Interim financial statements for the quarter ended 31 ... - ChartNexus

Interim financial statements for the quarter ended 31 ... - ChartNexus

Interim financial statements for the quarter ended 31 ... - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

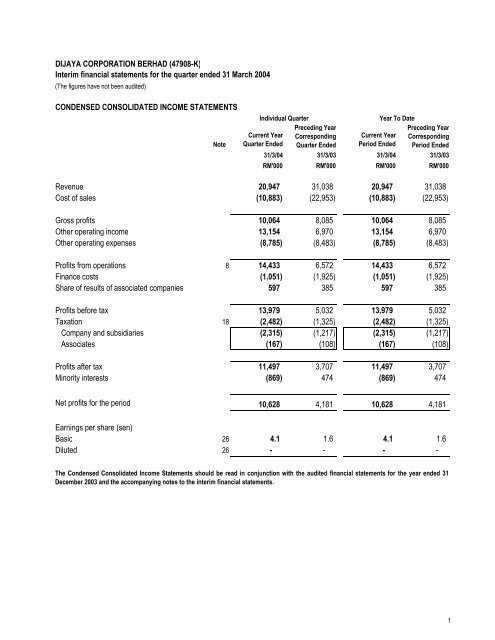

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

CONDENSED CONSOLIDATED INCOME STATEMENTS<br />

Note<br />

Current Year<br />

Quarter Ended<br />

Revenue 20,947<br />

Cost of sales (10,883)<br />

Gross profits 10,064<br />

O<strong>the</strong>r operating income 13,154<br />

O<strong>the</strong>r operating expenses (8,785)<br />

Profits from operations 8 14,433<br />

Finance costs (1,051)<br />

Share of results of associated companies 597<br />

Profits be<strong>for</strong>e tax 13,979<br />

Taxation 18 (2,482)<br />

Company and subsidiaries (2,<strong>31</strong>5)<br />

Associates (167)<br />

Profits after tax 11,497<br />

Minority interests (869)<br />

Net profits <strong>for</strong> <strong>the</strong> period 10,628<br />

Earnings per share (sen)<br />

Basic 26 4.1<br />

Diluted 26 -<br />

Individual Quarter Year To Date<br />

Preceding Year<br />

Corresponding<br />

Quarter Ended<br />

Current Year<br />

Period Ended<br />

Preceding Year<br />

Corresponding<br />

Period Ended<br />

<strong>31</strong>/3/04 <strong>31</strong>/3/03 <strong>31</strong>/3/04 <strong>31</strong>/3/03<br />

RM'000 RM'000 RM'000 RM'000<br />

<strong>31</strong>,038<br />

(22,953)<br />

8,085<br />

6,970<br />

(8,483)<br />

6,572<br />

(1,925)<br />

385<br />

5,032<br />

(1,325)<br />

(1,217)<br />

(108)<br />

3,707<br />

474<br />

4,181<br />

1.6<br />

-<br />

20,947<br />

(10,883)<br />

10,064<br />

13,154<br />

(8,785)<br />

14,433<br />

(1,051)<br />

597<br />

13,979<br />

(2,482)<br />

(2,<strong>31</strong>5)<br />

(167)<br />

11,497<br />

(869)<br />

10,628<br />

4.1<br />

-<br />

<strong>31</strong>,038<br />

(22,953)<br />

8,085<br />

6,970<br />

(8,483)<br />

6,572<br />

(1,925)<br />

385<br />

5,032<br />

(1,325)<br />

(1,217)<br />

(108)<br />

3,707<br />

474<br />

The Condensed Consolidated Income Statements should be read in conjunction with <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong> <strong>31</strong><br />

December 2003 and <strong>the</strong> accompanying notes to <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong>.<br />

