ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MURRAY VALLEY CITRUS BOARD<br />

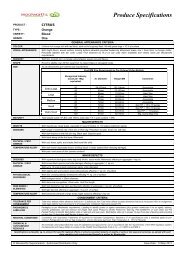

NOTES TO AND FORMING PART OF THE ACCOUNTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2005</strong><br />

24. FINANCE LEASE COMMITMENTS<br />

There are no finance lease commitments as at 30 June, <strong>2005</strong>. (2004:nil)<br />

25. FINANCIAL INSTRUMENTS<br />

(a) Terms, Conditions and Accounting Policies<br />

The <strong>Board</strong>’s accounting policies including the terms and conditions of each class of<br />

financial asset and financial liability instrument are as follows:<br />

Recognised Financial<br />

Instruments<br />

(a) Financial Assets<br />

Statement of<br />

financial position<br />

notes<br />

Cash and Deposits at Call 11<br />

Receivables 12<br />

Fixed Term Deposits 11<br />

(b) Financial Liabilities<br />

Payables 15<br />

Accounting Policies Terms and Conditions<br />

Cash Deposits deemed to<br />

be in excess of short term<br />

needs are placed in bank<br />

term deposits.<br />

Debtors are carried at the<br />

nominal amounts less any<br />

provision for doubtful<br />

debts. A doubtful debt<br />

provision is made for any<br />

amounts which are<br />

considered unlikely to be<br />

collectable.<br />

Term Deposits are stated<br />

at the nominal amounts.<br />

Interest Revenue is<br />

recognised in the Profit<br />

and Loss Statement when<br />

earned.<br />

Creditors and accruals are<br />

recognised for future<br />

amounts to be paid in<br />

respect of goods and<br />

services received, whether<br />

or not billed to the <strong>Board</strong><br />

Cash in the Bank account<br />

has interest paid on a<br />

sliding scale, with an<br />

average rate of 0.22% for<br />

the year.<br />

Normal terms for Levies<br />

outstanding are 28 days<br />

after the end of the month<br />

outstanding. For trading<br />

debtors, terms are 30 days<br />

from after month end.<br />

The fixed term is 60 days<br />

maturity and effective<br />

interest rate of 5.20%.<br />

Terms for the payment of<br />

creditors are 30 days from<br />

the end of the month of<br />

invoice.<br />

Page 42