A single-tier pension: what does it really mean? - The Institute For ...

A single-tier pension: what does it really mean? - The Institute For ...

A single-tier pension: what does it really mean? - The Institute For ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A <strong>single</strong>-<strong>tier</strong> <strong>pension</strong>: <strong>what</strong> <strong>does</strong> <strong>it</strong> <strong>really</strong> <strong>mean</strong>?<br />

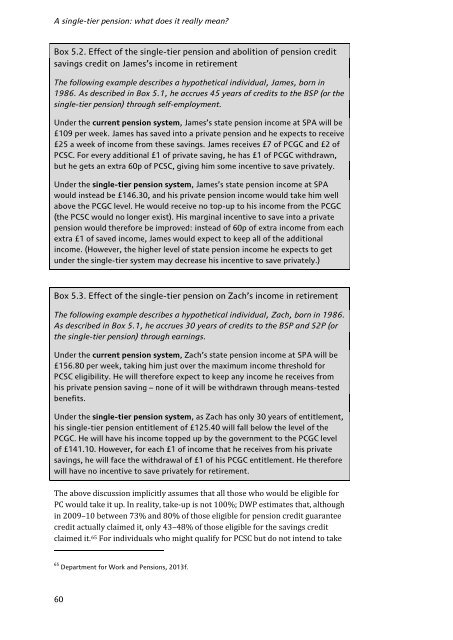

Box 5.2. Effect of the <strong>single</strong>-<strong>tier</strong> <strong>pension</strong> and abol<strong>it</strong>ion of <strong>pension</strong> cred<strong>it</strong><br />

savings cred<strong>it</strong> on James’s income in retirement<br />

<strong>The</strong> following example describes a hypothetical individual, James, born in<br />

1986. As described in Box 5.1, he accrues 45 years of cred<strong>it</strong>s to the BSP (or the<br />

<strong>single</strong>-<strong>tier</strong> <strong>pension</strong>) through self-employment.<br />

Under the current <strong>pension</strong> system, James’s state <strong>pension</strong> income at SPA will be<br />

£109 per week. James has saved into a private <strong>pension</strong> and he expects to receive<br />

£25 a week of income from these savings. James receives £7 of PCGC and £2 of<br />

PCSC. <strong>For</strong> every add<strong>it</strong>ional £1 of private saving, he has £1 of PCGC w<strong>it</strong>hdrawn,<br />

but he gets an extra 60p of PCSC, giving him some incentive to save privately.<br />

Under the <strong>single</strong>-<strong>tier</strong> <strong>pension</strong> system, James’s state <strong>pension</strong> income at SPA<br />

would instead be £146.30, and his private <strong>pension</strong> income would take him well<br />

above the PCGC level. He would receive no top-up to his income from the PCGC<br />

(the PCSC would no longer exist). His marginal incentive to save into a private<br />

<strong>pension</strong> would therefore be improved: instead of 60p of extra income from each<br />

extra £1 of saved income, James would expect to keep all of the add<strong>it</strong>ional<br />

income. (However, the higher level of state <strong>pension</strong> income he expects to get<br />

under the <strong>single</strong>-<strong>tier</strong> system may decrease his incentive to save privately.)<br />

Box 5.3. Effect of the <strong>single</strong>-<strong>tier</strong> <strong>pension</strong> on Zach’s income in retirement<br />

<strong>The</strong> following example describes a hypothetical individual, Zach, born in 1986.<br />

As described in Box 5.1, he accrues 30 years of cred<strong>it</strong>s to the BSP and S2P (or<br />

the <strong>single</strong>-<strong>tier</strong> <strong>pension</strong>) through earnings.<br />

Under the current <strong>pension</strong> system, Zach’s state <strong>pension</strong> income at SPA will be<br />

£156.80 per week, taking him just over the maximum income threshold for<br />

PCSC eligibil<strong>it</strong>y. He will therefore expect to keep any income he receives from<br />

his private <strong>pension</strong> saving – none of <strong>it</strong> will be w<strong>it</strong>hdrawn through <strong>mean</strong>s-tested<br />

benef<strong>it</strong>s.<br />

Under the <strong>single</strong>-<strong>tier</strong> <strong>pension</strong> system, as Zach has only 30 years of ent<strong>it</strong>lement,<br />

his <strong>single</strong>-<strong>tier</strong> <strong>pension</strong> ent<strong>it</strong>lement of £125.40 will fall below the level of the<br />

PCGC. He will have his income topped up by the government to the PCGC level<br />

of £141.10. However, for each £1 of income that he receives from his private<br />

savings, he will face the w<strong>it</strong>hdrawal of £1 of his PCGC ent<strong>it</strong>lement. He therefore<br />

will have no incentive to save privately for retirement.<br />

<strong>The</strong> above discussion implic<strong>it</strong>ly assumes that all those who would be eligible for<br />

PC would take <strong>it</strong> up. In real<strong>it</strong>y, take-up is not 100%; DWP estimates that, although<br />

in 2009–10 between 73% and 80% of those eligible for <strong>pension</strong> cred<strong>it</strong> guarantee<br />

cred<strong>it</strong> actually claimed <strong>it</strong>, only 43–48% of those eligible for the savings cred<strong>it</strong><br />

claimed <strong>it</strong>. 65 <strong>For</strong> individuals who might qualify for PCSC but do not intend to take<br />

65 Department for Work and Pensions, 2013f.<br />

60