Texas Financial Services Industry Report - Office of the Governor ...

Texas Financial Services Industry Report - Office of the Governor ...

Texas Financial Services Industry Report - Office of the Governor ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Texas</strong> <strong>Financial</strong> <strong>Services</strong><br />

<strong>Industry</strong> <strong>Report</strong><br />

JANUARY 2012<br />

www.<strong>Texas</strong>WideOpenForBusiness.com<br />

<strong>Office</strong> <strong>of</strong> <strong>the</strong> <strong>Governor</strong> | Economic Development & Tourism

Contents<br />

Overview…………………………………………………………………. 1<br />

Banking, Savings, & Credit Unions…………..…………….… 9<br />

Credit & Consumer Lending <strong>Services</strong>……….………...…… 11<br />

Investment-Related Activities……………...………………….. 15<br />

Insurance Carriers…………………………………………………….<br />

Accounting & Related <strong>Services</strong>…………………………………<br />

20<br />

24

Overview<br />

T<br />

he financial services industry encompasses<br />

many aspects <strong>of</strong> money management, including<br />

banking, insurance, credit, lending,<br />

investment, and financial transactions. A strong<br />

financial industry provides businesses with access to<br />

affordable capital, stimulates global trade, and<br />

presents investors with an array <strong>of</strong> products to<br />

increase return and manage risk. The industry plays an<br />

important role in <strong>the</strong> <strong>Texas</strong> economy, employing<br />

nearly 450,000 workers in <strong>the</strong> state.<br />

This report covers <strong>the</strong> wide variety <strong>of</strong> financial firms<br />

in <strong>Texas</strong>, including commercial and investment banks,<br />

credit unions, credit card issuers, consumer lenders,<br />

mortgage companies, money transfer providers,<br />

insurance carriers, venture capital firms, investment<br />

funds, financial advisers, stock and securities brokerages,<br />

accounting firms, and <strong>the</strong> Federal Reserve.<br />

Compared to <strong>the</strong> U.S. financial sector as a whole, <strong>the</strong><br />

<strong>Texas</strong> financial services industry is significantly more<br />

specialized in sales financing, real estate lending, and<br />

consumer finance than <strong>the</strong> financial sectors <strong>of</strong> most<br />

o<strong>the</strong>rs states. In contrast, <strong>the</strong> financial industries <strong>of</strong><br />

states like New York and Massachusetts are much<br />

more dependent upon investment activities, such as<br />

securities brokerage and investment banking. As a<br />

result, <strong>the</strong> <strong>Texas</strong> financial services industry is less<br />

directly tied to Wall Street activities.<br />

Nationally, <strong>the</strong> financial services industry is highly<br />

fragmented compared to o<strong>the</strong>r industries, with many<br />

2<br />

<strong>Texas</strong> is more specialized in sales<br />

financing, real estate lending, and<br />

consumer finance than most o<strong>the</strong>r states.<br />

companies competing for small portions <strong>of</strong> market<br />

share. Additionally, <strong>the</strong> rise <strong>of</strong> online services has<br />

dramatically changed <strong>the</strong> pace and face <strong>of</strong> financial<br />

services, helping to transform it into a highly automated<br />

and technology-dependent industry.<br />

<strong>Texas</strong> <strong>Financial</strong> <strong>Services</strong> Sectors<br />

by Total Workers<br />

Data note: This report covers most activities categorized as Sector 52, Finance and<br />

Insurance, under <strong>the</strong> North American <strong>Industry</strong> Classification System (NAICS).<br />

Additionally, <strong>the</strong> report extends coverage to accounting and related services, categorized<br />

as NAICS Sector 5412. Real estate services, credit bureaus, collections<br />

agencies, and <strong>of</strong>fices <strong>of</strong> insurance agents are not included in this report.

State <strong>of</strong> <strong>the</strong> <strong>Industry</strong> in <strong>Texas</strong><br />

In 2010, one out <strong>of</strong> approximately every 12 U.S.<br />

financial services workers was located in <strong>Texas</strong>, while<br />

one out <strong>of</strong> approximately every 13 U.S. financial<br />

services establishments was located in <strong>Texas</strong>, according<br />

to <strong>the</strong> U.S. Bureau <strong>of</strong> Labor Statistics (BLS).<br />

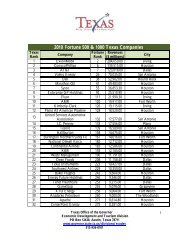

In addition, seven financial services giants headquartered<br />

in <strong>Texas</strong> are ranked on <strong>the</strong> 2011 Fortune 1000<br />

list, including USAA (San Antonio), Torchmark<br />

(McKinney), American National Insurance<br />

(Galveston), Alliance Data Systems (Plano), Comerica<br />

(Dallas), HCC Insurance Holdings (Houston), and<br />

Stewart Information <strong>Services</strong> (Houston).<br />

<strong>Texas</strong>-based financial services firms ranked in <strong>the</strong> Fortune 1000<br />

Worldwide, <strong>the</strong> financial services industry has<br />

undergone a massive shake-up over <strong>the</strong> past several<br />

years, enduring <strong>the</strong> credit crisis <strong>of</strong> <strong>the</strong> late 2000s and<br />

<strong>the</strong> collapse <strong>of</strong> leading firms like Lehman Bro<strong>the</strong>rs<br />

and Wachovia. As <strong>the</strong> industry grapples with <strong>the</strong> new<br />

playing field, some <strong>of</strong> <strong>the</strong> biggest firms, such as<br />

Goldman Sachs, Bank <strong>of</strong> America, Citicorp, and J.P.<br />

Morgan Chase, continue to operate a variety <strong>of</strong><br />

corporate locations in <strong>Texas</strong> (see map, opposite page).<br />

The <strong>Texas</strong> financial services sector has remained<br />

relatively healthy and continues to grow, despite <strong>the</strong><br />

global and national economic downturn that began in<br />

2007. <strong>Texas</strong> is <strong>the</strong> only one <strong>of</strong> <strong>the</strong> 15 largest U.S.<br />

MoneyGram Moves Headquarters<br />

from Minneapolis to Dallas<br />

In September 2010, MoneyGram International,<br />

<strong>the</strong> world’s second-largest provider <strong>of</strong> money<br />

transfer services, announced <strong>the</strong> relocation <strong>of</strong> its<br />

corporate headquarters from Minneapolis,<br />

Minnesota, to Dallas, <strong>Texas</strong>. MoneyGram’s move<br />

to <strong>Texas</strong> reduced its costs and streamlined<br />

operations, according to <strong>the</strong> company.<br />

MoneyGram cited <strong>the</strong> Dallas region’s dynamic<br />

corporate community, highly-connected<br />

international airport, and skilled, multi-lingual<br />

workforce as contributing to its selection <strong>of</strong> Dallas.<br />

states that has more finance and insurance jobs today<br />

than it did five years ago, before <strong>the</strong> recession hit. In<br />

contrast, California, Illinois, Florida, and Georgia<br />

shed financial jobs by double digit percentages during<br />

that same time period.<br />

The resilience <strong>of</strong> <strong>the</strong> <strong>Texas</strong> financial sector can be<br />

attributed to a number <strong>of</strong> factors, including <strong>the</strong> overall<br />

strength <strong>of</strong> <strong>the</strong> broader state economy. In 2011, <strong>Texas</strong><br />

led <strong>the</strong> country in job creation in energy, construction,<br />

manufacturing, and health care services. Additionally,<br />

<strong>Texas</strong>’ nation-leading business climate and sensible<br />

home equity laws helped <strong>the</strong> state avoid <strong>the</strong> worst <strong>of</strong><br />

<strong>the</strong> real estate foreclosure crisis that accompanied <strong>the</strong><br />

economic downturn. Media outlets such as <strong>the</strong> Wall<br />

Street Journal and CNBC have noted that <strong>Texas</strong>’<br />

consumer protections regarding home-equity loans<br />

were one factor that shielded <strong>the</strong> state from <strong>the</strong> high<br />

foreclosure rates experienced by o<strong>the</strong>r sunbelt states.<br />

48,600<br />

Number <strong>of</strong> financial services jobs added in <strong>Texas</strong><br />

from 2001-2011, more than quadruple that <strong>of</strong><br />

any o<strong>the</strong>r U.S. state.<br />

-U.S. Bureau <strong>of</strong> Labor Statistics<br />

OVERVIEW<br />

3

OVERVIEW<br />

Top <strong>Financial</strong> <strong>Services</strong> Companies with<br />

Corporate Operations in <strong>Texas</strong><br />

Firms with total corporate revenues exceeding $1 billion<br />

4<br />

See also:<br />

Insurance Carrier<br />

Map, pg. 21<br />

Representative sample only. Sources: D&B, company websites

The Lone Star State has provided substantial incentives<br />

to help develop <strong>the</strong> financial services industry<br />

over <strong>the</strong> past decade.<br />

In 2003, <strong>the</strong> <strong>Texas</strong> Legislature authorized <strong>the</strong> $295<br />

million <strong>Texas</strong> Enterprise Fund (TEF), a “deal closing”<br />

fund created to attract businesses and new jobs to<br />

<strong>Texas</strong>. The Legislature reauthorized <strong>the</strong> TEF in 2005,<br />

