DailyFX - FXstreet.com

DailyFX - FXstreet.com

DailyFX - FXstreet.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

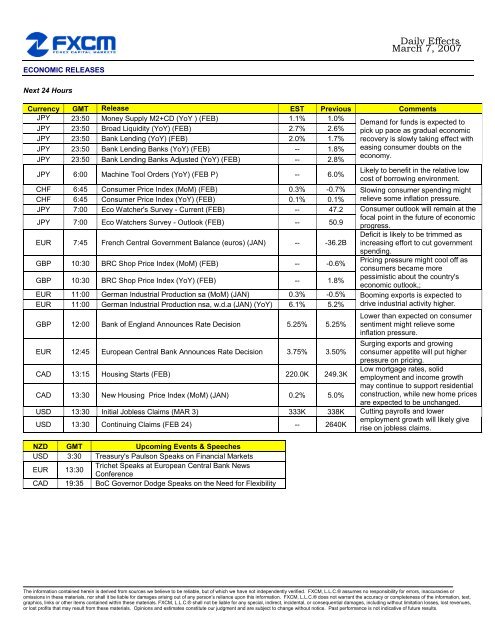

ECONOMIC RELEASES<br />

Next 24 Hours<br />

Daily Effects<br />

March 7, 2007<br />

Currency GMT Release EST Previous Comments<br />

JPY 23:50 Money Supply M2+CD (YoY ) (FEB) 1.1% 1.0%<br />

JPY 23:50 Broad Liquidity (YoY) (FEB) 2.7% 2.6%<br />

JPY 23:50 Bank Lending (YoY) (FEB) 2.0% 1.7%<br />

JPY 23:50 Bank Lending Banks (YoY) (FEB) -- 1.8%<br />

JPY 23:50 Bank Lending Banks Adjusted (YoY) (FEB) -- 2.8%<br />

JPY 6:00 Machine Tool Orders (YoY) (FEB P) -- 6.0%<br />

CHF 6:45 Consumer Price Index (MoM) (FEB) 0.3% -0.7%<br />

CHF 6:45 Consumer Price Index (YoY) (FEB) 0.1% 0.1%<br />

JPY 7:00 Eco Watcher's Survey - Current (FEB) -- 47.2<br />

JPY 7:00 Eco Watchers Survey - Outlook (FEB) -- 50.9<br />

EUR 7:45 French Central Government Balance (euros) (JAN) -- -36.2B<br />

GBP 10:30 BRC Shop Price Index (MoM) (FEB) -- -0.6%<br />

GBP 10:30 BRC Shop Price Index (YoY) (FEB) -- 1.8%<br />

EUR 11:00 German Industrial Production sa (MoM) (JAN) 0.3% -0.5%<br />

EUR 11:00 German Industrial Production nsa, w.d.a (JAN) (YoY) 6.1% 5.2%<br />

GBP 12:00 Bank of England Announces Rate Decision 5.25% 5.25%<br />

EUR 12:45 European Central Bank Announces Rate Decision 3.75% 3.50%<br />

CAD 13:15 Housing Starts (FEB) 220.0K 249.3K<br />

CAD 13:30 New Housing Price Index (MoM) (JAN) 0.2% 5.0%<br />

USD 13:30 Initial Jobless Claims (MAR 3) 333K 338K<br />

USD 13:30 Continuing Claims (FEB 24) -- 2640K<br />

NZD GMT Up<strong>com</strong>ing Events & Speeches<br />

USD 3:30 Treasury's Paulson Speaks on Financial Markets<br />

EUR 13:30<br />

Trichet Speaks at European Central Bank News<br />

Conference<br />

CAD 19:35 BoC Governor Dodge Speaks on the Need for Flexibility<br />

Demand for funds is expected to<br />

pick up pace as gradual economic<br />

recovery is slowly taking effect with<br />

easing consumer doubts on the<br />

economy.<br />

Likely to benefit in the relative low<br />

cost of borrowing environment.<br />

Slowing consumer spending might<br />

relieve some inflation pressure.<br />

Consumer outlook will remain at the<br />

focal point in the future of economic<br />

progress.<br />

Deficit is likely to be trimmed as<br />

increasing effort to cut government<br />

spending.<br />

Pricing pressure might cool off as<br />

consumers became more<br />

pessimistic about the country's<br />

economic outlook,;<br />

Booming exports is expected to<br />

drive industrial activity higher.<br />

Lower than expected on consumer<br />

sentiment might relieve some<br />

inflation pressure.<br />

Surging exports and growing<br />

consumer appetite will put higher<br />

pressure on pricing.<br />

Low mortgage rates, solid<br />

employment and in<strong>com</strong>e growth<br />

may continue to support residential<br />

construction, while new home prices<br />

are expected to be unchanged.<br />

Cutting payrolls and lower<br />

employment growth will likely give<br />

rise on jobless claims.<br />

The information contained herein is derived from sources we believe to be reliable, but of which we have not independently verified. FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or<br />

omissions in these materials, nor shall it be liable for damages arising out of any person’s reliance upon this information. FXCM, L.L.C.® does not warrant the accuracy or <strong>com</strong>pleteness of the information, text,<br />

graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues,<br />

or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

![Hedge [Modo de compatibilidad] - FXstreet.com](https://img.yumpu.com/17927360/1/190x135/hedge-modo-de-compatibilidad-fxstreetcom.jpg?quality=85)