Technical STraTegy Hidden Divergence In The Forex ... - FXstreet.com

Technical STraTegy Hidden Divergence In The Forex ... - FXstreet.com

Technical STraTegy Hidden Divergence In The Forex ... - FXstreet.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1 SFOmag.<strong>com</strong><br />

<strong>The</strong> Official Advocate for Personal <strong>In</strong>vesting<br />

Originally published June 2010. SFO magazine.<br />

<strong>Technical</strong> sTraTegy<br />

hidden divergence in <strong>The</strong> <strong>Forex</strong> MarkeT<br />

By James Chen, CMT<br />

Price-oscillator divergences represent some of the<br />

most prevalent, high-probability trading opportunities<br />

available in forex and other financial markets.<br />

<strong>The</strong>se regularly occurring chart signals should be<br />

heeded for their capacity to warn of either price<br />

momentum changes or trend continuations.<br />

BackgroUnd<br />

<strong>Divergence</strong>s occur when there is an imbalance<br />

between price action and an oscillator, which is a<br />

mathematical derivative of price. Examples of <strong>com</strong>mon<br />

oscillators include: stochastics, relative strength<br />

index (RSI), moving average convergence divergence<br />

(MACD), MACD histogram, rate of change (ROC),<br />

Commodity Channel <strong>In</strong>dex (CCI) and many others.<br />

Under normal circumstances without divergence, an<br />

oscillator that measures momentum should follow price.<br />

<strong>The</strong> extremes (peaks and valleys) in both price and the<br />

oscillator should be in relative agreement. Higher highs,<br />

higher lows, lower highs and lower lows on the oscillator<br />

should correspond with those of price action.<br />

Once divergence occurs, however, the indication<br />

is that price and the oscillator disagree with regard<br />

to momentum. This temporary aberration can be a<br />

significant indication of events to <strong>com</strong>e.<br />

Every technical trader should be aware of two<br />

types of divergence. Regular divergence indicates<br />

the potential for a reversal in current<br />

momentum, resulting in a possible trend change.<br />

Conversely, hidden divergence indicates the potential<br />

for continuation of the current trend momentum.<br />

higher odds<br />

As regular divergence is more well-known, in this column<br />

I only discuss the lesser-known type: hidden divergence.<br />

Many traders believe that of the two types of<br />

divergences the hidden variety is a higher-probability<br />

potential trading setup. This is due to the fact<br />

that hidden divergence is an indicator of potential<br />

trend continuation as opposed to a potential reversal<br />

indication.<br />

Trading with the trend is considered by many<br />

technical analysts and traders as a higherprobability<br />

type of trading than attempting to pick<br />

tops and bottoms, which is essentially the type of<br />

trading approach encouraged by regular divergence<br />

signals.<br />

Like regular divergence, hidden divergence is<br />

a technical imbalance between price movement<br />

and oscillator movement. But instead of signaling<br />

a potential reversal, hidden divergence is used<br />

primarily to signal a possible continuation in the<br />

prevailing trend.<br />

BUllish and Bearish signals<br />

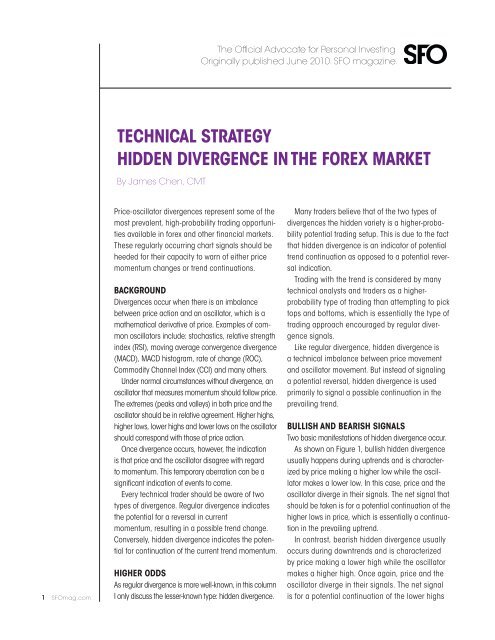

Two basic manifestations of hidden divergence occur.<br />

As shown on Figure 1, bullish hidden divergence<br />

usually happens during uptrends and is characterized<br />

by price making a higher low while the oscillator<br />

makes a lower low. <strong>In</strong> this case, price and the<br />

oscillator diverge in their signals. <strong>The</strong> net signal that<br />

should be taken is for a potential continuation of the<br />