2007, 2009, and 2011. As <strong>of</strong> fourth quarter 2011, <strong>the</strong><br />

TEF had invested over $57 million in financial<br />

services-related projects. The table above details<br />

<strong>the</strong>se projects and <strong>the</strong> more than 12,700 jobs <strong>the</strong>y<br />

have committed to create.<br />

In 2005, <strong>the</strong> <strong>Texas</strong> Legislature authorized an additional<br />

business development program, <strong>the</strong> $200 million<br />

<strong>Texas</strong> Emerging Technology Fund (TETF), which<br />

<strong>Texas</strong> Enterprise Fund<br />

<strong>Financial</strong> <strong>Services</strong>-Related Awards<br />

Company City Description Jobs<br />

Award<br />

(Millions)<br />

JP Morgan Chase San Antonio Commercial Banking 4,200 $15.0<br />

Bank <strong>of</strong> America Richardson Mortgage Lending 3,876 $11.5<br />

Automatic Data Processing (ADP) El Paso Payroll <strong>Services</strong> 1,028 $3.0<br />

Fidelity Global Brokerage Westlake (Tarrant Co.) Investment <strong>Services</strong> 850 $4.5<br />

Torchmark McKinney Insurance Carrier 500 $2.0<br />

Comerica Dallas Commercial Banking 200 $3.5<br />

Nationwide Mutual Insurance San Antonio Insurance Carrier NA NA<br />

Allstate Insurance San Antonio Insurance Carrier 200 $1.1<br />

Nationstar Mortgage Lewisville Mortgage Lending 400 $0.5<br />

TDAmeritrade Fort Worth Investment <strong>Services</strong> 490 $1.2<br />

PayPal / eBay Austin <strong>Financial</strong> Transactions 1,000 $2.8<br />

TOTALS — — 12,744 $45.1<br />

State Government Initiatives<br />

OVERVIEW<br />

was established to promote and finance breakthrough<br />

technological innovations. The TETF, which was<br />

most recently reauthorized in 2011, functions as a<br />

state-operated venture capital fund for commercializing<br />

new technologies developed across <strong>the</strong> state.<br />

supplementing <strong>the</strong> network <strong>of</strong> private venture capital<br />

in <strong>Texas</strong>, <strong>the</strong> TETF has helped secure millions in<br />

matching grants from both inside and outside <strong>the</strong> state<br />

and nurtured <strong>Texas</strong>-based startups when traditional<br />

financing sources have been scarce.<br />

The State <strong>of</strong> <strong>Texas</strong> also operates o<strong>the</strong>r specialized<br />

financing programs through <strong>the</strong> <strong>Texas</strong> Economic<br />

Development Bank, <strong>the</strong> <strong>Texas</strong> Department <strong>of</strong> Agriculture,<br />

<strong>the</strong> <strong>Texas</strong> Department <strong>of</strong> Housing and Community<br />

Affairs, and o<strong>the</strong>r divisions <strong>of</strong> <strong>the</strong> state government.<br />

5

OVERVIEW<br />

<strong>Financial</strong> <strong>Services</strong> Workforce<br />

<strong>Texas</strong> is home to more than 28,800 financial services<br />

firms, including banks, credit unions, credit<br />

and consumer lending services, insurance<br />

companies, investment firms, securities<br />

brokerages, accounting firms, and o<strong>the</strong>rs.<br />

These companies employ more than<br />

446,600 <strong>Texas</strong> workers.<br />

Compared to <strong>the</strong> U.S. as a whole, The<br />

<strong>Texas</strong> financial services workforce is<br />

significantly more concentrated in commercial<br />

banking, sales financing, and real estate<br />

and consumer lending than o<strong>the</strong>r areas <strong>of</strong><br />

finance. In fact, <strong>Texas</strong> has <strong>the</strong> largest real<br />

estate lending workforce <strong>of</strong> any state, with<br />

more than 30,000 employed by mortgage<br />

companies, construction lenders, etc.<br />

Additionally, North <strong>Texas</strong> is home to a<br />

large concentration <strong>of</strong> workers in <strong>the</strong> Auto<br />

Finance sector (see pg. 12 for more detail).<br />

The <strong>Texas</strong> insurance labor force, with more<br />

than 80,500 workers, excluding insurance<br />

agents and brokers, is one <strong>of</strong> <strong>the</strong> largest in<br />

<strong>the</strong> country. Compared to o<strong>the</strong>r states,<br />

6<br />

60,000<br />

40,000<br />

<strong>Texas</strong> is more specialized in property and casualty<br />

insurance and less so in health and medical insurance.<br />

<strong>Financial</strong> <strong>Services</strong> Employment Change<br />

in <strong>the</strong> 10 Largest States, Sep. 2001-Sep. 2011<br />

20,000<br />

0<br />

-20,000<br />

-40,000<br />

-60,000<br />

<strong>Texas</strong><br />

N. Carolina<br />

Florida<br />

Michigan<br />

Georgia<br />

<strong>Financial</strong> <strong>Services</strong> Employment in <strong>Texas</strong><br />

Second Quarter 2011<br />

Pennsylvania<br />

Sector (<strong>Industry</strong> Code) Employees Firms<br />

Ohio<br />

Illinois<br />

California<br />

New York<br />

Source: U.S. Bureau <strong>of</strong> Labor Statistics<br />

Average<br />

Annual Wage<br />

Banking, Credit, and Consumer Lending <strong>Services</strong> (522) 241,179 4,262 $53,664<br />

Insurance Carriers (5241) 80,539 862 $68,484<br />

Securities and O<strong>the</strong>r <strong>Financial</strong> Investment <strong>Services</strong> (523) 48,544 4,843 $120,328<br />

Funds, Trusts, and O<strong>the</strong>r <strong>Financial</strong> Vehicles (525) 8,503 549 $84,552<br />

Monetary Authorities/Central Bank (521) 1,731 NA $75,140<br />

Accounting, Payroll, and Related <strong>Services</strong> (5412) 66,151 8,374 $56,316<br />

TOTALS 446,647 18,890 ---<br />

Source: <strong>Texas</strong> Workforce Commission

During <strong>the</strong> height <strong>of</strong> <strong>the</strong> financial crisis in 2009,<br />

employment in all <strong>of</strong> <strong>the</strong> major financial services<br />

sectors in <strong>Texas</strong> suffered some degree <strong>of</strong> decline.<br />

Never<strong>the</strong>less, <strong>the</strong> state’s financial services employment<br />

held up remarkably well, given <strong>the</strong> shocks that<br />

threatened to upend <strong>the</strong> global financial industry in <strong>the</strong><br />

late 2000s. <strong>Texas</strong> employment in <strong>the</strong> Insurance<br />

Carriers sector shrank by only 1% in 2009. Addition-<br />

<strong>Financial</strong> Education<br />

<strong>Texas</strong> is home to a number <strong>of</strong> world-class, accredited<br />

business schools that provide a pipeline <strong>of</strong> trained<br />

workers to <strong>the</strong> financial services industry. <strong>Texas</strong><br />

business schools have been highly ranked by major<br />

publications including BusinessWeek, The Economist,<br />

<strong>Financial</strong> Times, Forbes, U.S. News & World <strong>Report</strong>,<br />

and The Wall Street Journal.<br />

In Spring 2010, <strong>Texas</strong> graduated over 35,500 students<br />

with business degrees, according to <strong>the</strong> National<br />

Center for Education Statistics. Of those, over 9,900<br />

received accounting or finance degrees.<br />

ally, by mid 2011, <strong>the</strong> Accounting <strong>Services</strong>, <strong>Financial</strong><br />

Investment <strong>Services</strong>, and Funds & Trusts sectors had<br />

all increased <strong>the</strong>ir employment in <strong>Texas</strong> to above prerecession<br />

levels. Employment in <strong>the</strong> Banking, Credit,<br />

& Lending sector, which was hard-hit in many parts <strong>of</strong><br />

<strong>the</strong> world during <strong>the</strong> recession, increased gradually in<br />

<strong>Texas</strong> after <strong>the</strong> recovery began, and remains at about<br />

2% below 2007 levels.<br />

<strong>Texas</strong> <strong>Financial</strong> <strong>Services</strong> 5-Year Employment Trends, Q2 2007-Q2 2011<br />

2007 2008 2009 2010 2011<br />

Eight <strong>Texas</strong> Business Schools<br />

Rank in U.S. Top 100<br />

No. 17: The University <strong>of</strong> <strong>Texas</strong> at Austin<br />

No. 32 (tied): <strong>Texas</strong> A&M University<br />

No. 34 (tied): Rice University<br />

No 40 (tied): The University <strong>of</strong> <strong>Texas</strong> at Dallas<br />

No 57 (tied): Sou<strong>the</strong>rn Methodist University<br />

No 60 (tied): Baylor University (Hankamer)<br />

No. 80 (tied): <strong>Texas</strong> Christian University<br />

No. 94 (tied): The University <strong>of</strong> Houston<br />

OVERVIEW<br />

Source: U.S. News & World <strong>Report</strong>, Best Business Schools 2012<br />

7

OVERVIEW<br />

8<br />

As one <strong>of</strong> twelve regional Federal Reserve<br />

Banks (<strong>the</strong> Fed), <strong>the</strong> Dallas Fed serves <strong>the</strong><br />

