Vellakovil City Development Plan - Municipal

Vellakovil City Development Plan - Municipal

Vellakovil City Development Plan - Municipal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>Development</strong> <strong>Plan</strong> for Vellakoil <strong>Municipal</strong>ity SMEC India Pvt Ltd<br />

Final Report TNUDP III<br />

The growth rates for the various heads of income and expenditure have been arrived based on the<br />

past growth rates and the future estimated population growth. Improvements to the existing current<br />

and arrears collection percentages have been assumed for the various revenues directly collected<br />

by the <strong>Municipal</strong>ity, which implies that the <strong>Municipal</strong>ity would have to improve its collection<br />

mechanism to sustain full investments.<br />

Given below are the various assumptions forming part of the FOP workings :<br />

8.5.1 INCOME<br />

a) Property Tax<br />

The population of Vellakoil <strong>Municipal</strong>ity is estimated to grow at around 2.5% p.a. Based on the same<br />

Property Tax Revenue are assumed to increase @ 2.5% per annum. The last revision of Property<br />

Tax was carried out on 1-10-98 and it is assumed that the next revision will be carried out in the<br />

current year. It is assumed that there will be an increase of 25% due to revision in 2008-09 & that<br />

revision would be done @ 15% every 5 years.<br />

It has also been established as per the Survey in 2002 that around 27% of the properties are<br />

unassessed and further 20-25% of the properties are unassessed. Considering the above, it is<br />

assumed that the same shall be set right and together these shall contribute to increase in property<br />

tax revenue by 20% from next year viz. 2009-10, after completion of GIS mapping.<br />

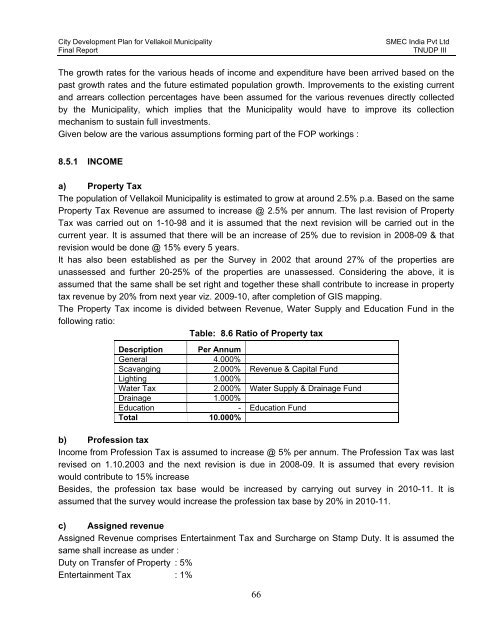

The Property Tax income is divided between Revenue, Water Supply and Education Fund in the<br />

following ratio:<br />

Table: 8.6 Ratio of Property tax<br />

Description Per Annum<br />

General 4.000%<br />

Scavanging 2.000% Revenue & Capital Fund<br />

Lighting 1.000%<br />

Water Tax 2.000% Water Supply & Drainage Fund<br />

Drainage 1.000%<br />

Education - Education Fund<br />

Total 10.000%<br />

b) Profession tax<br />

Income from Profession Tax is assumed to increase @ 5% per annum. The Profession Tax was last<br />

revised on 1.10.2003 and the next revision is due in 2008-09. It is assumed that every revision<br />

would contribute to 15% increase<br />

Besides, the profession tax base would be increased by carrying out survey in 2010-11. It is<br />

assumed that the survey would increase the profession tax base by 20% in 2010-11.<br />

c) Assigned revenue<br />

Assigned Revenue comprises Entertainment Tax and Surcharge on Stamp Duty. It is assumed the<br />

same shall increase as under :<br />

Duty on Transfer of Property : 5%<br />

Entertainment Tax : 1%<br />

66