4,181<br />

1.6<br />

-<br />

1

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

CONDENSED CONSOLIDATED BALANCE SHEETS<br />

As At As At<br />

Note <strong>31</strong>/3/2004 <strong>31</strong>/12/2003<br />

RM'000 RM'000<br />

Non-current assets<br />

Property, plant and equipment 9 289,265<br />

289,817<br />

Land held <strong>for</strong> development 24,300<br />

24,300<br />

Investment in associated companies 46,424<br />

45,994<br />

O<strong>the</strong>r investments 44,158<br />

44,158<br />

Security retainers accumulation fund 2,005<br />

2,005<br />

406,152<br />

Current assets<br />

Development properties 285,439<br />

Inventories 36,609<br />

Trade and o<strong>the</strong>r receivables 40,251<br />

Marketable securities 20 27,252<br />

Cash and bank balances 122,354<br />

511,905<br />

Current liabilities<br />

Provision <strong>for</strong> liabilities 664<br />

Short term borrowings 22 39,611<br />

Trade and o<strong>the</strong>r payables 122,271<br />

Tax payable 14,111<br />

176,657<br />

Net current assets 335,248<br />

741,400<br />

406,274<br />

320,362<br />

34,391<br />

40,926<br />

27,252<br />

119,110<br />

542,041<br />

664<br />

58,289<br />

134,041<br />

13,939<br />

206,933<br />

335,108<br />

741,382<br />

2

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

CONDENSED CONSOLIDATED BALANCE SHEETS<br />

As At As At<br />

Note <strong>31</strong>/3/2004 <strong>31</strong>/12/2003<br />

RM'000 RM'000<br />

Financed by:<br />

Share capital 259,526<br />

259,526<br />

Reserves 202,467<br />

191,839<br />

Minority Interests<br />

461,993<br />

61,890<br />

Negative goodwill, net 16,141<br />

540,024<br />

Non-current liabilities<br />

Long term borrowings 22 3,481<br />

Deferred taxation 99,6<strong>31</strong><br />

Sinking fund reserve 3,763<br />

Security retainers 27,370<br />

Deferred licence fees 67,1<strong>31</strong><br />

201,376<br />

741,400<br />

Net tangible asset per share (RM) 1.78<br />

451,365<br />

61,021<br />

16,444<br />

528,830<br />

3,481<br />

110,968<br />

3,562<br />

27,370<br />

67,171<br />

212,552<br />

741,382<br />

The Condensed Consolidated Income Statements should be read in conjunction with <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong><br />

<strong>31</strong> December 2003 and <strong>the</strong> accompanying notes to <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong>.<br />

1.74<br />

3

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

Share Share<br />

Reserves<br />

Attributable Accumulated<br />

Capital Premium To Capital Losses Total<br />

RM'000 RM'000 RM'000 RM'000 RM'000<br />

As at 1 January 2003<br />

As previously stated 259,526 402,654 512<br />

Prior year adjustments -<br />

-<br />

-<br />

As at 1 January 2003 (restated) 259,526 402,654 512<br />

Net profit <strong>for</strong> <strong>the</strong> period<br />

Foreign exchange differences, representing net<br />

-<br />

-<br />

gains not recognised in <strong>the</strong> income statement (147)<br />

As at <strong>31</strong> December 2003 259,526<br />

As at 1 January 2004 259,526<br />

Net profit <strong>for</strong> <strong>the</strong> period -<br />

As at <strong>31</strong> March 2004 259,526<br />

402,654<br />

402,654<br />

-<br />

402,654<br />

365<br />

365<br />

-<br />

365<br />

(226,469)<br />

(1,966)<br />

(228,435)<br />

17,255<br />

(211,180)<br />

(211,180)<br />

10,628<br />

(200,552)<br />

436,223<br />

(1,966)<br />

434,257<br />

17,255<br />

(147)<br />

451,365<br />

451,365<br />

10,628<br />

461,993<br />

The Condensed Consolidated Income Statements should be read in conjunction with <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong> <strong>31</strong> December<br />

