1984<br />

Pat Sheehan .........2007<br />

Frank Sherwood .....1983<br />

Clay Shultz .......... 2002<br />

Aaron Sillanpa .......2006<br />

<strong>St</strong>uart Simek ........ 1992<br />

Doug Simek ..........1995<br />

Phil Simonet .........1980<br />

Charlie Smoot .......2005<br />

Jim Soderberg .......1986<br />

Joe Springer ......... 1987<br />

David <strong>St</strong>alsberg .....2005<br />

Barbara <strong>St</strong>assart ....2007<br />

Linsey <strong>St</strong>ender ......2002<br />

Mike <strong>St</strong>etz ............2003<br />

Chris <strong>St</strong>ockness .....2002<br />

Bob <strong>St</strong>rachota .......1975<br />

Jase <strong>St</strong>umph .........2006<br />

Louis Suarez .........1997<br />

Peter Tanis ............2006<br />

Kelly Theis ............1985<br />

Jack Tornquist .......1999<br />

Herb Tousley .........2002<br />

Herb Tousley IV .....2001<br />

Leah Truax ............2005<br />

Teresa Tschida .......2007<br />

Vik Uppal ..............2006<br />

Bryan Van Ho<strong>of</strong> .....1992<br />

Tim Venne ............ 2008<br />

Nate Voss ............. 2005<br />

Peter Wehseler ......2006<br />

Casey Weiss ..........2006<br />

Dan Wicker .......... 1990<br />

Jenny Wietecki ..... 2001<br />

Adam Wilford ........2001<br />

Justin Wing ...........2006<br />

Jon Yanta ..............1985<br />

Ben Yarbrough .......<strong>2009</strong><br />

Joe Zimmerman .....1999

Grant Campbell ‘06<br />

Golf Tournament Co-Chair<br />

WelshInvest<br />

7 TH Annual<br />

UST REAA<br />

Golf<br />

Tournament<br />

On Tuesday, September 15th, over 45 business pr<strong>of</strong>essionals<br />

and <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong> alumni participated in the 7th<br />

Annual <strong>St</strong>. <strong>Thomas</strong> Real Estate <strong>Alumni</strong> Golf Tournament held<br />

at Braemar Golf Course in Edina, MN. An 18-hole scramble golf<br />

event was followed by a short program and dinner which highlighted<br />

on-going events and developments within the Real Estate <strong>Alumni</strong><br />

Association and the <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong>. The event provided<br />

a great opportunity for attendees to reconnect with old friends and<br />

expand their pr<strong>of</strong>essional network by meeting fellow supporters <strong>of</strong><br />

the <strong>St</strong>. <strong>Thomas</strong> Real Estate Program.<br />

In addition, through the generosity <strong>of</strong> our supporters, the <strong>University</strong> <strong>of</strong><br />

<strong>St</strong>. <strong>Thomas</strong> Real Estate <strong>Alumni</strong> Association was able to raise proceeds<br />

for two memorial scholarship funds set up on the behalf <strong>of</strong> Mr. Jon<br />

Just (’04) and Mr. Tom Hildman (’05).<br />

Mike Doyle ‘07, Rob Lunz, Brad Moore ‘03, Doug Wageman<br />

and Grant Campbell ’06, Ev <strong>St</strong>rand (not pictured)<br />

Congratulations to Brad Moore, Rob Lunz, Ev <strong>St</strong>rand<br />

(not pictured) and Doug Wageman who placed fi rst in the<br />

golf event and thank you to all those in attendance who<br />

helped make this year’s event truly a great experience.<br />

Your support allows the <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong> Real<br />

Estate <strong>Alumni</strong> Association to continue in its goal <strong>of</strong><br />

