rct-abercrombie & fitch

rct-abercrombie & fitch

rct-abercrombie & fitch

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual Report<br />

Abercrombie & Fitch<br />

Catherine Rios<br />

ACG2021- 001

Executive Summary<br />

Abercrombie & Fitch FISCAL 2008 ended in<br />

January 31 2009 it showed a decrease in net sales<br />

showing it is being affected by the current countries<br />

crisis. During this year the Company used cash from<br />

operation to finance its growth strategy. The steep<br />

decline in consumer spending is affecting the<br />

company and has reacted by having seasonal ending<br />

clearance sales and are scaling back on domestic<br />

expansion. This allowed the company to end<br />

FISCAL 2008 with a strong cash position.<br />

Abercrombie & Fitch Annual Report

Part A. Introduction<br />

• Mike Jeffries CEO.<br />

• home office:<br />

6301 Fitch Path<br />

New Albany, Ohio 43054<br />

United States.<br />

• Fiscal year ended January 31,<br />

2009 (Fiscal 2008).<br />

• Abercrombie & Fitch is a<br />

specialty retailer that sells casual<br />

sportswear apparel. In addition it<br />

offers bras, underwear, personal<br />

care products, sleepwear and at<br />

home products for women.<br />

• Company operates 1.125 in the<br />

United States, Canada and the<br />

United Kingdom.

Part A. Audit Report<br />

• Independent Auditor:<br />

Pricewaterhouse<br />

Coopers LLC.<br />

• According to<br />

Pricewaterhouse<br />

Coopers, the company<br />

maintained effective<br />

internal control over<br />

financial reporting for<br />

Fiscal 2008.

Part A. Stock Market<br />

Information<br />

• Most recent price of stock: $36.42<br />

• Twelve month trading range of the<br />

company’s stock has been:<br />

• High: $82.06<br />

• Low: $13.66<br />

• Dividend per share: $0.175<br />

• February 16, 2010<br />

• In my opinion this company is being affected<br />

by the recent economic situation customers<br />

are more interested in lower priced clothing<br />

stores. The price of stock has decreased<br />

compared to Fiscal 2007 and the company<br />

does not seem to be in a stable condition. I<br />

would not recommend to buy stock in this<br />

company since it seems its financial position<br />

will only worsen with the current economy.<br />

Abercrombie & Fitch

Part B. Industry Situation and<br />

Company Plans<br />

• Abercrombie & Fitch is a leading fashion specialty retailer<br />

store that sell clothing and accessories under the Abercrombie<br />

& Fitch, <strong>abercrombie</strong>, RUEHL, Gilly Hicks and Hollister. The<br />

company views the customer in store experience as the primary<br />

way of communicating the spirit of each brand. The retailer has<br />

two principal selling seasons which are spring and fall. The<br />

current financial situation has had a huge impact on the<br />

company business. The company plans on continue expanding<br />

but focusing more on expansion overseas.

Part C. Income<br />

Statement<br />

•Abercrombie & Fitch uses a<br />

Multistep Income Statement, going<br />

through a series of steps, or subtotals,<br />

to arrive at their net income.<br />

A&F<br />

(in thousands)<br />

2008 2007<br />

Gross Profit $2,361,692 $2,511,367<br />

Operating<br />

Income<br />

$439,386 $740,497<br />

Net Income $272,255 $475,697<br />

The company Gross<br />

Profit decreased 30 basis<br />

points this was due to the<br />

current financial crisis<br />

and the companies need<br />

to clear merchandize as a<br />

result of the declining<br />

sales. The operating<br />

income decrease was due<br />

to foreign currency<br />

transactions and the<br />

decrease in income due to<br />

gift cards.

Part C. Balance Sheet<br />

A&F Assets = Liabilities + Stock Holders<br />

(in thousands) Equity<br />

2008 $2,848,181 $1,002,603 $1,845,578<br />

2007 $2,567,598 $949,285 $1,618,313<br />

• Abercrombie & Fitch showed an increase in<br />

all three accounts. Its assets increased with the<br />

openings of new stores abroad as well as its<br />

Liabilities increased with it.