2003 and <strong>the</strong> accompanying notes to <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong>.<br />

4

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

CONDENSED CONSOLIDATED CASH FLOW STATEMENT<br />

Quarter <strong>ended</strong><br />

<strong>31</strong>/3/2004 <strong>31</strong>/3/2003<br />

RM'000 RM'000<br />

Net cashflow generated from operating activities (5,333) 34,330<br />

Net cashflow from investing activities 35,522 1,209<br />

Net cashflow from financing activities (19,729) (17,608)<br />

Net increase/ (decrease) in cash and cash equivalents 10,460 17,9<strong>31</strong><br />

Cash and cash equivalents at beginning of <strong>financial</strong> period 107,471 24,137<br />

Cash and cash equivalents at end of <strong>financial</strong> period * 117,9<strong>31</strong> 42,068<br />

* Cash and cash equivalents at end of <strong>the</strong> <strong>financial</strong> period comprise <strong>the</strong> following:<br />

Quarter <strong>ended</strong><br />

<strong>31</strong>/3/2004 <strong>31</strong>/3/2003<br />

RM'000 RM'000<br />

Cash and bank balances 122,354 56,545<br />

Less: Bank overdrafts (3,495) (11,916)<br />

118,859 44,629<br />

Less: Cash and cash equivalents not available <strong>for</strong> use (928) (2,561)<br />

117,9<strong>31</strong> 42,068<br />

The Condensed Consolidated Income Statements should be read in conjunction with <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong> <strong>31</strong><br />

December 2003 and <strong>the</strong> accompanying notes to <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong>.<br />

5

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

PART A - EXPLANATORY NOTES PURSUANT TO MASB 26<br />

1. Basis of preparation<br />

The interim <strong>financial</strong> <strong>statements</strong> are unaudited and have been prepared in accordance with <strong>the</strong> requirements of MASB<br />

26: <strong>Interim</strong> Financial Reporting and Paragraph 9.22 of <strong>the</strong> Listing Requirements of <strong>the</strong> Bursa Malaysia Securities Bhd.<br />

The interim <strong>financial</strong> <strong>statements</strong> should be read in conjunction with <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong><br />

<strong>31</strong> December 2003. These explanatory notes attached to <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong> provide an explanation of<br />

events and transactions that are significant to an understanding of <strong>the</strong> changes in <strong>the</strong> <strong>financial</strong> position and per<strong>for</strong>mance<br />

of <strong>the</strong> Group since <strong>the</strong> <strong>financial</strong> year <strong>ended</strong> <strong>31</strong> December 2003.<br />

The accounting policies and methods of computation adopted by <strong>the</strong> Group in this interim <strong>financial</strong> statement are<br />

consistent with those adopted in <strong>the</strong> audited <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>financial</strong> year <strong>ended</strong> <strong>31</strong> December 2003, except<br />

<strong>for</strong> <strong>the</strong> adoption of <strong>the</strong> relevant new accounting standards, which became effective from 1 January 2004. The adoption<br />

of MASB 32 does not have material effect on <strong>the</strong> <strong>financial</strong> results of <strong>the</strong> Group <strong>for</strong> <strong>the</strong> <strong>financial</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March<br />

2004.<br />

2. Auditors' report on preceding annual <strong>financial</strong> <strong>statements</strong><br />

The auditors' report on <strong>the</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong> <strong>31</strong> December 2003 was not qualified.<br />

3. Seasonal or cyclical factors<br />

The Group's business operations are not materially affected by any seasonal/ cyclical factors.<br />

4 Nature and amount of items affecting assets, liabilities, equity, net income or cash flows that are unusual<br />

because of <strong>the</strong>ir nature, size or incidence<br />

There were no unusual items affecting assets, liabilities, equity, net income or cash flows during <strong>the</strong> <strong>financial</strong> period<br />

<strong>ended</strong> <strong>31</strong> March 2004, save <strong>for</strong> receipt of <strong>the</strong> proceeds from sale of land in Mukim Ijok.<br />