bringing together students, alumni, friends and partners<br />

<strong>of</strong> the <strong>University</strong>.<br />

Derek Engler ‘09, Erika Englebrecht ‘09,<br />

Jill Olson ‘09, David Glass ‘09<br />

We would like to give a special thank<br />

you to our sponsors who helped make<br />

this event possible:<br />

MINNESOTA REAL ESTATE JOURNAL<br />

BRIGGS AND MORGAN<br />

WELSH COMPANIES<br />

ROSEVILLE PROPERTIES<br />

OAK GROVE CAPITAL<br />

UST MS REAL ESTATE<br />

FIRST NATIONAL BANK BUILDING<br />

SHENEHON COMPANY<br />

DOMINIUM DEVELOPMENT &<br />

ACQUISITION<br />

OPUS<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 3

<strong>2009</strong> End <strong>of</strong> the Year<br />

Banquet<br />

Mike Salmen ‘87, Chris Simmons, Danny Commers and Tim Murnane ‘81<br />

Since 2005, our End <strong>of</strong> the Year Banquet has been held<br />

at Interlachen Country Club, and similar to years past<br />

we had a great night. On April 29, <strong>2009</strong> we had our<br />

7th annual event with approximately 65 attendees. Mike<br />

Salmen <strong>of</strong> Transwestern moderated the panel discussion.<br />

Panelists included Tim Murnane ’81 (Peak Partners), Danny<br />

Commers (Roseville Properties) and Chris Simmons (Welsh<br />

Companies). Discussions included industry trends and<br />

recommendations for students and young pr<strong>of</strong>essionals.<br />

Two students from the undergraduate real estate program<br />

were presented scholarship checks from funds the UST<br />

REAA has helped raise money for over the years. The Tom<br />

Hildman Memorial Scholarship recipient was Jeff Zicarelli<br />

and the USTREAA Jon Just Memorial Scholarship recipient<br />

was Mitch Irvin.<br />

Ben Bastian ‘05<br />

End <strong>of</strong> the Year Banquet Chair<br />

Cushman & Wakefi eld<br />

4 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

2010 Board <strong>of</strong> Directors<br />

PRESIDENT<br />

Pete Tanis | The C. Chase Company<br />

ptanis@cchaseco.com<br />

VICE PRESIDENT<br />

Grant Campbell | WelshInvest, LLC<br />

gcampbell@welshco.com<br />

TREASURER<br />

Mike <strong>St</strong>etz | Jones Lang LaSalle<br />

mike.stetz@am.jll.com<br />

SECRETARY<br />

Alyssa Hamilton | Mardell Partners<br />

ahamilton@mardellpartners.com<br />

IMMEDIATE PAST PRESIDENT<br />

Ben Bastian | Cushman & Wakefi eld<br />

Benjamin.bastian@cushwake.com<br />

Executive Committee<br />

GOLF COMMITTEE CO-CHAIRS<br />

Grant Campbell | WelshInvest, LLC<br />

gcampbell@welshco.com<br />

Tim Kleiman | Cushman & Wakefi eld<br />

tkleiman@fnbbuilding.com<br />

EVENTS CHAIR<br />

Brett Olson | Grandbridge Real Estate Capital<br />

bolson@gbrecap.com<br />

END OF THE YEAR BANQUET<br />

CO-CHAIRS<br />

Ben Bastian | Cushman & Wakefi eld<br />

Benjamin.bastian@cushwake.com<br />

Kelsey Malecha | Mardell Partners<br />

kmalecha@mardellpartners.com<br />

NEWSLETTER CHAIR<br />

Dan Brown | CBRE<br />

daniel.brown@cbre.com<br />

Kelsey Gregory | WelshInvest, LLC<br />

kgregory@welshco.com<br />

COMMUNICATION CHAIR<br />

Ryan Maurer | CBBurnet Realty<br />

ryanmaurer@hotmail.com<br />

UST REAA WEBSITE CHAIR<br />

Shawn Smith | WelshInvest, LLC<br />

srsmith@welshco.com<br />

STUDENT LIAISON<br />

Joe Dixon<br />

UST Real Estate Society President<br />

jsdixon@stthomas.edu<br />

Faculty Advisors<br />

PROFESSOR OF REAL ESTATE<br />

Tom Hamilton, Ph.D, CRE, FRICS<br />

twhamilton@stthomas.edu<br />

PROFESSOR OF REAL ESTATE<br />

Tom Musil, DPA<br />

tamusil@stthomas.edu<br />

DIRECTOR, SHENEHON<br />

CENTER FOR REAL ESTATE<br />

AND MS IN REAL ESTATE<br />

Herb Tousley<br />

hwtousley1@stthomas.edu<br />

DISTINGUISHED CHAIR<br />

OF REAL ESTATE<br />

George Karvel, Ph.D, CRE<br />

gkarvel@stthomas.edu

D.C. & Vegas: Listen to young people,<br />

voting with pocketbooks<br />

Sheldon Adelson, Chair <strong>of</strong> the Las Vegas Sands Corp.,<br />

is the perfect poster boy for Las Vegas’ fi nancial<br />

meltdown. The 76-year-old who was third on Forbes’<br />

list <strong>of</strong> the 400 Richest Americans in both 2007 &<br />

2008 has lost $36.5 billion dollars (91.25% <strong>of</strong> his net<br />

worth) – more than anyone else in the world has lost during<br />

this recession. While most retailers across the country are<br />

changing their tune, listening to their customers and providing<br />

products and services at lower prices while marketing their<br />

value, Adelson is staying the course.<br />

He may have achieved success through a combination <strong>of</strong> hard<br />

work, luck and persistence, but his stubborn insistence on<br />

sticking with the same strategy is killing his bottom line. On<br />

Aug. 24, <strong>2009</strong>, TIME magazine columnist, Joel <strong>St</strong>ein, shared<br />

his interviews with Adelson and other Vegas casino moguls: ‘he’s<br />

(Adelson’s) not changing his strategy <strong>of</strong> using high-end dining,<br />

giant suites and plush convention spaces to attract customers.<br />

He does not believe that America is going to fundamentally<br />

change its values from extravagance to thrift. “There’s no way<br />

this world will change. There’s no way people are going to stop<br />

doing things they want to do…,”’ he quotes Adelson.<br />

Adelson borrowed as much as he could as fast as he could<br />

and built, built, built. He added a micro-version <strong>of</strong> the Vegas<br />

<strong>St</strong>rip to his successful hotel and casino in Macao, China and<br />

also added 100% more space to the Venetian with the Palazzo<br />

addition. This aggressive borrowing and building strategy<br />

helped him rack up massive amounts <strong>of</strong> debt, and as <strong>St</strong>ein<br />

reports: “…he has accumulated a debt-to-earnings ratio <strong>of</strong> 6.8<br />

to 1 in the U.S. Then the loans stopped coming, and his stock<br />

price sank from $144 to $1.42 in March.”<br />

photo courtesy: http://www.workingworld.com/articles/Sheldon-Adelson-and-Las-Vegas-Sands<br />

I think Adelson is right in assuming that human nature isn’t<br />

going to change – people are always going to want certain<br />

pleasures. Las Vegas feeds and satisfi es many basic pleasures<br />

and desires for: attention, sex, the thrill <strong>of</strong> risk-taking and<br />

gambling, socializing and a euphoric sense <strong>of</strong> getting away<br />

from it all. Where I think Adelson goes wrong, is in assuming<br />

that Las Vegas is the only place where people can and will go<br />

to satisfy these pleasures.<br />

Most <strong>of</strong> the aforementioned human desires can be fulfi lled in<br />

much less expensive ways. With the exception <strong>of</strong> gambling,<br />

they can all be fulfi lled for the attractive price tag <strong>of</strong> $0.00.<br />

