The Telegraph - All Townships.txt - Notepad - Lee County, Illinois

The Telegraph - All Townships.txt - Notepad - Lee County, Illinois The Telegraph - All Townships.txt - Notepad - Lee County, Illinois

07-02-18-476-004 70,000 WITTENAUER, JOSHUA C & WITTENAUER, HEATHER J 07-08-04-205-009 70,900 WITTENAUER, RUSSELL A AND CHRISTINE A 07-02-32-255-022 42,000 WITZLEB, BETTY J 07-08-06-429-002 20,900 WOHRLEY, BRADLEY H & WOHRLEY, MARY ANN 07-08-05-153-010 65,900 WOHRLEY, BRADLEY H & HENRY W 07-02-32-106-018 51,000 WOHRLEY, LOUIS A & DORIS M 07-08-05-304-017 12,000 WOLBER, CONSTANCE A 07-08-04-160-008 25,400 WOLBER, MARK A 07-02-32-284-006 30,500 WOLBER, SHANE R JACLYNN D 07-02-29-402-020 75,000 WOLF, GEORGE AND LAVONNE 07-08-05-306-022 27,000 WOLF, LARRY & ORTIZ, ERIN 07-02-31-279-006 38,300 WOLF, ROBERT J & DONNA L 07-02-32-405-007 37,000 WOLFE, ALDEN L & DIANE M 07-08-04-313-007 22,500 WOLFE, CHRISTINE A 07-08-04-451-026 28,500 WOLFE, EARLENE J & JERROLD E 07-02-24-104-002 62,300 WOLFE, JERROLD E & EARLENE J 07-02-30-151-002 191,000 WOLFE, SKIP E & KIMBERLY A 07-08-04-313-004 32,000 WOLFLEY, MICHAEL A & MONICA L 07-02-33-157-011 25,500 WOLFORD TRUST 07-02-33-103-008 30,200 WOLOSONOVICH, DIANA 07-08-04-209-004 56,300 WONG, CHRISTINE 07-08-06-329-016 40,400 WOODS, GREGORY H & MELISSA A 07-02-31-281-004 39,000 WORRELL, JASON J & WORRELL, CHRISTINA L 07-08-06-430-022 23,000 WORRELL, JOSHUA R 07-08-04-305-007 32,000 WORTON, KATHERINE F 07-02-32-128-052 426,000 WRIGHT, LOYAL WAYNE 07-08-06-405-020 9,000 WRIGHT, LUCILLE ANN 07-08-04-308-003 25,500 WRIGHT, ORVILLE & DEBORAH L 07-08-06-479-018 21,500 WRIGHT, VIVIAN K 07-08-04-129-010 35,300 WRIGHT, WILLIAM F & VICTORIA A 07-02-33-204-001 29,800 WYMAN, KAREN E 07-08-06-407-008 18,600 YARBROUGH, CURTIS W & EDITH L 07-08-05-476-004 31,300 YEARIAN, GERTRUDE 07-02-32-377-010 14,500 YINDEEROOP, TREERAWAT & PINYOWATTAYAKORN, PITAWAN 07-02-32-255-015 25,000 YINGLING, ED 07-02-32-377-036 19,400 YINGLING, EDWIN 07-08-05-129-005 14,500 YINGLING, EDWIN & MARY P 07-02-32-377-006 20,500 YINGLING, EDWIN D & YINGLING, MARY P 07-02-31-427-001 32,000 YINGLING, EDWIN D & MARY P 07-02-32-255-018 24,500 YINGLING, EDWIN D & MARY P 07-08-04-206-029 53,000 YOCUM, KIMBERLY N & YOCUM, DENTON M 07-02-25-451-012 49,000 YONK, DAVE F 07-02-33-179-008 48,000 YOUKER TRUST, DAVID E & YOUKER TRUST, CAROL E 07-02-32-127-008 21,900 YOUNG, JOSEPH R & YOUNG, CRYSTAL A 07-08-05-177-030 26,800 YOUNG, JULIE K 07-02-32-285-007 38,500 YOUNG, STEPHEN R & BEVERLY A Page 60