5. Changes in estimates of amounts reported in prior interim periods of <strong>the</strong> current <strong>financial</strong> year or in prior<br />

<strong>financial</strong> year<br />

There were no changes in estimates of amounts reported in prior interim periods of <strong>the</strong> current <strong>financial</strong> year or prior<br />

<strong>financial</strong> year.<br />

6. Debt and equity securities<br />

There were no issuances, cancellations, repurchases, resale and repayments of debt and equity securities.<br />

7. Dividends paid<br />

No dividend has been paid during <strong>the</strong> <strong>financial</strong> period.<br />

6

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

8. Segmental in<strong>for</strong>mation<br />

Real property<br />

and resort Engineering<br />

development and trading Investment O<strong>the</strong>rs Consolidated<br />

RM'000 RM'000 RM'000 RM'000 RM'000<br />

YTD <strong>ended</strong> <strong>31</strong> March 2004<br />

Revenue 17,679 3,268<br />

-<br />

- 20,947<br />

Results from operations 15,370 (<strong>31</strong>7) (408) (212) 14,433<br />

Finance cost (<strong>31</strong>2) (77) (662) - (1,051)<br />

Share of results of -<br />

associated companies -<br />

-<br />

597<br />

597<br />

Profit/(Loss) be<strong>for</strong>e tax 15,058 (394) (473) (212) 13,979<br />

YTD <strong>ended</strong> <strong>31</strong> March 2003<br />

Revenue 24,113<br />

6,470<br />

-<br />

455<br />

<strong>31</strong>,038<br />

Results from operations 3,895<br />

87 3,321 (7<strong>31</strong>) 6,572<br />

Finance cost (819) (63) (1,043) - (1,925)<br />

Share of results of -<br />

associated companies -<br />

-<br />

385<br />

-<br />

385<br />

Profit/(Loss) be<strong>for</strong>e tax 3,076<br />

24 2,663 (7<strong>31</strong>) 5,032<br />

9 Valuations of property, plant and equipment<br />

The valuations of property, plant and equipment have been brought <strong>for</strong>ward without any amendment from <strong>the</strong> audited<br />

<strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> year <strong>ended</strong> <strong>31</strong> December 2003.<br />

10. Subsequent events<br />

There were no material events subsequent to <strong>the</strong> end of <strong>the</strong> current <strong>quarter</strong>.<br />

11. Changes in composition of <strong>the</strong> Group<br />

There were no changes in <strong>the</strong> composition of <strong>the</strong> Group during <strong>the</strong> current <strong>quarter</strong>.<br />

12. Changes in contingent liabilities or contingent assets<br />

There were no significant changes in contingent liabilities since <strong>the</strong> last annual balance sheet date.<br />

13. Capital commitments<br />

There were no capital commitments not provided <strong>for</strong> in <strong>the</strong> interim <strong>financial</strong> <strong>statements</strong> as at <strong>31</strong> March 2004.<br />

7

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

PART B - EXPLANATORY NOTES PURSUANT TO APPENDIX 9B OF THE LISTING REQUIREMENTS OF BURSA<br />

MALAYSIA SECURITIES BHD<br />

14. Per<strong>for</strong>mance review<br />

The revenue <strong>for</strong> <strong>the</strong> current <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004 was lower at RM20.9 million compared to RM<strong>31</strong>.0 million <strong>for</strong><br />

<strong>the</strong> corresponding period last year. However, despite <strong>the</strong> lower revenue <strong>the</strong> pre-tax profit increased substantially to<br />

RM13.9 million <strong>for</strong> <strong>the</strong> current <strong>quarter</strong> from RM5.0 million in <strong>the</strong> previous year's <strong>quarter</strong> as a result of better profit<br />

margins earned by <strong>the</strong> property development division and a gain of RM8.9 million from disposal of land.<br />

