Vietnam feasibility study - EITI

Vietnam feasibility study - EITI

Vietnam feasibility study - EITI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32<br />

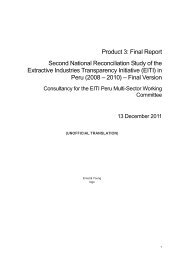

Exploration Exploitation Processing Trading Mine closure<br />

1.Natural resources tax<br />

2.Corporate income tax<br />

3. VAT<br />

4.Export, import tax<br />

TAXES<br />

5.Personal income tax<br />

The Extractive Industries Transparency Initiative and the Implementation Perspective of <strong>Vietnam</strong><br />

CENTRAL BUDGET<br />

1.Disovery bonus<br />

3.Production bonus<br />

2.Charge of purchase,<br />

use of information<br />

4.Environmental protection fee<br />

5.Signature bonus<br />

LOCAL<br />

BUDGET<br />

6. Fee of violation punishment (if the enterprise commits a violation)<br />

CHARGES AND<br />

FEES<br />

7.Other charges and fees<br />

1. Rental of land, water surface<br />

2.Deduction rate of prot distribution<br />

3.Study, training fund<br />

4.Mine clearance fund<br />

<strong>Vietnam</strong> Oil<br />

and Gas Group<br />

5.Social responsibility, commitment to the local area<br />

OTHER FINANCIAL<br />

OBLIGATIONS<br />

Figure 2. Financial liabilities of the oil and gas company