Eleventh Federal Reserve District, which<br />

consists <strong>of</strong> <strong>Texas</strong>, nor<strong>the</strong>rn Louisiana, and<br />

Sou<strong>the</strong>rn New Mexico. The 12<br />

regional Reserve Banks, along with<br />

<strong>the</strong> Board <strong>of</strong> <strong>Governor</strong>s in<br />

Washington, D.C., make up <strong>the</strong> Fed<br />

System.<br />

Established by Congress in 1913,<br />

<strong>the</strong> Fed’s primary mission is to<br />

maintain <strong>the</strong> stability <strong>of</strong> <strong>the</strong> U.S.<br />

financial system and to contain any<br />

systemic risks in financial markets.<br />

To accomplish this, <strong>the</strong> Fed<br />

supervises and regulates U.S.<br />

banking institutions, moderates<br />

long-term national interest rates,<br />

maintains sufficient currency<br />

supplies, buys and sells U.S.<br />

government securities, and more.<br />

Regional <strong>Financial</strong> Hub:<br />

The Federal Reserve Bank <strong>of</strong> Dallas<br />

Dallas was selected as <strong>the</strong> headquarters <strong>of</strong> <strong>the</strong><br />

Fed’s Eleventh District in 1914 for, among o<strong>the</strong>r<br />

factors, its developed<br />

banking sector and<br />

central location.<br />

In 1999, <strong>the</strong> U.S.<br />

Treasury selected <strong>the</strong><br />

Dallas Fed as <strong>the</strong> nation's<br />

central processor for<br />

Treasury coupons and to<br />

manage <strong>the</strong> national<br />

Electronic Transfer<br />

Accounts (ETAs)<br />

program. ETAs are used by millions <strong>of</strong> federal<br />

benefit recipients receiving payments by<br />

check, including veterans’ benefits, Social<br />

Security, and civilian and military wages.<br />

The Dallas Fed<br />

provides regional<br />

financial services, such as credit to lending<br />

institutions from <strong>the</strong> Discount Window and<br />

supervision over all chartered banks in <strong>the</strong><br />

region. The Fed branch also provides regional<br />

economic research and analysis.<br />

The Dallas Fed is headquartered near<br />

downtown Dallas in a 17-story building<br />

containing all <strong>the</strong> Bank’s financial operations<br />

(pictured at left). The Dallas Fed employs over<br />

1,100 people and maintains branches in<br />

El Paso, Houston, and San Antonio.

Banking, Savings, and Credit Unions<br />

Overview<br />

<strong>Texas</strong> is home to more than 1,200 banking firms,<br />

credit unions, and o<strong>the</strong>r savings and depository institutions,<br />

which employ more than 146,600 Texans.<br />

This sector is easily <strong>the</strong> largest financial sector in<br />

<strong>Texas</strong>, comprising nearly 39% percent <strong>of</strong> all financial<br />

services employment. Within <strong>the</strong> sector, commercial<br />

banks dominate in terms <strong>of</strong> number <strong>of</strong> firms<br />

and total workers (see table below).<br />

According to <strong>the</strong> <strong>Texas</strong> Department <strong>of</strong> Banking<br />

(DOB), which oversees <strong>the</strong> state’s banking industry,<br />

<strong>Texas</strong> has a total <strong>of</strong> 639 chartered banks with $804.3<br />

billion in assets and $744.2 billion in deposits. A list<br />

<strong>of</strong> <strong>the</strong> TDOB’s top 10 banks follows on page 10.<br />

Banking, Savings, and Credit Union Employment<br />

Second Quarter 2011 (NAICS 5221)<br />

Sector (<strong>Industry</strong> Code) Examples Employees Firms<br />

Average<br />

Annual Wage<br />

Commercial Banking (52211) Commercial Banks 113,504 5,610 $52,260<br />

Credit Unions (52213) Credit Unions 20,189 1,195 $40,612<br />

Savings Institutions (52212) Savings & Loans 11,700 311 $50,700<br />

O<strong>the</strong>r Depository Credit Institutions (52219)<br />

Private and<br />

Industrial Banks<br />

Comerica Headquarters<br />

Established in <strong>Texas</strong><br />

In October 2007, Comerica Inc. relocated its<br />

corporate headquarters from Detroit, Michigan,<br />

to Dallas, <strong>Texas</strong>. Since <strong>the</strong> state invested<br />

$3.5 million through <strong>the</strong> <strong>Texas</strong> Enterprise Fund<br />

to incentivize <strong>the</strong> relocation, <strong>the</strong> project has<br />

created approximately 200 direct jobs and<br />

generated an estimated $16.2 million in capital<br />

investment in <strong>the</strong> state. Comerica, a Fortune<br />

1000 company, is <strong>the</strong> largest U.S. bank headquartered<br />

in <strong>Texas</strong>. In addition, Austin serves<br />

as <strong>the</strong> regional headquarters for <strong>the</strong> bank's<br />

Technology & Life Sciences division, which<br />

provides specialized services to that industry.<br />

The <strong>Texas</strong> Credit Union Department (TCUD), <strong>the</strong><br />

primary regulator <strong>of</strong> all <strong>Texas</strong>-chartered credit unions,<br />

reported in June 2011 that <strong>the</strong> state’s 202 statechartered<br />

credit unions had $24.3 billion in assets, a<br />

5.2% increase from a year earlier.<br />

755 23 $71,240<br />

TOTALS 146,149 1,222 ---<br />

9

BANKING, SAVINGS, AND CREDIT UNIONS<br />

Top 10 Banks in <strong>Texas</strong> by In-State Assets<br />

September 2011<br />

Bank Name Headquarters Assets<br />

(in billions)<br />

JP Morgan Chase Bank New York, NY $96.0<br />

Bank <strong>of</strong> America Charlotte, NC $77.6<br />

Comerica Bank Dallas, TX $60.8<br />

Wells Fargo Bank San Francisco, CA $51.2<br />

Wells Fargo Bank South<br />

Central NA<br />

Houston, TX $29.2<br />

Compass Bank Birmingham, AL $26.0<br />

Frost National Bank San Antonio, TX $19.5<br />

Amegy Bank NA Houston, TX $11.4<br />

Prosperity Bank El Campo, TX $9.6<br />

International Bank <strong>of</strong><br />

Commerce<br />

Laredo, TX $9.5<br />

In 2010, one out <strong>of</strong> approximately every 11 U.S.<br />

Banking, Savings, and Credit Unions workers was<br />

employed in <strong>Texas</strong>. Additionally, many <strong>of</strong> <strong>the</strong> nation’s<br />

top 50 bank holding companies, according to <strong>the</strong> Federal<br />

<strong>Financial</strong> Institutions Examination Council<br />

(FFIEC), have various types <strong>of</strong> operations in <strong>Texas</strong>.<br />

They include <strong>the</strong> top five: Bank <strong>of</strong> America, JP Morgan<br />

Chase, Citigroup, Wells Fargo, and Goldman<br />

Sachs. Comerica, headquartered in Dallas, is ranked<br />

No. 32 nationally by <strong>the</strong> FFIEC.<br />

According to <strong>the</strong> FDIC, in Q4 2010, 615 FDICinsured<br />

banking institutions in <strong>Texas</strong> had $374.8 billion<br />

in assets. Of <strong>the</strong>se, 181 were located in <strong>the</strong> Dallas<br />

area, followed by 115 institutions in <strong>the</strong> Houston area,<br />

with <strong>the</strong> rest distributed throughout <strong>the</strong> state.<br />

Banks and savings institutions in <strong>Texas</strong> are performing<br />

better than <strong>the</strong> nationwide averages, based on <strong>the</strong><br />

percentage <strong>of</strong> pr<strong>of</strong>itable institutions recently reported<br />

by <strong>the</strong> FDIC. Only one <strong>Texas</strong> state-chartered bank<br />

was closed in 2011.<br />

10<br />

Source: <strong>Texas</strong> Dept. <strong>of</strong> Banking<br />

Federal Deposit Insurance Corp.<br />

Expands Regional HQ in Dallas<br />

Dallas is <strong>the</strong> headquar-<br />

ters <strong>of</strong> one <strong>of</strong> <strong>the</strong><br />

Federal Deposit Insur-<br />

ance Corporation’s<br />

(FDIC) eight supervisory regional <strong>of</strong>fices. The<br />

Dallas Regional <strong>Office</strong> serves <strong>Texas</strong>, Colorado,<br />

New Mexico, and Oklahoma and has <strong>Texas</strong><br />

field <strong>of</strong>fices in Austin, Houston, and Lubbock.<br />

Dallas is also <strong>the</strong> headquarters <strong>of</strong> <strong>the</strong> FDIC’s<br />

Division <strong>of</strong> Resolution and Receivership, <strong>the</strong><br />

unit that handles failed banks.<br />

The FDIC preserves and promotes public<br />

confidence in <strong>the</strong> U.S. financial system by,<br />

among o<strong>the</strong>r duties, insuring deposits in banks<br />

for at least $250,000.<br />

In 2008, <strong>the</strong> FDIC expanded <strong>the</strong> Dallas Region-<br />

al <strong>Office</strong>, adding over 125,000 square feet and<br />

hundreds <strong>of</strong> staff to handle failing and trou-<br />

bled banks around <strong>the</strong> country. The Dallas<br />

Regional <strong>Office</strong> employs 1,275 in Dallas, while<br />

<strong>the</strong> <strong>Texas</strong> field <strong>of</strong>fices employ 41 in Austin, 62<br />

in Houston, and 35 in Lubbock.

