ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

ANNUAL REPORT 2005 - MVCB - Murray Valley Citrus Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MURRAY VALLEY CITRUS BOARD<br />

NOTES TO AND FORMING PART OF THE ACCOUNTS FOR THE<br />

YEAR ENDED 30 JUNE <strong>2005</strong><br />

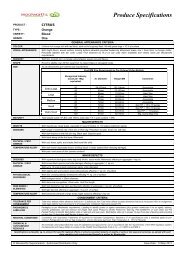

1. SUMMARY OF ACCOUNTING POLICIES<br />

(i) Basis of Accounting<br />

The financial report is a general purpose financial report which has been prepared in<br />

accordance with applicable Australian Accounting Standards, Urgent Issues Group<br />

Consensus Views and other authorative pronouncements of the Australian Accounting<br />

Standards <strong>Board</strong> and the requirements of the Financial Management Act 1994. The<br />

financial report is prepared on an accruals basis and is based on historical costs and does<br />

not take into account changing money values or, except where stated, current valuations<br />

of non-current assets. The accounting policies adopted for the financial year are<br />

consistent with those of the previous financial year unless otherwise stated. The<br />

following is a summary of significant accounting policies adopted by the <strong>Board</strong> in the<br />

preparation of the financial report.<br />

(ii) Plant and Equipment<br />

Fixed Assets include plant, equipment, furniture and motor vehicles that are shown at<br />

cost unless otherwise stated. Items with a cost value in excess of $300 and a useful life to<br />

the <strong>Board</strong> of more than one year are capitalised. All other assets acquired are expensed.<br />

Assets acquired at no cost or for nominal consideration, are recognised at their fair value<br />

at the date of acquisition. Depreciation has been provided over the fixed asset's useful life<br />

using the Diminishing Value Method. The methods 2004-<strong>2005</strong> are the same as 2003-<br />

2004. Fixed assets are depreciated at the following rates.<br />

<strong>2005</strong> 2004<br />

Plant and Equipment 11.25% - 37.5% 11.25% - 37.5%<br />

Motor Vehicles 22.50% 22.50%<br />

(iii) Rounding Off<br />

All amounts shown in the Financial Statements are expressed to the nearest dollar.<br />

(iv) Investments<br />

Investments are valued at cost. Interest revenue from investments is brought to account<br />

when it is earned.<br />

(v) Revenues<br />

- Levy Revenue is recognised upon the receipt from the receiver's self-assessment.<br />

- Industry Project Funding is mainly funding provided by Commonwealth grants to<br />

assist meeting general and specific citrus project expenses. The funds are recognised<br />

when payment is received.<br />

- Sale of Goods, the revenue is recognised when control of the goods has passed to the<br />

buyer. Credit terms are within 30 days of month end.<br />

- Interest Revenue includes interest and other revenue earned during the financial year<br />

from bank term deposits. It is recognised on an accrual basis, based upon control of<br />

the right to receive.<br />

- Proceeds from disposal of assets are recognised at the date of disposal and is<br />

determined after deducting from the proceeds the carrying value of the asset at the<br />

time.<br />

Page 30