tax notes international - Tuck School of Business - Dartmouth College

tax notes international - Tuck School of Business - Dartmouth College

tax notes international - Tuck School of Business - Dartmouth College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SPECIAL REPORTS<br />

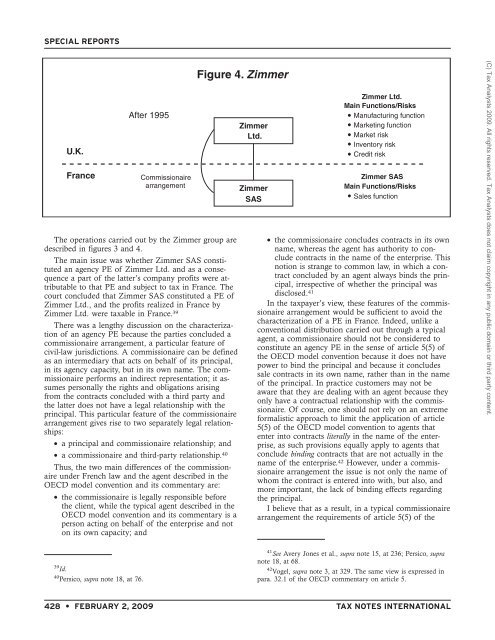

The operations carried out by the Zimmer group are<br />

described in figures 3 and 4.<br />

The main issue was whether Zimmer SAS constituted<br />

an agency PE <strong>of</strong> Zimmer Ltd. and as a consequence<br />

a part <strong>of</strong> the latter’s company pr<strong>of</strong>its were attributable<br />

to that PE and subject to <strong>tax</strong> in France. The<br />

court concluded that Zimmer SAS constituted a PE <strong>of</strong><br />

Zimmer Ltd., and the pr<strong>of</strong>its realized in France by<br />

Zimmer Ltd. were <strong>tax</strong>able in France. 39<br />

There was a lengthy discussion on the characterization<br />

<strong>of</strong> an agency PE because the parties concluded a<br />

commissionaire arrangement, a particular feature <strong>of</strong><br />

civil-law jurisdictions. A commissionaire can be defined<br />

as an intermediary that acts on behalf <strong>of</strong> its principal,<br />

in its agency capacity, but in its own name. The commissionaire<br />

performs an indirect representation; it assumes<br />

personally the rights and obligations arising<br />

from the contracts concluded with a third party and<br />

the latter does not have a legal relationship with the<br />

principal. This particular feature <strong>of</strong> the commissionaire<br />

arrangement gives rise to two separately legal relationships:<br />

• a principal and commissionaire relationship; and<br />

• a commissionaire and third-party relationship. 40<br />

Thus, the two main differences <strong>of</strong> the commissionaire<br />

under French law and the agent described in the<br />

OECD model convention and its commentary are:<br />

• the commissionaire is legally responsible before<br />

the client, while the typical agent described in the<br />

OECD model convention and its commentary is a<br />

person acting on behalf <strong>of</strong> the enterprise and not<br />

on its own capacity; and<br />

39 Id.<br />

U.K.<br />

France<br />

40 Persico, supra note 18, at 76.<br />

After 1995<br />

Commissionaire<br />

arrangement<br />

Figure 4. Zimmer<br />

Zimmer<br />

Ltd.<br />

Zimmer<br />

SAS<br />

Zimmer Ltd.<br />

Main Functions/Risks<br />

Manufacturing function<br />

Marketing function<br />

Market risk<br />

Inventory risk<br />

Credit risk<br />

Zimmer SAS<br />

Main Functions/Risks<br />

Sales function<br />

• the commissionaire concludes contracts in its own<br />

name, whereas the agent has authority to conclude<br />

contracts in the name <strong>of</strong> the enterprise. This<br />

notion is strange to common law, in which a contract<br />

concluded by an agent always binds the principal,<br />

irrespective <strong>of</strong> whether the principal was<br />

disclosed. 41<br />

In the <strong>tax</strong>payer’s view, these features <strong>of</strong> the commissionaire<br />

arrangement would be sufficient to avoid the<br />

characterization <strong>of</strong> a PE in France. Indeed, unlike a<br />

conventional distribution carried out through a typical<br />

agent, a commissionaire should not be considered to<br />

constitute an agency PE in the sense <strong>of</strong> article 5(5) <strong>of</strong><br />

the OECD model convention because it does not have<br />

power to bind the principal and because it concludes<br />

sale contracts in its own name, rather than in the name<br />

<strong>of</strong> the principal. In practice customers may not be<br />

aware that they are dealing with an agent because they<br />

only have a contractual relationship with the commissionaire.<br />

Of course, one should not rely on an extreme<br />

formalistic approach to limit the application <strong>of</strong> article<br />

5(5) <strong>of</strong> the OECD model convention to agents that<br />

enter into contracts literally in the name <strong>of</strong> the enterprise,<br />

as such provisions equally apply to agents that<br />

conclude binding contracts that are not actually in the<br />

name <strong>of</strong> the enterprise. 42 However, under a commissionaire<br />

arrangement the issue is not only the name <strong>of</strong><br />

whom the contract is entered into with, but also, and<br />

more important, the lack <strong>of</strong> binding effects regarding<br />

the principal.<br />

I believe that as a result, in a typical commissionaire<br />

arrangement the requirements <strong>of</strong> article 5(5) <strong>of</strong> the<br />

41<br />

See Avery Jones et al., supra note 15, at 236; Persico, supra<br />

note 18, at 68.<br />

42<br />

Vogel, supra note 3, at 329. The same view is expressed in<br />

para. 32.1 <strong>of</strong> the OECD commentary on article 5.<br />

428 • FEBRUARY 2, 2009 TAX NOTES INTERNATIONAL<br />

(C) Tax Analysts 2009. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.