ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18.<br />

MURRAY VALLEY CITRUS BOARD<br />

NOTES TO AND FORMING PART OF THE ACCOUNTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2005</strong><br />

<strong>2005</strong> 2004<br />

$ $<br />

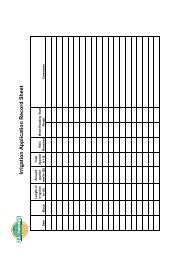

RECONCILIATION OF CASH FLOWS<br />

Profit from ordinary activities (175,422) (94,682)<br />

Depreciation 39,807 33,108<br />

(Profit) on sale of assets (522) (2,048)<br />

Changes in Assets and Liabilities<br />

(136,137) (63,622)<br />

(Increase)/Decrease in Receivables 262,842 (140,224)<br />

(Increase)/Decrease in Inventories (21,641) 5,622<br />

Increase/(Decrease) in Payables (17,501) (31,915)<br />

Increase/(Decrease) in Employee Entitlements 15,903 1,689<br />

Net Cash provided by Operating Activities 103,466 (228,450)<br />

19. SUPERANNUATION CONTRIBUTIONS<br />

Fund<br />

No. of<br />

Employees<br />

Contributions Made Contributions<br />

Outstanding<br />

04/05 03/04 04/05 03/04 04/05 03/04<br />

National FlexiSuper Plus 2 2 $25,443 $24,864 $1,949 Nil<br />

Australian Retirement Fund 0 1 Nil $12,174 Nil Nil<br />

Colonial First State Investments 1 1 $22,551 $12,816 $2,061 Nil<br />

Australian Primary 1 1 $4,824 $4,914 $94 Nil<br />

VicSuper 1 1 $59 $144 Nil Nil<br />

Macquarie Investment Management Ltd 1 1 $1,342 $1,340 $111 Nil<br />

Westpac Financial Services 1 1 Nil $215 Nil Nil<br />

IRSF Pty Ltd 1 1 Nil $5,634 Nil Nil<br />

CARE Super 1 1 $2,828 $1,483 $243 Nil<br />

Australian Skandia Limited 1 0 $2,532 Nil $206 Nil<br />

Vision Super 1 0 $193 Nil Nil Nil<br />

General<br />

- Applies to above Superannuation funds.<br />

- At 30 June <strong>2005</strong> there was no unfunded superannuation liability.<br />

- Contributions are paid at the rate of 10% of Gross Normal Earnings for the Field<br />

Manager and as per contracts of employment and at the rate of 9% for the remaining<br />

employees. The remainder of contributions comes from salary sacrifice<br />

arrangements.<br />

- There were no loans to the entity from the Superannuation Scheme.<br />

- Each employee can nominate an approved superannuation fund to contribute their<br />

superannuation.<br />

Page 40