Gambling is exciting because it’s about taking risks and<br />

potentially reaping large rewards. There are other ways to<br />

satisfy this desire to take risks, which are less expensive than<br />

throwing hundred dollar bills at the craps table, such as cliffjumping<br />

or sky-diving. Really, you could have your own Vegasstyle<br />

party in your own basement for free if you wanted to. (I’m<br />

not necessarily recommending you do this, I’m just stating<br />

the obvious.) Adelson doesn’t think you will, so he’s going to<br />

keep furnishing his rooms with the biggest and the best for<br />

you to purchase, even though you and your friends may now be<br />

unemployed, thanks to the recession.<br />

Adelson’s “build it and they will come” strategy is a great<br />

example <strong>of</strong> how to lose touch with your customer and build<br />

your own grave as an entrepreneur. Yes, success is about taking<br />

risks. But right now, Sands is acting like a child. He wants to<br />

play by his rules and refuses to adjust his business strategy to<br />

his market.<br />

CONTINUED ON PAGE 6<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 5

As David Kelley writes in The New<br />

Individualist’s Summer <strong>2009</strong> edition:<br />

‘There can be no “rule” that one’s<br />

job – or even the company one works<br />

for – will exist forever. There can be no<br />

“rule” that a job or an investment, or<br />

the real estate market will continue to<br />

<strong>of</strong>fer the opportunities and returns they<br />

have in the past. As every investment<br />

prospectus says, “Past performance<br />

is no guarantee <strong>of</strong> future returns.”<br />

If entrepreneurs and leaders in our<br />

country look to investors like Sands as<br />

their role models, we will be doomed to<br />

further economic stress.<br />

Whether you are a business leader or a<br />

politician, you are only as successful as<br />

the people who got you there. President<br />

Obama can not assume that because<br />

66 percent <strong>of</strong> young people elected him<br />

into <strong>of</strong>fi ce based on the hope that he<br />

would <strong>of</strong>fer positive change and ideas<br />

for growth that he’s locked in. There<br />

6 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

D.C. & VEGAS CONTINUED FROM PAGE 5<br />

are no rules other than the people’s<br />

rules. President Obama’s approval<br />

ratings have been falling on issues<br />

because, while he did an excellent job<br />

<strong>of</strong> marketing “change” and “hope,”<br />

he hasn’t provided us with reasons to<br />

jump on-board with his healthcare plan<br />

or economic stimulus proposals.<br />

According to a Sept. 10, <strong>2009</strong> article<br />

by Beth Jinks on Bloomberg.com,<br />

“Las Vegas <strong>St</strong>rip gambling revenue fell<br />

11 percent in July, the 19th straight<br />

decline, and Atlantic City’s dropped 16<br />

percent in August as the two biggest<br />

U.S. gambling centers grapple with<br />

the worst slump on record.” Clearly,<br />

the people Adelson is counting on to<br />

support his fl amboyant casinos are<br />

making a lifestyle change: They are<br />

fi nding other ways to have fun beyond<br />

throwing money at his luxurious table<br />

games and hotel rooms.<br />

Meanwhile throngs <strong>of</strong> American people<br />

have gathered on Capital hill for<br />

protests, as Michelle Malkin exposed<br />

in her September 12th blog post, they<br />

are forming their own tea parties and<br />

participating in Town Hall meetings. All<br />

these citizen gatherings send a clear<br />

message to our elected <strong>of</strong>fi cials: We<br />

want you to listen to us – we are the<br />

consumers, the constituents and the<br />

voters. And if I haven’t made it clear,<br />

we vote with our pocketbooks.<br />

I’m sure our leaders in Washington<br />

don’t want to lose their constituents in<br />

the way Las Vegas is – by obstinately<br />

pushing forward with their own business<br />

model and ignoring the voice <strong>of</strong> the<br />

marketplace.<br />

Katie Kieffer ‘05<br />

www.katiekieffer.com<br />

Thank You to Our <strong>2009</strong> Annual Sponsors!<br />

FOUNDER LEVEL PRESIDENT LEVEL<br />

BENEFACTOR LEVEL

Commercial RE MarketWatch:<br />

New IRS Regulations Might Contain CMBS Defaults,<br />

but Won’t End the Commercial Real Estate Crisis<br />

As property owners holding commercial mortgagebacked<br />

securities (CMBS) funded loans have<br />

attempted to address fi nancing concerns over the<br />

past 12 months, many have complained <strong>of</strong> the<br />

impossibility <strong>of</strong> getting special servicers on the phone.<br />

Constrained by tax regulations that dictated real estate<br />

mortgage investment conduits (REMICs) could not allow<br />

modifi cations to their mortgage pools without incurring tax<br />

penalties and the possible loss <strong>of</strong> REMIC status, servicers told<br />

borrowers to wait until they were in default to contact them.<br />

That’s lead to frustration and a lot <strong>of</strong> inaction.<br />

As a result, there is now a lot <strong>of</strong> buzz being generated by the<br />

move last week from the Internal Revenue Service and the<br />

U.S. Department <strong>of</strong> the Treasury to loosen the rules to allow for<br />

loan modifi cations and extensions. If all goes well, the relaxed<br />

rules will get servicers to work with borrowers on potentially<br />

distressed situations earlier in the game, and might stave <strong>of</strong>f a<br />

signifi cant number <strong>of</strong> mortgage defaults, according to market<br />