Part C. Statement of<br />

Cash Flows<br />

•Abercrombie & Fitch cash flows<br />

from operations in the last two years<br />

were significantly larger than net<br />

income.<br />

•The companies growth is due to<br />

investing in capital expenditures<br />

primarily to new store constructions,<br />

store remodels and refreshnes, and<br />

purchases of marketable securities.<br />

•In FISCAL 2008 finances consisted<br />

primarily of repurchase of<br />

Companies Common Stock and the<br />

payment of dividends.<br />

•Overall cash has increased in the last<br />

two years.

Part D. Accounting Policies<br />

•Revenue recognition: The Company recognizes retail sales at<br />

the time the customer takes possession of the merchandize .<br />

Direct to customer sales are recorded upon customer receipt<br />

of merchandize.<br />

•Inventories: principally valued at the lower than average cost<br />

or market utilizing the retail method.<br />

•Property and equipment: are computed on a straight line<br />

basis, using service lives.<br />

•Income taxes: are calculated in accordance with SFAS No.<br />

109 “Accounting for income taxes” which requires the use of<br />

asset and liability method.<br />

Abercrombie & Fitch

• Notes to the financial<br />

statements:<br />

1. Basis of presentation<br />

2. Summary of significant<br />

accounting policies<br />

3. Recently issued accounting<br />

pronouncements<br />

4. Share based compensation<br />

5. Cash and equivilents and<br />

investments<br />

6. Fair value<br />

7. Property and equipment<br />

8. Deferred lease credits, Net<br />

9. Leased facilities and<br />

commitments<br />

10. Accrued expenses<br />

11. Other liabilities<br />

12. Income taxes<br />

13. Debt<br />

14. Derivatives<br />

15. Retirement benefits<br />

16. Contingencies<br />

17. Prefered stoch purchase rights<br />

18. Quaterly financial data<br />

19. Subsequent event

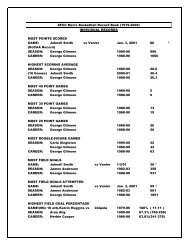

Part E. Financial Analysis<br />

Liquidity Ratios<br />

A&F 2008 2007<br />

Working Capital $636,028 $597,142<br />

Current Ratio 2.41 2.10<br />

Receivable turnover 66.22 70.14<br />

Average days’ sales<br />

uncollected<br />

5.51 5.20<br />

Inventory turnover 22.04 23.16<br />

Average days’<br />

inventory on hand<br />

16.56 15.75<br />

•The working capital and the current ratio both increased this<br />

shows A&F liquidity and ability to pay off debts.<br />

The decreases in the inventory turnover and increases in the<br />

average days of inventory on hand show A&F inefficient use of<br />

inventory.

Part E. Financial Analysis<br />

Profitability Ratios<br />

A&F 2008 2007<br />

Profit margin 0.07 0.12<br />

Asset turnover 1.30 1.38<br />

Return on assets 0.10 0.17<br />

Return of equity 0.15 0.27<br />

• This shows that from 2007 to 2008 the company lost in net income for every<br />

dollar in net sales. This means that the company is loosing money.<br />

• The return on assets and return on equity decreased significantly in both this<br />

means that the stockholders are loosing money off of each dollar invested.<br />

• The loss in asset turnover means that A&F is not using properly their assets<br />

and should look for other ways to invest in their company.

Part E. Financial Analysis<br />

Solvency Ratio<br />

A&F 2008 2007<br />

Debt to<br />

equity<br />

0.54 0.58<br />

• The debt to equity percentage<br />

remains low and has increased<br />

form 2007 to 2008 very little. This<br />

means that the Abercrombie &<br />

Fitch is in control of its<br />

Companies assets.

Part E. Financial Analysis<br />

Market Strength Ratios<br />

A&F 2008 2007<br />

Price<br />

/earnings<br />

Dividends<br />

yield<br />

42.81 66.56<br />

0.02 0.008<br />

• The decrease in<br />

price/earnings per share<br />

shows that the company is<br />

failing.