higher lows in price, which is essentially a continuation<br />

in the prevailing uptrend.<br />

<strong>In</strong> contrast, bearish hidden divergence usually<br />

occurs during downtrends and is characterized<br />

by price making a lower high while the oscillator<br />

makes a higher high. Once again, price and the<br />

oscillator diverge in their signals. <strong>The</strong> net signal<br />

is for a potential continuation of the lower highs

2 SFOmag.<strong>com</strong><br />

Figure 1: Bullish <strong>Hidden</strong> <strong>Divergence</strong><br />

in price, essentially a continuation of the prevailing<br />

downtrend.<br />

<strong>The</strong> Trade<br />

Once an instance of hidden divergence occurs, cues<br />

can be taken from other technical indicators to enter<br />

a trade in the direction of the trend.<br />

One of the best ways to enter a trade after a<br />

hidden divergence signal involves waiting for<br />

a breakout of a key support or resistance level<br />

or countertrend trendline in the direction of the<br />

prevailing trend. Supported by hidden divergence,<br />

higher low<br />

lower low<br />

Source: FX Solutions—FX AccuCharts<br />

these trend-following breakouts often carry a<br />

higher probability of success than if divergence<br />

were absent.<br />

James Chen, CTA, CMT, is chief technical strategist<br />

at FX Solutions, a leading forex broker. He is also a<br />

registered Commodity Trading Advisor and Chartered<br />

Market Technician. Chen is the author of Essentials of<br />

Foreign Exchange Trading and Essentials of <strong>Technical</strong><br />

Analysis for Financial Markets.<br />

Copyright 2011 by Wasendorf & Associates <strong>In</strong>c. All rights reserved. No part of this publication may be reproduced or transmitted in any form by any means,<br />

electronic or mechanical including posting to another website, photocopying, recording or by any informative storage and retrieval system without the written<br />

permission of Wasendorf & Associates <strong>In</strong>c.’s President.<br />

This article is strictly the opinion and conjecture of its writers and is intended solely for informative and educational purposes and is not to be construed, under<br />

any circumstances, by implication or otherwise, as an offer to sell or a solicitation to buy or trade in any <strong>com</strong>modities or securities herein named. This article<br />

is not meant to re<strong>com</strong>mend, promote or in any way imply the effectiveness of any trading system, strategy or approach. <strong>In</strong>formation is obtained from sources<br />

believed to be reliable, but is in no way guaranteed. Further, there is no guarantee of any kind that is implied or possible where projections of future conditions<br />

are attempted. <strong>The</strong> publisher is not liable for typographical errors.<br />

Commodity futures, securities, options and forex trading involve risk and are not suitable investments for everyone. Any investment should be carefully<br />

considered in light of an investor’s personal financial objectives and risk tolerance.<br />

<strong>The</strong> article contained herein may provide hypothetical or simulated performance results. Hypothetical or simulated performance results have certain<br />

inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been<br />

executed, the results may have over- or under<strong>com</strong>pensated for the impact, if any, of certain market factors such as the lack of liquidity. Simulated trading<br />

programs are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely<br />

to achieve profits or losses similar to those shown. Further, past performance does not guarantee future results.

![Hedge [Modo de compatibilidad] - FXstreet.com](https://img.yumpu.com/17927360/1/190x135/hedge-modo-de-compatibilidad-fxstreetcom.jpg?quality=85)