Credit Card Application - Dutch-Bangla Bank Limited

Credit Card Application - Dutch-Bangla Bank Limited

Credit Card Application - Dutch-Bangla Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

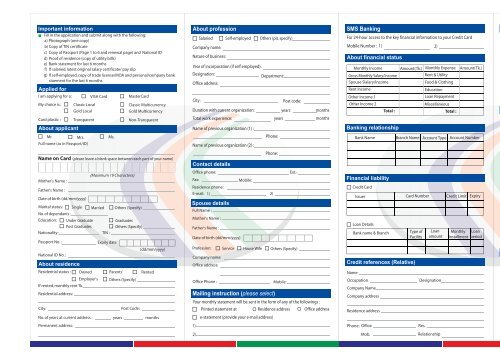

Important information<br />

Fill in the application and submit along with the following:<br />

a) Photograph (one copy)<br />

b) Copy of TIN certificate<br />

c) Copy of Passport (Page 1 to 6 and renewal page) and National ID<br />

d) Proof of residence (copy of utility bills)<br />

e) <strong>Bank</strong> statement for last 6 months<br />

f ) If salaried, latest original salary certificate/ pay slip<br />

g) If self-employed, copy of trade license/MOA and personal/company bank<br />

staement for the last 6 months<br />

Applied for<br />

I am applying for a: VISA <strong>Card</strong> Master<strong>Card</strong><br />

My choice is: Classic Local Classic Multicurrency<br />

Gold Local Gold Multicurrency<br />

<strong>Card</strong> plastic : Transparent Non-Transparent<br />

About applicant<br />

Mr. Mrs. Ms.<br />

Full name (as in Passport/ID)<br />

Name on <strong>Card</strong> (please leave a blank space between each part of your name)<br />

Mother's Name :<br />

Father's Name :<br />

Date of birth (dd/mm/yyyy)<br />

Marital status:<br />

No. of dependants :<br />

Single Married Others (Specify)<br />

Education: Under Graduate Graduates<br />

Post Graduates<br />

Others (Specify)<br />

Nationality:<br />

TIN :<br />

Passport No. : Expiry date :<br />

National ID No. :<br />

About residence<br />

(dd/mm/yyyy)<br />

Residential status : Owned Parents' Rented<br />

Employer's<br />

If rented, monthly rent Tk.<br />

Residential address:<br />

(Maximum 19 Characters)<br />

Others (Specify)<br />

City: Post Code:<br />

No. of years at current address :<br />

Permanent address:<br />

years months<br />

About profession SMS <strong>Bank</strong>ing<br />

Contact details<br />

Office phone: Ext.-<br />

Fax:<br />

Residence phone:<br />

Mobile:<br />

E-mail: 1) 2)<br />

Spouse details<br />

Full Name :<br />

Mother's Name :<br />

Father's Name :<br />

Date of birth (dd/mm/yyyy)<br />

Profession: Service House Wife Others (Specify)<br />

Company name:<br />

Office address:<br />

Office Phone : Mobile:<br />

Mailing instruction (please select)<br />

Your monthly statement will be sent in the form of any of the followings :<br />

1)<br />

2)<br />

Salaried Self-employed Others (pls. specify)<br />

Company name:<br />

Nature of business:<br />

Year of incorporation (if self employed):<br />

Designation:<br />

Department:<br />

Office address:<br />

City: Post code:<br />

Duration with current organization: years months<br />

Total work experience: years months<br />

Name of previous organization (1) :<br />

Name of previous organization (2) :<br />

Printed statement at<br />

Phone:<br />

Phone:<br />

e-statement (provide your e-mail address)<br />

Residence address Office address<br />

For 24-hour access to the key financial information to your <strong>Credit</strong> <strong>Card</strong><br />

Mobile Number : 1)<br />

About financial status<br />

Monthly Income Amount(Tk.) Monthly Expense Amount(Tk.)<br />

Gross Monthly Salary/Income<br />

Rent & Utility<br />

Spouse Slalary/Income<br />

Food & Clothing<br />

Rent Income<br />

Education<br />

Other Income 1<br />

Loan Repayment<br />

Other Income 2<br />

Miscellaneous<br />

Total :<br />

Total :<br />

<strong>Bank</strong>ing relationship<br />

<strong>Bank</strong> Name Branch Name Account Type Account Number<br />

Financial liability<br />

<strong>Credit</strong> <strong>Card</strong><br />

Issuer <strong>Card</strong> Number <strong>Credit</strong> Limit Expiry<br />

Loan Details<br />

<strong>Bank</strong> name & Branch<br />

<strong>Credit</strong> references (Relative)<br />

Type of<br />

Facility<br />

Loan<br />

amount<br />

Name<br />

Occupation Designation<br />

Company Name<br />

Company address<br />

Residence address<br />

Phone: Office Res.<br />

2)<br />

Mob. Relationship<br />

Monthly Loan<br />

installment period

<strong>Credit</strong> references (Other than relative)<br />

Name<br />

Occupation Designation<br />

Company Name<br />

Company address<br />

Residence address<br />

Phone : Office Res.<br />

Auto debit instruction (for DBBL A/C holders only)<br />

I/We the undersigned<br />

hereby irrevocably authorize <strong>Dutch</strong>-<strong>Bangla</strong> <strong>Bank</strong> <strong>Limited</strong> to debit my/our<br />

under mentioned account for payment of my/our DBBL <strong>Card</strong> dues as follows:<br />

