2012 Publication - Amboy News.TXT - Notepad - Lee County, Illinois

2012 Publication - Amboy News.TXT - Notepad - Lee County, Illinois

2012 Publication - Amboy News.TXT - Notepad - Lee County, Illinois

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> <strong>Publication</strong> - <strong>Amboy</strong> <strong>News</strong>.<strong>TXT</strong><br />

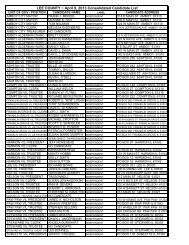

02-15-13-353-001 43,185 WITTENAUER, DONALD C TRUST<br />

02-15-22-303-007 56,287 WM E SHAW & JANET SHAW JOINT TENANCY TRUST,<br />

02-15-28-400-007 22,072 ZELLHOFER, JERAD M<br />

<strong>Lee</strong> Center<br />

11-16-05-200-006 51,381 ARCHER DANIELS MIDLAND<br />

11-16-34-400-007 225,426 BEETZ, JOHN S & BEETZ, DAVID A ETAL<br />

11-16-34-200-008 225,426 BONNELL, ALLEN C & EUGENE C<br />

11-16-34-400-005 225,426 BONNELL, ALLEN C & EUGENE C<br />

11-16-22-400-003 49,068 CAVAN TRUST<br />

11-16-27-300-004 29,588 CONSIDINE, KASEY D & DANA M<br />

11-16-06-451-014 16,553 DELHOTAL, GORDON E<br />

11-16-33-400-007 450,852 DUNN, SHAUNA M<br />

11-16-34-300-004 225,426 DUNN, SHAUNA M<br />

11-16-34-300-006 225,426 DUNN, SHAUNA M<br />

11-16-33-400-010 225,426 EUGENE A LEFFELMAN REVOCABLE TRUST,<br />

11-16-33-300-006 225,426 EUGENE A LEFFELMAN REVOCABLE TRUST,<br />

11-16-09-400-011 2,362 HAMBLEY, MICHAEL J & LANA M<br />

11-16-06-330-006 31,466 HUTCHERSON, KIMBERLY G<br />

11-16-21-401-009 20,730 KESSEL, RAMONA R<br />

11-16-21-402-022 40,322 KESSEL, RAMONA R & RAYMOND K<br />

11-16-27-100-005 52,112 LAUER, MARTIN E & CATHY L<br />

11-16-06-304-013 2,827 MC NINCH, MELVIN F AND SHARON D<br />

11-16-17-200-004 48,308 MHC O'CONNELL'S RV RESORT,LLC<br />

11-16-06-451-006 23,504 NILES, CYNTHIA<br />

11-16-09-300-004 42,908 PHELPS, DONALD L<br />

11-16-29-100-016 7,618 WAGNER, DAVID D & ZALE, MARY C<br />

11-16-30-100-002 89,485 WALTER, CRAIG B TRUSTEE<br />

11-16-28-200-004 57,761 WALTER, LANCE E & BECKY R<br />

11-16-26-100-005 24,249 WIDOLFF, STEVEN P & PAULA S<br />

11-16-32-376-013 88,228 WITTENAUER, ROGER & SANDRA<br />

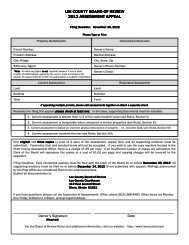

Notice to May and Sublette Township Taxpayers: Assessed Values for <strong>2012</strong><br />

Valuation date (35ILCS 200/9-95) January 1, <strong>2012</strong><br />

Required level of assessment (35ILCS 200/9-145) 33.33%<br />

Valuation based on sales from (35ILCS 200/1-155) 2009 – 2011<br />

Questions about these valuations should be directed to:<br />

Bob Lauer<br />

PO Box 407, Sublette 61367<br />

815-849-5190<br />

Office Hours: By Appointment<br />

Property in this township, other than farmland, is to be assessed at a 33.33% median level<br />

of assessment, based on the fair cash value of the property. You may check the accuracy<br />

of your assessment by dividing your assessment by the median level of assessment. The<br />

resulting value should equal the estimated fair cash value of your property. If the<br />

resulting value is greater than the estimated fair cash value of your property, you may be<br />

over-assessed. If the resulting value is less than the fair cash value of your property,<br />

you may be under-assessed. You may appeal your assessment to the Board of Review.<br />

If you believe your property’s fair cash value is incorrect or that the equalized assessed<br />

valuation is not uniform with other comparable properties in the same neighborhood, the<br />

following steps should be taken.<br />

1. Contact your township assessor to review the assessment.<br />

2. If not satisfied with the assessor review, taxpayers may file an appeal with the <strong>Lee</strong><br />

<strong>County</strong> Board of Review. For appeal forms, instructions, and the Rules and Procedures of<br />

the Board of Review, visit www.leecountyil.com or call (815) 288-4483.<br />

3. The final filing deadline for your township is 30 days from this publication date.<br />

After that date, the Board of Review is prohibited by law from accepting assessment<br />

appeals.<br />

Your property may be eligible for homestead exemptions, which can reduce your property’s<br />

taxable assessment. For more information on homestead exemptions, visit<br />

www.leecountyil.com or call (815) 288-4483.<br />

Your property tax bill will be calculated as follows:<br />

Page 2