Credit & Consumer Lending <strong>Services</strong><br />

Overview<br />

<strong>Texas</strong> is home to more than 2,100 firms employing<br />

over 73,500 workers in Credit Card Issuance, Sales<br />

Financing, Consumer & Real Estate Lending,<br />

International Trade Financing, and O<strong>the</strong>r Non-<br />

Depository Credit <strong>Services</strong>. About 19% <strong>of</strong> all state<br />

financial services employees work in this sector, with<br />

<strong>the</strong> largest portion employed by consumer and real<br />

estate lending firms (see table below).<br />

Credit & Consumer Lending Sector Employment<br />

Second Quarter 2011 (NAICS 5222)<br />

Sector (<strong>Industry</strong> Code) Examples Employees Firms<br />

Average<br />

Annual Wage<br />

Credit Card Issuance (52221) Credit Card Banks 5,146 50 $58,552<br />

Sales Financing 52222)<br />

Loan & Finance<br />

Companies<br />

10,394 261 $69,420<br />

Consumer Lending (522291) Cash Loan Firms 13,555 674 $51,324<br />

Real Estate Credit (522292)<br />

Mortgage Firms,<br />

Construction Lenders<br />

31,489 582 $63,336<br />

International Trade Financing (522293) Trade & Export Banks 433 83 $99,684<br />

All O<strong>the</strong>r Non-Depository Credit <strong>Services</strong><br />

(522298)<br />

Federal Home Loan<br />

Banks, etc.<br />

Alliance Data Signs Retail Giant<br />

to Client Roster<br />

Plano, <strong>Texas</strong>-based Fortune 1000 company<br />

Alliance Data provides private-label and<br />

commercial credit card services, shopper loyalty<br />

programs, and consumer marketing and<br />

analytics. The company’s clients include financial<br />

services firms and retailers.<br />

In October<br />

2011, Fort<br />

Worth, <strong>Texas</strong>based<br />

Pier 1<br />

Imports announced its new, private-label credit<br />

card agreement with Alliance Data. Alliance will<br />

provide end-to-end private-label credit card<br />

services from account acquisition to marketing<br />

and customer service for Pier 1 Imports.<br />

O<strong>the</strong>r major Alliance Data customers include<br />

21st Century Insurance, Kellogg, J.Crew,<br />

Whirlpool, La Quinta Inns, and Kraft Foods.<br />

9,814 494 $41,860<br />

TOTALS 73,533 2,138 —<br />

11

CREDIT & CONSUMER LENDING SERVICES<br />

<strong>Texas</strong> is home to a large share <strong>of</strong> <strong>the</strong> national workforce<br />

in this sector. In 2010, one out <strong>of</strong> approximately<br />

every 8 U.S. credit and consumer lending employees<br />

worked in <strong>Texas</strong>.<br />

While <strong>Texas</strong> is a major center for U.S. real estate<br />

finance, <strong>the</strong> state has not experienced residential<br />

foreclosures at <strong>the</strong> high rates <strong>of</strong> many o<strong>the</strong>r large<br />

states. The reasons for this have been attributed to<br />

<strong>Texas</strong>’ rapid population growth, lower housing prices,<br />

and state limits on home equity loans.<br />

In June 2011, Gov. Rick Perry signed two bills to<br />

regulate <strong>the</strong> over 3,000 payday and auto title lenders in<br />

<strong>Texas</strong>. The bills establish a licensing and regulatory<br />

framework for short-term consumer loans, while<br />

stopping short <strong>of</strong> capping fees or loan amounts, and<br />

bring <strong>the</strong> state’s payday and auto title lenders under<br />

<strong>the</strong> authority <strong>of</strong> <strong>the</strong> state’s Consumer Credit Commission,<br />

which regulates <strong>Texas</strong>’ credit industry. The bills<br />

took effect January 1, 2012.<br />

North <strong>Texas</strong> Drives Auto Finance Sector<br />

The Dallas-Fort Worth metro area is home to a<br />

significant number <strong>of</strong> major automotive finance<br />

companies, including <strong>the</strong> headquarters <strong>of</strong> General<br />

Motors (GM) <strong>Financial</strong>, CapitalOne Auto Finance,<br />

and Santander Consumer Finance. Major<br />

carmakers Daimler and Ford also run finance<br />

operations out <strong>of</strong> <strong>the</strong> DFW region.<br />

The largest firm in this auto finance “cluster”<br />

formed in October 2010 when GM completed a<br />

$3.5 billion acquisition <strong>of</strong> Fort Worth-based<br />

AmeriCredit. The newly renamed GM <strong>Financial</strong><br />

remains headquartered in <strong>Texas</strong>, and allows <strong>the</strong><br />

automaker to once again <strong>of</strong>fer in-house financial<br />

solutions to car dealers across North America.<br />

12<br />

Cash America Spins Off Subsidiary<br />

In September 2010, Fort Worth, <strong>Texas</strong>-based<br />

Cash America International, a payday lender<br />

serving customers who do not obtain financial<br />

services from traditional lenders, announced<br />

plans to spin <strong>of</strong>f its online financial services<br />

subsidiary, Enova International, in an initial<br />

public <strong>of</strong>fering. Enova serves consumers in <strong>the</strong><br />

U.S., <strong>the</strong> U.K., Australia and Canada.<br />

Cash America is a public company (NYSE: CSH)<br />

that owns and operates over 1,000 locations in<br />

<strong>the</strong> U.S. and Mexico, and via <strong>the</strong> Internet,<br />

Canada, <strong>the</strong> UK, and Australia. It has expanded<br />

rapidly since its founding in 1983 with one retail<br />

location in Irving, <strong>Texas</strong>.

Workforce Concentrations<br />

The map below identifies <strong>the</strong> state’s Workforce<br />

Development regions with above-average specializations<br />

in credit and consumer lending services. The<br />

highlighted regions are not <strong>the</strong> only areas in <strong>Texas</strong><br />

where workers in this sector can be found, but ra<strong>the</strong>r<br />

represent areas with <strong>the</strong> greatest concentrations relative<br />

to <strong>the</strong> size <strong>of</strong> <strong>the</strong> local labor force.<br />

Credit & Consumer<br />

Lending <strong>Services</strong><br />

Workforce<br />

Concentration<br />

Moderate<br />

Above Average<br />

High<br />

Data: <strong>Texas</strong> Workforce Commission, Q4 2010<br />

This analysis compares <strong>the</strong> portion <strong>of</strong> each <strong>Texas</strong> region’s<br />

workforce employed in <strong>the</strong> sector to <strong>the</strong> portion<br />

<strong>of</strong> <strong>the</strong> entire U.S. workforce employed in that sector.<br />

The comparison provides a ratio that measures how<br />

intensively a certain region is specialized in this industry,<br />

and ranks it as “moderate,” “above average,”<br />

or “high.”<br />

North Central Region<br />

Real Estate Credit<br />

Debit Card Provider NetSpend Raises $200 Million in IPO<br />

In October 2010, Austin-based financial services<br />

company NetSpend raised more than $200 million<br />

in its initial public <strong>of</strong>fering. NetSpend is one <strong>of</strong> <strong>the</strong><br />

largest distributors <strong>of</strong> reloadable, prepaid debit<br />

cards in <strong>the</strong> U.S., targeting consumers who are<br />

unable or unwilling to deposit <strong>the</strong>ir money in a<br />

bank. The company has issued more than 2 million<br />

CREDIT & CONSUMER LENDING SERVICES<br />

Capital Region<br />

Sales Financing<br />

Consumer Lending<br />

Credit Card Issuing<br />

Dallas/Fort Worth<br />

Real Estate Credit<br />

Consumer Lending<br />

Sales Financing<br />

Credit Card Issuing<br />

Central <strong>Texas</strong><br />

Secondary Market<br />

Financing<br />

active cards, which it<br />

distributes directly to<br />

consumers via <strong>the</strong><br />

Internet or through<br />

retailers. Founded in<br />

Austin in 1999, NetSpend now employs about 500<br />

workers in multiple states.<br />

13

CREDIT & CONSUMER LENDING SERVICES<br />

Major Companies<br />

Top Credit & Consumer Lending Companies Headquartered in <strong>Texas</strong><br />

By Revenues<br />

Company Name Headquarters Sector<br />

Revenue<br />

(Millions)<br />

Alliance Data Systems Plano Credit Card Issuance $2,791<br />

General Motors <strong>Financial</strong> Company Fort Worth Sales Financing $1,523<br />

Cash America International Inc. Fort Worth Consumer Lending $1,293<br />

MoneyGram Dallas <strong>Financial</strong> Transactions $1,167<br />

EZCORP Inc. Austin Consumer Lending $733<br />

First Cash <strong>Financial</strong> <strong>Services</strong> Inc. Arlington Consumer Lending $431<br />