Monthly Payment : Minimum amount due _____ % of current balance<br />

Accountholder's Signature:<br />

Suplementary <strong>Card</strong><br />

Mr. Mrs. Ms.<br />

Full name (as in Passport/ID)<br />

Name on card(please<br />

leave a blank space between each part of your name)<br />

Date of birth (dd/mm/yyyy)<br />

Address<br />

Signature (1)<br />

Signature Verified by:<br />

Full amount due<br />

Type of <strong>Card</strong> Account Name Account Number<br />

For Local <strong>Card</strong><br />

For USD <strong>Card</strong><br />

Mob. Relationship<br />

(Maximum 19 Characters)<br />

Phone Mobile<br />

Signature (2)<br />

(Joint accountholder)<br />

Signature of Branch/<strong>Card</strong> Division official PA Number<br />

Relationship with Primary card applicant<br />

Would you like to set up a spending limit per billing cycle ? Yes No<br />

If yes, amount per month (Tk.) or % of the <strong>Card</strong> limit<br />

(lower of the two will be applicable and will be rounded off to the nearest'00).<br />

I request and authorize you to issue a supplementary card to the above person(s).<br />

I agree to pay and be liable for all dues in respect of the card issued as above.<br />

Photographs<br />

Primary card applicant Supplementary card applicant<br />

Please attach a recent color<br />

passport size photograph in this<br />

box, write your name and sign on<br />

the back of the photograph.<br />

(Please do not staple)<br />

Signatures<br />

Signature with date of Primary Applicant<br />

Supplementary <strong>Card</strong> Applicant Declaration<br />

I/we, the supplementary card applicant(s) agree to be jointly and severally<br />

liable for all transactions processed by the use of the card(s) applied for and<br />

issued <strong>Dutch</strong>-<strong>Bangla</strong> <strong>Bank</strong> to the Primary <strong>Card</strong> applicant and/or myself<br />

(ourselves), and to be bound by all the terms and conditions of the <strong>Bank</strong>'s<br />

<strong>Credit</strong> card agreement which accompanies the card.<br />

Signature with date of Supplementary <strong>Card</strong> Applicant<br />

Primary <strong>Card</strong> applicant's signature Supplementary <strong>Card</strong> applicant's signature<br />

(sign within white area, use ball point only)<br />

Please attach a recent color<br />

passport size photograph in this<br />

box, write your name and sign on<br />

the back of the photograph.<br />

(Please do not staple)<br />

Primary card applicant’s declaration<br />

I hereby apply for the issuance of a DBBL <strong>Credit</strong> <strong>Card</strong>. I declare that the information<br />

provided in this application is true and correct and I shall advise you of any changes<br />

thereto. I declare that all the information stated in this application is correct and do not<br />

have any objection if DBBL or its appropriate agent(s) verify this. I accept that DBBL is<br />

entitled in its absolute discretion to accept or reject this application without assigning any<br />

reason whatsoever and that the application and its supporting documents shall become<br />

part of the <strong>Bank</strong>'s records and shall not be returned to me. I acknowledge and agree that<br />

the use of the Primary <strong>Card</strong> and/or Supplementary <strong>Card</strong>(s), if any, issued on my account<br />

shall be deemed as an acceptance of the Terms and Conditions of the DBBL <strong>Credit</strong> <strong>Card</strong><br />

Agreement (which may be amended from time to time). Upon approval I agree to pay the<br />

prevailing fees and charges. By signing and/or activating and/or using the <strong>Card</strong>, I agree to<br />

be bound by the Terms and Conditions (including amendments) as mentioned in the DBBL<br />

<strong>Credit</strong> <strong>Card</strong> Agreement. Where requested, I authorize DBBL to issue Supplementary <strong>Card</strong>(s)<br />

for use on my account to the person(s) named who I undertake is/are over 18 years of age,<br />

and is resident of <strong>Bangla</strong>desh and agree that you may provide information to him/her<br />

about the account. In case the Supplementary <strong>Card</strong> Applicant is between 18 and 21 years<br />

of age, I hereby undertake that the use of such <strong>Card</strong> shall be made under my supervision<br />

and control. I hereby agree to indemnify DBBL against any loss, damage, liability or cost<br />

incurred by the <strong>Bank</strong> on account of any breach by me or the Supplementary <strong>Card</strong>holder(s)<br />

of the aforesaid Conditions or any other Terms and Conditions contained in the <strong>Bank</strong>'s<br />

<strong>Credit</strong> <strong>Card</strong> Agreement or by reason of any legal disability or incapacity of the Supplementary<br />

<strong>Card</strong>holder. I also understand that the Supplementary <strong>Card</strong> fees shall be billed in my<br />

Statement and it shall be my primary responsibility to honour all charges incurred on the<br />

Supplementary<br />

<strong>Card</strong>. The continuation of the membership of the Supplementary<br />

<strong>Card</strong>holder(s) shall be dependent on the continuation of my membership.<br />