analysts. The measure might even lessen potential losses from<br />

defaulting loans, giving servicers the opportunity to hold on<br />

to distressed assets until conditions in the investment sales<br />

market improve somewhat.<br />

But like the banks’ strategy to “pretend and extend” on<br />

traditional mortgages, the new CMBS regulations might only<br />

be effective in delaying the problem, not solving it, says<br />

Clint Myers, strategist with Property & Portfolio Research, a<br />

Boston-based real estate research fi rm. Plus, analysts remain<br />

concerned about the possibility <strong>of</strong> unnecessary modifi cations<br />

and loss <strong>of</strong> value for holders <strong>of</strong> highest rated CMBS securities<br />

if the new regulations allow for the forgiveness <strong>of</strong> principal<br />

debt or long-term extensions.<br />

“It doesn’t make problems go away, it delays them for another<br />

day with the hope that things will get better in the meantime,”<br />

says Myers. “This will give servicers slightly more fl exibility<br />

and lengthen out the cycle, making less clear what values are<br />

and delaying the bottom.”<br />

The changes, effective as <strong>of</strong> Sept. 16, will cover loans<br />

modifi ed on or after Jan. 1, 2008. They will allow for<br />

modifi cations to the loans’ collateral and guarantees, as<br />

well as giving servicers the power to switch non-recourse<br />

mortgages to recourse. As a result <strong>of</strong> the new regulations,<br />

servicers will now also have greater discretion in deciding<br />

which loans might need modifi cation, enabling them to step<br />

into those situations where a loan that’s still performing today<br />

has a high likelihood <strong>of</strong> defaulting in the future.<br />

Overall, according to Federal Reserve data there is $900<br />

billion in outstanding CMBS debt accounting for 25.7<br />

percent <strong>of</strong> the $3.5 trillion in commercial real estate debt<br />

outstanding. In 2010, there will be somewhere about $39<br />

billion in CMBS debt coming due and about $150 billion<br />

coming due by the end <strong>of</strong> 2012. In July, the delinquency rate<br />

for CMBS loans reached 3.1 percent, according to Realpoint<br />

LLC, a Horsham, Pa.-based credit rating agency. By the end<br />

<strong>of</strong> the year, the fi rm predicts the delinquency rate will move<br />

past 6 percent.<br />

“It’s defi nitely a positive move, as it will temper the level <strong>of</strong><br />

distress that we otherwise would project for the securitization<br />

market and will indirectly benefi t the larger pool <strong>of</strong><br />

commercial mortgages,” says Sam Chandan, president and<br />

chief economist with Real Estate Econometrics, a New York<br />

City-based research fi rm. “But this program will be most<br />

effective in cases in which some reasonable modifi cation will<br />

allow the mortgage to perform. Some <strong>of</strong> the most egregiously<br />

underwritten mortgages from the peak <strong>of</strong> the market will not<br />

benefi t from this program.”<br />

In addition, the new regulations might turn out to be more<br />

beneficial for holders <strong>of</strong> lower rated CMBS bonds than<br />

for those who invested in AAA-rated securities. Because<br />

AAA-rated bonds are, in theory, backed by highest quality<br />

properties, those investors expect to see full repayment<br />

<strong>of</strong> loans at maturity date, says Frank Innaurato, managing<br />

director <strong>of</strong> analytical services with Realpoint. They tend<br />

to hold the bonds for the short term and, for them, more<br />

modifications might mean lower yields. For investors in<br />

AA-rated and A-rated securities, on the other hand, who<br />

tend to hold the bonds for a longer-term and who incur<br />

most <strong>of</strong> the penalties in default cases, more modifications<br />

mean smaller losses.<br />

“If too much fl exibility is granted, you are going to have<br />

investors losing money because what is good for the borrower<br />

might not necessarily be good for the investor. The position<br />

we are taking is that it can be a double-edged sword—it<br />

may preclude balloon defaults, but it will increase the risk<br />

<strong>of</strong> extension and modifi cation,” says Innaurato. “Will there<br />

be any type <strong>of</strong> debt forgiveness that will lead to a loss for<br />

the Trust? And one <strong>of</strong> the biggest concerns is how many<br />

borrowers with otherwise performing properties and stable<br />

cash fl ows will be in line for this?”<br />

Andrew Chana ‘01<br />

CHANA Investment Group<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 7

News from the <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong><br />

Real Estate Programs<br />

As alumni <strong>of</strong> the <strong>University</strong> <strong>of</strong> <strong>St</strong>. <strong>Thomas</strong>, many <strong>of</strong> you<br />

have, in one way or another, worked with real estate<br />

program staff and faculty. We want to take this<br />

opportunity to introduce you to the real estate team as well as<br />

to highlight some <strong>of</strong> the new and exciting things planned for<br />

the spring semester and beyond, and how all <strong>of</strong> these plans<br />

will affect you as alumni.<br />

This academic year has included the addition <strong>of</strong> familiar<br />

faces to full-time staff and faculty within the <strong>University</strong> <strong>of</strong><br />

<strong>St</strong>. <strong>Thomas</strong> real estate programs team. These additions<br />

allow for expanded program <strong>of</strong>ferings, real estate community<br />

involvement and further development <strong>of</strong> the Shenehon Center<br />

for Real Estate, the UST BS Degree in Real Estate, the<br />

UST MS Degree in Real Estate and real estate pr<strong>of</strong>essional<br />

development programs.<br />

8 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

New Full-time Real Estate<br />

Faculty Member<br />

Many <strong>of</strong> you may know Dr. Tom<br />

Musil as the former director<br />

<strong>of</strong> the Shenehon Center for<br />

Real Estate and the UST MS<br />

Degree in Real Estate. As <strong>of</strong><br />

September, Tom has accepted<br />

a faculty position teaching both<br />

undergraduate and graduate<br />

real estate courses in the Opus<br />

College <strong>of</strong> Business. Tom will<br />

be teaching the Advanced Topics<br />

in Real Estate course, Real Estate Decision Making, Real<br />

Estate Development, Real Estate Property Management and<br />

Real Estate Appraisal. Tom is working on a major research<br />

paper addressing how the mortgage foreclosure crisis differs<br />

among the largest 200 Metropolitan <strong>St</strong>atistical Areas in the<br />