Amerisource Funding Inc. Houston Commercial Financing $341<br />

Ace Cash Express Irving Consumer Lending $310<br />

NetSpend Austin <strong>Financial</strong> Transactions $275<br />

Nationstar Mortgage Lewisville Real Estate Credit $261<br />

<strong>Texas</strong> Guaranteed Student Loan Corp. Round Rock Consumer Lending $190<br />

Capital One Auto Finance Inc. Plano Sales Financing $154<br />

Brazos Student Finance Corp. Waco Consumer Lending $125-$150<br />

DHI Mortgage / D.R. Horton Austin Real Estate Credit $84<br />

Ascension Capital Group Inc. Arlington Consumer Lending $80<br />

ORIX USA Corp. Dallas Commercial Financing $54<br />

North <strong>Texas</strong> Higher Education Authority Arlington Consumer Lending $49<br />

First Investors <strong>Financial</strong> <strong>Services</strong> Group Houston Sales Financing $36<br />

PreCash Inc. Houston <strong>Financial</strong> Transactions $25-$50<br />

Santander Consumer USA Fort Worth Consumer Lending NA<br />

Group 1 Automotive Houston Sales Financing NA<br />

14<br />

Representative sample only. Sources: D&B, LexisNexis, company websites<br />

Top 5:

Investment<br />

Investment-Related Investment Related <strong>Services</strong><br />

Overview<br />

<strong>Texas</strong> is home to more than 5,400 investment services<br />

firms employing nearly 56,900 workers. This ranks<br />

<strong>Texas</strong> fourth in <strong>the</strong> nation for <strong>the</strong> size <strong>of</strong> its investment<br />

services workforce. While about 29% <strong>of</strong> all financial<br />

services firms in <strong>the</strong> state are investment-related, <strong>the</strong><br />

sector accounts for only 9% <strong>of</strong> all financial services<br />

employment in <strong>the</strong> state, indicating that many <strong>Texas</strong><br />

investment firms are small enterprises. Securities<br />

brokerage, portfolio management, and investment<br />

advice dominate this sector (see chart below),<br />

concentrating most heavily in <strong>the</strong> Dallas area.<br />

Investment-Related <strong>Services</strong> Employment<br />

Second Quarter 2011 (NAICS 523 and 525)<br />

Sector (<strong>Industry</strong> Code) Examples Employees Firms<br />

Security & Commodity Investment (5231)<br />

O<strong>the</strong>r <strong>Financial</strong> Investment Activities (5239)<br />

Insurance & Employee Benefit Funds (5251)<br />

Stock & Bond Brokerage,<br />

Commodity Contract Trading<br />

Portfolio Management,<br />

Investment Advice<br />

Insurance, Pension,<br />

& Health Funds<br />

Internet services have radically changed and increased<br />

<strong>the</strong> size <strong>of</strong> <strong>the</strong> state’s investment-related industry, with<br />

ever-growing numbers <strong>of</strong> investors, products, and<br />

firms such as stock brokerages, operating online.<br />

Fidelity Investments Expands at<br />

300-Acre <strong>Texas</strong> Campus<br />

In 2000, Massachusetts-based Fidelity<br />

Investments located a major regional center in<br />

Westlake, <strong>Texas</strong>, which now employs more<br />

than 3,000 workers. In 2007, <strong>the</strong> company<br />

announced plans for a 600,000 sq. ft.<br />

expansion at <strong>the</strong> campus, which has since been<br />

completed. The regional center currently<br />

supports 25 <strong>of</strong> <strong>the</strong> company’s operating units.<br />

Fidelity is one <strong>of</strong> <strong>the</strong> world’s largest providers<br />

<strong>of</strong> financial services, <strong>of</strong>fering investment<br />

management, retirement planning, brokerage,<br />

and employee benefits outsourcing.<br />

Average<br />

Annual Wage<br />

25,068 997 $133,952<br />

23,421 3,857 $106,236<br />

3,897 120 $63,232<br />

O<strong>the</strong>r Investment Pools & Funds (5259) Mutual Funds, Trusts, Estates 4,606 431 $102,544<br />

TOTALS 56,992 5,405 —-<br />

15

INVESTMENT-RELATED SERVICES<br />

Despite <strong>the</strong> global financial crisis <strong>of</strong> <strong>the</strong> late 2000s,<br />

<strong>the</strong> number <strong>of</strong> securities brokerage establishments in<br />

<strong>Texas</strong> exploded by 103% from 2005 to 2011, while<br />

employment in that category grew by 24%.<br />

Investment advising has remained ano<strong>the</strong>r bright spot<br />

in <strong>the</strong> <strong>Texas</strong> financial sector, adding more than 3,300<br />

jobs between 2005 and 2011, which represents a<br />

nearly 80% gain.<br />

Some <strong>of</strong> <strong>the</strong> world’s largest and best-known<br />

investment companies, such as Fidelity, Charles<br />

Schwab, and Invesco, maintain substantial corporate<br />

operations in <strong>Texas</strong>. Their presence underscores <strong>the</strong><br />

significance <strong>of</strong> <strong>the</strong> state as a major financial<br />

investment center. (See pg. 22 for an expanded list <strong>of</strong><br />

<strong>the</strong> largest investment firms in <strong>Texas</strong>.)<br />

Investment Funds in <strong>Texas</strong><br />

<strong>Texas</strong> is home to more than 1,300 private, definedbenefit<br />

plans insured by <strong>the</strong> Pension Benefit<br />

Guaranty Corp., a U.S. government agency that<br />

regulates such plans. <strong>Texas</strong> also has nearly 1,800<br />

public retirement systems, which are overseen by <strong>the</strong><br />

<strong>Texas</strong> Pension Review Board.<br />

Additionally, <strong>Texas</strong> ranks No. 2 nationally for<br />

mutual fund assets per state, with $855 billion,<br />

according to <strong>the</strong> Investment Company Institute (ICI),<br />

a national association <strong>of</strong> U.S. investment companies.<br />

<strong>Texas</strong> Venture Capital<br />

Investment,<br />

by <strong>Industry</strong> (2010)<br />

82% <strong>of</strong> venture capital investment<br />

into <strong>Texas</strong> companies<br />

was attracted from out <strong>of</strong><br />

state, according to <strong>the</strong> National<br />

Venture Capital Association<br />

(NVCA).<br />

16<br />

<strong>Texas</strong> Flexes Venture Capital Muscle<br />

Nationwide, <strong>Texas</strong> ranks No. 2 in employment<br />

and No. 3 in revenues for venturebacked<br />

companies headquartered in <strong>the</strong><br />

state, according to economic analyst IHS<br />

Global Insight.<br />

In 2010, <strong>Texas</strong> ranked No. 4 nationally for<br />

overall venture capital investment with $981<br />

million invested, according to <strong>the</strong> National<br />

Venture Capital Association (NVCA).<br />

Over <strong>the</strong> period 1970 to 2010, <strong>Texas</strong> ranked<br />

No. 3 nationally for <strong>the</strong> amount <strong>of</strong> venture<br />

capital invested, according to <strong>the</strong> NVCA, with<br />

$27.7 billion invested.<br />

In 2010, <strong>the</strong> leading industries for venture<br />

funding in <strong>Texas</strong> were energy, s<strong>of</strong>tware, and<br />

medical devices (see pie chart below).<br />

Top Five <strong>Texas</strong> Venture Capital Firms<br />

Company Name HQ<br />

Total Assets<br />

(in millions)<br />

Austin Ventures Austin $3,900<br />

SCF Partners Houston $1,500<br />

Capital Southwest Dallas $502<br />

Centerpoint Ventures Dallas $421<br />

21st Century Group Dallas $166

Mutual Fund Management Firm<br />

Moves HQ to Austin<br />

Dimensional Fund Advisors (DFA), a mutual fund<br />

firm with nearly $200 billion in assets under<br />

management, relocated its headquarters from<br />

Santa Monica, Calif., to Austin, <strong>Texas</strong>, in 2009.<br />

The company had established its first <strong>of</strong>fice in<br />

Austin three years earlier, citing <strong>the</strong> region’s low<br />

cost <strong>of</strong> living, strong educational base and tax<br />

climate as selling points.<br />

DFA today manages about 25 mutual funds and<br />

serves institutional<br />

and<br />

individual investors<br />

through its<br />

network <strong>of</strong><br />

affiliated advisors<br />

around <strong>the</strong><br />

world.<br />

Commodity Markets: Energy<br />

As a leading oil and gas state, <strong>Texas</strong> has developed a<br />

significant specialization in energy commodities and<br />

futures contracts. The percentage <strong>of</strong> <strong>the</strong> Houston<br />

workforce employed in <strong>the</strong> sector is nearly triple <strong>the</strong><br />

U.S. average, with more than 1,400 workers in<br />

commodity contract trading and brokerage. This<br />

places Houston behind only Chicago and New York<br />

City in terms <strong>of</strong> sector workforce size in <strong>the</strong> U.S.<br />