For office use only<br />

<strong>Application</strong> Number<br />

Source Code<br />

Principal <strong>Card</strong> Number:<br />

File No.<br />

Fee Code<br />

<strong>Credit</strong> Limit: BDT: USD:<br />

Supplementary <strong>Card</strong> Number (if any):<br />

1.<br />

Fee Code<br />

File No.<br />

<strong>Credit</strong> Limit: BDT: USD:<br />

2.<br />

Fee Code<br />

Signature with date of Primary Applicant<br />

File No.<br />

<strong>Credit</strong> Limit: BDT: USD:<br />

Data Captured by Checked & Authorized by

TERMS AND CONDITIOINS OF DBBL VISA/MASTERCARD CREDIT CARD<br />

1. DEFINITIONS AND INTERPRETATION<br />

In the following Agreement few words shall have their own respective meanings set out for understanding<br />

of the customers, viz.<br />

A. DBBL means <strong>Dutch</strong>-<strong>Bangla</strong> <strong>Bank</strong> <strong>Limited</strong><br />

B. ATM means any Automated Teller Machine<br />

C. CARD means:<br />

i. Valid card issued by DBBL bearing the name VISA International/Master<strong>Card</strong> International Incor. or the<br />

Service Mark of VISA/MASTERCARD (whether or not it also bears the name or mark of any person or<br />

entities) to the Principal / Supplementary <strong>Card</strong>holder for the use of their own accounts and includes any<br />

such <strong>Card</strong> issued in replacement or renewal thereof. All <strong>Card</strong>s issued for use on <strong>Card</strong> Account remain the<br />

property of DBBL all the times.<br />

ii. The card will be issued by DBBL under the condition where all the asked information on the <strong>Credit</strong><br />

<strong>Card</strong> <strong>Application</strong> Form will have to be truly furnished with utmost satisfaction of DBBL.<br />

D. CARDHOLDER means an applicant to whom a credit card has been issued by DBBL bearing<br />

individual applicant's name to operate a card account, and it also includes Supplementary <strong>Card</strong>holder.<br />

E. CARD ACCOUNT means an account (the embossed card number) of the Principal <strong>Card</strong>holder<br />

against his/her issued card along with any supplementary one and which will be thoroughly observed and<br />

monitored by DBBL.<br />

F. CARD ACCOUNT STATEMENT means a statement or statements generated by DBBL of the<br />

amount charged, debited or paid to card account(s) stated therein. <strong>Card</strong> account statement shall have all<br />

detail transactions of Principal and Supplementary cardholder included to the card account during the<br />

statement period.<br />

G. CARD TRANSACTION means a payment whether for goods, services, other charges or cash<br />

advance availed or obtained through the use of card account number or the PIN of a card. If the <strong>Card</strong> is used<br />

by someone else other than the <strong>Card</strong>holder or Supplementary <strong>Card</strong>holder with or without the permission or<br />

concern of the aforesaid <strong>Card</strong>holder(s), all the liabilities in case of that transaction will be put into Principal<br />

<strong>Card</strong>holder's <strong>Card</strong> Account and which he /she has to settle.<br />

H. CASH ADVANCE means an advance of payment made in any currency or by Travelers' Cheque or<br />

other forms by the card representing an amount of any currency.<br />

I. VISA/MASTERCARD means VISA/MASTERCARD International Incorporated.<br />

J. MERCHANT means any person or entity with whom DBBL or any member of<br />

VISA/MASTERCARD has a subsisting agreement relating to the use or acceptance of the card in payment<br />

to such person or entity whether for goods, services or charges incurred or to obtain cash advances from<br />

such persons or entity.<br />

K.OUTSTANDING BALANCE in relation to any card account statement means the outstanding<br />

balance in favour of DBBL as stated therein or where more than one outstanding balances the total of all the<br />

outstanding balances stated therein.<br />

L. PIN means Personal Identification Number issued by DBBL against the cardholder's nominated card<br />

account which will be used to access cash advance through ATM, POS or internet.<br />

M. PRINCIPAL CARDHOLDER means the person to whom a card is issued in his / her favour against<br />

his/her application alone.<br />

N. SUPPLEMENTARY CARDHOLDER means the person (other than the principal cardholder) to<br />

whom a card is issued on application of the Principal <strong>Card</strong>holder whether alone or jointly with the Principal<br />

<strong>Card</strong>holder and the full liability will be borne by the principal cardholder but if in case any thing goes<br />

wrong with the Principal <strong>Card</strong>holder (death/abnormality etc.) then Supplementary <strong>Card</strong>holder will be liable<br />

to pay the total outstanding of the card issued to the Principal <strong>Card</strong>holder.<br />

O. PAYMENT DUE DATE means the last date of payment and is usually 20 days from the date of<br />

statement, if not mentioned or specified otherwise on the card account statement. At least, the minimum<br />

payment due (excluding the overdue amount) must be paid by the cardholder within the due date at any<br />

branch of DBBL. Any overdue or over limit amount must be paid immediately.<br />

P. COMPANY, when used in relation to a cardholder, shall mean (i) Company of which such cardholder<br />

is Director or Employee, (ii) Business Enterprise of which such cardholder is the sole proprietor, (iii) Firm<br />

of which such <strong>Card</strong>holder is a partner.<br />

2. FACILITIES AVAILABLE WITH THE CARD<br />

a. Making payments to Merchants against purchase of all goods and services by the <strong>Card</strong>holder from<br />

