ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MURRAY VALLEY CITRUS BOARD<br />

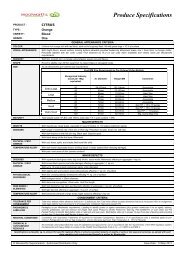

NOTES TO AND FORMING PART OF THE ACCOUNTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2005</strong><br />

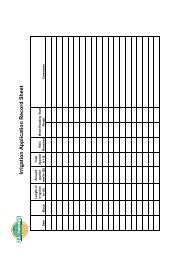

(b) Interest Rate Exposure<br />

The <strong>Board</strong>’s exposure to interest rate risks of financial assets and financial liabilities<br />

recognised and unrecognised at balance date are as follows:<br />

Financial<br />

Instruments<br />

(a)Financial Assets<br />

Cash<br />

Receivables<br />

Term Deposits<br />

Fixed Interest Maturing in:<br />

1 year or less Floating Interest Non-interest<br />

bearing<br />

<strong>2005</strong><br />

$<br />

-<br />

-<br />

732,084<br />

2004<br />

$<br />

-<br />

-<br />

743,168<br />

<strong>2005</strong><br />

$<br />

130,579<br />

-<br />

-<br />

2004<br />

$<br />

40,440<br />

-<br />

-<br />

<strong>2005</strong><br />

$<br />

245<br />

36,975<br />

-<br />

2004<br />

$<br />

570<br />

146,744<br />

-<br />

Total carrying<br />

amount per<br />

statement of<br />

financial position<br />

<strong>2005</strong><br />

$<br />

130,824<br />

36,975<br />

732,084<br />

2004<br />

$<br />

41,010<br />

146,744<br />

743,168<br />

Page 43<br />

Weighted<br />

average<br />

effective<br />

interest rate<br />

Total Financial Assets 732,084 743,168 130,579 40,440 37,220 147,314 899,883 930,922 - -<br />

(c) Net fair Values<br />

The aggregate net fair values of financial assets and financial liabilities recognised and<br />

unrecognised a balance date, are as follows:<br />

(a)Financial Assets<br />

Cash<br />

Receivables<br />

Term Deposits<br />

Total Carrying Amount<br />

Statement of Financial<br />

Position<br />

<strong>2005</strong><br />

$<br />

130,824<br />

36,975<br />

732,084<br />

2004<br />

$<br />

41,010<br />

146,744<br />

743,168<br />

Aggregate Fair Value<br />

<strong>2005</strong><br />

$<br />

130,824<br />

36,975<br />

732,084<br />

2004<br />

$<br />

41,010<br />

146,744<br />

743,168<br />

Total Financial Assets 899,883 930,922 899,883 930,922<br />

(d) Credit Risk<br />

The maximum exposure to credit risk, excluding the value of any collateral or other<br />

security, at balance date to be recognised financial assets is the carrying amount, net of<br />

any provisions for doubtful debts of those assets, as disclosed in the statement of<br />

financial position and notes to the financial statements.<br />

26. AUDIT FEES<br />

The fees payable to the Auditor General for the audit of the financial statements for the year<br />

ending 30th June <strong>2005</strong> was $6,900, plus applicable GST.<br />

27. EMERGENGY RESPONSE RESERVE<br />

The emergency response reserve is an allocation of funds from retained earings that have been<br />

approved by growers that enable the <strong>Board</strong> to respond to an industry emergency. The funds are<br />

allocated annually, subject to grower approval, to enable the reserve to accumulate to a sizable<br />

amount to enable effective contribution to counteract the event.<br />

<strong>2005</strong><br />

$<br />

0.0%<br />

n/a<br />

0%<br />

2004<br />

$<br />

0.20%<br />

n/a<br />

5.20%