U.S. and how government solutions to the crisis should refl ect<br />

community social and economic characteristics.<br />

New Director <strong>of</strong> the Shenehon<br />

Center for Real Estate and the<br />

MS Degree in Real Estate<br />

Herb Tousley has been a member<br />

<strong>of</strong> the UST real estate team<br />

since 2004 as an adjunct faculty<br />

member teaching undergraduate<br />

and graduate real estate courses.<br />

He has more recently accepted<br />

the director position to join the<br />

team on a full-time basis.<br />

Herb comes to <strong>St</strong>. <strong>Thomas</strong> from Griffi n Companies, where he<br />

was a senior vide president handling acquisitions and client<br />

services with an emphasis on property tax appeals. In this<br />

new position, Herb plans to add programs that are timely and<br />

relevant to today’s rapidly changing real estate environment<br />

and continue to build strong relationships within the real<br />

estate community. In the UST MSRE program, he plans to<br />

allow candidates the opportunity to tailor their courses <strong>of</strong><br />

study to provide more opportunities to specialize in areas that<br />

best fi t their interests and career situations. In addition, he<br />

would like to develop more robust internship and mentorship<br />

programs for students in the MSRE program. These changes<br />

will enable MSRE graduates to enter positions with relevant<br />

work experience, making them even more marketable to<br />

potential employers<br />

Transition from Undergraduate<br />

to Graduate Courses<br />

Dr. Tom Hamilton teaches in both<br />

the undergraduate and graduate<br />

programs in real estate, as well<br />

as in pr<strong>of</strong>essional development<br />

programs. As the “new” MSRE<br />

program is growing and evolving<br />

to meet ever-changing market<br />

demands, Tom has transitioned to<br />

teaching more graduate courses<br />

at UST. Taking the successes<br />

achieved from developing the<br />

undergraduate program from a handful <strong>of</strong> students in 2000<br />

to more than 70 majors today, he is working to develop<br />

similar strategies and promotions to give graduate students<br />

(MSRE and MBA-Real Estate) a similar advantage in the<br />

marketplace. Using his experience and background (coming<br />

from the Wisconsin Real Estate program), he hopes to recreate<br />

the successes <strong>of</strong> the “Big Red Machine” at UST to develop<br />

the best, well-rounded real estate “thinkers and doers” in<br />

the world. The goal <strong>of</strong> the UST real estate programs is to<br />

develop the best prepared, equipped and trained real estate<br />

pr<strong>of</strong>essionals in the world—second to none.<br />

In addition to teaching, Tom has also been working on<br />

researching numerous real estate-related issues in the<br />

marketplace, including inequitable property tax assessment<br />

and valuation practices. The current standards used and<br />

applied by assessors are <strong>of</strong>tentimes misinterpreted by local<br />

and state assessment districts and state agencies, especially<br />

the use <strong>of</strong> nonparametric statistics to test for valuation<br />

uniformity within and between classes <strong>of</strong> property.<br />

CONTINUED ON PAGE 9

CONTINUED FROM PAGE 8<br />

Even though the international<br />

standards are statistically<br />

sound and well documented,<br />

their application is <strong>of</strong>tentimes<br />

misused by government,<br />

resulting in adjustments in<br />

valuations that are not supported<br />

by sales data. The improper<br />

application <strong>of</strong> statistics can<br />

result in inequitable and<br />

improper valuation and tax<br />

liabilities for property owners.<br />

Research issues like this are<br />

frequently brought into the<br />

classroom to enhance student/<br />

graduate advancement in the<br />

workplace.<br />

Recruiting, Admissions and<br />

<strong>St</strong>udent Life for the MS<br />

Degree in Real Estate<br />

Susie Eckstein works with the<br />

recruiting, admissions and<br />

student life for the UST MS<br />

Degree in Real Estate, and<br />

also works with projects for<br />

the Shenehon Center for Real<br />

Estate. In addition to working<br />

for UST, Susie earned a B.A.<br />

in Marketing from UST in<br />

2003 and will complete the<br />

Evening UST MBA program this<br />

December. With knowledge<br />

<strong>of</strong> and experience with all <strong>of</strong><br />

the Opus College <strong>of</strong> Business<br />

graduate programs along<br />

with real estate pr<strong>of</strong>essional<br />

development programs, Susie<br />

can help you to fi nd educational<br />

opportunities that best fi t your<br />

needs.<br />

Peter Tanis sat down with <strong>St</strong>. <strong>Thomas</strong> alum,<br />

