Mining Tax Guide - Minnesota State Legislature

Mining Tax Guide - Minnesota State Legislature Mining Tax Guide - Minnesota State Legislature

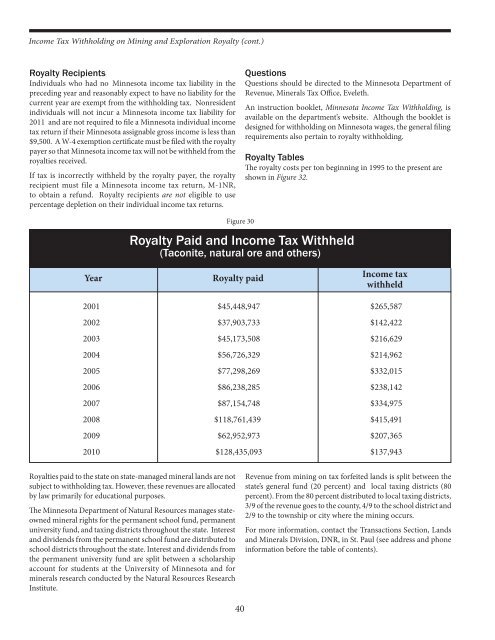

Income Tax Withholding on Mining and Exploration Royalty (cont.) Royalty Recipients Individuals who had no Minnesota income tax liability in the preceding year and reasonably expect to have no liability for the current year are exempt from the withholding tax. Nonresident individuals will not incur a Minnesota income tax liability for 2011 and are not required to file a Minnesota individual income tax return if their Minnesota assignable gross income is less than $9,500. A W-4 exemption certificate must be filed with the royalty payer so that Minnesota income tax will not be withheld from the royalties received. If tax is incorrectly withheld by the royalty payer, the royalty recipient must file a Minnesota income tax return, M-1NR, to obtain a refund. Royalty recipients are not eligible to use percentage depletion on their individual income tax returns. Year Figure 30 Royalty Paid and Income Tax Withheld (Taconite, natural ore and others) Royalties paid to the state on state-managed mineral lands are not subject to withholding tax. However, these revenues are allocated by law primarily for educational purposes. The Minnesota Department of Natural Resources manages stateowned mineral rights for the permanent school fund, permanent university fund, and taxing districts throughout the state. Interest and dividends from the permanent school fund are distributed to school districts throughout the state. Interest and dividends from the permanent university fund are split between a scholarship account for students at the University of Minnesota and for minerals research conducted by the Natural Resources Research Institute. Royalty paid 2001 $45,448,947 $265,587 2002 $37,903,733 $142,422 2003 $45,173,508 $216,629 2004 $56,726,329 $214,962 2005 $77,298,269 $332,015 2006 $86,238,285 $238,142 2007 $87,154,748 $334,975 2008 $118,761,439 $415,491 2009 $62,952,973 $207,365 2010 $128,435,093 $137,943 40 Questions Questions should be directed to the Minnesota Department of Revenue, Minerals Tax Office, Eveleth. An instruction booklet, Minnesota Income Tax Withholding, is available on the department’s website. Although the booklet is designed for withholding on Minnesota wages, the general filing requirements also pertain to royalty withholding. Royalty Tables The royalty costs per ton beginning in 1995 to the present are shown in Figure 32. Income tax withheld Revenue from mining on tax forfeited lands is split between the state’s general fund (20 percent) and local taxing districts (80 percent). From the 80 percent distributed to local taxing districts, 3/9 of the revenue goes to the county, 4/9 to the school district and 2/9 to the township or city where the mining occurs. For more information, contact the Transactions Section, Lands and Minerals Division, DNR, in St. Paul (see address and phone information before the table of contents).

Figure 31 Average Royalty Cost Per Ton of Pellets Produced ** Reserve’s/Northshore’s royalty costs per ton are based primarily on shipments, not production. Royalty per ton 1995 2000 2002 2003 2004 2005 2006 2007 2008 2009 2010 Industry Production (millions of tons) 45.9 44.9 38.3 34.9 39.4 40.2 39.7 38.7 39.9 17.6 36.0 Eveleth/EVTAC 1.416 1.986 1.287 NA NA NA NA NA NA NA NA Hibbing 1.495 1.561 1.338 1.492 1.631 2.045 1.92 2.19 2.31 5.32 2.90 ArcelorMittal (formerly Ispat Inland) 0.810 0.997 1.056 1.097 1.298 1.819 1.73 2.11 2.91 2.33 3.10 National 1.606 0.943 0.943 1.114 NA NA NA NA NA NA NA Northshore** 1.472 1.690 1.614 1.716 2.659 5.481 5.08 5.02 6.95 4.45 6.08 United Taconite – – – – 1.333 1.724 1.84 2.16 2.72 2.34 3.68 USS – Minntac 0.397 0.948 0.844 0.990 1.180 1.498 1.63 2.13 2.37 1.95 2.38 USS – Keewatin – – – 1.217 1.463 1.740 2.14 2.40 3.20 0.00 3.26 Industry Average – Weighted 1.144 1.327 1.100 1.244 1.516 2.169 2.22 2.55 3.15 2.84 3.31 Arithmetic 1.249 1.394 1.180 1.271 1.594 2.384 2.39 2.67 3.41 2.73 3.57 $3.30 $3.20 $3.10 $3.00 $2.90 $2.80 $2.70 $2.60 $2.50 $2.40 $2.30 $2.20 $2.00 $1.80 $1.60 $1.40 $1.20 $1.00 1.144 1995 1.212 1999 1.327 2000 2001 Figure 32 Royalty Costs per Ton Taconite Industry Weighted Average 1.253 1.100 2002 1.244 2003 41 1.516 2004 2.169 2005 2.220 2006 2.55 2007 3.15 2008 2.84 2009 3.31 2010

- Page 1 and 2: This document is made available ele

- Page 3 and 4: 2011 PRODUCTION TAX DISTRIBUTION ..

