City Corporate & Business Plan - Municipal

City Corporate & Business Plan - Municipal

City Corporate & Business Plan - Municipal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

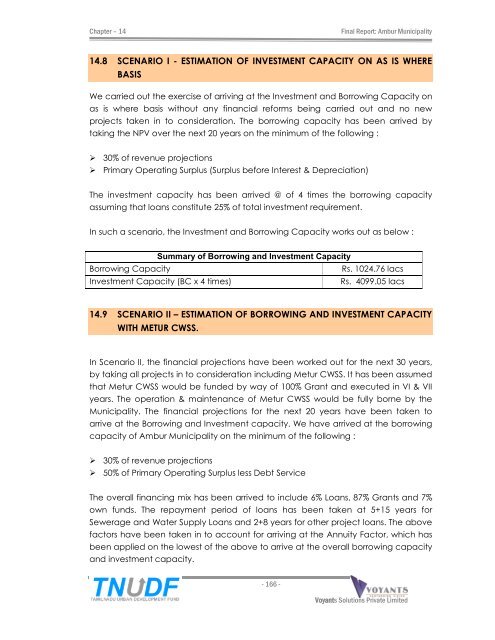

Chapter ñ 14 Final Report: Ambur <strong>Municipal</strong>ity<br />

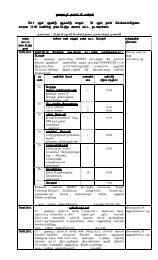

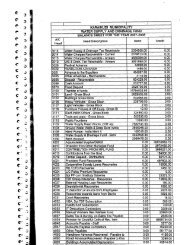

14.8 SCENARIO I - ESTIMATION OF INVESTMENT CAPACITY ON AS IS WHERE<br />

BASIS<br />

We carried out the exercise of arriving at the Investment and Borrowing Capacity on<br />

as is where basis without any financial reforms being carried out and no new<br />

projects taken in to consideration. The borrowing capacity has been arrived by<br />

taking the NPV over the next 20 years on the minimum of the following :<br />

30% of revenue projections<br />

Primary Operating Surplus (Surplus before Interest & Depreciation)<br />

The investment capacity has been arrived @ of 4 times the borrowing capacity<br />

assuming that loans constitute 25% of total investment requirement.<br />

In such a scenario, the Investment and Borrowing Capacity works out as below :<br />

Summary of Borrowing and Investment Capacity<br />

Borrowing Capacity Rs. 1024.76 lacs<br />

Investment Capacity (BC x 4 times) Rs. 4099.05 lacs<br />

14.9 SCENARIO II ñ ESTIMATION OF BORROWING AND INVESTMENT CAPACITY<br />

WITH METUR CWSS.<br />

In Scenario II, the financial projections have been worked out for the next 30 years,<br />

by taking all projects in to consideration including Metur CWSS. It has been assumed<br />

that Metur CWSS would be funded by way of 100% Grant and executed in VI & VII<br />

years. The operation & maintenance of Metur CWSS would be fully borne by the<br />

<strong>Municipal</strong>ity. The financial projections for the next 20 years have been taken to<br />

arrive at the Borrowing and Investment capacity. We have arrived at the borrowing<br />

capacity of Ambur <strong>Municipal</strong>ity on the minimum of the following :<br />

30% of revenue projections<br />

50% of Primary Operating Surplus less Debt Service<br />

The overall financing mix has been arrived to include 6% Loans, 87% Grants and 7%<br />

own funds. The repayment period of loans has been taken at 5+15 years for<br />

Sewerage and Water Supply Loans and 2+8 years for other project loans. The above<br />

factors have been taken in to account for arriving at the Annuity Factor, which has<br />

been applied on the lowest of the above to arrive at the overall borrowing capacity<br />

and investment capacity.<br />

- 166 -<br />

Voyants Solutions Private Limited