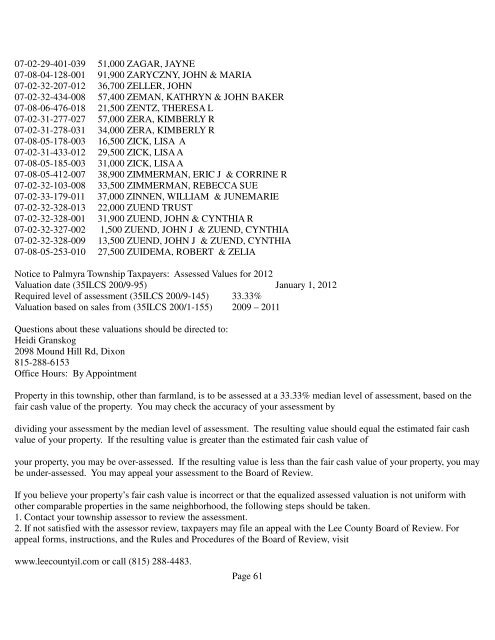

07-02-29-401-039 51,000 ZAGAR, JAYNE 07-08-04-128-001 91,900 ZARYCZNY, JOHN & MARIA 07-02-32-207-012 36,700 ZELLER, JOHN 07-02-32-434-008 57,400 ZEMAN, KATHRYN & JOHN BAKER 07-08-06-476-018 21,500 ZENTZ, THERESA L 07-02-31-277-027 57,000 ZERA, KIMBERLY R 07-02-31-278-031 34,000 ZERA, KIMBERLY R 07-08-05-178-003 16,500 ZICK, LISA A 07-02-31-433-012 29,500 ZICK, LISA A 07-08-05-185-003 31,000 ZICK, LISA A 07-08-05-412-007 38,900 ZIMMERMAN, ERIC J & CORRINE R 07-02-32-103-008 33,500 ZIMMERMAN, REBECCA SUE 07-02-33-179-011 37,000 ZINNEN, WILLIAM & JUNEMARIE 07-02-32-328-013 22,000 ZUEND TRUST 07-02-32-328-001 31,900 ZUEND, JOHN & CYNTHIA R 07-02-32-327-002 1,500 ZUEND, JOHN J & ZUEND, CYNTHIA 07-02-32-328-009 13,500 ZUEND, JOHN J & ZUEND, CYNTHIA 07-08-05-253-010 27,500 ZUIDEMA, ROBERT & ZELIA Notice to Palmyra Township Taxpayers: Assessed Values for 2012 Valuation date (35ILCS 200/9-95) January 1, 2012 Required level of assessment (35ILCS 200/9-145) 33.33% Valuation based on sales from (35ILCS 200/1-155) 2009 – 2011 Questions about these valuations should be directed to: Heidi Granskog 2098 Mound Hill Rd, Dixon 815-288-6153 Office Hours: By Appointment Property in this township, other than farmland, is to be assessed at a 33.33% median level of assessment, based on the fair cash value of the property. You may check the accuracy of your assessment by dividing your assessment by the median level of assessment. The resulting value should equal the estimated fair cash value of your property. If the resulting value is greater than the estimated fair cash value of your property, you may be over-assessed. If the resulting value is less than the fair cash value of your property, you may be under-assessed. You may appeal your assessment to the Board of Review. If you believe your property’s fair cash value is incorrect or that the equalized assessed valuation is not uniform with other comparable properties in the same neighborhood, the following steps should be taken. 1. Contact your township assessor to review the assessment. 2. If not satisfied with the assessor review, taxpayers may file an appeal with the Lee County Board of Review. For appeal forms, instructions, and the Rules and Procedures of the Board of Review, visit www.leecountyil.com or call (815) 288-4483. Page 61

