The Telegraph - All Townships.txt - Notepad - Lee County, Illinois

The Telegraph - All Townships.txt - Notepad - Lee County, Illinois

The Telegraph - All Townships.txt - Notepad - Lee County, Illinois

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

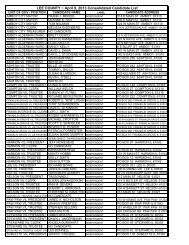

16-07-19-151-004 107,790 MCCASLIN, TIMOTHY E & MCCASLIN, TRACEY L<br />

16-07-06-476-008 79,142 MONTANEZ, JULIO C & MONTANEZ, MARYSOL<br />

16-01-28-200-003 42,494 NICKLAUS, SETH A<br />

16-07-01-202-001 32,106 PARKE, NIKY<br />

16-07-09-300-008 47,027 PETERSON, EDIE<br />

16-01-13-400-068 150,760 RANDICK, DONALD & MELISSA<br />

16-01-16-200-002 128,654 RHODES TRUST<br />

16-07-06-451-025 106,674 RILEY, ERIC & RILEY, SUSANNA<br />

16-01-26-376-007 30,000 ROOS, BARBARA J<br />

16-01-35-300-009 94,555 SANDERS, RICHARD C & MARY E<br />

16-07-19-102-004 84,773 SCHILLING, JOHN I & SARA J<br />

16-01-17-100-002 106,609 SCHOLL, BRUCE & JULIE A ETAL<br />

16-07-19-102-005 76,440 SMITH, SEAN & SMITH, DAYONA<br />

16-01-31-400-009 41,782 T & J PARTNERSHIP<br />

16-01-19-100-007 36,895 WITMER, RICHARD M & JENNIFER L<br />

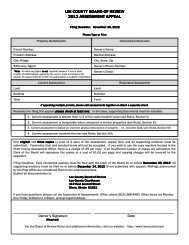

Notice to East Grove, Hamilton, Marion and South Dixon Township Taxpayers: Assessed Values for 2012<br />

Valuation date (35ILCS 200/9-95) January 1, 2012<br />

Required level of assessment (35ILCS 200/9-145) 33.33%<br />

Valuation based on sales from (35ILCS 200/1-155) 2009 – 2011<br />

Questions about these valuations should be directed to:<br />

Linda Dunphy<br />

1028 Hoyle Rd., Harmon<br />

815-359-7329<br />

Office Hours: By Appointment<br />

Property in this township, other than farmland, is to be assessed at a 33.33% median level of assessment, based on the<br />

fair cash value of the property. You may check the accuracy of your assessment by<br />

dividing your assessment by the median level of assessment. <strong>The</strong> resulting value should equal the estimated fair cash<br />

value of your property. If the resulting value is greater than the estimated fair cash value of<br />

your property, you may be over-assessed. If the resulting value is less than the fair cash value of your property, you may<br />

be under-assessed. You may appeal your assessment to the Board of Review.<br />

If you believe your property’s fair cash value is incorrect or that the equalized assessed valuation is not uniform with<br />

other comparable properties in the same neighborhood, the following steps should be taken.<br />

1. Contact your township assessor to review the assessment.<br />

2. If not satisfied with the assessor review, taxpayers may file an appeal with the <strong>Lee</strong> <strong>County</strong> Board of Review. For<br />

appeal forms, instructions, and the Rules and Procedures of the Board of Review, visit<br />

www.leecountyil.com or call (815) 288-4483.<br />

3. <strong>The</strong> final filing deadline for your township is 30 days from this publication date. After this date, the Board of Review<br />

is prohibited by law from accepting assessment appeals.<br />

Page 63