Merchant(s).<br />

b. availing cash advances:<br />

i. from any of DBBL ATMs or any member of VISA/MASTERCARD International or any Merchant<br />

authorized to make cash advances as may be agreed upon by DBBL.<br />

ii. by using the <strong>Card</strong> on any ATM of DBBL or other bank's ATM with VISA/MASTERCARD logo,<br />

subject to these terms and conditions and in compliance with such requirements, limitations and procedures<br />

as may be imposed by DBBL.<br />

3. CREDIT LIMIT<br />

DBBL may sanction any <strong>Credit</strong> Limit depending on its credit policy which will be the maximum credit<br />

available to the cardholder and which can be accessed at any one time, for the facilities under condition 2<br />

hereof and may terminate or modify or vary such facilities or <strong>Credit</strong> Limit without any prior notice. Unless<br />

the <strong>Credit</strong> Limit is imposed in relation to each card account, the imposed credit limit is applicable to the<br />

aggregate of the balances due to DBBL on all the card accounts of the Principal <strong>Card</strong>holders and<br />

Supplementary <strong>Card</strong>holder(s). The limit imposed for Cash Advances shall be part of the <strong>Credit</strong> Limit<br />

imposed. The cardholder will be notified about his/her credit limit in written form. The available credit is<br />

the unused balance available to the <strong>Card</strong>holder at any point of time. The available credit shown on card<br />

account statement shall depict the amount available to the <strong>Card</strong>holder as on the date of statement.<br />

4. LOSS OF CARD OR DISCLOSURE OF PIN<br />

a. The <strong>Card</strong>holder shall not disclose or cause to be disclosed to any person the PIN assigned to the <strong>Card</strong>.<br />

Immediately upon learning that the card is lost or stolen or the PIN is disclosed, the <strong>Card</strong>holder shall report<br />

it to DBBL followed by written confirmation containing <strong>Card</strong>holder's signature on the said loss. The<br />

<strong>Card</strong>holder shall, at the request of DBBL, furnish DBBL with a statutory declaration in such a form as<br />

DBBL may require and F.I.R/ police report and/or any other information as DBBL may require.<br />

b. If the lost or stolen card is found or recovered, the <strong>Card</strong>holder shall not make use of the card but shall<br />

immediately cut it into halves and return those parts to DBBL.<br />

c. Notwithstanding the lost or theft of any <strong>Card</strong> or disclosure of the PIN in respect of any <strong>Card</strong>, DBBL<br />

may charge and debit the <strong>Card</strong> Account the amount of each and every <strong>Card</strong> Transaction made effected<br />

before written confirmation by the <strong>Card</strong>holder for such loss, theft or disclosure is received by DBBL.<br />

Replacement of <strong>Card</strong> may be made to the <strong>Card</strong>holder on payment of required charges in this regard.<br />

5. CHARGES TO CARD ACCOUNT:<br />

DBBL may charge and debit the <strong>Card</strong> Account the amount of each and every transaction made or<br />

effected, whether by the <strong>Card</strong>holder or any other person(s) with or without the <strong>Card</strong>holder's knowledge or<br />

authority, notwithstanding that the balance due to DBBL on the <strong>Card</strong> Account may as a consequence of any<br />

such charges or debit exceeding any <strong>Credit</strong> Limit that may be sanctioned. For existing fees and service<br />

charges, one may contact <strong>Card</strong> Division at DBBL's Head Office or any branch of DBBL.<br />

6. CASH ADVANCE FEE<br />

In respect of each Cash Advance made through the use of any <strong>Credit</strong> <strong>Card</strong> and or the PIN, DBBL shall<br />

charge and debit the <strong>Card</strong> Account a fee as decided from time to time.<br />

7. PAYMENT<br />

A. In respect of each <strong>Card</strong> Account Statement, the following stated therein shall be paid to any of DBBL<br />

branches within the Payment Due Date:<br />

i. at least the aggregate of the minimum payment(s) specified as such in the <strong>Card</strong> Account Statement.<br />

ii. the amount, if any, by which the Outstanding Balances stated therein exceed the credit limit in relation<br />

to the <strong>Card</strong> Account(s) stated therein.<br />

B. If, Outstanding Balance stated in <strong>Card</strong> Account Statement is not paid in full within the Payment Due<br />

Date stated therein, DBBL may charge and debit the <strong>Card</strong> Account calculated on a daily basis, subject to a<br />

minimum monthly finance charge of @1.90% for local card and @2.25% for multicurrency card per month<br />

or such other figure as may be determined from time to time by DBBL without prior notice.<br />

i. on the amount of each and every charge stated in that <strong>Card</strong> Account Statement is from the date when<br />

such charge was incurred or was posted to the <strong>Card</strong> Account, as DBBL may elect, to the billing date stated<br />

in that <strong>Card</strong> Account Statement and<br />

ii. on the entire Outstanding Balance from the billing date stated in that <strong>Card</strong> Account Statement until full<br />

payment of the Outstanding Balance is made. A charge in relation to any <strong>Card</strong> Transaction shall be deemed<br />

to have been incurred on the <strong>Card</strong> Account on the date when the <strong>Card</strong> Transaction was effected.<br />