- Page 9 and 10: 07-08-04-110-002 30,500 BURKHALTER,

- Page 11 and 12: 07-08-04-355-019 23,500 CHILDERS, R

- Page 13 and 14: 07-02-29-402-019 43,000 CORWELL FAM

- Page 15 and 16: 07-08-05-335-002 7,000 DELHOTAL, CH

- Page 17 and 18: 07-08-05-160-005 22,000 DWYER, KATH

- Page 19 and 20: 07-08-04-127-002 19,400 FINKLE, TIM

- Page 21 and 22: 07-02-33-154-040 28,800 FRYE, MICHA

- Page 23 and 24: 07-02-32-405-002 29,900 GREENAWALT,

- Page 25 and 26: 07-02-09-426-027 48,440 HARTZELL RE

- Page 27 and 28: 07-08-06-454-010 25,000 HIMES, CLIN

- Page 29 and 30: 07-02-29-426-014 23,500 JENSEN, ALA

- Page 31 and 32: 07-02-32-257-007 18,400 KENT, PHILI

- Page 33 and 34: 07-02-29-454-020 45,000 LALLY, DAVI

- Page 35 and 36: 07-08-04-226-037 150,000 LONG, PAUL

- Page 37 and 38: 07-02-24-101-008 42,101 MC CARDLE,

- Page 39 and 40: 07-02-33-128-009 47,500 MILLER, SCO

- Page 41 and 42: 07-02-28-452-013 53,800 NELSON, DEN

- Page 43 and 44: 07-08-06-410-008 16,000 PARTINGTON,

- Page 45 and 46: 07-02-33-151-002 34,000 QUASS, MICH

- Page 47 and 48: 07-08-05-407-002 15,500 ROMERO, BEN

- Page 49 and 50: 07-08-05-479-011 29,000 SEIBLE, RAP

- Page 51 and 52: 07-02-31-279-005 41,400 SMITH, JACK

- Page 53 and 54: 07-02-28-453-016 30,600 STEDER, ROB

- Page 55 and 56: 07-08-04-326-007 38,000 THOMPSON, S

- Page 57 and 58: 07-08-06-481-017 22,000 VAUGHN, MIC

- Page 59: 07-02-31-280-011 37,800 WHITE, ROGE

- Page 63 and 64: 16-07-19-151-004 107,790 MCCASLIN,

- Page 65 and 66: 08-20-02-100-009 36,314 ANDERS TRUS

- Page 67 and 68: 08-20-03-200-012 32,258 DRAPER, MAT

- Page 69 and 70: 08-20-13-300-004 2,509 LEFFELMAN TR

- Page 71 and 72: 08-20-19-100-001 2,765 ROSENE, CARY

- Page 73 and 74: 08-20-21-100-002 7,588 YUSUF, ASIF

- Page 75 and 76: 09-19-07-400-007 1,802 FARMERS NATL

- Page 77 and 78: 09-19-30-400-002 73,405 MAGNUSON, D

- Page 79 and 80: 12-14-13-400-009 57,581 APPLEMAN, T

- Page 81 and 82: 12-14-34-400-006 5,520 DRAPER, THOM

- Page 83 and 84: 12-14-16-100-003 10,319 KENNEY FAMI

- Page 85 and 86: 12-14-26-100-002 16,515 MEAD, JOHN

- Page 87 and 88: 12-14-08-100-001 6,280 RHODENBAUGH,

- Page 89 and 90: 18-08-09-100-010 19,627 BONNELL, JA

- Page 91 and 92: 18-08-12-200-014 120,407 COMMONWEAL

- Page 93 and 94: 18-08-12-200-013 10,479,690 DUKE EN

- Page 95 and 96: 18-08-18-200-004 35,205 HANSEN, HOW

- Page 97 and 98: 18-08-16-100-001 500,000 IMECO INC

- Page 99 and 100: 18-08-20-200-003 47,819 LEVAN TRUST

- Page 101 and 102: 18-08-08-103-003 27,805 OTTO, DALE

- Page 103 and 104: 18-08-21-300-003 11,723 SCHIELEIN T

- Page 105 and 106: 18-08-16-400-001 33,224 WADDELL, SE

- Page 107 and 108: -4483. Your property tax bill will

- Page 109 and 110: 10-13-03-400-003 56,163 DEMPSEY, WI

07-02-29-401-039 51,000 ZAGAR, JAYNE<br />

07-08-04-128-001 91,900 ZARYCZNY, JOHN & MARIA<br />

07-02-32-207-012 36,700 ZELLER, JOHN<br />

07-02-32-434-008 57,400 ZEMAN, KATHRYN & JOHN BAKER<br />

07-08-06-476-018 21,500 ZENTZ, THERESA L<br />

07-02-31-277-027 57,000 ZERA, KIMBERLY R<br />

07-02-31-278-031 34,000 ZERA, KIMBERLY R<br />

07-08-05-178-003 16,500 ZICK, LISA A<br />

07-02-31-433-012 29,500 ZICK, LISA A<br />

07-08-05-185-003 31,000 ZICK, LISA A<br />

07-08-05-412-007 38,900 ZIMMERMAN, ERIC J & CORRINE R<br />

07-02-32-103-008 33,500 ZIMMERMAN, REBECCA SUE<br />

07-02-33-179-011 37,000 ZINNEN, WILLIAM & JUNEMARIE<br />

07-02-32-328-013 22,000 ZUEND TRUST<br />

07-02-32-328-001 31,900 ZUEND, JOHN & CYNTHIA R<br />

07-02-32-327-002 1,500 ZUEND, JOHN J & ZUEND, CYNTHIA<br />

07-02-32-328-009 13,500 ZUEND, JOHN J & ZUEND, CYNTHIA<br />

07-08-05-253-010 27,500 ZUIDEMA, ROBERT & ZELIA<br />

Notice to Palmyra Township Taxpayers: Assessed Values for 2012<br />

Valuation date (35ILCS 200/9-95) January 1, 2012<br />

Required level of assessment (35ILCS 200/9-145) 33.33%<br />

Valuation based on sales from (35ILCS 200/1-155) 2009 – 2011<br />

Questions about these valuations should be directed to:<br />

Heidi Granskog<br />

2098 Mound Hill Rd, Dixon<br />

815-288-6153<br />

Office Hours: By Appointment<br />

Property in this township, other than farmland, is to be assessed at a 33.33% median level of assessment, based on the<br />

fair cash value of the property. You may check the accuracy of your assessment by<br />

dividing your assessment by the median level of assessment. <strong>The</strong> resulting value should equal the estimated fair cash<br />

value of your property. If the resulting value is greater than the estimated fair cash value of<br />

your property, you may be over-assessed. If the resulting value is less than the fair cash value of your property, you may<br />

be under-assessed. You may appeal your assessment to the Board of Review.<br />

If you believe your property’s fair cash value is incorrect or that the equalized assessed valuation is not uniform with<br />

other comparable properties in the same neighborhood, the following steps should be taken.<br />

1. Contact your township assessor to review the assessment.<br />

2. If not satisfied with the assessor review, taxpayers may file an appeal with the <strong>Lee</strong> <strong>County</strong> Board of Review. For<br />

appeal forms, instructions, and the Rules and Procedures of the Board of Review, visit<br />

www.leecountyil.com or call (815) 288-4483.<br />

Page 61