directors' report - Dutch-Bangla Bank Limited

directors' report - Dutch-Bangla Bank Limited

directors' report - Dutch-Bangla Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

● To develop small-scale entrepreneur, a long<br />

term local currency loan equivalent to EURO<br />

5.0 million was also arranged from<br />

Netherlands Development Finance Company<br />

(FMO) to finance small-scale enterprises<br />

engaged in manufacturing, agriculture,<br />

transport, tourism and productive trade &<br />

commerce and service industries. The loan<br />

amount was increased to EURO 7.5 million<br />

to include residential housing finance only<br />

for fixed income group.<br />

Subordinated debt<br />

The total amount of Subordinated loans stood at<br />

Taka 1,416.3 million at the end of 2010.<br />

Subordinated loans have been arranged from FMO<br />

for financing housing sector of the country and to<br />

strengthen the Tier 2 capital as well as total capital<br />

of the <strong>Bank</strong>. Subordinated loans are eligible as Tier<br />

2 capital of the <strong>Bank</strong> subject to the regulatory limit<br />

of maximum 30% of Tier 1 capital. All the<br />

subordinated loans were restructured in 2010 in line<br />

with <strong>Bangla</strong>desh <strong>Bank</strong> requirement under Basel II.<br />

Shareholders' equity<br />

As at 31 December 2010, DBBL's shareholders'<br />

equity increased to Taka 7,001.0 million from Taka<br />

4,351.8 million of 2009 registering an increase by<br />

Taka 2,649.2 million (60.9%). The increase resulted<br />

from Taka 2,002.3 million after tax profit, Taka 41.4<br />

million reserves against HFT and HTM securities and<br />

Taka 605.5 million against assets revaluation<br />

reserves. After issuing bonus shares @ 1:0.33, paid<br />

up share capital of the <strong>Bank</strong> increased by Taka<br />

500.0 million and stood at Taka 2,000.0 million at<br />

the end of 2010. The statutory reserve increased to<br />

Taka 2,748.4 million at the end of 2010 from Taka<br />

2,000.0 million of 2009. The paid up share capital<br />

and the statutory reserve together stood at Taka<br />

4,748.4 million as at 31 December 2010. As per<br />

<strong>Bangla</strong>desh <strong>Bank</strong> regulation, paid up share capital<br />

and statutory reserve should be increased to at<br />

least Taka 4,000.0 million latest by 11 August 2011<br />

of which paid up share capital should be minimum<br />

Taka 2,000.0 million. DBBL has met the<br />

requirement much earlier before the deadline.<br />

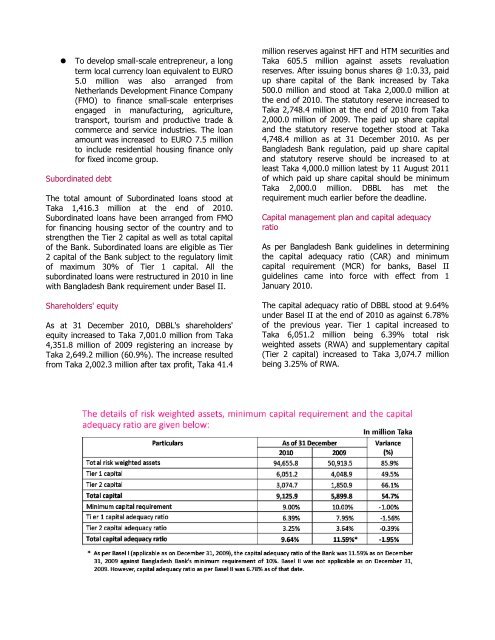

Capital management plan and capital adequacy<br />

ratio<br />

As per <strong>Bangla</strong>desh <strong>Bank</strong> guidelines in determining<br />

the capital adequacy ratio (CAR) and minimum<br />

capital requirement (MCR) for banks, Basel II<br />

guidelines came into force with effect from 1<br />

January 2010.<br />

The capital adequacy ratio of DBBL stood at 9.64%<br />

under Basel II at the end of 2010 as against 6.78%<br />

of the previous year. Tier 1 capital increased to<br />

Taka 6,051.2 million being 6.39% total risk<br />

weighted assets (RWA) and supplementary capital<br />

(Tier 2 capital) increased to Taka 3,074.7 million<br />

being 3.25% of RWA.