C. If any amount required to be paid under Condition 7(A) hereof is not paid in full by the Payment Due<br />

Date stated in the statement, DBBL may charge and debit the <strong>Card</strong> Account a Late Payment Charge at such<br />

rate or amount as DBBL may determine from time to time without prior notice.<br />

D. Any payment made by a <strong>Card</strong>holder shall be applied in the following order: i) Any over limit amount<br />

ii) Any overdue amount iii) Service Charges iv) Cash Advances v) Fees vi) Purchases.<br />

E. In respect of payment of <strong>Card</strong>holder (<strong>Card</strong> Type: Global Gold and Global Classic, Local Gold, Local<br />

Classic) to DBBL, charges shall be made by <strong>Bank</strong>ers' draft payable in US $ or any other settlement mode<br />

acceptable to DBBL. If DBBL decides to accept payment tendered into some other currency, payment will<br />

not be credited in the <strong>Card</strong> Account. Charges incurred in any currency other than US$ will be converted into<br />

US$ at rates that will not be less favorable to <strong>Card</strong>holder than the rate arrived at by use of an inter-bank rate<br />

in existence within 24 hours that DBBL or any authorized Agent processes the Charge plus 1% of the<br />

converted amount. An official rate will be used where required by law. Charges converted by common<br />

carriers shall be billed at rates used by such carries and submitted to DBBL by such carriers in other than<br />

US$ shall be converted to US$ in accordance with foregoing procedures. DBBL may charge the <strong>Card</strong><br />

Account for cost resulting for converting payments.<br />

8. OTHER CHARGES AND FEES:<br />

DBBL may charge and debit the <strong>Card</strong> Account relating to any <strong>Card</strong>:<br />

a. An Annual Service Fee for issue or renewal of the <strong>Card</strong> at such rate as DBBL may prescribe without<br />

notice from time to time and such fee shall not be refundable in any event.<br />

b. Where any Cheque or <strong>Bank</strong>er's Draft drawn to the order of DBBL by <strong>Card</strong>holder (or pursuant to<br />

<strong>Card</strong>holder's authorization) is not honoured for the full amount thereon, DBBL may assess a Service Charge<br />

for each Cheque, which will be dishonored or returned to reimburse DBBL for the cost and expenses of<br />

collection.<br />

c. An administrative fee of such amount as DBBL prescribes from time to time without prior notice for<br />

the replacement of the <strong>Card</strong> or for the provision of any records, statements, sales drafts, credit vouchers or<br />

other documents relating to the use of the <strong>Card</strong> Account and copies thereof at the request of any <strong>Card</strong>holder.<br />

d. A charge for each travel, airline or hotel reservation made through the use of the <strong>Card</strong> which is<br />

subsequently cancelled or not taken up and such charge shall be at the rate prescribed by the Merchant with<br />

or through whom the reservation was made or at such rate as prescribed from time to time without prior<br />

notice.<br />

e. Where by any arrangement executed between any <strong>Card</strong>holder and financial institution, any payment is<br />

to be made to DBBL for the credit of any <strong>Card</strong> Account, whether at regular intervals or otherwise, a fee of<br />

such amount as prescribed from time to time without prior notice for each occasion when any payment to<br />

DBBL is not effected at the time when such payment should have been effected in accordance with such<br />

arrangement.<br />

9. TERMINATION OF USE OF CARD AND CARD ACCOUNT:<br />

a. DBBL reserves the absolute right and discretion to terminate use of <strong>Card</strong> and <strong>Card</strong> Account or<br />

seize/cancel the <strong>Card</strong> so issued or revoke <strong>Card</strong> Account/<strong>Card</strong> at any time without prior notice and without<br />

assigning any reason for such termination.<br />

b. The use of any or all <strong>Card</strong>s may be terminated by the <strong>Card</strong>holder by giving written notice thereof<br />

giving at least 30 days notice and returning to DBBL the <strong>Card</strong> or <strong>Card</strong>s cut into halves provided that such<br />

termination shall be effective only upon receipt of such <strong>Card</strong> or <strong>Card</strong>s by DBBL and square-up of all<br />

liabilities and dues, if any.<br />

c. Upon termination of the use of any <strong>Card</strong> by DBBL the <strong>Card</strong>holder shall return such <strong>Card</strong> to DBBL cut<br />

into halves and square-up of all liabilities and dues, if any.<br />

10. PAYMENT ON TERMINATION:<br />

Upon termination of the use of any <strong>Card</strong>, whether by DBBL or by <strong>Card</strong>holder, the Principal <strong>Card</strong>holder<br />

and in the case where <strong>Card</strong> is issued to a Supplementary <strong>Card</strong>holder, the Supplementary <strong>Card</strong>holder shall<br />

pay DBBL on demand the entire balance due to DBBL on the <strong>Card</strong> Account, relating to that <strong>Card</strong> and until<br />

payment in full is made. DBBL shall be entitled to charge the Financial Charge provided in Condition 7(B)<br />

hereof on the balance due to DBBL on the <strong>Card</strong> Account and debit that <strong>Card</strong> Account accordingly.<br />

