Vietnam feasibility study - EITI

Vietnam feasibility study - EITI

Vietnam feasibility study - EITI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

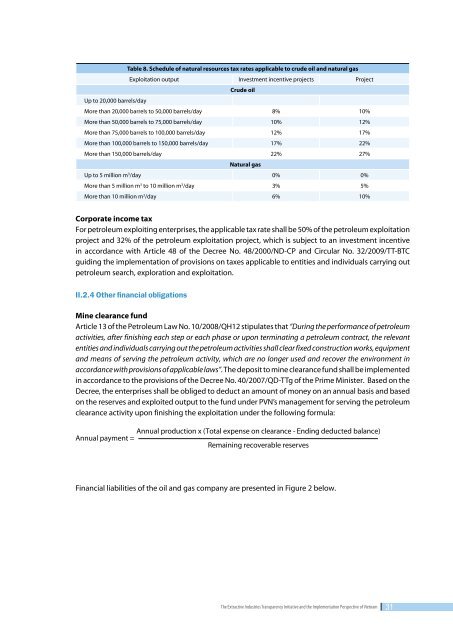

table 8. schedule of natural resources tax rates applicable to crude oil and natural gas<br />

Exploitation output Investment incentive projects Project<br />

Crude oil<br />

Up to 20,000 barrels/day<br />

More than 20,000 barrels to 50,000 barrels/day 8% 10%<br />

More than 50,000 barrels to 75,000 barrels/day 10% 12%<br />

More than 75,000 barrels to 100,000 barrels/day 12% 17%<br />

More than 100,000 barrels to 150,000 barrels/day 17% 22%<br />

More than 150,000 barrels/day 22% 27%<br />

natural gas<br />

Up to 5 million m3 /day 0% 0%<br />

More than 5 million m3 to 10 million m3 /day 3% 5%<br />

More than 10 million m3 /day 6% 10%<br />

Corporate income tax<br />

For petroleum exploiting enterprises, the applicable tax rate shall be 50% of the petroleum exploitation<br />

project and 32% of the petroleum exploitation project, which is subject to an investment incentive<br />

in accordance with Article 48 of the Decree No. 48/2000/ND-CP and Circular No. 32/2009/TT-BTC<br />

guiding the implementation of provisions on taxes applicable to entities and individuals carrying out<br />

petroleum search, exploration and exploitation.<br />

II.2.4 Other financial obligations<br />

mine clearance fund<br />

Article 13 of the Petroleum Law No. 10/2008/QH12 stipulates that “During the performance of petroleum<br />

activities, after finishing each step or each phase or upon terminating a petroleum contract, the relevant<br />

entities and individuals carrying out the petroleum activities shall clear fixed construction works, equipment<br />

and means of serving the petroleum activity, which are no longer used and recover the environment in<br />

accordance with provisions of applicable laws”. The deposit to mine clearance fund shall be implemented<br />

in accordance to the provisions of the Decree No. 40/2007/QD-TTg of the Prime Minister. Based on the<br />

Decree, the enterprises shall be obliged to deduct an amount of money on an annual basis and based<br />

on the reserves and exploited output to the fund under PVN’s management for serving the petroleum<br />

clearance activity upon finishing the exploitation under the following formula:<br />

Annual production x (Total expense on clearance - Ending deducted balance)<br />

Annual payment =<br />

Remaining recoverable reserves<br />

Financial liabilities of the oil and gas company are presented in Figure 2 below.<br />

The Extractive Industries Transparency Initiative and the Implementation Perspective of <strong>Vietnam</strong><br />

31