tax notes international - Tuck School of Business - Dartmouth College

tax notes international - Tuck School of Business - Dartmouth College

tax notes international - Tuck School of Business - Dartmouth College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SPECIAL REPORTS<br />

Singapore<br />

India<br />

precedent in favor <strong>of</strong> the authorized OECD approach,<br />

rather than the single <strong>tax</strong>payer approach as it might<br />

look at first sight.<br />

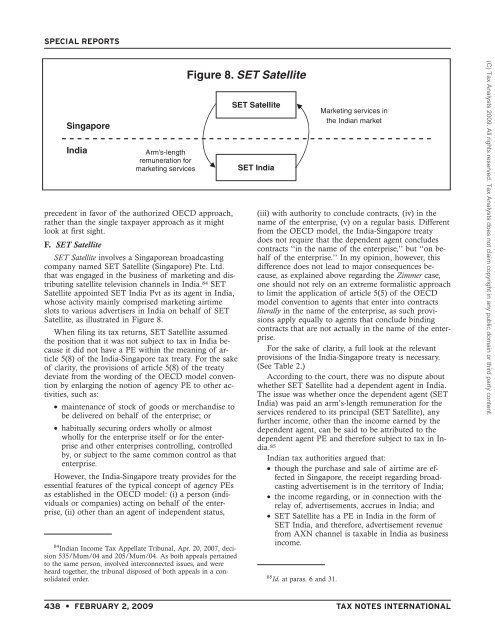

F. SET Satellite<br />

SET Satellite involves a Singaporean broadcasting<br />

company named SET Satellite (Singapore) Pte. Ltd.<br />

that was engaged in the business <strong>of</strong> marketing and distributing<br />

satellite television channels in India. 84 SET<br />

Satellite appointed SET India Pvt as its agent in India,<br />

whose activity mainly comprised marketing airtime<br />

slots to various advertisers in India on behalf <strong>of</strong> SET<br />

Satellite, as illustrated in Figure 8.<br />

When filing its <strong>tax</strong> returns, SET Satellite assumed<br />

the position that it was not subject to <strong>tax</strong> in India because<br />

it did not have a PE within the meaning <strong>of</strong> article<br />

5(8) <strong>of</strong> the India-Singapore <strong>tax</strong> treaty. For the sake<br />

<strong>of</strong> clarity, the provisions <strong>of</strong> article 5(8) <strong>of</strong> the treaty<br />

deviate from the wording <strong>of</strong> the OECD model convention<br />

by enlarging the notion <strong>of</strong> agency PE to other activities,<br />

such as:<br />

• maintenance <strong>of</strong> stock <strong>of</strong> goods or merchandise to<br />

be delivered on behalf <strong>of</strong> the enterprise; or<br />

• habitually securing orders wholly or almost<br />

wholly for the enterprise itself or for the enterprise<br />

and other enterprises controlling, controlled<br />

by, or subject to the same common control as that<br />

enterprise.<br />

However, the India-Singapore treaty provides for the<br />

essential features <strong>of</strong> the typical concept <strong>of</strong> agency PEs<br />

as established in the OECD model: (i) a person (individuals<br />

or companies) acting on behalf <strong>of</strong> the enterprise,<br />

(ii) other than an agent <strong>of</strong> independent status,<br />

84 Indian Income Tax Appellate Tribunal, Apr. 20, 2007, decision<br />

535/Mum/04 and 205/Mum/04. As both appeals pertained<br />

to the same person, involved interconnected issues, and were<br />

heard together, the tribunal disposed <strong>of</strong> both appeals in a consolidated<br />

order.<br />

Figure 8. SET Satellite<br />

SET Satellite<br />

Arm’s-length<br />

remuneration for<br />

marketing services SET India<br />

(iii) with authority to conclude contracts, (iv) in the<br />

name <strong>of</strong> the enterprise, (v) on a regular basis. Different<br />

from the OECD model, the India-Singapore treaty<br />

does not require that the dependent agent concludes<br />

contracts ‘‘in the name <strong>of</strong> the enterprise,’’ but ‘‘on behalf<br />

<strong>of</strong> the enterprise.’’ In my opinion, however, this<br />

difference does not lead to major consequences because,<br />

as explained above regarding the Zimmer case,<br />

one should not rely on an extreme formalistic approach<br />

to limit the application <strong>of</strong> article 5(5) <strong>of</strong> the OECD<br />

model convention to agents that enter into contracts<br />

literally in the name <strong>of</strong> the enterprise, as such provisions<br />

apply equally to agents that conclude binding<br />

contracts that are not actually in the name <strong>of</strong> the enterprise.<br />

For the sake <strong>of</strong> clarity, a full look at the relevant<br />

provisions <strong>of</strong> the India-Singapore treaty is necessary.<br />

(See Table 2.)<br />

According to the court, there was no dispute about<br />

whether SET Satellite had a dependent agent in India.<br />

The issue was whether once the dependent agent (SET<br />

India) was paid an arm’s-length remuneration for the<br />

services rendered to its principal (SET Satellite), any<br />

further income, other than the income earned by the<br />

dependent agent, can be said to be attributed to the<br />

dependent agent PE and therefore subject to <strong>tax</strong> in India.<br />

85<br />

Indian <strong>tax</strong> authorities argued that:<br />

• though the purchase and sale <strong>of</strong> airtime are effected<br />

in Singapore, the receipt regarding broadcasting<br />

advertisement is in the territory <strong>of</strong> India;<br />

• the income regarding, or in connection with the<br />

relay <strong>of</strong>, advertisements, accrues in India; and<br />

• SET Satellite has a PE in India in the form <strong>of</strong><br />

SET India, and therefore, advertisement revenue<br />

from AXN channel is <strong>tax</strong>able in India as business<br />

income.<br />

85 Id. at paras. 6 and 31.<br />

Marketing services in<br />

the Indian market<br />

438 • FEBRUARY 2, 2009 TAX NOTES INTERNATIONAL<br />

(C) Tax Analysts 2009. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.