11. LIABILITY OF PRINCIPAL & SUPPLEMENTARY CARDHOLDER:<br />

a. The Principal <strong>Card</strong>holder shall be liable for and shall pay DBBL on demand the balance due to DBBL<br />

on each and all <strong>Card</strong> Accounts at any time including all charges effected or debited to any and all <strong>Card</strong><br />

Accounts in accordance with this Agreement.<br />

b. Each Supplementary <strong>Card</strong>holder shall be liable for and shall pay DBBL on demand the balance due to<br />

DBBL at any time on the <strong>Card</strong> Account relating to the <strong>Card</strong> issued to that Supplementary <strong>Card</strong>holder

including all charges effected or debited to that <strong>Card</strong> Account in accordance with this Agreement.<br />

c. The liability of the Principal <strong>Card</strong>holder and each and all Supplementary <strong>Card</strong>holders under any of the<br />

provisions of this Agreement shall be separate and any invalidity, unenforceability, release or discharge of<br />

the liability of the Principal <strong>Card</strong>holder or any Supplementary <strong>Card</strong>holder to DBBL shall not affect or<br />

discharge the liability of the other <strong>Card</strong>holder to DBBL.<br />

d. Company and <strong>Card</strong>holder shall be jointly and severally liable to pay to DBBL the amount of any and<br />

all purchase charged to the <strong>Card</strong> Account as a result of the use of <strong>Card</strong> issued to the <strong>Card</strong>holder and all<br />

other dues together with all annual, renewal and other fees.<br />

12. EXCLUSIONS AND EXCEPTIONS:<br />

A. DBBL shall not be responsible or liable to any and all <strong>Card</strong>holders for any loss or damage incurred or<br />

suffered as a consequence of:<br />

i. Any act or omission of any Merchant howsoever caused including, without limitation, any refusal to<br />

honour or accept any <strong>Card</strong> or any statement or other communication made in connection therewith or any<br />

defect or deficiency in goods or services supplied, but not limited to, the negligent act or omission of DBBL<br />

or its Agents. <strong>Card</strong>holder will handle any claim or dispute directly with the said Merchant and will not be<br />

entitled to withhold payment from DBBL on account of any such claim or dispute.<br />

ii. Any malfunction, defect or error in any ATM, or other machines or system of authorization whether<br />

belonging to or operated by DBBL or otherwise.<br />

iii. Any delay or inability of DBBL to perform any of its obligations pursuant to this Agreement because<br />

of any mechanical, data processing or telecommunication failure, act of God, civil disturbance or any event<br />

outside of DBBL's control or as a consequence of any fraud or forgery.<br />

iv. Any damage to or loss of or inability to retrieve any data or information that may be stored in any <strong>Card</strong><br />

howsoever caused.<br />

v. Any undesired fraud and forgery by means of computer hacking or any means which causes any burden<br />

to the <strong>Card</strong>holder.<br />

B. DBBL shall not be responsible for the delivery, quality or performance of any goods or services paid<br />

for through the use of the <strong>Card</strong> including any goods or services made available or introduced to any<br />

<strong>Card</strong>holder by DBBL and DBBL shall be entitled to charge the <strong>Card</strong> Account in respect of the payment<br />

made notwithstanding the non-delivery or non-performance of or any defect in those goods or services. All<br />

<strong>Card</strong>holders shall seek redress in respect of such goods and services from the Merchant directly.<br />

13. CONCLUSIVENESS OF DOCUMENTS AND CERTIFICATES<br />

A. DBBL shall be entitled to rely upon and to treat any document relating to any <strong>Card</strong> Transaction with<br />

the signature of any <strong>Card</strong>holder as conclusive evidence of the fact that the <strong>Card</strong> Transaction as therein<br />

stated or recorded was authorized and properly made or effected by the <strong>Card</strong>holder.<br />

B. Each <strong>Card</strong> Account Statement shall state the <strong>Card</strong> Accounts in relation to the <strong>Card</strong> issued to the<br />

Principal <strong>Card</strong>holder and each of the <strong>Card</strong>s issued to each Supplementary <strong>Card</strong>holder and DBBL shall not<br />

be required to send to any Supplementary <strong>Card</strong>holder any <strong>Card</strong> Account Statement or any statement with<br />

respect to the <strong>Card</strong> Account of the <strong>Card</strong> issued to that Supplementary <strong>Card</strong>holder.<br />

C. Any error or inaccuracy in any <strong>Card</strong> Account Statement shall be notified in writing to DBBL within 25<br />

days from the date when such statement is received or deemed to be received by the Principal <strong>Card</strong>holder.<br />

Each <strong>Card</strong> Account Statement shall constitute conclusive evidence as against all <strong>Card</strong>holders that every<br />

<strong>Card</strong> Transaction stated therein is effected by the <strong>Card</strong>holder and every charge stated and every amount<br />

debited therein is valid and properly incurred or debited in the amount stated therein save for such error or<br />

inaccuracy which the cardholder had notified DBBL in writing within the time prescribed herein.<br />

14. APPROPRIATION OF PAYMENTS:<br />

Any payment made or sent by the Principal <strong>Card</strong>holder or any Supplementary <strong>Card</strong>holder(s) may be<br />

applied and appropriated by DBBL in such a manner and order and to such <strong>Card</strong> Account(s) (whether<br />

relating to the <strong>Card</strong> issued to that <strong>Card</strong>holder or otherwise) as DBBL may determine notwithstanding any<br />

specific appropriation by that <strong>Card</strong>holder.<br />

15. AMENDMENTS<br />

DBBL may at any time amend any of these terms and conditions by giving notice to the Principal<br />