15. Variation of results against previous <strong>quarter</strong><br />

<strong>31</strong>/3/2004 <strong>31</strong>/12/2003<br />

RM’000 RM’000<br />

Revenue 20,947 53,215<br />

Consolidated profit be<strong>for</strong>e taxation 13,979 21,210<br />

16. Current year prospects<br />

The property development division is expected to be <strong>the</strong> main contributor in terms of revenue and profits <strong>for</strong> this <strong>financial</strong><br />

year, supported by <strong>the</strong> encouraging sales achieved to date. Overall, <strong>the</strong> directors are of <strong>the</strong> view that <strong>the</strong> Group<br />

operating results will continue to be satisfactory <strong>for</strong> <strong>the</strong> current year.<br />

17. Profit <strong>for</strong>ecast or profit guarantee<br />

The Group has not provided any profit <strong>for</strong>ecast or profit guarantee in a public document.<br />

18. Taxation<br />

Individual <strong>quarter</strong> <strong>ended</strong><br />

Quarter <strong>ended</strong><br />

The Group's profit be<strong>for</strong>e taxation <strong>for</strong> <strong>the</strong> current <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004 of RM13.9 million represented a<br />

decrease of 34% from <strong>the</strong> previous <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> December 2003 of RM21.2 million. This was attributable to lower<br />

of recognition progress billing from <strong>the</strong> real property development projects and losses incurred by <strong>the</strong> engineering and<br />

investment holding segments during <strong>the</strong> period.<br />

Cumulative <strong>quarter</strong>s <strong>ended</strong><br />

<strong>31</strong>/3/04 <strong>31</strong>/3/03 <strong>31</strong>/3/04 <strong>31</strong>/3/03<br />

RM'000 RM'000 RM'000 RM'000<br />

Tax expense <strong>for</strong> <strong>the</strong> period 13,652 1,767 13,652 1,767<br />

Deferred taxation transfers (11,337) (550) (11,337) (550)<br />

2,<strong>31</strong>5 1,217 2,<strong>31</strong>5 1,217<br />

Share of taxation of associated company 167 108 167 108<br />

2,482 1,325 2,482 1,325<br />

The taxation charge <strong>for</strong> <strong>the</strong> Group is disproportionate to <strong>the</strong> results of <strong>the</strong> Group due to losses of certain subsidiaries<br />

which cannot be set-off against taxable profits made by o<strong>the</strong>r subsidiaries as no group relief is available and certain<br />

expenses which are disallowed <strong>for</strong> taxation purposes.<br />

19. Sale of unquoted investments and/ or properties<br />

There were no sales of unquoted investments or properties outside <strong>the</strong> ordinary course of business of <strong>the</strong> Group during<br />

<strong>the</strong> <strong>financial</strong> period under review.<br />

8

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

20. Quoted securities<br />

Current Current year<br />

<strong>quarter</strong> to date<br />

3/<strong>31</strong>/2004 3/<strong>31</strong>/2003<br />

RM'000 RM'000<br />

Total purchases Nil Nil<br />

Total disposals Nil 341<br />

Total gain/ (loss) on disposals Nil 199<br />

As at<br />

3/<strong>31</strong>/2004<br />

RM'000<br />

At cost 79,399<br />

At carrying value/ book value 34,489<br />

At market value 41,632<br />

21. Corporate proposals<br />

The Special Bumiputra Issue ("SBI") of <strong>31</strong>,000,000 new ordinary shares of RM1.00 each in <strong>the</strong> Company to Bumiputra<br />

investors approved by <strong>the</strong> Ministry of International Trade and Industry at an issue price of RM1.00 per share is still<br />

pending implementation. As announced on 7 January 2004, <strong>the</strong> Securities Commission had approved a fur<strong>the</strong>r<br />

extension of time of one year until <strong>31</strong> December 2004 <strong>for</strong> implementation of <strong>the</strong> SBI.<br />