Dan Gleason <strong>of</strong> NorthMarq. Dan is a well<br />

known <strong>of</strong>fi ce broker specializing in leasing<br />

and sales in the Twin Cities market.<br />

Dan has distinguished himself as a leading<br />

broker in the brokerage industry and has been<br />

recognized each year as a member <strong>of</strong> the<br />

NorthMarq Offshore Club. Dan is known for<br />

his strategic viewpoint and problem-solving<br />

capabilities along with his knowledge and<br />

relationships throughout the Minneapolis/<strong>St</strong>.<br />

Paul marketplace. He has been responsible for<br />

representing a variety <strong>of</strong> owners in obtaining<br />

their real estate objectives. Throughout his<br />

career, Dan has been responsible for the<br />

marketing, leasing and sales <strong>of</strong> numerous<br />

projects consisting <strong>of</strong> more than eight<br />

million square feet. He has leased more than<br />

four million square feet <strong>of</strong> <strong>of</strong>fi ce and been<br />

involved in numerous commercial property<br />

acquisitions and disposition projects. He<br />

has completed numerous large transactions<br />

involving companies like Blue Cross Blue<br />

Shield, Seagate, ADC and CH Robinson.<br />

Q: Dan, what year did you<br />

graduate from UST and<br />

what was your focus?<br />

A: I graduated in 1988 with a BA in<br />

Accounting.<br />

Q: Dan, tell me a little about<br />

your family and home life?<br />

A: My wife and I met at UST, and we have<br />

been married for 19 years. We live<br />

in Highland Park, <strong>St</strong>. Paul, with our<br />

four children.<br />

Q: What were you doing<br />

before your current position<br />

and NorthMarq?<br />

A: Before joining NorthMarq, I was a<br />

senior associate with the Koll/Shelard<br />

Group for about fi ve years specializing<br />

in <strong>of</strong>fi ce leasing and sales.<br />

Tommie Spotlight<br />

DAN GLEASON<br />

OF NORTHMARQ<br />

Q: Dan, what is your favorite<br />

aspect <strong>of</strong> the business?<br />

A: I really enjoy the people. Our business<br />

allows us to develop relationships with<br />

our customers, our competition, and<br />

our co-workers. I feel blessed to be able<br />

to work with so many great people.<br />

Q: What groups are you<br />

involved with within the<br />

industry and community?<br />

A: I am a past president <strong>of</strong> the Minnesota<br />

Commercial Association <strong>of</strong> Realtors and<br />

try to stay active in the industry.<br />

Additionally, I participate with various<br />

non-pr<strong>of</strong>i t organizations and spend time<br />

coaching the various sports activities <strong>of</strong><br />

my kids.<br />

Q: What keeps you motivated?<br />

A: The challenge, the deal, and<br />

troubleshooting for clients. I love<br />

collaborating with other individuals and<br />

working hard to meet my client’s needs<br />

and expectations.<br />

Q: What is your favorite Sport or hobby?<br />

A: Golf.<br />

Q: This market has been diffi cult for<br />

many people in the business<br />

especially the younger pr<strong>of</strong>essionals;<br />

what advice do you have for new or<br />

younger real estate pr<strong>of</strong>essionals?<br />

A: A: First <strong>of</strong> all, maintain an attitude <strong>of</strong><br />

gratitude. Ask yourself; do I have to<br />

be here or do I get to be here? A<br />

grateful perspective will make all <strong>of</strong><br />

the difference. Negativity is just noise;<br />

don’t let it zap your energy and<br />

enthusiasm. Secondly, manage your<br />

expectations. Be patient and let<br />

things play themselves out. Thirdly,<br />

embrace change, it is the gift that<br />

keeps on giving, and those who can<br />

adjust will be the winners. Finally,<br />

appreciate every relationship and let it<br />

shape who you become.<br />

Peter Tanis ‘06<br />

UST REAA Vice President<br />

The C. Chase Company<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 9

THE UNIVERSITY OF ST. THOMAS<br />

and<br />

OPUS COLLEGE OF BUSINESS<br />

are pleased to introduce the inaugural members <strong>of</strong> the university’s<br />

REAL ESTATE ADVISORY BOARD<br />

<strong>St</strong>ephen Baker Ramsey County Assessor<br />

Bill Beard Beard Group<br />

Luigi Bernardi Aurora Investments<br />

<strong>Thomas</strong> Burke TOLD Development Company<br />

Colleen Carey The Cornerstone Group<br />

Charles Caturia CB Richard Ellis<br />

Richard Collins Ryan Companies<br />

Daniel Commers Roseville Properties<br />

Management Company<br />

<strong>Thomas</strong> Crowley Dougherty Funding LLC<br />

Robert Cunningham TOLD Development Company<br />

Michael Dwyer Opus Northwest L.L.C.<br />

Daniel Engelsma Kraus-Anderson<br />

Joseph Finley Leonard, <strong>St</strong>reet & Deinard<br />

James Gearen Zeller Realty Corporation<br />

Kyle Hansen U.S. Bancorp<br />

Gene Haugland Haugland Company<br />

David Jellison Liberty Property Trust<br />

John Johannson Welsh Companies<br />

Terrence Kingston Cushman & Wakefield<br />

10 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

Frank Lang Lang-Nelson Associates Inc.<br />

Timothy Murnane Opus Northwest L.L.C.<br />

Russell Nelson Nelson Tietz & Hoye<br />

Kathleen Nye-Reiling Silver Cliff Properties<br />

Edward Padilla NorthMarq Capital<br />

Ronald Peltier HomeServices <strong>of</strong> America, Inc.<br />

Christopher Puto Opus College <strong>of</strong> Business<br />

Mark Reiling Colliers Turley Martin & Tucker<br />

Howard Roston Malkerson Gilliland & Martin<br />

Mike Salmen Transwestern<br />

Jerome Sand Kraus-Anderson<br />

Richard Schadegg CB Richard Ellis<br />

Jeffrey Schoenwetter JMS Companies<br />

John Seidel John P. Seidel, Bank Consultant<br />

Boyd <strong>St</strong><strong>of</strong>er United Properties<br />

Robert <strong>St</strong>rachota Shenehon Company<br />

Paul Sween Dominium Group, Inc.<br />

Scott Tanken<strong>of</strong>f Hillcrest Development<br />

William Tobin CRESA Partners<br />

Vikram Uppal Uppal Enterprises<br />

UST <strong>Alumni</strong>: Please feel free to contact the above members <strong>of</strong> the UST Real<br />

Estate Advisory Board with industry questions. For individual contact information,<br />

call Bob <strong>St</strong>rachota at (612) 333-6533.<br />

Email<br />

Address<br />

Updates<br />

Needed<br />

The UST REAA<br />

utilizes email as<br />

our main line <strong>of</strong><br />

communication to<br />

inform members<br />

<strong>of</strong> important<br />

information.<br />

To update your<br />

contact information<br />

please email<br />

changes to<br />

benjamin.bastian@<br />

cushwake.com.