<strong>Card</strong>holder in the manner prescribed herein of such amendment(s) shall take effect on the date specified in<br />

such notice. If the Principal <strong>Card</strong>holder or any Supplementary <strong>Card</strong>holder continues to retrain or use any<br />

<strong>Card</strong> after the specified date, then all <strong>Card</strong>holders deem to accept such amendment(s).<br />

16. DISCLOSURE OF INFORMATION<br />

<strong>Card</strong> Division at DBBL's Head Office may disclose any information relating to any cardholder or the<br />

assets or liabilities of any <strong>Card</strong>holder for any <strong>Card</strong> Account or <strong>Card</strong> Transaction to DBBL authority or any<br />

member of VISA/MASTERCARD International or any other person if DBBL considers it in its interest to<br />

do so.<br />

17. SET OFF AND CONSOLIDATION<br />

DBBL may at any time and without prior notice or on demand combine or consolidate any and all<br />

account(s) maintained by any <strong>Card</strong>holder with DBBL and/or set off or transfer any sum standing to the<br />

credit in any or all such account(s) in or towards the discharge or payment of any or all sums due to DBBL<br />

from that <strong>Card</strong>holder or any <strong>Card</strong> Account or under this Agreement and the right herein conferred shall be<br />

exercisable notwithstanding that:<br />

- the use of the <strong>Card</strong> or the <strong>Card</strong> Account is not terminated;<br />

- and/or the balance then in favour of DBBL on the <strong>Card</strong> Account does not exceed the credit limit<br />

imposed on the <strong>Card</strong> Account.<br />

18. DOCUMENTATION<br />

DBBL will issue <strong>Card</strong> to the <strong>Card</strong>holder on completion of all documentary formalities. <strong>Card</strong>holder shall<br />

execute a set of Charge Documents and provide other legal documents as per <strong>Credit</strong> <strong>Card</strong> Policy of DBBL<br />

in this connection.<br />

19. MISCELLANEOUS<br />

19.1 The Principal <strong>Card</strong>holder and each Supplementary <strong>Card</strong>holder shall pay and reimburse DBBL on<br />

demand (on a full indemnity basis) all costs, fees and expenses incurred by DBBL in recovering or<br />

attempting to recovery any <strong>Card</strong> issued to and/or any sum due to DBBL from such <strong>Card</strong>holder.<br />

19.2 All references to dollars (international <strong>Card</strong>) and US$ in this Agreement shall mean US Dollars<br />

notwithstanding that the billing currency of the <strong>Card</strong> Account may be a currency other than US Dollars in<br />

which event the equivalent in such other currency shall apply at such rate or exchange as may be<br />

determined by DBBL. DBBL may charge all sums payable to DBBL under this Agreement to the relevant<br />

<strong>Card</strong> Account in the applicable billing currency. Charges incurred in the currency other than the billing<br />

currency shall be converted at such rate or rates of exchange as may be determined by DBBL from time to<br />

time.<br />

19.3 Any request or instruction to DBBL shall be in writing and shall be signed by the <strong>Card</strong>holder<br />

provided nevertheless that DBBL may but shall not be obliged to accept and act on any instruction or<br />

request by telex, facsimile transmission or through the telephone which is believed by the officers or<br />

employees of DBBL attending to such instruction or request to have been given or made or authorized by<br />

any cardholder notwithstanding that such instruction or request may not have been given or made or<br />

authorized by such <strong>Card</strong>holder and notwithstanding any fraud that may exist in relation thereto and DBBL<br />

shall not be liable for any loss or damage suffered as consequence of its acting on or acceding to any such<br />

instruction or request.<br />

19.4 Any and all <strong>Card</strong> Account Statements, notice (including notification of the PIN and of any<br />

amendments to this Agreement) or demands of DBBL may be sent to the Principal <strong>Card</strong>holder or any<br />

Supplementary <strong>Card</strong>holder by post/courier service, facsimile transmission or telex at the address stated in<br />

the application for the <strong>Card</strong> or any other address which the <strong>Card</strong>holder may notify DBBL in writing or from<br />

which any telex or facsimile transmission by the <strong>Card</strong>holder or purporting to be sent by the <strong>Card</strong>holder had<br />

been dispatched to DBBL.<br />

Any statement, notice or demand to any cardholder so sent or dispatched shall be effective and deemed to<br />

have been received by the <strong>Card</strong>holder -<br />

a. On the day immediately following the date of dispatch, if sent by post/Courier Service or<br />

b. immediately on dispatch if sent by facsimile transmission notwithstanding that it is not received by the<br />

<strong>Card</strong>holder or returned undelivered.<br />

19.5 Any <strong>Card</strong> Account Statement or notice relating to any amendment to this Agreement dispatched to<br />

the Principal <strong>Card</strong>holder shall be deemed to have been dispatched and received by each and every<br />

