Apple

Apple

Apple

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Apple</strong> inc. has done really well for its self in<br />

the past couple of years. The company is very<br />

profitable and it shows through the increase<br />

in net income and the increase of stock sales.<br />

<strong>Apple</strong>’s stock is at a very high price now<br />

proving that many investors trust that <strong>Apple</strong><br />

can sustain profitability. <strong>Apple</strong>’s success<br />

could be credited to its iproducts. The<br />

increased popularity of the iPod, iPhone, and<br />

iPad have rocketed sales.<br />

<strong>Apple</strong> inc. Annual Report

Introduction<br />

<strong>Apple</strong>’s founder and chief<br />

executive officer is Steve Jobs.<br />

His office is located at 1 Infinite<br />

loop Cupertino, California 95014.<br />

<strong>Apple</strong>’s ending date of the last<br />

fiscal year was September 25,<br />

2010. <strong>Apple</strong>s primary products<br />

are iPhones, iPods, computers<br />

and computer software. Their<br />

main geographic area of activity<br />

is in the Americas, Europe,<br />

Japan, and Asia.

Audit Report<br />

<strong>Apple</strong>’s independent auditor is Ernst and young<br />

LLP. They said that the financial statements are<br />

presented fairly in all the material with respect<br />

to the consolidated financial position of <strong>Apple</strong>.<br />

The results of its operations and cash flows are<br />

in conformity with the generally accepted<br />

accounting principles of the U.S.

Stock Market<br />

Information<br />

The most recent price of the<br />

company’s stock is $372.5<br />

The twelve month trading<br />

range of the company’s stock<br />

is from $281.82 to $422.86<br />

Dividend per share are 0<br />

Date of the above information<br />

October 5, 2011<br />

In my opinion about <strong>Apple</strong>’s<br />

stock I would have to say sell<br />

because its stock is really high<br />

right now and it will not last<br />

for long especially since the<br />

death of Steve Jobs.

<strong>Apple</strong>s future plan is to develop operating systems that are easy to use, well<br />

integrated, with a well industrialized design. <strong>Apple</strong> continues to stay ahead of<br />

competition with new innovations and products that capture our interests.<br />

With the introduction of the new iPad many other companies have followed in<br />

their footsteps to try and enter the tablet market. The iPhone another one of<br />

<strong>Apple</strong>s biggest success is one of the best selling smart phones in the U.S. and<br />

apple will continue to produce iPhones that are truly innovative.<br />

http://www.apple.com/ipad/<br />

http://www.apple.com/iphone/#

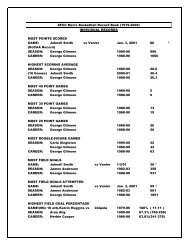

•Format most like a multistep format.<br />

•Gross profit, income from operations, and net<br />

income all increased but net income stood out<br />

the most because it had a staggering increase of<br />

about 70%.<br />

Gross Profit Income<br />

From<br />

Operations<br />

2009 $17,222 $12,066 $8,235<br />

Net Income<br />

2010 $25,684 $18,540 $14,013

Assets= Liabilities+ Stockholder’<br />

s Equity<br />

2009 $47,501 $15,861 $31,640<br />

2010 $75,183 $27,395 $47,791<br />

•All of <strong>Apple</strong>’s balance sheet accounts have<br />

increased but assets showed the biggest increase.

•Cash flows from operations have been more than<br />

net income for the past two years.<br />

•The company growing through investing<br />

activities.<br />

•The company’s primary source of financing is<br />

stock sales.<br />

•Overall, has cash increased over the past two<br />

years by almost doubling.

•Revenue Recognition- Net sales is derived primarily<br />

from revenues through the sale of software,<br />

hardware, digital content, peripherals, and service<br />

and support contracts. <strong>Apple</strong> recognizes revenue in<br />

accordance with industry specific software<br />

accounting guidance.<br />

•Cash- All highly liquid investments with maturities<br />

of there months or less are counted as cash<br />

equivalents.

Accounting Policies<br />

• Short-term investments- Marketable securities with<br />

maturities of less than 12 months are classified as<br />

short- term while marketable securities with maturities<br />

of more than 12 months are classified as long term.<br />

• Inventories- are computed using the first in first out<br />

method. The companies inventories consist of<br />

components and finished goods.<br />

• Property and Equipment- Depreciation is computed by<br />

straight line method over the useful lives of the asset.

Topics of the Notes to Financial<br />

Statements.<br />

1)Summary of Significant Accounting Policies<br />

2)Financial Instruments<br />

3)Fair Value Measurements<br />

4)Consolidated Financial Statements Details<br />

5)Goodwill and other Intangible Assets<br />

6)Income Taxes<br />

7)Shareholder’s Equity and Stock-Based Compensation<br />

8)Commitment and Contingencies<br />

9)Segment information and Geographic Data<br />

10)Selected Quarterly Financial Information (Unaudited)

Financial Analysis<br />

Liquidity Ratios 2009 2010<br />

Working Capitol $14,286 $20,049<br />

Current Ratio 2.7 1.5<br />

Receivables Turnover<br />

Average Day’s Sales<br />

uncollected<br />

16.1 11.07<br />

7.98 11.97<br />

Inventory Turnover 48.2 62.3<br />

Average Day’s Inventory<br />

on Hand<br />

7.62 5.98

Financial Analysis<br />

Liquidity Ratios<br />

Working capital increased because total assets increased.<br />

Current ratio has decreased because current liabilities have<br />

almost doubled in the year.<br />

Receivables turnover has decreased because net sales increased<br />

substantially while accounts receivable only increased by a little<br />

bit.<br />

Average day’s sales uncollected has increased because receivables<br />

turnover had decreased.<br />

Inventory turnover has increased because inventory for 2010 has<br />

increased.<br />

Average day’s inventory on hand has decreased because<br />

inventory turnover has increased showing that <strong>Apple</strong> is selling<br />

more inventory and is having less inventory on hand.

Financial Analysis<br />

Profitability Ratios<br />

2009 2010<br />

Profit Margin 19.2% 21.5%<br />

Asset Turnover .96 1.1<br />

Return on Assets 25.5% 23.8%<br />

Return on Equity 20.7% 35.3%

Financial Analysis<br />

Profitability Ratios<br />

Profit margin rose in 2010 because sales<br />

increased.<br />

Asset turnover increased because assets<br />

were increased.<br />

Return on assets decrease because net<br />

income increased.<br />

Return on equity has increased because<br />

more stockholders have invested in <strong>Apple</strong>.

Financial Analysis<br />

Solvency Ratio<br />

For the past two years debt to equity has increased because<br />

liabilities has increased substantially.<br />

2009 2010<br />

Debt to equity 0.50 0.57

Financial Analysis<br />

Market Strength Ratios<br />

Price/earnings per<br />

share<br />

2009 2010<br />

20.08 18.65<br />

Dividends Yield 0 0<br />

<strong>Apple</strong> stock price/ earnings per share decreased over the<br />

year because the price of the stock rose greatly within<br />

that year. The company did not pay out dividends<br />

because they anticipated that for the foreseeable future<br />

they will retain any earnings and use it for operations<br />

of its business.