UST Real<br />

Estate<br />

Society<br />

The Real Estate Society at the <strong>University</strong><br />

<strong>of</strong> <strong>St</strong>. <strong>Thomas</strong> is one <strong>of</strong> only ten clubs<br />

currently recognized by the OPUS College<br />

<strong>of</strong> Business. The organization is a group <strong>of</strong><br />

undergraduate business students with an<br />

interest in real estate; though is not exclusive<br />

to students in the real estate program at <strong>St</strong>.<br />

<strong>Thomas</strong>. Joe Dixon is the current President <strong>of</strong><br />

the Real Estate Society and is assisted through<br />

the help <strong>of</strong> Carissa <strong>St</strong>euck (Vice President),<br />

LJ <strong>St</strong>ead (Treasurer), Nick Armstrong (Social<br />

Chair) and Sierra Hamilton (Secretary).<br />

Over the course <strong>of</strong> the academic year, the Real<br />

Estate Society hosts guest speakers who are<br />

currently working in the real estate industry<br />

over the lunch hour. Typically, the guest<br />

speakers hold a senior management role and<br />

discuss things such as: their career path, how<br />

they are directly or indirectly involved with real<br />

estate, opportunities in the fi eld and share any<br />

advice they have for current students.<br />

Throughout the <strong>2009</strong>-2010 academic year,<br />

the Real Estate Society at <strong>St</strong>. <strong>Thomas</strong> will host<br />

speakers from companies including: Target<br />

Corporation, Express Scripts, Supervalu,<br />

Northmarq, OPUS, Ryan Companies, and<br />

other fi rms located in the Twin Cities with a<br />

real estate presence.<br />

In the spring <strong>of</strong> 2010, members <strong>of</strong> the Real<br />

Estate Society will work together with the<br />

students taking the Development class (REAL<br />

470) at <strong>St</strong>. <strong>Thomas</strong> to participate in the<br />

annual NAIOP Real Estate Challenge. This<br />

challenge puts students to the test <strong>of</strong> creating<br />

a development plan which is then judged by a<br />

group <strong>of</strong> panelists who decide on a winner. At<br />

the end <strong>of</strong> the academic year, the Real Estate<br />

Society joins with fellow alumni to attend the<br />

End <strong>of</strong> the Year Banquet hosted by the UST<br />

REAA. The Real Estate Society is always open<br />

to new ideas and involvement with the local<br />

community so please contact us with any<br />

suggestions!<br />

Joe Dixon ‘10<br />

UST RES President<br />

Shenehon Company<br />

Tom Hamilton<br />

THE DOC’S<br />

FINAL<br />

THOUGHTS<br />

Real Estate Markets<br />

<strong>2009</strong> and Beyond<br />

November <strong>2009</strong><br />

Introduction (Remember When Supply and<br />

Demand Mattered?)<br />

The past three months have been “better” than the rapid deterioration<br />

in the housing market over the prior 15 months. Researchers have<br />

started to look beyond the “almighty” Case-Shiller index and have<br />

found that bifurcated markets exist. This does not mean that “two”<br />

housing markets exist, but rather two distinct groups <strong>of</strong> transactions.<br />

Median housing prices for “traditional” home sales (those not<br />

mediated by lending institutions) have fallen only about 8-10% below<br />

their peak prices in 2006. On the other hand, mediated properties<br />

have fallen drastically—on the order <strong>of</strong> 35-45%. Even though these<br />

properties “compete” with each other, the two groups are quite<br />

different in quality. Often, purchasers <strong>of</strong> mediated properties must<br />

make signifi cant cash outlays after acquisition to get them up to the<br />

same quality as traditional properties. As such, the total price paid<br />

for these mediated properties brings the total cost <strong>of</strong> acquisition more<br />

in-line with traditional properties.<br />

In the commercial marketplace capital is still fairly limited, bid/ask<br />

spreads are wide, and prices have not yet fallen to the point to justify<br />

investment. From about 2004 to early 2008, there was a signifi cant<br />

oversupply <strong>of</strong> cheap capital pushing prices upward. With cashladen<br />

c<strong>of</strong>fers piling up at the entrances to banks, lenders ignored<br />

fundamental asset valuation and eagerly supplied unrealistically<br />

inexpensive sources <strong>of</strong> capital into the marketplace. That was the<br />

beginning <strong>of</strong> a “perfect storm”, and the hurricane is yet to come as<br />

these spreads are now starting to narrow.<br />

CONTINUED ON PAGE 12<br />

UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong> | 11

Overall Capital Markets: Liquidity<br />

Crunch and Risk-based Lending/<br />

Investing<br />

Global equity capital has been for over a year (and still is)<br />

sitting on the sidelines waiting for assets to re-price downward<br />

to risk-adjusted levels that warrant investment. Traditional<br />

lending institutions are now sitting on cash, waiting for the<br />

right time to start making investments—they are the vultures<br />

circling overhead. The time will come when these commercial<br />

real estate assets adjust to the new reality <strong>of</strong> signifi cantly<br />