Since <strong>the</strong> <strong>Texas</strong> commodities trading sector is<br />

focused primarily on oil and gas, <strong>Texas</strong> traders,<br />

unlike <strong>the</strong>ir counterparts in<br />

places like New York,<br />

are more likely to deal<br />

in contracts where<br />

commodities, such as<br />

crude oil, are<br />

physically<br />

delivered.<br />

Originally created in<br />

1937, <strong>the</strong> TRS is a<br />

public entity gov-<br />

erned by a board <strong>of</strong><br />

trustees appointed<br />

by <strong>the</strong> <strong>Governor</strong> <strong>of</strong> <strong>Texas</strong>.<br />

TRS now provides benefits for 1.3 million<br />

members, or approximately one out <strong>of</strong> every<br />

20 Texans.<br />

In February 2011, <strong>the</strong> TRS Pension Trust Fund<br />

was valued at $25.7 billion, which represented<br />

a market return <strong>of</strong> 14.5% from its previous<br />

valuation in August 2010.<br />

The TRS pension trust fund is currently <strong>the</strong><br />

seventh largest public pension fund and<br />

eighth largest overall in <strong>the</strong> nation, based on<br />

asset size.<br />

INVESTMENT-RELATED SERVICES<br />

Major Pension Fund:<br />

Teacher Retirement System <strong>of</strong> <strong>Texas</strong><br />

In 2010, <strong>the</strong> TRS was ranked <strong>the</strong> 23rd largest<br />

pension plan in <strong>the</strong> world by P&I Magazine/<br />

Towers Watson.<br />

TRS investments lead pension funding sources,<br />

ahead <strong>of</strong> state tax revenues and employee<br />

contributions.<br />

Some leading <strong>Texas</strong> companies in <strong>the</strong> energy trading<br />

business include OTC Global and U.S. Energy<br />

Markets, both <strong>of</strong> which are headquartered in Houston.<br />

Additionally, many major multinationals have<br />

energy trading <strong>of</strong>fices in Houston, including<br />

Citigroup Global Commodities, BNP Paribas Energy<br />

Trading, Macquarie Energy, Deutsche Bank, Barclays,<br />

Credit Suisse, LCM Commodities, DTE<br />

Energy Trading, and o<strong>the</strong>rs.<br />

17

INVESTMENT-RELATED SERVICES<br />

Workforce Concentrations<br />

The map below identifies <strong>the</strong> state’s Workforce<br />

Development regions with above-average specializations<br />

in financial investment services. The highlighted<br />

regions are not <strong>the</strong> only areas in <strong>Texas</strong> where workers<br />

in this sector can be found, but ra<strong>the</strong>r represent areas<br />

with <strong>the</strong> greatest concentrations relative to <strong>the</strong> size <strong>of</strong><br />

<strong>the</strong> local labor force.<br />

<strong>Financial</strong><br />

Investment<br />

<strong>Services</strong> Workforce<br />

Concentration<br />

Moderate<br />

Above Average<br />

High<br />

Data: <strong>Texas</strong> Workforce Commission,<br />

Q4 2010<br />

Alamo Region<br />

Portfolio Management<br />

Mutual Funds<br />

This analysis compares <strong>the</strong> portion <strong>of</strong> each <strong>Texas</strong> region’s<br />

workforce employed in <strong>the</strong> sector to <strong>the</strong> portion<br />

<strong>of</strong> <strong>the</strong> entire U.S. workforce employed in that sector.<br />

The comparison provides a ratio that measures how<br />

intensively a certain region is specialized in this industry,<br />

and ranks it as “moderate,” “above average,”<br />

or “high.”<br />

Panhandle<br />

Specialized Investors<br />

TD Ameritrade Expands in Fort Worth, Commits to Hiring 490<br />

In April 2011, <strong>the</strong> State <strong>of</strong> <strong>Texas</strong> announced a $1.2<br />

million TEF investment in brokerage firm TD<br />

Ameritrade for <strong>the</strong> expansion <strong>of</strong> its Fort Worth<br />

facility. The investment is expected to create 490<br />

new jobs within four years and generate $11 million<br />

in capital investment. The TEF award will help <strong>the</strong><br />

company to expand its current facilities in <strong>the</strong> city.<br />

18<br />

Dallas County<br />

Portfolio Management<br />

Investment Advice<br />

Investment Banking<br />

Securities Brokerage<br />

Commodity Contracts<br />

Gulf Region<br />

Portfolio Management<br />

Commodity Contracts<br />

Mutual Funds<br />

Capital Region<br />

Investment Advice<br />

Venture Capital<br />

Pension Funds<br />

TD Ameritrade, one <strong>of</strong> <strong>the</strong> nation's leading investment<br />

firms, provides brokerage services and<br />

processes trades and o<strong>the</strong>r financial transactions<br />

for over eight million U.S. client accounts.

Major Companies<br />

Company Name Primary Location(s) Line Of Business<br />

INVESTMENT-RELATED SERVICES<br />

Top Investment-Related Companies with Corporate Operations in <strong>Texas</strong><br />

by Revenues<br />

Revenue<br />

(Millions)<br />

Goldman Sachs Dallas Investment <strong>Services</strong> $45,967<br />

Morgan Stanley Houston, Austin Investment <strong>Services</strong> $38,036<br />

Merrill Lynch / Bank <strong>of</strong> America Houston, Dallas, Austin Investment <strong>Services</strong> $37,492<br />

Macquarie Group Houston Investment <strong>Services</strong> $13,340<br />

Fidelity Investments Westlake (Fort Worth) Fund Management $11,490<br />

BNP Paribas Dallas, Houston Investment <strong>Services</strong> NA<br />

State Street Austin Investment <strong>Services</strong> $9,716<br />

Deutsche Bank Securities Houston Investment <strong>Services</strong> $7,588<br />

Quantum Energy Partners Houston Private Equity $5,700<br />

Charles Schwab Austin Securities Brokerage $4,474<br />

RBC Wealth Management Houston Investment <strong>Services</strong> $3,887<br />

Invesco Dallas, Houston Fund Management $3,487<br />

Raymond James <strong>Financial</strong> Dallas, Houston Securities Brokerage $3,400<br />

AXA <strong>Financial</strong> Dallas, Houston Investment Advice & Brokerage $3,250<br />

Jeffries Group Dallas, Houston Investment <strong>Services</strong> $2,797<br />

TD Ameritrade Fort Worth Securities Brokerage $2,767<br />

Stifel, Nicolaus & Company San Antonio, Houston Investment <strong>Services</strong> $1,400<br />

Energy Spectrum Capital Dallas Private Equity $1,300<br />

UBS <strong>Financial</strong> <strong>Services</strong> Dallas, Houston, San Antonio Investment <strong>Services</strong> $1,300<br />

H.D. Vest Irving Investment <strong>Services</strong> $1,000<br />

Representative sample only. Sources: D&B, LexisNexis, company websites<br />

19<br />

Top 5:

Insurance Carriers<br />

Overview<br />

<strong>Texas</strong> is home to approximately 860 insurance carriers<br />

employing more than 80,500 workers. That workforce<br />

size nearly ties <strong>Texas</strong> with California as <strong>the</strong> largest in<br />

<strong>the</strong> country. While about 21% <strong>of</strong> all financial services<br />

workers in <strong>the</strong> state are employed by insurance<br />

carriers, <strong>the</strong> sector accounts for less than 5% <strong>of</strong> all<br />

<strong>Texas</strong> financial services firms, revealing that most <strong>of</strong><br />

<strong>the</strong> state’s insurance carriers are large employers.<br />

Compared to o<strong>the</strong>r states, <strong>the</strong> <strong>Texas</strong> workforce is less<br />

specialized in health and medical insurance carriers,<br />

and more so in property and casualty carriers.<br />

Insurance Carrier Sector Employment<br />

Second Quarter 2011 (NAICS 5241)<br />

The <strong>Texas</strong> insurance industry is regulated by <strong>the</strong><br />

<strong>Texas</strong> Department <strong>of</strong> Insurance (TDI). The TDI’s<br />

latest annual report indicates <strong>the</strong> state’s insurance<br />

market is adding new insurers and <strong>the</strong> state’s 2009<br />

total insurance market premiums totaled approximately<br />

$102.2 billion, led by <strong>the</strong> property & casualty area<br />

(see chart below).<br />

Five Fortune 1000 insurance carriers are headquartered<br />

in <strong>Texas</strong>, including USAA (San Antonio),<br />

Torchmark Corporation (McKinney), American<br />

National Insurance (Galveston), HCC Insurance<br />

Holdings (Houston), and Stewart Information <strong>Services</strong><br />

(Houston).<br />

2009 <strong>Texas</strong> Insurance Market<br />

(in billions)<br />

Sector (<strong>Industry</strong> Code) Employees Firms<br />

Type <strong>of</strong> Business <strong>Texas</strong> Premiums<br />

Property & Casualty $37.7<br />

Accident & Health $22.5<br />

Annuity $19.7<br />

Health Maintenance Org. (HMO) $12.4<br />

Life $8.9<br />

Title $1.0<br />

O<strong>the</strong>r $3.8<br />

TOTAL $106.0<br />

Source: TDI 2010 Annual <strong>Report</strong><br />

Average<br />

Annual Wage<br />

Direct Life, Health & Medical Insurance Carriers (52411) 30,678 257 $68,484<br />

Direct Property, Casualty & Title Insurance Carriers (52412) 49,019 588 $67,808<br />