Supplementary <strong>Card</strong>holder at the time when the Principal <strong>Card</strong>holder shall have received or is deemed to<br />

have received the same.<br />

19.6 The use of any <strong>Card</strong> is also subject to other terms and conditions governing the use of other facilities<br />

or benefits which may from time to time be made available. Cash withdrawals from any account with<br />

DBBL shall be subject to the terms and conditions of DBBL.<br />

19.7 Any Charge Slip or Transaction Information Document signed by the <strong>Card</strong>holder shall be the<br />

conclusive proof of the charges recorded therein as incurred by the <strong>Card</strong>holder him/herself and/or Corporate<br />

Member and/or Supplementary <strong>Card</strong>holder.<br />

19.8 The <strong>Card</strong>holder is responsible for collecting the bills and copies of the Charge Slip or Transaction<br />

Information Document signed by him/her from the Member establishment. DBBL will not provide any<br />

copy of the charge slip.<br />

19.9 The cardholder is responsible for possessing the <strong>Card</strong> with utmost care and security and not to<br />

permit anyone unauthorized to use or have possession of the same.<br />

19.10 The <strong>Card</strong>holder is responsible for notifying DBBL immediately in respect of any change to<br />

<strong>Card</strong>holder name/business /home/ telephone number and billing address or any other particulars as<br />

furnished in the <strong>Credit</strong> <strong>Card</strong> <strong>Application</strong> Form earlier for issuance of the <strong>Card</strong>.<br />

19.11 The <strong>Card</strong>holder is responsible to return immediately the <strong>Card</strong> (including the Supplementary<br />

<strong>Card</strong>(s), if any), issued to them, to DBBL or its Agents upon request where DBBL Authority believe that<br />

they have a good reason to request the <strong>Card</strong>(s) to be returned.<br />

19.12 The <strong>Card</strong>holder (<strong>Card</strong> Type Gold/Silver Global) must comply with all applicable Foreign Exchange<br />

Control Regulations and all amendments and additions thereto and the terms and conditions in any special<br />

approval of <strong>Bangla</strong>desh <strong>Bank</strong> as and where applicable.<br />

19.13 The <strong>Card</strong>holder and DBBL shall be unconditionally agreeable to submit to the jurisdiction of the<br />

Court of the Country in respect of all disputes arising out of this Agreement.<br />

19.14 This Agreement shall be construed according to the Laws applicable in <strong>Bangla</strong>desh and these<br />

Terms and Conditions set down in the Agreement will be governed by Laws applicable in <strong>Bangla</strong>desh. All<br />

<strong>Card</strong>holders submit themselves to the non-exclusive jurisdiction of the Courts of the Government of the<br />

People's Republic of <strong>Bangla</strong>desh.<br />

19.15 DBBL will reserve all the authority to emboss or print or declare the cardholder's or supplementary<br />

cardholder's photograph(s) on the daily newspapers for publication, if i/we deny to pay or i/we becomes<br />

traceless without paying outstanding against my card.<br />

19.16 DBBL will reserve all the rights to file a case in any police station and in court against the defaulter<br />

(may be Principal <strong>Card</strong>holder or Supplementary <strong>Card</strong>holder(s) of the card, who is not paying his/her<br />

outstanding bills for quite a longer period of time.<br />

19.17 DBBL will reserve all the rights to cancel or block the <strong>Card</strong> without informing the <strong>Card</strong>holder at<br />

any time of the period, if the information given in application form by the <strong>Card</strong>holder is found not be true<br />

or irrelevant or false at any period of time after issuance of the <strong>Card</strong>.<br />

19.18 If the <strong>Card</strong>holder is a <strong>Bangla</strong>deshi national and he /she leaves <strong>Bangla</strong>desh without settling his / her<br />

outstanding against his / her card then DBBL will reserve all the rights to inform the embassy where the<br />

cardholder has gone away without informing DBBL or settling its card dues. In connection with that DBBL<br />

will file a case against him / her where he / she has gone away to recover the DBBL card outstanding bill<br />

through the embassy where cardholder has gone to.<br />

20. DECLARATION:<br />

I / We do hereby declare, understand and affirm as under:<br />

i. I/We am/are not a loan defaulter with any <strong>Bank</strong> or Financial Institute or in any way or the other.<br />

ii. If any of my office or present / mailing address are changed then I will inform DBBL immediately in no<br />

time or DBBL reserves all the right to take any sort of official / legal action against me without my concern.<br />

iii. If any dispute arise in my monthly credit card statement, I will immediately inform the DBBL <strong>Card</strong><br />

Division regarding the disputed transaction which is shown in my monthly statement and DBBL <strong>Card</strong><br />

Division will immediately take necessary steps to verify my(the cardholder) disputed transaction but not<br />

later than one(1) month. DBBL <strong>Card</strong> Division will not accept or liable for any transactions if I (the<br />

cardholder) do not inform DBBL <strong>Card</strong> Division in the above mentioned one(1) month period on receipt of<br />

statement.<br />

iv) I/We do hereby undertake that I/We will abide by the rules and regulation of hotels where I/We will<br />

use the cards particularly the cancellation policy of reserved room(s). I/We also authorized DBBL to debit<br />

my/our card account(s) as per policy of hotel where I/We will use the card(s).<br />

I have read and understood the above terms and conditions and accepted it.<br />

Signature of the applicant