On 30 March 2004, Bakat Rampai Sdn Bhd, a wholly-owned subsidiary of <strong>the</strong> Company, toge<strong>the</strong>r with Tan Sri Dato' Seri<br />

Vincent Tan Chee Yioun, Dato' Robin Tan Yeong Ching, Rayvin Tan Yeong Sheik, Nerine Tan Sheik Ping, JMP<br />

Holdings Sdn Bhd and Vecc-Men Holdings Sdn Bhd entered into a conditional sale and purchase agreement with Matrix<br />

International Bhd ("MIB") to sell its entire shareholding of 36,081,980 ordinary shares of RM1.00 each representing<br />

approximately 11.25% equity interest in Berjaya Times Square Sdn Bhd to MIB <strong>for</strong> a consideration of RM111,854,138 to<br />

be satisfied by <strong>the</strong> issuance of 79,895,813 new ordinary shares of RM1.00 each in MIB at an issue price of RM1.40 per<br />

share. The proposed disposal is still pending all approvals of <strong>the</strong> relevant authorities including <strong>the</strong> Securities<br />

Commission.<br />

22. Borrowings<br />

Particulars of <strong>the</strong> Group's borrowings are as follows:<br />

As at As at<br />

<strong>31</strong>/3/04 <strong>31</strong>/12/03<br />

RM'000 RM'000<br />

Secured short-term borrowings 39,611 58,289<br />

Secured long-term borrowings 3,481 3,481<br />

All of <strong>the</strong> above borrowings are denominated in Ringgit Malaysia.<br />

43,092 61,770<br />

23. Off balance sheet <strong>financial</strong> instruments<br />

There is no <strong>financial</strong> instruments with off balance sheet risk as at <strong>the</strong> date of this <strong>quarter</strong>ly report.<br />

24. Material litigation<br />

There is no pending material litigation as at <strong>the</strong> date of this announcement, <strong>the</strong> value of which exceeds 5% of <strong>the</strong><br />

Group's net tangible assets.<br />

9

DIJAYA CORPORATION BERHAD (47908-K)<br />

<strong>Interim</strong> <strong>financial</strong> <strong>statements</strong> <strong>for</strong> <strong>the</strong> <strong>quarter</strong> <strong>ended</strong> <strong>31</strong> March 2004<br />

(The figures have not been audited)<br />

25. Dividend payable<br />

As announced on 19 April 2004, <strong>the</strong> Company declared a first and final dividend of 2% less 28% Malaysian income tax<br />

amounting to dividend payable of 1.44 sen per share in respect of <strong>the</strong> year <strong>ended</strong> <strong>31</strong> December 2003. The proposed<br />

dividend payment is subject to <strong>the</strong> shareholders' approval at a general meeting of <strong>the</strong> Company to be held later.<br />

26. Earnings per share<br />

(a) Basic earnings per ordinary share<br />

Basic earnings per ordinary share is calculated by dividing <strong>the</strong> net profit <strong>for</strong> <strong>the</strong> period by <strong>the</strong> weighted average<br />

number of ordinary shares in issue during <strong>the</strong> period.<br />

3 months <strong>ended</strong> 3 months <strong>ended</strong><br />

3/<strong>31</strong>/2004 3/<strong>31</strong>/2003<br />

Net profit <strong>for</strong> <strong>the</strong> period (RM'000) 10,628 4,180<br />

Weighted average number of ordinary shares ('000) 259,526 259,526<br />

Basic earnings per share (sen) 4.1<br />

(b) Diluted earnings per ordinary share<br />

The effect on <strong>the</strong> basic earnings per share arising from <strong>the</strong> assumed exercise of ESOS is anti-dilutive.<br />

Accordingly, diluted earnings per share was not presented.<br />

By Order of <strong>the</strong> Board<br />

Low Nyoke Fun<br />

Secretary<br />

Petaling Jaya<br />

21 May 2004<br />

1.6<br />

10