Reinsurance Carriers ( 52413) 842 24 $108,264<br />

20<br />

TOTALS 80,539 862 ---

Top Insurance Carriers with<br />

Corporate Operations in <strong>Texas</strong><br />

Firms with total corporate revenues exceeding $1 billion<br />

INSURANCE CARRIERS<br />

Representative sample only. Sources: D&B, company websites<br />

21

INSURANCE CARRIERS<br />

Property & Casualty Carriers<br />

<strong>Texas</strong> leads <strong>the</strong> nation with <strong>the</strong> largest property and<br />

casualty insurance workforce <strong>of</strong> any U.S. state.<br />

Among <strong>Texas</strong> metro areas, San Antonio<br />

has <strong>the</strong> highest concentration <strong>of</strong><br />

property insurance workers in <strong>the</strong> state.<br />

This local cluster is anchored by <strong>the</strong><br />

headquarters <strong>of</strong> industry leader USAA.<br />

Founded in San Antonio in 1922, <strong>the</strong> company today<br />

provides auto insurance, homeowners insurance, and<br />

o<strong>the</strong>r financial services to active and former members<br />

<strong>of</strong> <strong>the</strong> U.S. military around <strong>the</strong> world. USAA employs<br />

more than 14,800 workers in San Antonio alone. The<br />

city is also <strong>the</strong> U.S. headquarters location <strong>of</strong> Bermuda<br />

-based property insurer <strong>the</strong> Argo Group.<br />

The Houston metro area is headquarters to three<br />

multi-billion dollar property insurance firms. American<br />

National Insurance has operated out <strong>of</strong> Galveston,<br />

<strong>Texas</strong>, for more than 100 years. Stewart Information<br />

<strong>Services</strong>, which provides real estate title insurance,<br />

and HCC Insurance, which <strong>of</strong>fers specialized property<br />

and casualty coverage for sectors such as marine and<br />

aviation, are both based in Houston.<br />

Allstate Locates 600-Job Facility<br />

in San Antonio<br />

In February 2010, Gov. Rick Perry announced a<br />

<strong>Texas</strong> Enterprise Fund investment <strong>of</strong> $1.1 million<br />

to bring Allstate's<br />

new bilingual<br />

customer<br />

service center to<br />

San Antonio. The 75,000 sq. ft. center will enable<br />

Illinois-based Allstate to tap into a growing market<br />

<strong>of</strong> bilingual Americans. The center is expected<br />

to create 600 new jobs in <strong>Texas</strong>, along with more<br />

than $11 million in capital investment. Allstate is<br />

one <strong>of</strong> <strong>the</strong> largest property insurers in <strong>the</strong> U.S.<br />

22<br />

Insurance Giant Moves HQ to <strong>Texas</strong><br />

In March 2006, <strong>the</strong> Fortune 1000-ranked Torchmark<br />

Corp. announced <strong>the</strong> relocation <strong>of</strong> its headquarters<br />

from Alabama to McKinney, <strong>Texas</strong>. The<br />

state <strong>of</strong> <strong>Texas</strong> invested $2 million through <strong>the</strong><br />

<strong>Texas</strong> Enterprise Fund to close <strong>the</strong> deal, which<br />

created 500 new jobs in <strong>Texas</strong>. Torchmark also<br />

received more than $3 million in local incentives.<br />

Torchmark is<br />

a holding<br />

company<br />

specializing in<br />

life and<br />

supplemental<br />

health insurance.<br />

Its<br />

subsidiaries include Liberty National Insurance<br />

and Globe Life and Accident Insurance.<br />

Life, Health & Medical Carriers<br />

Dallas-Fort Worth has <strong>the</strong> largest health and medical<br />

insurance workforce in <strong>Texas</strong>, with more than 7,300<br />

workers in <strong>the</strong> sector. In addition to <strong>the</strong> headquarters<br />

<strong>of</strong> life and health insurer Torchmark Corp. (see<br />

sidebar above), DFW is also home to corporate<br />

operations <strong>of</strong> WellPoint, UnitedHealth Group, Cigna,<br />

Aegon, Met Life, and o<strong>the</strong>rs. The city <strong>of</strong> Waco,<br />

<strong>Texas</strong>, has also established a significant concentration<br />

in this sector, with nearly 2,000 life insurance workers<br />

in <strong>the</strong> area. Three leading firms headquartered in<br />

Waco include American Income Life, <strong>Texas</strong> Life<br />

Insurance, and American Amicable Life, all <strong>of</strong> which<br />

are subsidiaries <strong>of</strong> larger national firms.<br />

The State <strong>of</strong> <strong>Texas</strong> has also worked to bolster <strong>the</strong><br />

health insurance industry through legislation. In<br />

September 2003, <strong>the</strong> <strong>Texas</strong> Medical Malpractice and<br />

Tort Reform Act went into effect, leading to decreases<br />

in insurance premiums and an increase in <strong>the</strong> number<br />

<strong>of</strong> insurance companies entering <strong>the</strong> <strong>Texas</strong> marketplace,<br />

according to <strong>the</strong> <strong>Texas</strong> Medical Association.

Workforce Concentrations<br />

The map below identifies <strong>the</strong> state’s Workforce<br />

Development regions with above-average specializations<br />

in <strong>the</strong> insurance carrier sector. The highlighted<br />

regions are not <strong>the</strong> only areas in <strong>Texas</strong> where workers<br />

in this sector can be found, but ra<strong>the</strong>r represent areas<br />

with <strong>the</strong> greatest concentrations relative to <strong>the</strong> size <strong>of</strong><br />

<strong>the</strong> local labor force.<br />

Insurance<br />

Carrier Workforce<br />

Concentration<br />

Moderate<br />

Above Average<br />

High<br />

<strong>Texas</strong> Workforce Commission, Q4 2010<br />

Alamo Region<br />

Property Insurance<br />

In March 2011, Nationwide Mutual Insurance<br />

celebrated <strong>the</strong> groundbreaking <strong>of</strong> its 300,000-sq. ft.<br />

corporate campus in San Antonio. The new facility<br />

will add 800 new jobs and generate more than $94<br />

million in capital investment in <strong>the</strong> city. The company,<br />

which currently employs more than 1,000 in San<br />

This analysis compares <strong>the</strong> portion <strong>of</strong> each <strong>Texas</strong> region’s<br />

workforce employed in <strong>the</strong> sector to <strong>the</strong> portion<br />

<strong>of</strong> <strong>the</strong> entire U.S. workforce employed in that sector.<br />

The comparison provides a ratio that measures how<br />

intensively a certain region is specialized in this industry,<br />

and ranks it as “moderate,” “above average,”<br />

or “high.”<br />

Panhandle<br />

Property Insurance<br />

West Central <strong>Texas</strong><br />

Health Insurance<br />

Nationwide Insurance Locates New Campus in San Antonio<br />

INSURANCE CARRIERS<br />

Dallas County<br />

Property Insurance<br />

Life Insurance<br />

Health Insurance<br />

Heart <strong>of</strong> <strong>Texas</strong><br />

Life Insurance<br />

Property Insurance<br />

Antonio, was lured, in part, by<br />

<strong>the</strong> region’s pool <strong>of</strong> skilled and<br />

bilingual labor. Ohio-based<br />

Nationwide is one <strong>of</strong> <strong>the</strong> country’s largest property<br />

insurers. The San Antonio campus is scheduled to<br />

open in mid 2012.<br />

23

INSURANCE CARRIERS<br />

Major Companies<br />

Top Insurance Carriers with Corporate Operations in <strong>Texas</strong><br />

by Revenues<br />

Company Name Primary Location(s) Primary Type<br />

UnitedHealth Group<br />

Dallas, San Antonio,<br />

Harlingen<br />

Revenue<br />

(Millions)<br />

Health & Medical 94,155<br />

Zurich <strong>Financial</strong> <strong>Services</strong> Dallas, Houston Property & Casualty 70,272<br />

Aegon Plano, Bedford Life 65,172<br />

State Farm Mutual Insurance Dallas, Austin, El Paso Property & Casualty 63,200<br />

WellPoint Plano Health & Medical 58,801<br />

Met Life Dallas Life 52,717<br />

Allstate San Antonio Property & Casualty 31,400<br />

Swiss Re Dallas, Houston Reinsurance 28,835<br />

Travelers Richardson Property & Casualty 25,110<br />

New York Life Dallas, Houston, Austin Life 24,148<br />

Cigna Plano Health & Medical 21,253<br />

Tokio Marine Nichido Houston Property & Casualty 21,029<br />

Nationwide Mutual Insurance San Antonio Property & Casualty 20,751<br />

USAA San Antonio Property & Casualty 17,946<br />

ACE Ltd. Dallas, Houston, Amarillo Property & Casualty 16,006<br />

Progressive Austin Property & Casualty 14,963<br />

Geico Dallas Property & Casualty 13,576<br />

Chubb Dallas Property & Casualty 13,319<br />

American General Life / AIG Houston Life 6,005<br />

Amerigroup San Antonio Health & Medical 5,806<br />

Farmers Austin Property & Casualty 5,515<br />

Chartis Dallas Property & Casualty 3,759<br />

FM Global Plano Property & Casualty 3,648<br />

Torchmark McKinney, Waco Life 3,367<br />

HealthSpring Houston, Irving Health & Medical 3,135<br />

24<br />

Representative sample only. Sources: D&B, LexisNexis, company websites<br />

Top 5:

Accounting & Related <strong>Services</strong><br />

Overview<br />

<strong>Texas</strong> is home to approximately 8,400 accounting and<br />

related firms employing more than 66,100 workers.<br />

Certified Public Accountants (CPAs) dominate this<br />

sector, followed by O<strong>the</strong>r Accounting <strong>Services</strong> (see<br />

table below).<br />

Accounting and related services are critical to economic<br />

functions across all industries and integral to<br />

financial services. Accounting is widely referred to as<br />

<strong>the</strong> language <strong>of</strong> business because it produces financial<br />

statements necessary for businesses to run smoothly.<br />

At <strong>the</strong> state, national and international levels, financial<br />

statements are certified by accountants and auditors<br />

with <strong>the</strong> expectation that <strong>the</strong> results are accurate and<br />

independent.<br />

Accounting & Related Activities Employment<br />

First Quarter 2011 (NAICS 5412)<br />

Sector (<strong>Industry</strong> Code) Employees Firms<br />

The <strong>Texas</strong> State Board <strong>of</strong> Public Accountancy<br />

(TSBPA) regulates <strong>the</strong> state’s accountants and<br />

auditors, as well as examining, certifying, and licensing<br />

<strong>the</strong>m. The TSBPA reports that Texans testing to<br />

become CPAs have increased steadily in recent years,<br />

totaling 10,578 in 2009, <strong>the</strong> most recent data available.<br />

All <strong>of</strong> <strong>the</strong> Big Four accounting firms have <strong>of</strong>fices<br />

across <strong>Texas</strong>.<br />

In 2009, <strong>Texas</strong> graduated a total <strong>of</strong> 3,067 students<br />

with Bachelor’s Accounting degrees and 1,304<br />

students with Master’s Accounting degrees, according<br />

to <strong>the</strong> latest data from <strong>the</strong> <strong>Texas</strong> Higher Education<br />

Coordinating Board (THECB).<br />

The Dallas-Fort Worth region is home to <strong>the</strong> largest<br />

accounting-related workforce in <strong>Texas</strong>, with more<br />

than 23,000 workers in <strong>the</strong> sector. The portion <strong>of</strong> all<br />

Dallas County jobs that are in accounting, tax prep, or<br />

o<strong>the</strong>r similar services is 60% above <strong>the</strong> national<br />

average.<br />

Average<br />

Annual Wage<br />

<strong>Office</strong>s <strong>of</strong> Certified Public Accountants (541211) 29,148 3,778 $72,228<br />

Tax Preparation <strong>Services</strong> (541213) 8,556 1,308 $28,340<br />

Payroll <strong>Services</strong> (541214) 9,790 437 $47,684<br />

O<strong>the</strong>r Accounting <strong>Services</strong> (541219) 18,656 2,871 $48,776<br />

TOTALS 66,151 8,374 ---<br />

25

ACCOUNTING & RELATED SERVICES<br />

Major Companies<br />

Top Accounting <strong>Services</strong> Companies with Operations in <strong>Texas</strong><br />

by Revenues<br />

Deloitte<br />

Company Name Location(s) Type<br />

PricewaterhouseCoopers<br />

Ernst &Young<br />

KPMG<br />

ADP<br />

Ryan, Inc..<br />

<strong>Texas</strong> University Accounting<br />

Programs Rank Nationally<br />

Bloomberg BusinessWeek’s 2010 Top Schools<br />

for Accounting picked 6 <strong>Texas</strong> universities:<br />

No. 16: The University <strong>of</strong> <strong>Texas</strong> at Austin<br />

No. 29: The University <strong>of</strong> <strong>Texas</strong> at Dallas<br />

No. 40: <strong>Texas</strong> Christian University<br />

No. 46: <strong>Texas</strong> A&M University<br />

No. 83: The University <strong>of</strong> Houston<br />

No. 96: <strong>Texas</strong> Tech University<br />

Fort Worth, Irving, Houston,<br />

Austin, San Antonio<br />

Dallas, Fort Worth,<br />

Houston, Austin<br />

Dallas, Fort Worth, Houston,<br />

Austin, San Antonio<br />

Dallas, Fort Worth, Houston,<br />

Austin, San Antonio<br />

Dallas, Houston, El Paso,<br />

Austin, San Antonio<br />

Dallas, Houston, El Paso,<br />

Austin, San Antonio<br />

Revenue<br />

(Millions)<br />

Accounting, Tax Advisory 26,600<br />

Accounting, Tax Advisory 26,570<br />

Accounting, Tax Advisory 21,260<br />

Accounting, Tax Advisory 20,110<br />

Payroll <strong>Services</strong><br />

Accounting, Tax Advisory $212.4<br />

Weaver & Tidwell LLP Fort Worth CPAs $26.1<br />

MFR, P.C. Houston CPAs $20<br />

UHY Advisors Houston CPAs $20<br />

26<br />

Representative sample only. Sources: D&B, company websites<br />

Top 5:

Appendix: Selected <strong>Industry</strong> Resources<br />

American Bankers Association (ABA) at www.aba.com/<br />

The ABA is a national trade association representing banks <strong>of</strong> all sizes and charters and is <strong>the</strong> voice for <strong>the</strong> nation's<br />

$13 trillion banking industry and its 2 million employees.<br />

Consumer Service Alliance <strong>of</strong> <strong>Texas</strong> (CSAT) at http://consumerservicealliance<strong>of</strong>texas.org/<br />

A state trade association representing <strong>the</strong> interests <strong>of</strong> consumers and Credit Service Organizations. The website<br />

<strong>of</strong>fers best practices and links to articles, legislation, studies, and much more.<br />

<strong>Texas</strong> Credit Union Department (TCUD) at www.cud.texas.gov/<br />

The TCUD is a state agency and <strong>the</strong> primary regulator <strong>of</strong> all <strong>Texas</strong>-chartered credit unions.<br />

<strong>Texas</strong> Department <strong>of</strong> Savings and Mortgage Lending (SML) at www.sml.texas.gov<br />

The SML is a state agency operating under <strong>the</strong> jurisdiction <strong>of</strong> <strong>the</strong> <strong>Financial</strong> Commission <strong>of</strong> <strong>Texas</strong>. Its two key<br />

areas <strong>of</strong> regulatory responsibility are <strong>the</strong> chartering, regulation and supervision <strong>of</strong> <strong>the</strong> state’s thrift industry; and <strong>the</strong><br />

licensing/registration and regulation <strong>of</strong> <strong>the</strong> state’s mortgage industry.<br />

Federal Deposit Insurance Corporation (FDIC) at www.fdic.gov/<br />

The FDIC is an independent agency <strong>of</strong> <strong>the</strong> U.S. federal government that preserves and promotes public confidence<br />

in <strong>the</strong> U.S. financial system by insuring deposits in banks and thrift institutions. See quick links for bankers at<br />

http://www.fdic.gov/quicklinks/bankers.html.<br />

Federal Reserve Bank <strong>of</strong> Dallas (Dallas Fed) at www.dallasfed.org/<br />

The Dallas Fed is one <strong>of</strong> twelve regional Reserve Banks in <strong>the</strong> Federal Reserve System. Its website holds a wealth<br />

<strong>of</strong> data and publications covering national and regional economic issues, banking, and much more.<br />

Federal Reserve System (Fed) at www.federalreserve.gov/<br />

The Fed is <strong>the</strong> nation’s central bank and its primary mission is to maintain <strong>the</strong> stability <strong>of</strong> <strong>the</strong> U.S. financial system.<br />

See <strong>Texas</strong> state pr<strong>of</strong>ile at www.fdic.gov/bank/analytical/statepr<strong>of</strong>ile/Dallas/tx/TX.xml.html. See <strong>Texas</strong> FDIC<br />

insured banks at http://fdicinsuredbanks.com/fdic/<strong>Texas</strong>.htm.<br />

The Finance Commission <strong>of</strong> <strong>Texas</strong> (FCT) at www.fc.state.tx.us/<br />

The FCT is a state agency that ensures that <strong>the</strong> banks, savings institutions, consumer credit grantors, and o<strong>the</strong>r regulated<br />

entities chartered or licensed under state law operate as sound and responsible institutions. The FCT oversees<br />

<strong>the</strong> <strong>Texas</strong> Dept. <strong>of</strong> Banking, <strong>Texas</strong> Dept. <strong>of</strong> Savings and Mortgage Lending, and <strong>Office</strong> <strong>of</strong> Consumer Credit<br />

Commissioner.<br />

Independent Bankers Association <strong>of</strong> <strong>Texas</strong> (IBAT) at www.ibat.org/<br />

IBAT is a state trade industry association that promotes <strong>the</strong> interests <strong>of</strong> independent banking.<br />

Investment Company Institute (ICI) at www.ici.org/<br />

ICI is a national association <strong>of</strong> U.S. investment companies.<br />

<strong>Office</strong> <strong>of</strong> Consumer Credit Commissioner (OCCC) at www.occc.state.tx.us/<br />

The OCCC is a state agency that regulates <strong>the</strong> credit industry and educates consumers and creditors.<br />