higher cap rates, and the vultures will swoop down to feast on<br />

the dead and weary prey below. This will result in a massive<br />

deleveraging <strong>of</strong> assets from abnormally and unsustainably<br />

high LTVs underwritten by the “creative fi nance promoting<br />

Wizards <strong>of</strong> Oz” a few years ago. But in 6-12 years’ time—as<br />

history tends to repeat itself—the progeny <strong>of</strong> Oz will rise and<br />

create yet another bubble as they preach to the masses that<br />

underlying fundamental valuation (DCRs, LTVs and other risk<br />

ratios) no longer matter in the “new economy”.<br />

When we think <strong>of</strong> our overall GDP, we are seeing “Consumer<br />

Savings”. As such, no spending = contracting GDP. Earlier<br />

this year some economists were saying that this was going to<br />

be a protracted and deep recession. The deep part is correct,<br />

but by the end <strong>of</strong> the year, GDP should show slow growth,<br />

much less than the ~3% growth recorded in the third quarter<br />

(gimmicks only work for so long). Overall, the current fi nancial<br />

and economic situation is like a dam without an outlet,<br />

and the question remains, “When will the dam burst and<br />

capital start fl owing again?” The answer, like with residential<br />

property, is when prices reset to a more reasonable level and<br />

a sustainable, natural growth rate.<br />

For residential property purchases, fundamental purchasing<br />

ability (income/expense ratios and down payments) will<br />

produce stable and slightly rising housing prices as the region’s<br />

population continues to increase. The region’s economy<br />

will also start to grow, relieving some <strong>of</strong> the stress felt by<br />

current owners and future purchasers regarding their homes.<br />

Nationally, we should see unemployment stay relatively high,<br />

but that too will wane over the next three years as GDP grows<br />

slowly, business capacity is eventually reached and real net<br />

employment occurs.<br />

Who is at Fault?<br />

THE DOC’S FINAL THOUGHTS CONTINUED FROM PAGE 11<br />

Passing the buck, which means “IT IS NOT MY FAULT”,<br />

is not the answer. Some participants might say that the<br />

market changed—or, did they really do their homework? How<br />

different would the world be today if all past residential loans<br />

were conforming loans (prime loans)? With a minimum <strong>of</strong><br />

20% down, conforming loans have a reasonable buffer for<br />

temporary asset value reductions. It also requires investors<br />

to have some “skin in the game”. It also helps to limit overly<br />

leveraged deals. Overall, the Fannie/Freddie issue would be<br />

much different than what we are dealing with today. Ditto for<br />

commercial mortgage debt market.<br />

12 | UST REAA RE CAP | <strong>Fall</strong> <strong>2009</strong><br />

Appraisers (the Gatekeepers) and appraisal reports require<br />

a complete market analysis to be valid. Historical data<br />

and performance are only PART <strong>of</strong> the process—it tells us<br />

where we were (with 100% accuracy by the way). In reality,<br />

prospective (future) market conditions are what matter to<br />

investors. Understanding that change is ever present, a good<br />

market analysis will help us to better estimate what we should<br />

expect. With better analysis (by strengthening and enforcing<br />

USPAP requirements—no more “preferred appraisers”), the<br />

incentives would be better pay for better work because, in the<br />

long-run, better work pays dividends for everyone. Changes in<br />

the appraisal process are necessary because current methods<br />

haven’t worked well and are part <strong>of</strong> the blame for our current<br />

situation. I say “part” because cities are also to blame. In the<br />

past decade, building permits (and their associated fees—<br />

$$$) went wild to fund local government operations and was<br />

seen as a cheap and easy source <strong>of</strong> money—until it is gone.<br />

The Future <strong>of</strong> Real Estate Markets<br />

and Closing <strong>St</strong>atements<br />

Regarding real estate capital markets, everyone is waiting<br />

for prices to reset lower. When prices reset to realistic levels,<br />

capital will again start to fl ow. Right now there is an imbalance<br />

between sellers and buyers, and these new, future (lower)<br />

prices will refl ect reality. Once prices fall, on average 30-<br />

40% THEN, AND ONLY THEN, will capital markets recover<br />

and investment activity start to improve. On a positive note,<br />

real estate markets have had some needed down time from<br />

the frenzy <strong>of</strong> the early part <strong>of</strong> this decade. Everyone needs<br />

to evaluate alternatives wisely because opportunities do exist<br />

today and more will become apparent once prices reset to<br />

realistic levels: 8% cap rate for Apartments; 10% cap rate<br />

for <strong>of</strong>fi ce; and 10-11% for industrial/warehouse. But also<br />

realize that it will take about 9 to 12 more months before any<br />

signifi cant transaction volume will resume (say, to 2003 or<br />

2004 levels).<br />

Lastly, we want to welcome Herb Tousley as the new Director<br />

<strong>of</strong> the Shenehon Center for Real Estate and Director <strong>of</strong> the<br />

MS in Real Estate program at UST. Please feel free to contact<br />

Herb and welcome him to the UST real estate programs! His<br />

contact information is:<br />

Herb Tousley, CCIM<br />

Director, Shenehon Center for Real Estate and<br />

MS in Real Estate<br />

1000 LaSalle Avenue, TMH 551F<br />

Minneapolis, MN 55403<br />

hwtousley1@stthomas.edu<br />

651-962-4263<br />

Thoughts <strong>of</strong> Tom Hamilton, PhD, CRE, FRICS<br />

UST Pr<strong>of</strong>essor <strong>of</strong> Real Estate