- Page 5 and 6: The Minnesota Mining Tax Guide is p

- Page 7 and 8: Figure 3 History of Minnesota Tacon

- Page 9 and 10: Definition The taconite production

- Page 11 and 12: Distribution of Funds (M.S. 298.28)

- Page 13 and 14: The index is calculated as follows:

- Page 15 and 16: (c) Occupation Tax Grandfather Amou

- Page 17 and 18: Douglas J. Johnson Economic Protect

- Page 19 and 20: Figure 8 Taconite Residential Homes

- Page 21 and 22: Name Figure 10 Taconite Production

- Page 23 and 24: 166 Cook County 5 1996 2016 $503,46

- Page 25 and 26: Million Tons 40 35 30 25 20 15 10 5

- Page 27 and 28: Year Production tons (000’s) Prod

- Page 29 and 30: Iron Range Resources & Rehabilitati

- Page 31 and 32: Figure 20 FY 12 Iron Range Resource

- Page 33 and 34: Figure 22 Taconite Industry Investm

- Page 35 and 36: Final Directive - 2010 Occupation T

- Page 37 and 38: Year Figure 23 Occupation Tax Mine

- Page 39 and 40: Figure 26 Crude Ore Mined Company 2

- Page 41 and 42: Figure 28 Taconite Industry Occupat

- Page 43: Income Tax Withholding on Mining an

- Page 47 and 48: Mandatory Electronic Payments If yo

- Page 49 and 50: Aggregate material is nonmetallic n

- Page 51 and 52: Ad Valorem Tax on Auxiliary Mining

- Page 53 and 54: 1996 4,448,800 1997 10,900 34,900 2

- Page 55 and 56: Ad Valorem Tax on Severed Mineral I

- Page 57 and 58: Taxes on Other Mining and Explorati

- Page 59 and 60: Occupation Tax-Corporate Income Tax

- Page 61 and 62: M.S. 298.225 — A Minnesota statut

- Page 63 and 64: Index Map - Minnesota Mesabi Map Se

Income <strong>Tax</strong> Withholding on <strong>Mining</strong> and Exploration Royalty (cont.)<br />

Royalty Recipients<br />

Individuals who had no <strong>Minnesota</strong> income tax liability in the<br />

preceding year and reasonably expect to have no liability for the<br />

current year are exempt from the withholding tax. Nonresident<br />

individuals will not incur a <strong>Minnesota</strong> income tax liability for<br />

2011 and are not required to file a <strong>Minnesota</strong> individual income<br />

tax return if their <strong>Minnesota</strong> assignable gross income is less than<br />

$9,500. A W-4 exemption certificate must be filed with the royalty<br />

payer so that <strong>Minnesota</strong> income tax will not be withheld from the<br />

royalties received.<br />

If tax is incorrectly withheld by the royalty payer, the royalty<br />

recipient must file a <strong>Minnesota</strong> income tax return, M-1NR,<br />

to obtain a refund. Royalty recipients are not eligible to use<br />

percentage depletion on their individual income tax returns.<br />

Year<br />

Figure 30<br />

Royalty Paid and Income <strong>Tax</strong> Withheld<br />

(Taconite, natural ore and others)<br />

Royalties paid to the state on state-managed mineral lands are not<br />

subject to withholding tax. However, these revenues are allocated<br />

by law primarily for educational purposes.<br />

The <strong>Minnesota</strong> Department of Natural Resources manages stateowned<br />

mineral rights for the permanent school fund, permanent<br />

university fund, and taxing districts throughout the state. Interest<br />

and dividends from the permanent school fund are distributed to<br />

school districts throughout the state. Interest and dividends from<br />

the permanent university fund are split between a scholarship<br />

account for students at the University of <strong>Minnesota</strong> and for<br />

minerals research conducted by the Natural Resources Research<br />

Institute.<br />

Royalty paid<br />

2001 $45,448,947 $265,587<br />

2002 $37,903,733 $142,422<br />

2003 $45,173,508 $216,629<br />

2004 $56,726,329 $214,962<br />

2005 $77,298,269 $332,015<br />

2006 $86,238,285 $238,142<br />

2007 $87,154,748 $334,975<br />

2008 $118,761,439 $415,491<br />

2009 $62,952,973 $207,365<br />

2010 $128,435,093 $137,943<br />

40<br />

Questions<br />

Questions should be directed to the <strong>Minnesota</strong> Department of<br />

Revenue, Minerals <strong>Tax</strong> Office, Eveleth.<br />

An instruction booklet, <strong>Minnesota</strong> Income <strong>Tax</strong> Withholding, is<br />

available on the department’s website. Although the booklet is<br />

designed for withholding on <strong>Minnesota</strong> wages, the general filing<br />

requirements also pertain to royalty withholding.<br />

Royalty Tables<br />

The royalty costs per ton beginning in 1995 to the present are<br />

shown in Figure 32.<br />

Income tax<br />

withheld<br />

Revenue from mining on tax forfeited lands is split between the<br />

state’s general fund (20 percent) and local taxing districts (80<br />

percent). From the 80 percent distributed to local taxing districts,<br />

3/9 of the revenue goes to the county, 4/9 to the school district and<br />

2/9 to the township or city where the mining occurs.<br />

For more information, contact the Transactions Section, Lands<br />

and Minerals Division, DNR, in St. Paul (see address and phone<br />

information before the table of contents).